Gold moving up today over 1810. Like to see them grades that have been going to Enami would make it that much sweeter.

Hi done deal,

I kind of feel bad for the previous miners at the Fortuna Mine. The grades were and still are wonderful but they were producing 64 gpt gold and the price of gold was only $35 per ounce vs $1,800 now-ouch! To add a little salt in the wound, they decided to produce from Level 2 from the intersection of Shaft 1 towards the SE. Maurizio comes along many years later and samples the northern wall of shaft 1 (which they never touched) and comes up with the numbers they recently reported. Double ouch!

Hi done deal,

I misspoke. I went back to my sources and confirmed that the big loser was not SMFL but instead a Sr. Figueroa. SMFL sold the property to Sr. Figueroa right before Augusto Pinochet pulled off a coup and took over as dictator of Chile. He started stealing all of the mines and handing them to his political cronies. Sr. Figueroa obviously refused to put a dime into the mine under these circumstances even though Enami’s top geoscientists told Figueroa where all of the goodies were probably located. Sr. Figueroa then blast-caved all of the open adits to the mine to hide the mine from the government. The trouble was that Pinochet stuck around for 17 years. The year Pinochet ended his rule, Sr. Juan Jose Quijano bought the property and vended it into the old Cerro Dorado. He and his “colleagues” were unable to advance the development of the property and Maurizio and his private company, Auryn Mining Chile, came along and consolidated the whole area. At the time, Cerro had 5% of the action and Medinah about 25% with Auryn privateco owning the remaining 70%.

Maurizio then brought Auryn privateco public through the Cerro corporate vehicle. Cerro’s shareholders retained their 5% ownership interest and Medinah retained its approximately 24-25% interest and the owners of Auryn privateco retained their 70% interest. I think it’s critical to understand the history so that you can realize WHY the property stayed inactive for so long despite the grade of the ore present that had barely been touched by SMFL. Of the 1.7 Km strike length of the DL1 Vein, SMFL only mined about 300 meters and only the most superficial aspect of that 300 meters. Now we know that there are well over 16 veins in that MESOTHERMAL “vein system”. It was until after Maurizio retained Richard Sillitoe that anybody realized that it was indeed a MESOTHERMAL vein system and not just an epithermal vein system. ACA Howe hinted at this being the case but Sillitoe sealed the deal. The high-grade ore has been sitting there all of this time but it just wasn’t dictator proof. The recent sampling of where Shaft #1 intersected Level 2 by Auryn showed huge grades right at the very spot that SMFL ended their mining and decided to head to the SE instead of the NW. OOPS!

Thank You Berecciaboy for that page in history.

That “South America” has many chapters to that book.

Glad to have you on board.

What on earth was going on at AMERICAN SIERRA GOLD CORP (AMNP) this morning!?!?!? I don’t see any news. Is Maurizio planning to do something with that holding?

Hi EZ,

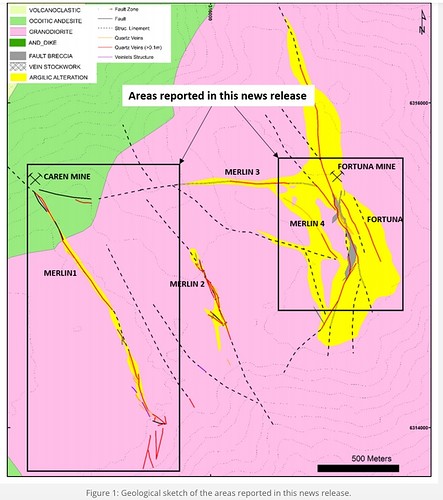

I’ve got no clue as to what’s going on with AMNP today but they own the placers sitting in the valley at the base of the northern downslope off of the ADL plateau. We know that the Merlin 1 Vein outcrops on the northern downslope where those 3 historical adits are located. Back in 2015 Auryn, Auryn sampled the heck out of the Merlin 1 Vein getting 200 trench samples and a couple of adit samples. The weighted average came in at 26.9 got gold which is pretty much off the chart for channel samples from surface trenches. Those placers have to be loaded after 91 million years of rain pounding on the vein outcroppings. When people get word of the mesothermal veins at the ADL, this area of AMNP may turn into an “area play”. I think Medinah owns 11+ million shares of AMNP.

I noticed on the Auryn website’s “gallery” section that Auryn put the very first vein they ran into while drifting the Antonino Adit into production. On that hand-drawn map referenced on the PR at this link it would be the northernmost of those 2 yet to be named “new veins”:

On that same map notice the 12 samples taken from Shaft #1 or “ST 1”. Shaft 1 is approximately 21 meters in vertical height and it is 1 of 7 shafts that joins level 1 to level 2. Recent channel sample results from this 21-meter shaft include from top to bottom in terms of grams per tonne: 23,22,21,9,85,50,42,103,112,64,103, and 1,220 (not a misprint but probably not “representative” either). Shaft A represents the northern extent of the previous mining efforts. Perhaps SMFL should have kept going to the NW further but apparently opted not to. If you take out that 1,220 intercept then the average grade is about 65 gpt gold which is what they averaged over 30 years of mining. In a sense, this sampling does provide some corroboration of the extremely high-grade nature of this ore. If you incorporate that 1,220 gpt sample then the average grade at this location (Shaft 1) becomes 210 gpt gold. Interestingly, the silver grades found in the 11-pound sample measuring 1,220 gpt gold was also off the charts even though it was assayed via a different procedure. The hope would be that Auryn nicked an “ore shoot” which is a part of a vein structure in which the grades are off the charts because all of the various conditions were ideal for the deposition of extremely high-grade gold (and silver). The “gallery” portion of the Auryn website shows some very large gold nuggets that were mined by Auryn and photographed. I’m not sure if they came from this area or not.

Link didn’t come up. This must be the Map you referenced from the PR:

…and the old surface sampling area shown in the gallery:

I wonder how many shareholders own AMNP? Gary Goodin

was Pres at the time and had a significant position. At this point my recall isn’t great so if someone can find the details- thanks.

Apologies BB, the link work great, and that’s a great Map!

Very detailed information.

EZ

Hi EZ,

That topographical map I referenced is critical to understand but it is incomplete compared to what’s recently occurred. As of about a month ago, management had intersected 5 veins within the Antonino Adit alone. That number could be 7 or 8 by now. First, they hit what you might refer to as “northernmost new vein” which is shown on the topo map as 1 of the 2 “new veins”. The new picture on the Auryn “gallery” as of a day or so ago shows us a stockpile of production from that vein. The second vein they hit was also labeled “new vein” on the topo map. I’d call it the “southernmost new vein”. Both of these are located nice and close to the portal/opening of the adit. On June 23,2021 they hit another vein that they thought might be the DL1 Vein but it turned out not to be. I’d call this the “June 23 Vein”. Then on Aug 12 they hit a fourth vein which they actually remained in for 8 meters until it diverged to the south. They didn’t chase it yet but continued on their original path. I assumed they stockpiled the ore from it for testing. Then on September 9 they hit the fifth vein within the Antonino Adit. The last we heard they thought that this one was the sought-after DL1 Vein. They said they’ll inform us after corroborating whether it is the DL1 or not. So, you’ve got 5 intersections in the new Antonino Adit which is below the old Fortuna Mine. Its depth is about 188 meters below the plateau.

The old Fortuna Mine is higher up within the DL1 Vein structure. It has two main adits serving as production adits. These are called “Level 1” and “Level 2”. L1 is about 45 meters below the plateau. L2 is about 65 meters below the plateau. There are 2 other adits below L1 and L2. These are called Level N and Level S-1. The available literature doesn’t say much about them except that Enami’s geoscientist did some modeling and recommended the mining of several “ore blocks” through these structures. It was never accomplished. On the topo map, you can see the results of the 12 samples taken from shaft #1. There are 7 shafts that link level 1 to level 2. Auryn calls them shafts 1 thru 7. Enami referred to them as shafts A-G. The lengths of the lines next to the various shafts is indeed proportional to the vertical extent of the shaft. Most are about 24 meters but shaft C is 52 meters in height.

Each of the 5 new intersections in the Antonino Adit open up the possibility of 2 new working faces to mine. The 2 ends of Levels 1 and 2 (higher up in the DL1 Vein) offer a total of 4 other possible working faces. This totals 14 possibilities so far that we know about. On the topo map you can see the vein to the west labeled “LA” for Leopoldo Antonino. This is one of the 2 “massive veins” that measured over 2 meters in width AT SURFACE. It also came in with a grade of 10 gpt gold AT SURFACE. The other “massive vein” is not pictured here. I was told it is either east or west of the LA vein. If the 2 “massive veins” come in with widths around 2.5 to 3-meters and high grades like the rest, then you can bet they’re going to go after them quickly.

The thing to key in on is how many working faces Auryn can simultaneously mine. They’re obviously going to cherry pick the fattest and juiciest veins to go after first.

Lots of information here re American Sierra Gold:

https://sec.report/otc/financial-report/275836

Chile’s lower house votes to impeach president over Pandora Papers allegations

Chile’s lower house voted early Tuesday to impeach President Sebastián Piñera over allegations of corruption raised in the Pandora Papers investigation — the latest political fallout from the media reports on the offshore financial system.

The investigation by The Washington Post and media partners led by the International Consortium of Investigative Journalists (ICIJ) showed that a mining company owned in part by Piñera’s children was sold for $152 million to a close friend of the president, Chilean businessman Carlos Alberto Délano. The sale was made in December 2010, almost nine months into Piñera’s first term as president.

The last payment in the deal was contingent on the government’s declining to impose environmental protections on the mining area, a clause blasted by opposition politicians as a “serious” conflict of interest.

Piñera has denied wrongdoing, saying that neither he nor his family has investment companies incorporated abroad. He said he “completely and totally detached” himself from family businesses before assuming his first presidency, which ended in 2014. He took office again in 2018.

(https://www.washingtonpost.com/world/2021/11/09/chile-impeach-president-sebastian-pinera/)

“American Sierra Gold Corporation is currently anticipating a 1 for 500 reverse stock split.”

This stinks for those of us still alive and conned into shares back in the day of liars and thieves.

What’s the reason for the reverse split? It’s not like they need the pps to be higher for any reason is there?

Just a WAG - Since MDMN owns 11 million shares of AMNP, which is quite illiquid, there’s little opportunity to convert that to cash. Maybe after a RS it would be much easier to move 22,000 shares of AMNP at the higher converted price into a market betting on speculation that it would go up. Then, MDMN could use the cash to settle some debt.

Wowza!

Check out those images on the gallery and videos on YouTube!

Nice!

1st time seeing Aumc Bid over a $1.00

Hoping for some financial projections soon, would be nice to have those for PDAC