As of the meeting, just a few days ago, there had been no response yet to Gary’s complaint.

CHG correctly explained what I meant to say when they disposed of debt and shares by giving them back. Divest was a poor choice to use in explaining they cancelled the debt (totaled $4.1M) and returned preferred shares and Greg transferred his 1.7M AURYN shares back to the treasury. Also, 110 M (?) common shares were returned. A news release in the way of a summary was expected this week if I’m not mistaken. There was much information at the meeting. Many contributed what went on at the meeting in various forms in the Informational Meeting News thread, now closed, but worth rereading IMO.

Continuing the discussion from October 1st, 2016 Informational Meeting News:

I filled against medinah

Why? So the SEC will shut down MDMN?

As far as the LDM tailings go since Les stole 1.5 billion shares of MDMN and JJ hasn’t stolen anything yet I would think he wouldn’t want to be left out in the stealing frenzy so he probably stole the LDM tailings because he thought he deserved them.

Adding further insult to injuries to all shareholders - thank you.![]()

What do you think an SEC action typically consists of?

Have you ever seen a pink sheet company that has the SEC take action against it?

Trading halt is the usual result (and is not what is needed for MDMN).

This is deemed appropriate in protecting the public interest, usually after shareholder complaints.

After a trading halt, effectively destroying a company, the SEC can issue a cease-and-desist proceedings to individuals, go after disgorgement and civil penalties which is paid directly to the SEC. How much to you expect to have returned from something like that? The SEC has administrative remedies, not criminal.

The plan as I understand it was to have the attorneys determine the facts and apply maximum leverage to the individuals responsible in order to claw-back and repair the share structure as much as possible. This was not vindictive in nature as much as it is to restore value back to the company:

Continuing the discussion from October 1st, 2016 Informational Meeting News:

After the attorneys accomplish whatever can be recovered through leverage and “goodwill” I would expect any evidence of forgery, fraudulent misrepresentations and registration violations that occurred in the sale of stock to be turned over to the appropriate authorities for criminal prosecution. Damages from these same individuals responsible for criminal malfeasance would then be liable in any civil proceeding that may further recover monetary damages. The company informing the SEC was an administrative step necessary in preserving the future integrity of the company and not vindictive in nature. Shareholder complaints are not constructive at this point, IMO.

At the meeting it was hinted that the SEC has a pretty full plate. If they are satisfied that the Company has undertaken their own serious internal investigation they will await the results and then just piggyback off of them - especially with a pinksheet. Good or Bad I don’t think they are going to do too much with anyone’s complaint until H&H is done.

In the meantime, maybe golddigin should withdraw his complaint about Medinah, and just put it against Les Price. We don’t need shut down, after waiting all these years. Let’s just let Auryn take care of things, okay? I for one want some rewards from this investment, and I believe we are finally on our way to making some money on this investment, even though it may take a little longer than we all wanted it to be. Thanks, ldras

I guess this may have already been posted, but I missed it while returning home from the meeting.

Here it is again for anyone else that may have missed seeing it like I did:

MEDINAH Retains Law Firm for Forensic Audit and Improves its Capital Structure

Oct 03, 2016

OTC Disclosure & News Service

Las Vegas, NV -

October 2, 2016

On Saturday, October 1, 2016, MEDINAH Minerals, Inc. (OTCMARKETS: MDMN) participated in AURYN Mining Chile’s Informational Meeting in Las Vegas, NV. During the meeting MEDINAH discussed its current financial position and made further disclosure regarding its 15c211 discrepancies.

MEDINAH has retained the law firm of Holland & Hart to represent it and direct an independent forensic investigation into its financial and share issues. Additionally, the firm will prosecute all necessary legal actions and will defend MEDINAH in the pending Okanadian legal action. J Stephen Peek and Holly Stein Sollod will serve as the lead attorneys representing MEDINAH.

During the meeting MEDINAH announced that Greg Chapin and Les Price signed an agreement on August 23, 2016, cancelling all alleged debts owed to them by MEDINAH. In addition, former directors and officers Vittal Karra and Greg Chapin agreed to return to MEDINAH all of their shares of MEDINAH stock (common and preferred.) Furthermore, Greg Chapin agreed to give MEDINAH the shares he owned in AURYN Mining Chile SpA which he obtained through his ownership position in NUOCO.

In summary MEDINAH anticipates the following changes to its capital structure and ownership in AURYN.

A decrease of $4.3 million in alleged debt leaving the alleged remaining debts totaling $373,000. This is A 92% reduction in debt.

A return and cancellation of approximately 122 million shares of common stock. This will lead to a 4.1% reduction in the amount of common shares issued.

A return and cancellation of approximately 1,600,000 shares of preferred stock. This will lead to a 38% reduction in the amount of preferred shares issued.

An increase in its shares of AURYN Mining Chile SpA of 1,704,000 shares. This increases MEDINAH’s ownership in AURYN by approximately 7%, from 25,000,000 to 26,704,000 shares of AURYN.

MEDINAH intends to cancel the common and preferred shares returned to it, thereby reducing its shares issued and outstanding. As soon as possible, MEDINAH will reduce its authorized shares commensurately. Once these transactions are completed MEDINAH will report accurate, finalized totals to its shareholders.

Please note that the cancellation of the debt and return of the shares was voluntary. This is not a quid pro quo transaction. It does not prevent or influence the company or its shareholders from bringing legal action against any individual should such action be deemed appropriate.

Submitted by the Board of Directors

I understand your concern which is why I specifically filed a complaint against LES PRICE not MDMN. I do not want the SEC to shut down MDMN for all the reasons you mentioned. What I would like is for some regulatory authority to step in and freeze LES PRICE’s accounts so he stops selling and depressing the share price. It is fairly clear that current shareholders are not selling so it really only leaves one possible explanation…LES PRICE. He has practically admitted to fraud, why is still being allowed to influence the share price in ANY way? He needs to be shut down ASAP!

Did they explain at the meeting why the transfer agent reported outstanding share totals to Les Price when he has not been an officer of Medinah

for many years? Seems to me that the TA may be in trouble.

No, not specifically. Just my impression and take away from the meeting that I previously expressed and cabezon placed on the Meeting Information thread:

Continuing the discussion from October 1st, 2016 Informational Meeting News:

I’d prefer to let the attorneys figure out the facts and proceed with the proper course from there. It is apparent to me that far too many people mistakenly trusted Les to handle things for which he wasn’t authorized.

449000 shares for sale @ .01 Somebody tell me that’s not Lester selling

That’s not Lester selling.

I don’t really know, I just figured I’d reply to your request. ![]()

Thanks TR:laughing:

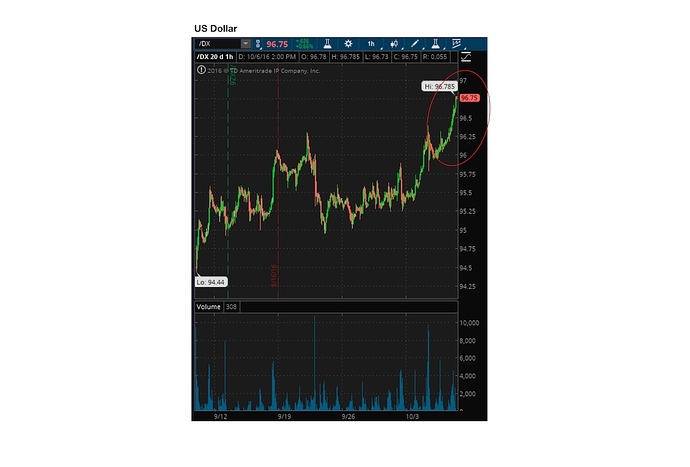

The USD is again crushing gold, silver, & other currencies. The blame is being put on the Fed speak for a Dec rate hike. Not sure about that. But the higher the USD goes the more it is both a signal of and a cause of overall monetary systemic stress. There will be lots of squealing all over if this continues very long.

Yes, In addition to forging signatures, Les changed transfer agent figures before forwarding to our bod for reports, don’t know why it went through Les.

Sorry about the possible troll that appeared today. I think you can figure out who… re:SEC Hope that didn’t really happen. Person came back with a new log in after a previous suspension, shut down now. I’ll have to check the new member list for other reincarnations.

From Sprott, in addition to the Fed speak:

We believe this is a correction within a secular bull market. So far we do not see any the developments as the catalyst for a bear market. The real issue is the lack of liquidity due to holidays (Rosh Hashanah, Passover, and China’s Golden Week) and skittishness of where central bank policies are going. We do not see the end of negative interest rates and we do not see monetary policy giving way to fiscal policy (if it happens) to be gold bearish either.

This information is for information purposes only and is not intended to be an offer or solicitation …

http://www.sprottglobal.com/thoughts/articles/gold-insights/

Presently, it is around 10k to buy or sell 1 million shares. Investors who have many millions of shares, may decide to sell some of their position. That could put some serious selling pressure on the stock like today. Especially, if they are not willing to wait it out. Until we can somehow excite some new investors to start buying, we could be in dangerous territory, concerning our share price. Panic selling scares me to death, especially if we remain under .01. So please, let’s not panic sell. Or at least, wait for some buying to sell into. Of course, that is a personal choice for anyone to make, and I certainly would understand, no matter what the reason. Good news about production can not get here soon enough!!!

After the AGM which was a positive event how much lower can it go. The legal events should take 18 mo. at a minimum so unless you have to sell No Worries. If we get a JV partnership with the P N in January all things should start to turn positive with the announcement.