Keep them in a clean sock drawer. We have had enough of dirty shares.

Huge volume today so far for AUMC…83k shares which is more than I can remember on any given day. Perhaps Wizard sold his shares that he was awarded for services rendered. But I doubt he would ever tell us, now that he has disappeared…

Note that Masglas still seems to be active:

It came up with $338,000 to buy some royalties.

“Looking back in my MDMN file I found a post from Blockman on 2/28/2007. He mentions that there was a 50/50 JV deal reached with Hochschild? Can anyone elaborate on what happened. Obviously they have some serious interest for them to come back after 11 years!”

Hi Z,

About a dozen years ago at an AGM in Las Vegas, JJ stood up at the podium and mentioned that Hochschild was very interested in a JV. From what I recall, JJ did not have permission to use Hochschild’s name at that point in the negotiations. Apparently Hochschild got miffed and backed off.

Later, at the “informational meeting” in LV hosted by Auryn about 3 years ago, Maurizio mentioned that a representative from a stud muffin law firm in NYC that both Hochschild and Auryn were clients of, commented that his client Hochschild was not interested in a deal at the ADL until JJ was totally out of the scene.

Hochschild has been around the ADL forever and a day. There is a lot of interconnectedness between Auryn, Lima-based Maurizio and Lima/London-based Hochschild as well as London-based Dick Sillitoe. At least three of Auryn’s P. Geos used to work for Hochschild. That would be Sillitoe, Dr. Ray Jannas and Luciano Bocanegro. Jannas used to be head of South American exploration for GoldFields. His PHD is from Harvard. Sillitoe is beyond a legend and Luciano B. is a well-respected porphyry specialist known for his work in “vector analysis”. This involves certain types of clays (illite, smectite, etc.) located at certain distances from the sought-after goodies within a porphyry. Sillitoe’s accomplishments are listed on pages “xi and xii” in this tribute to him done by Rio Tinto.

I personally am not sure if it were fair to characterize this as the ADL has attracted the best of the best from the mining industry or Maurizio’s deep pockets have attracted them. These guys are some of the most talented geoscientists on the planet.

I personally don’t see the Hochschild JV as the thing to focus on right now. First of all, Hochschild is going to end up with in between 51% and 60% of the action if they perform on the option. These “Lacustrine sediment hosted stratabound copper deposits” are typically copper/silver deposits. “Dr. Copper”, as it is known, is tied to economic circumstances which are tied to the supply and demand of industrial metals. Silver is a hybrid between an industrial metal and a precious metal. Compared to GOLD, copper is not the place to be until the recovery from the pandemic occurs.

The industry wide attention right now and for the foreseeable future for those with a polymetallic deposit like the ADL is GOLD and to a lesser extent SILVER. Auryn controls not 51% but 100% of the Caren and Fortuna Mines where very high-grade GOLD is the sought-after commodity. Several of the PRs from Auryn have noted that “Auryn is continuing to execute on the mine plan”. So, what exactly is the “mine plan” that they’ve communicated via PRs and their “informational meeting” in LV a couple of years ago?

The mine plan is to produce from three different “production adits” at the Caren Mine while a fourth “crosscut exploration adit” is drifted eastward towards the Fortuna Mine area. Maurizio’s comment at the “informational meeting” was that he wanted Auryn to become a “mid-sized gold producer” ASAP. Once fully permitted and into production the projections are to produce over 25,000 ounces in the first full year of production. This is based on the allowable mining rate of just 5,000 tonnes per month to start with. This figure was expected to increase through time. Because of the aggressiveness of the mine plan, SERNAGEOMIN mandated that Auryn/Medinah fabricate three vertical “ventilation/safety” raises prior to receiving the final production permitting. OUCH! That’s going to take a while. In a PR dated December of 2018, however, Auryn stated that they were nearing completion of the task.

To me, it appears that any production is going to come much quicker at the 100% owned Caren (and Fortuna Gold mines) than at the perhaps 51%-owned LDM copper/silver deposit. At the Caren Mine, the grades were deemed “economic” back when the price of gold was about $400 per ounce cheaper than today. The average “all in sustaining costs” to mine an ounce of gold worldwide is expected to be at around $907 per ounce in 2020 (Metals Focus group). The infrastructure at the ADL is clearly superior to the average producing gold mine in the world and lower “all-in sustaining costs” to produce an ounce of gold should reflect that.

The math is pretty straight forward. At, let’s say, $1,700 per ounce gold and an “AISC” of around, let’s say, $850 per ounce, based on the initial production rate of just 25,000 ounces of gold, you can ballpark the kind of profits that could be made annually IF THESE ASSUMPTIONS HOLD TRUE.

With all of this Covid-19 coronavirus and the associated quantitative easing to infinity measures being undertaken most mining analysts agree that the prognosis for the price of gold going up is pretty good IF, IF, IF, YOUR DISCOVERY INCLUDES RELATIVELY NEAR SURFACE HIGH GRADE GOLD IN FAVORABLE MINING JURISDICTIONS. The current shutdown in gold production in many areas due to the virus should support the price of gold. The ideal scenario would be to be ready to go into gold production within a couple of months (hopefully) when these restrictions are lifted.

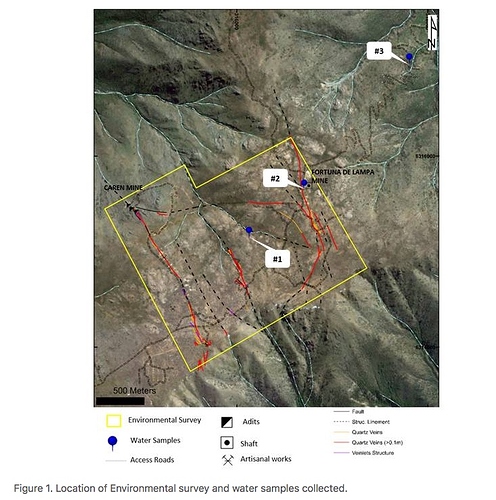

The Fortuna Mine also contains very high-grade gold. The last we heard there, Auryn had dewatered the mine and has been removing the associated mud. Then they’re going to sample the adits. The baseline environmental studies near there were already completed a few years ago by IAL Ambiental, South America.

Don’t get me wrong about the importance of the Hochschild JV. Although the news was met with more share price downticking as has been the norm, this deal gives Auryn some street credibility. Hochschild is following the battle plan drafted by Sillitoe himself. Copper deposits with by product silver will definitely have their day in the sun but if you have gold production as an option in a polymetallic system most producers are going to focus their efforts on those gold assets.

Gold producers fetch a higher EPS multiple than base metal producers. With relatively fixed costs to produce an ounce of gold, any increases in the price of gold tends to drop straight to the bottom line.

NOW GO WASH YOUR HANDS AND STAY SAFE!

Thank you Doc! Nice to see a little conversation about mining. Always appreciate your insight.

They talk a lot about things they’re going to do but nothing is followed through on.

I would think if the properties are that rich in mineralization, there would be a lot more attention coming to Auryn from the outside.

I owned a little CDCH and a lot of MDMN so as of now I have a few shares of Auryn and nothing to show for MDMN except a big fu”’incg loss from my initial investment

I believed Mauruzio, Goodin and Tupper at informational meeting in Vegas and had renewed hope.

It appears Masglas is growing in assets and expenditures but last time I checked Auryn has no stake in Masglas.

So here we sit with the story of the ADL which hasn’t changed much over the years and those are many now.

I can only imagine what that asshole LP would have done with Corona virus.

Hey Doc,

What knowledge or educated opinion do you have as to why MDMN has not done the share distribution yet? TIA

While we wait for Docs response, i thought I would post these thoughts that Doc posted which may be relevant to your question.

Medinah’s $51 million Net Operating Loss (NOL) carryforward in combination with profitable Caren production and (hopefully) AMC’s willingness to at least temporarily dividend out profits to its Medinah and Cerro shareholders represents somewhere around a $15 million asset based on a 30% Medinah tax rate. The keys here would be PROFITABLE production (high grades and good infrastructure) and AMC’s willingness to temporarily forego rolling any Caren Mine profits into further development efforts at least until Medinah could take advantage of the NOL carryforward. AMC has previously stated that they would consider dividending out profits after their first quarter of full production had been achieved.

Thanks Zotron.

Any thoughts Brecciaboy about this statement made by Dentman? I have often wondered the same thing.

Hi guys,

I don’t have a lot of insight into the nature of the delays associated with the unrestricting, allocation and distribution processes involved in us getting our “AUMC” shares. In my experience, the unrestricting process is simple. The issuer’s legal counsel drafts a letter and works in conjunction with the company’s Transfer Agent. So, I doubt the hang up is here.

The allocation process would involved pulling what used to be called an “SPR” or “Securities Position Report”. The process is described at:

Then I would assume the TA would apply the conversion ratio of about .0056 shares of AUMC for each share of Medinah tendered and have the NSCC subdivision of the DTCC credit the various shareholder accounts (“distribution”) at the various clearing firms. I would think that this is pretty straight forward also.

If the plan is to bring about the “dissolution” of Medinah as part of this overall process then things get a little more complex because the 16.2 million AUMC shares comprise the vast majority of Medinah’s assets. The Nevada Revised Statutes Chapter 78 covers this “dissolution” process. (Note: Even thought this statute deals with “private corporations” this applies to publicly-traded “private corporations”.)

https://www.leg.state.nv.us/NRS/NRS-078.html

A couple of months ago, one of the forum participants reached out to one of the new Medinah BOD members asking what was going on and the reply came back that Medinah was waiting for a “full legal opinion” from, I assume, their securities attorneys. I would assume that this would be submitted to Finra, the SEC or maybe a Nevada Circuit Court judge. Kevin warned us, I believe it was on a TMP post a while back, that working with the government regulators and self-regulatory organizations (an SRO like Finra) things move very slowly.

I think management made a wise decision in using the Cerro corporate vehicle in order for Auryn Mining Chile (and therefore the ADL Mining District) to “go public”. Since Cerro already owned a 5% stake there was no need for using the typical assetless “shell company” whose shareholders would have received a cut of the ADL action in exchange for the use of their corporate vehicle. This would have cut into that .0056 ratio. Cerro shareholders came in owning 5% of the action and left with 5% of the action. This was smart as the Medinah shareholders suffered no dilution during this process.

The downside of this smart decision may have been that until Medinah and Auryn Mining Chile privateco got their shares unrestricted, allocated and distributed then this new “AUMC” would only have 5% of its share in a free trading status. THE MANAGEMENT TEAM OF AN ISSUER WITH 5% OF ITS SHARES FREE-TRADING CAN’T DO DIDDLY DURING THIS INTERIM PHASE. THEY’RE LITERALLY HANDCUFFED.

If “AUMC” were to put out good news under these conditions, us Medinah and Auryn privateco shareholders would throw a fit if the “AUMC” share price took off and we couldn’t participate. Finra would be screaming “pump and dump” from the of of their lungs. In reality, all of us, indirectly or directly, own a tiny little percentage of the ADL Mining District. Since Medinah owns about one-fourth of the action, an owner of 4% of Medinah’s shares would indirectly own 1% of the ADL Mining District. A 20% owner of Cerro would DIRECTLY own 1% of the action also.

The problem for the Medinah shareholder is that his 1% ownership in the ADL is currently “packaged” in a train wreck of a corporate vehicle that is currently nonreporting and currently in default with the Secretary of State of Nevada. Due to Medinah’s ownership of the one-fourth stake in the ADL, it is anything but being on its deathbed BUT IT SURE LOOKS LIKE IT TO A PROSPECTIVE INVESTOR. As a Medinah shareholder, I would go nuts if “AUMC” put out positive news that moved the “AUMC” share price up X% (for the Cerro shareholders) but the Medinah share price only up maybe .5X%.

Except for (temporarily homeless) idiots like myself that have familiarized themselves with the assets, nobody in their right mind would buy shares of either Medinah which looks (to a casual observer) like it’s on its deathbed or “AUMC” with only 5% of its shares in a free-trading status and a gigantic percentage spread between the bid and ask and zero liquidity.

If there were parties in the mining sector with an interest in the ADL, I don’t think they would do anything until the AUMC shares were unrestricted, allocated and distributed. If somebody approached Maurizio with an interest in the Caren or Fortuna Mines (the high-grade gold mines), I would hope that Maurizio would tell them to go fly a kite.

The TIMING is the toughest thing to predict. In this interim period, I personally am buying ownership interest points in the ADL IN AN INDIRECT FASHION while they’re “packaged” in the train wreck of a corporate vehicle discounted because it appears to the average guy to perhaps be on its death bed. The goal is to sell them down the road IN A DIRECT OWNERSHIP FASHION when the discount is removed. Many more risk averse investors that have confidence in the assets might wait until the share distribution occurs as long as it still appears to be trading at a discount to NPV.

I appreciate the comments “if the assets are so fancy then where is the interest from the big boys?”. I do not pretend to know the interest level generated to date within the mining sector. If there were significant interest, I don’t think we’d have access to that information. If there is ZERO interest, I don’t think we’d have access to that fact either. I would assume that in today’s mining realities with gold looking like it is, more interest would be generated in the precious metal side than in the base metal side. Maurizio and the rest of us will get more bang for the buck by self-developing especially the Caren Mine which appears to be closest to production. The stars are lining up pretty nicely for any junior with a bona fide discovery that features early gold production opportunities. The majors can’t match the production growth profiles that the new producers can generate.

I totally agree. I haven’t forgotten the Shareholder Update of Dec. 28, 2015;

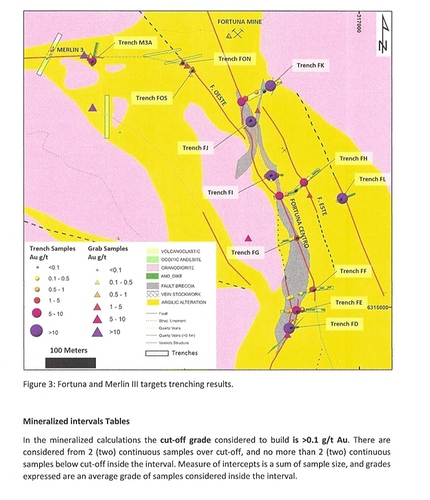

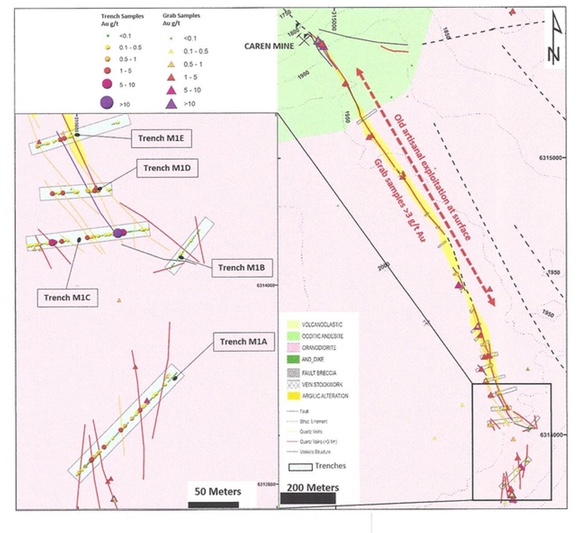

It contains a vast amount of information about the known mineralization which certainly hasn’t disappeared today. Included are diagrams of the trenching and summaries of the sample results on Caren Mine, Merlin 1 & 2, and the Fortuna claim areas. One thing I found particularly interesting was the revelation: “In the mineralized calculations the cut-off grade considered to build is >0.1 g/t Au.” This clearly could be interpreted as a preliminary assessment needed for open pit operations on surface claims.

https://www.otcmarkets.com/ajax/showNewsReleaseDocumentById.pdf?id=18449

Unfortunately, at the shareholder’s informational meeting in Las Vegas, when asked if an open pit was going to be developed on the ADL, MC said that decision had not yet been determined. It is likely this would need to be done after the Fortuna is producing a cash flow and a JV partner with deep pockets needed for an open pit was lined up and brought on to develop the project.

Review the Shareholder link cited above and you may see why there are many that have have put this away in the rear view mirror and looked to other opportunities, but I still found this statement quite revealing:

I agree MDMN is not in a position of strength here and is clearly acting strategically with respect to the conversion/allocation process. I’d surmise there was a “gameplan” unfolding by Dr. Jannas that actually brought Dr. Sillitoe onboard. There is a lot more than the LDM optioned by Hochschild on the Alto that seems to have some “pretty interesting geology” (Bustamante). It may well warrant the interest of bringing on additional companies but some cash flow may be necessary first. Recall that Dr. Jannas was previously employed as Vice President-Exploration & Geology by Hochschild Mining Plc. before his six months of consulting for AURYN Mining SpA . Also, recall that Raymond Jannas received a degree from the University of Chile before obtaining a doctorate degree from Harvard University and is quite well known in SA for his work. Refining the business plan for the development of the entire “regional” project was apparently defined and finalized by Dr. Sillitoe in his report, including the need of eventually bringing on additional partners. Shareholders can only speculate and wait.

Wizard has previously informed us that some delays are completely regulatory. Also, that the method that will be used is an allocation, which has a different legal meaning from that of a distribution.

In Sept 2017 MC stated, “AURYN continues to execute its mining plan.

All shareholders of AURYN will be treated equally as we move forward with our intention to access the public markets and provide eventual liquidity to all shareholders.” This intention can only be kept and makes sense if the unrestricting of shares is accompanied by a voluntarily trading halt to AUMC shares is requested to start the process. The trading halt would then only be lifted at the same time as some very significant news is released to merit appreciation of the company, along with the released allocation of free trading shares. The timing to unrestrict all shares will thus not likely occur before there is some very positive developments on the ADL to report and bring value to the company. What the news and timing is anybody’s guess until it occurs.

Thanks for the reply Doc.

The last update we received on the Caren mine ( planned early production ) was on 1/30/17 where we were informed that the first truck load of ore came in at 11gpt AU. Below the cutoff grade of 15gpt. They advised that 4 more trucks were sent to Enami and we were waiting results. No results were ever provided to us.

Forward to March 2017 when Dr. Sillitoe visits for 4 days.

Forward to the December 12, 2018 update where attention is now focused on the Fortuna mine.

Forward to the November 24, 2019 update where they made this statement:

“The AURYN team has come to the conclusion that the several high grade veins are all related and interconnected, including the Merlin and Larissa vein, and tentative mining plans are being reviewed.”

It seems as though the Caren mine was not able to meet the cutoff grade required for economical recovery or after Dr. Sillitoes visit the game plan changed completely or he suggested that we focus on the Fortuna for early production.

If the Fortuna does not meet the Cutoff grade requirement then the statement made in the November 24, 2019 update would seem to imply possible open pit recovery of the entire high grade vein network.

JMO

“The math is pretty straight forward. At, let’s say, $1,700 per ounce gold and an “AISC” of around, let’s say, $850 per ounce, based on the initial production rate of just 25,000 ounces of gold, you can ballpark the kind of profits that could be made annually IF THESE ASSUMPTIONS HOLD TRUE.“

$1,700 Gold = $21.25M Annual Profit

$2,000 Gold = $28.75M Annual Profit

I have always said. Until gold goes to $2000, we will be waiting.

Maybe the wait and the giant awakens, all we can hope.

TDK

Z,

Your conclusion may be well intentioned, or perhaps I did not pique your curiosity enough to review the link I provided. It was originally released as a PR stating the following highlights:

September 1, 2016 @ 20:31pm

(originally posted by AURYN Mining SpA)

AURYN Mining Chile SpA is pleased to announce the high-grade gold epithermal mineralization in Merlin and Fortuna targets at Altos de Lipangue Project.

Highlights

· Over 5 kilometers of mineralized veins were mapped.

· Over 1,600 rock and trench samples were collected.

· High-grade Au ± Cu ± Pb ± Zn mineralized veins.

· In Merlin I, the vertical zoning in quartz-carbonates textures suggest a preserved epithermal system.

Also you may have misinterpreted my comment about the 0.1 g/t Au being the cutoff grade. It was the cutoff grade for diagraming the trench samples and results:

I aslo interpret from information that the original shipments were costly to transport to ENAMI, but also necessary to determine the geochemistry and processing requirements. DOC (BB) also mentioned, “Because of the aggressiveness of the mine plan, SERNAGEOMIN mandated that Auryn/Medinah fabricate three vertical “ventilation/safety” raises prior to receiving the final production permitting. OUCH! That’s going to take a while.” I conclude the Caren mine is being prepared for production, after preparation of the Fortuna adit is completed.

ADL Project Update – January 2017

These initial shipments of ore were extracted from a 28 meter section of the vein between LC-3 going south toward LC-6. Although the results are slightly below the modeled grade of 15 gpt gold equivalent, they are economical and very encouraging given our stage in the project development.

These initial shipments of ore were extracted from a 28 meter section.

AURYN opens a 42m section of high grade vein in the Larissa Adit

Ore was extracted from the Larissa Adit until the LC-6 vicinity. At that point the vein disappeared and reappeared approximately 4m later. It’s reappearance visually appeared to indicate an increased level of mineralization.

We expect that this intersection extends vertically at least 30 meters in each direction with similar grades and width. Our speculation is that this vein is not the same vein that we uncovered in September on level 2. The vein on level 2 returned bonanza grades which we reported on at the informational meeting. However, further exploration and analysis is necessary to make a conclusive determination.

The trenching samples were at surface, whereas the Merlin and Fortuna adits give a glimpse of some of these same veins and veinlets at depth, which are quite numerous in trenching samples. First exploitation will occur from the adits to produce the estimated 25,000 Oz Au during the first full year of production. An open pit of the magnitude envisioned will require very deep pockets and defintely require a JV operator, IMO.

Large Low Grade Copper-Gold Deposits: How Low Can Grade Go?

It is often difficult for investors to assess the potential economic value of exploration results. In particular, the low grades that are characteristic of large, disseminated, copper-gold systems.

These systems are typically Porphyry-style deposits, but can also be of Iron Ore Copper Gold or Replacement style. Either copper or gold may be dominant, and they often have associated silver and molybdenum, which may be important, and even dominant, contributors to ore value.

In 2012 the Paracatu mine, operated by Kinross Gold Corporation in Brazil, treated around 58 million tonnes of ore at a grade of around 0.4grams per tonne (“g/t”) to produce 466,709 ounces of gold. At December 2012 it had reserves of 1.4 billion tonnes at grade of 0.40g/t gold for a total of 18 million ounces of gold. The cut-off grade is around 0.2g/t gold.

For the 2011 year Boliden’s Aitik mine (within the Arctic Circle in Sweden) milled 31.5 million tonnes at a head grade of 0.24% copper, 0.16g/t gold and 2.0g/t silver. At the end of 2011 it had reserves of 710 million tonnes at a grade of 0.25% copper, 0.13g/t gold and 1.6g/t silver. Resources totalled 1.7 billion tonnes at 0.18% copper, 0.11g/t gold and 1.0g/t silver.

The point is that large, disseminated, copper-gold systems can be profitable at very low grades. The investor therefore needs to know the style of mineralisation and the potential size of the deposit in addition to grades. Conversely, narrow, discontinuous, but high grade deposits may require a very high cut-off grade to be economically mined.

http://marketcap.com.au/large-low-grade-copper-gold-deposits-how-low-can-grade-go/

Thanks Easy. I am not questioning that these are all indicating high grade.

I am suggesting that production at the Caren mine was imminent. 1/30/17 was the last detailed Auryn update on Caren. Then nothing. Three plus years later and we still have no production.

Something changed. Dr. Sillitoe came in March 2017 so its very possible he suggested an alternative plan.

Even Doc, in a comment on The Mining Play in March 2016 (#222) suggested the possiblity of open pit mining.

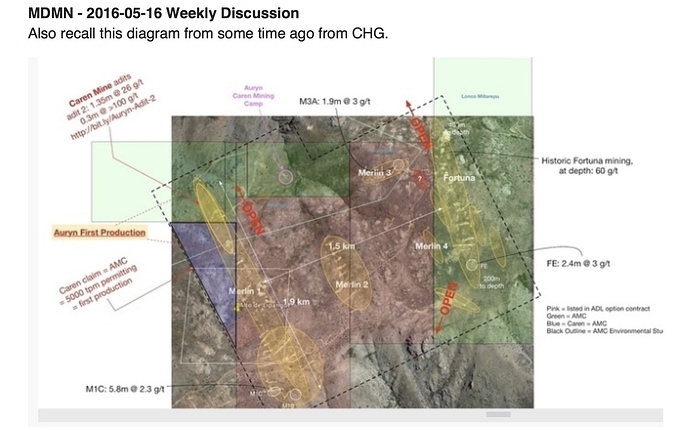

The initial production efforts are going to be at the Caren Mine because the permitting is already in place for a 5,000 TPM facility. It appears that this is going to be an UNDERGROUND operation unless the intra-adit drilling they’ve been doing plus any IPs done found nearby subparallel veins. If you closely study AMC’s brand new 24 page “ALTOS DE LIPANGUE PROJECT” power point presentation as well as the AMC Jan 13, 2016 press release regarding the completion of certain environmental studies the emphasis for the early production opportunities is clearly the 400 hectare plot stretching from Merlin 3 to the Fortuna mine about 85% of which is on Medinah’s ground. This area is a yellow box on the 1/13/16 PR of AMC and an oval surrounded by a red hatched line on the power point presentation on slide 13. The statement there reads: “Intersection between Fortuna and Merlin 3 suggests a WIDE (emphasis added) mineralized area coincident with the FDL Mine site (crossed red line)”. ACA Howe warned us that the mineralization at the FDL Mine has barely been touched. The criss-crossing of all of these vein systems in this Medinah/Cerro area clearly appears to render it open pitable and subject to bulk mining methodologies and the economies of scale associated therewith. You can see the IP/CSAMT print out at line 5500 (UTM 6315500) showing the red area of ultra high conductivity/ultra low resistivity.

It is unfortunate that management has chosen to keep us all in the dark on what is going on.

Interesting Z,

I don’t see the brand “new 24 page” presentation/report you are referring to and write about to reference. Do you have a link?

I look back and see what DOC posted back in March 2016 and still reach a different conclusion:

There aren’t very many interested investors and those out there have all kinds of bargains to consider in the junior exploration sector. This is not an environment in which you PROMOTE yourself to success especially in corrupt markets. It’s just the opposite. You want to resort to MECHANICAL measures that are predictable. If there’s a major DISCONNECT you lever it. Period! A TRANSACTION or two helps you confirm and measure the size of any DISCONNECT as well as remove the UNCERTAINTY associated with whether an option is going to be exercised or not.

DUE DILIGENCE TASKS

- Try to gain an appreciation for how the early production opportunities and the cash flowing therefrom might ramp up over time. When might new production permits be granted? When might existing production permits be increased?

- What kind of mine life are we talking for all of these high grade near surface early production opportunities? Does 10 years or so sound fair? Will there be any gap in time in between the end of the cash flow from the early production opportunities and the open pitting of the porphyry?

- Are the stellar grades found at the Caren Mine adits in the Merlin 1 Vein likely to be representative of what is found at the same depth level elsewhere on the Merlin 1 Vein?

Clearly things have changed drastically since then. These “due Diligence Tasks” have yet to come to fruition. To be sure, there was a lot going on in March 2016; there were all kinds of suspicion of NSS at the time. But as was revealed in August 2016, it was out and out fraud by one LP, fraudster and theif, who had doubled our OS and tried to hide it further with a number of law suits aiming to bankrupt MDMN. For all practical purposes, he succeeded. Late 2015, and early on in 2016, there were some very optimistic developments that had been reported;

and

auryn_project_presentation_17-mar-2016.pdf (5.8 MB) - not on internet?

and the environmental studies you refer to:

More recently, MDMN has gone dark. It is not going to report anything.That is why it is truly in my sock draw until AUMC has something significant to report that will bring value to ALL shareholders, including the roughly <30% held by current MDMN holders and former CDCH holders. AURYN Mining Chile SpA no longer exists. Additionally, MASGLAS is the controlling owner of AURYN Mining Corporation, AUMC, whose sole asset is the prospective Alto de Lipangue Mining district.

Sounds to me like we got screwed.

Would like to know one thing Auryn said they were going to do that followed through?