On Jan. 03, 2011, MDMN hit a high of .19. At the end of calendar year 2010 there were 698 million shares OS (reported). That equates to a fleeting market cap of $132 million.

FYI…this was a painful walk down memory lane.

On Jan. 03, 2011, MDMN hit a high of .19. At the end of calendar year 2010 there were 698 million shares OS (reported). That equates to a fleeting market cap of $132 million.

FYI…this was a painful walk down memory lane.

Lots of good discussion; we’re actually advancing the discussion instead of turning to insults. That’s refreshing. Some thoughts:

Thanks CHG. I referenced Klondex for that exact reason. When I say there’s no way this thing can average 40gpt+ over any duration it’s simply based on the odds of this being the highest grading, producing mine in the world. Maybe it is? The odds aren’t there though and nobody can really come up with an equally convincing argument that I’m wrong. Using 70 year old historical data based on artinsenal mining isn’t just wild speculation, it’s nuts. Nobody is claiming that there ain’t a lot of gold in them hills but, as CHG pointed out, we’re talking about 2000 tonnes over decades!!! Were they averaging 60gpt or were they conducting a hyper-high-grade operatoin as artisenal miners tend to do? Either way, one has to make way too many assumptions to make a detrimination to grade at any sort of scale. Were the 9 tonnes sent to Enami more representative of grades to be expected? Maybe, but I can guarantee you they were picking out the good stuff before sending it off to Enami as well. It’s not difficult to do with 9 tonnes. 900 tonnes is a different story and one that I’d be curious to see play out over the next year. My guess: if an investor asked Maurizio if he expects to be grading 30pgt+ material on a consistent basis he’d say: “not likely”

As BB points out there are no reserves currently caluclated. He’s also correct that not doing any drilling to establish reserves, simply blasting and mining, is a very cost effective strategy. Especially in a cash strapped situation. However, it’s not ideal, as without reserves you’re never going to get competitive financing. Sooo, if investors are looking for this to evolve from a rinky dink miner to one that could actually justify multiple 100’s of million of market cap there NEEDS to be something beyond Maurizio throwing some personal funds at the project. At least if you plan to generate capital gains in your lifetime. Based on my opinions of grade and the current infrastructure, they shouldn’t have a problem paying back the loan but production growth will be limited.

Mining is insanely challenging. There are always negative ramifications of throwing too much or too little $$ when getting started.

If it were 9,000 tonnes averaging 45 gpt you may be on to something.

Question for you…if these veins are so rich and wide…why did Auryn say this in July

“At the beginning of the quarter, AURYN

anticipated intersecting the vein within a couple of weeks, including 10-15 meters more

of tunneling. This was not the case. It took almost the entire quarter to intersect the

vein. Several days were missed for weather and equipment related issues, and miners

encountered extremely hard rock most of the way. In total the tunnel is 125 meters.

On June 23, 2021, AURYN intercepted the Don Luis vein”

And then tell us they are still hoping to have hit the DL six months later? I’m not saying they didn’t encounter mineralization along the way but they’ve been hunting for this elephant since April when they said the following (Q1 update)

“Intersection with the Don Luis vein body is expected to take another 10-15 meters and is likely to be accomplished within a week.”

I agree that it has been “boring”.

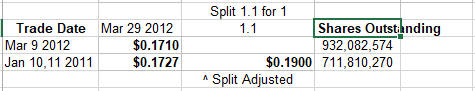

I believe the high was never $0.18. It was $0.1727 & $0.171 on 2 occasions.

The Jan 10 price, if adjusted to pre-split would actually be $0.19 ! Approx 712Msh.

Mar 9 price 932Msh.

Cheers,

Rod

Only problem is this is likely 600-800 million shares too low, plus the preferred. I wish people understood how damaging the preferred shares were to common stockholders and how self-serving they were to the issuers. Also at that time those number were not being reported correctly, imo, i.e. the falsifying of signatures and selling scheme had already started.

Someone took out the Ask this morning on Aumc. Bid .84 Ask 1.00

Volume for the day 56,345

MDMN attorney letter 10/18

https://www.otcmarkets.com/otcapi/company/financial-report/307040/content

I was doing a little El Penon research just to see what could be learned.

Of note:

EP is a large underground vein gold/silver system. It had some early open pit production but not for quite some time. It looks to contain quite a bit more silver than the ADL. At least up till now the silver grades at the ADL have been very low. But the ADL clearly has copper and moly content that I do not think exist at EP. The veins at EP are known to go down over 350m with current exploration continuing to extend the veins down dip.

EP is described primarily as a large epithermal system that is deeper than a normal system. I have seen one reference to “possibly mesothermal”. Perhaps the categorization is not completely clear and they blend over at this point.

EP in the early 2000s produced over 400,000 gold equivalent ounces per year. But they purposefully cut back production as they chose to mine more of the narrower veins which slows production. So they have gone from something like 4000 tpd to around 2000 tpd in production.

I was specifically curious about what “narrow” means. And I found this very useful Yamana site visit presentation from 2017:

https://minedocs.com/17/El_Penon_Presentation_SiteVisit_05302017.pdf

Slide 19 and 22 specifically address what “narrow” is at the time and how they were addressing economically mining “narrow” veins. At the time they had started to mine down to 1.1m but seem to have plans to get down to 0.5m width veins. There is discussion of equipment and so on.

Their mining grades are around 6 to 8 gpt Au with individual samples including 50, 100, or even 200 gpt. That sounds familiar.

Overall, especially in terms of economically mining fairly narrow veins of good but not extreme grade, I found that presentation and discussion pretty useful and encouraging that there is a known model for success here that seems to approach at least the preliminary data the ADL gold system. So for me the encouragement is less from a direct deposit to deposit geological comparison than from a technical mining approach comparison. As a caution though, anything much below 1m and especially 0.5m vein width is definitely a volume production issue unless grades are extreme world class. And that is what I was trying to figure out.

Yamana has mined over 5M Oz Au from El Penon and the expected mine life is still 10+ years. One might stash in the back of the mind that there is now at least a thread of connection between Auryn and Universidad de San Sebastian and thus indirectly to El Penon / Yamana and some actual engineering knowledge of how to have success with a system like this.

Yes, and this seems to validate what Prof. Luis de la Torre said:

"I have the firm belief that once La Fortuna de Lampa project goes into production, and a correct evaluation of the entire project is achieved, it will be a mining operation with very similar characteristics of El Peñon."

Hi CHG and Mr B,

I too have been studying that document for a while. What I like about Luis de la Tierra’s comment: “I have the firm belief that once La Fortuna de Lampa project goes into production, and a correct evaluation of the entire project is achieved, it will be a mining operation with very similar characteristics of El Peñon.” is how he’s referring to the ”mining operation” as having similar characteristics to that of El Penon. It’s almost like it’s a given that we’ve got a viable mine. As far as the “characteristics” of the deposit itself, the El Penon is making money as they produce 5 gpt gold and the gold equivalent of 2 more gpt AU via their silver production. So, you can definitely make money producing 7 gpt Au in today’s Chile.

The article is great at outlining the complexities involved in running a mine. The El Penon features both narrow low to intermediate sulfidation epithermal veins and wider, what appear to be more of a mesothermal variety of veins with much greater widths, grades and depths. They refer to the larger ones as “principal veins” and the narrower ones as “secondary” veins. They noted that the narrower/secondary veins were “related to the principal veins” and actually linked together the principal veins. The larger/principal veins are 2 to 10-meters wide and go to depths of 250 to 450 meters. At surface their “strike” is from 1.5 to 3-Km whereas the secondary vein’s surface “strike is from .6 to 1.2 Km. Our DL1 Vein has a surface strike of 1.7 Km but then it dips under the granodiorite, so who knows how much further it goes. The drawings they showed sure looked a whole lot like the surface trenching diagrams on the Auryn website. The ADL has got 6 to 8 somewhat parallel veins but then you’ve got the Merlin 3 “linking” together two of these.

On page 29 of the paper, you see a drawing they took from a paper Sillitoe delivered in the early 1980’s on “Major Au Deposits”. In the lower left, you see a deposit type labeled, shear zone hosted, greenstone hosted and orogenic. These are the 3 different types of “mesothermal vein deposits”. Note how much lower they go in the rock strata and how fat they look compared to the epithermal veins circled in red. In, Sillitoe’s report to Auryn, he cited that Auryn has one of these “mesothermal vein” types of deposits. ACA Howe suggested the same in their analysis. In reality, the meso’s tend to “telescope” into the epi’s. Recall how the ADL has an outcropping of a vein on its southern downslope off of the plateau down by the valley floor. This is “meso” territory where things like porphyries and skarns hang out.

“Hybrid” vein deposits like El Penon, give the operator the option to go after the fat veins first (sometimes called “high-grading) and make a fortune but then later on when you go after the narrower veins you need to drop down your production projections and keep a close eye on costs. It sounds like they adopted “split blasting” in which you go after the vein material itself with the first round and then the somewhat barren wall rock later. I could sure see Auryn using this mine as a template and learn from Meridian and Yamana Gold. Maurizio seems paranoid about dilution until after the share price reaches what he thinks is fair value. That’s what investors want to hear. Go after the wider, higher-grade veins first, and let the share price react. Th Antonino Adit has identified somewhere around 7 veins to date. They may or may not have intersected the DL 1 Vein on September 29. If they can locate the 2 “massive” veins, what Yamana might label as a “principal vein”, then pick the crèam of the crop and go with it. JUST DON’T DRILL 3 MILLION METERS IN A MASSIVE DRILL PROGRAM RIGHT NOW. Nice profits with only70 million shares O/S delivers a very nice EPS statistic. The industry average multiple is 30.21. Playing “SMALL BALL” can deliver big share prices. Later on, sure the production is going to plateau but then when you go after the narrower veins you do what Yamana did and settle for lesser production but still robust profits. Unfortunately, Yamana now has 1 billion shares outstanding and a $4 share price. Auryn could trade at $4 in a heartbeat. Thank you, CHG, for bringing that article to everybody’s attention, A MUST READ!

Doc, have you been into the nitrous oxide ? ![]()

Gold on the move this morning

Spoke to soon. Gold drops after Powell says the central bank is on track to taper its monthly bond purchases. Just for him saying that brought Gold back to unchanged after a $30 rise this morning. Wow his words must be god talking

What would be a reasonable guess on the actual number of days or weeks production can take place during the year. Are we completely shutdown through the winter months? Assuming during the spring and summer months that they work only a 5 day workweek.

Thanks for any replies

Best case is 50 weeks. Until all the infrastructure is properly built-up (better roads, post-C19 protocols, base camp, . . .) I think 43 to 45 weeks is more realistic. They don’t need to shut down the entire winter, but they did miss several days this winter because of extreme weather.

Thanks Wizard!

Just my opinion but they should start releasing the assays of the trucked material every 100 tonnes or so sent to Enami. They shoud have the first 20 tonne metrics already.

It would be helpful in gaining some momentum in the shares (assuming the grades hold up, which I imagine they will until there is volume).