SOME THOUGHTS

At the end of the day, Auryn is going to have to install some type of beneficiation equipment to concentrate their ore. This will decrease TRANSPORTATION CHARGES in that less valueless material (“gangue”) will be transported. The 2 most common methodologies include “Flotation” and “Gravimetric Separation”. Both methodologies have their pro’s and con’s. The “refractory” nature of the ore at the current level of the DL2 Vein (at about 1,840 masl), has rendered “flotation” as the preferred methodology for now. I personally don’t know enough about the cost differential and the performance differential to have a dog in this fight.

With the COMPREHENSIVE METALLURGICAL ANALYSIS now completed for the DL2 Vein ore, any interested potential OFFTAKE PARTNERS now have enough information to throw their hat into the ring for consideration if they so choose. The goal for Auryn is to find a buyer with better terms than Enami offers and perhaps to land a partner willing to advance the cash needed to ramp up production which would be of benefit to BOTH Auryn and the OFFTAKE PARTNER.

- It was unfortunate that a press release as important as this one was “packaged” as it was. This is not a critique of management that had “material” news they needed to disseminate. There was tremendous news and there was also disappointing news. Sometimes, we humans have a tendency to focus in on the “hiccups” and fail to appreciate the breakthroughs.

I think what set the table for the disappointment some are experiencing is the fact that management opted to keep quiet during the “COMPREHENSIVE METALLURGICAL TESTING” process instead of making their normal quarterly update. In retrospect though, since the new update was dated one day after the receipt of great news regarding the results from a shipment of ore to Enami, maybe management was waiting for the results of BOTH of these endeavors.

Maurizio was approached by, or maybe he reached out to, Goldlogic, and they said that they’d be interested in purchasing our ore concentrate if it passed muster with whatever “gravity plant” system they insisted on. It did NOT pass muster with that system even though the ADL ore had excellent results (over a 90% recovery rate) with the Sepro/Falconer gravity system at the Merlin 1 Vein just west of the DL2 Vein.

From the June 16, 2016 quarterly update.

“Metallurgical tests conducted at laboratories in Perú returned an average gold recovery greater than 90%. Test conditions confirmed the best recovery method entails use of a Falcon gravimetric system processing PREVIOUSLY CONCENTRATED (emphasis added) ore.”

The question becomes how did this lab “previously concentrate the ore”. Was it “flotation”, which was then followed by “gravimetrics”? With the 7 different Main Veins, as well as the LDM and Pegaso Nero, I’m going to assume that at the end of the day there will be a “flotation” facility as well as “gravity plants” on the plateau at the ADL. The “gravity plants” will typically be built into the “crushing/grinding” circuit.

“Goldlogic” purchases ore concentrate flow from miners. They are also a “fund” that will advance cash to a miner so that it can rapidly ramp up production which would mutually benefit both “Goldlogic” and their investors as well as Auryn i.e. a “Win-Win”. We shareholders don’t know what the “cost of capital” would have been but Maurizio seemed to think it was a good deal. I too am disappointed that the ore didn’t perform in such a way that we could have inked a deal with them and taken advantage of this “Win-Win”. I have a sneaky feeling that we may end up doing business with them elsewhere at the ADL Mining District. Why do I say that? Because Maurizio mentioned that the plan now is to advance the Antonino Adit straight ahead to the SSW. This is where the 2 “monster veins” (as referred to by management) reside. These are the 2 high-grade veins that showed widths at surface of over 2-meters. They are called the “Don Enrique” and the “Leopoldo Antonino”. The “DE” Vein, on the maps anyway, is very close to where the adit terminates now. The “LA” Vein is further to the SSW. I’m going to guess that the hope is that the ore character for these 2 veins is not “refractory”.

The question becomes, what will the cost of capital be in regards to a “flotation facility”. With a “flotation” system, I would assume that you’d start out with a small facility that matches the daily production rate at the time. Then, you could add “flotation cells” to the plant as production ramps up. The COST OF CAPITAL is typically inversely proportional to the grade of the ore being mined. Extremely high-grade ore, like that at the DL2 Vein, will have a relatively low ALL IN SUSTAINING COST (AISC) per ounce of gold mined. This leads to high MARGINAL PROFIT RATES on a per ounce basis. Financiers enjoy visibility of how they are going to be paid back. As the saying goes in the mining sector, “GRADE IS EVERYTHING”.

- So, what was the tremendous news?

First of all, we successfully intersected the “old workings” via the completion of a 40-meter “ventilation/safety egress chimney”. This will allow the simultaneous mining, in a safe manner, of several sub levels as well as level 3 at the same time. It provides SCALABILITY of production and therefore, of profits especially when that being mined is extremely high-grade. This was a huge accomplishment.

Secondly, SERNAGEOMIN already inspected the new ventilation system and checked off on it. The PR cited:” Following a rigorous evaluation, the mining authorities have formally accepted our updated ventilation measures.” Every positive step in the permitting process is a BIG DEAL. The question that might arise is what is the VALUE gained, in monetary terms, of accessing the “old workings”, getting the new ventilation system inspected and checked off and gaining access to SCALABILITY involving the ability to simultaneously mine several levels at a time. Over time, how many millions of dollars might we be talking about?

Thirdly, during the construction of the “chimney”, Auryn mined 972 tonnes of high-grade ore. This would include the extremely high-grade vein ore as well as the less well-mineralized wall rock.

Fourthly, with the completion of the COMPREHENSIVE METALLURGICAL ANALYSIS done in Peru, Auryn did learn that “flotation” is the preferred method to concentrate the ore at the DL2 Vein. Enami does offer flotation. There has been no mention of any need for “roasting”, Pressure Oxidation (POX) or BIOX (Bio-Oxidation) measures. “Flotation” is a very common, straight forward, environmentally friendly and predictable process.

Fifth, Enami has placed Auryn on the “MINING REGISTRY” which allows, which authorizes the delivery and sale of minerals from Auryn’s operations to ENAMI. This encompasses both DIRECT SMELTING and FLOTATION RECOVERY techniques.

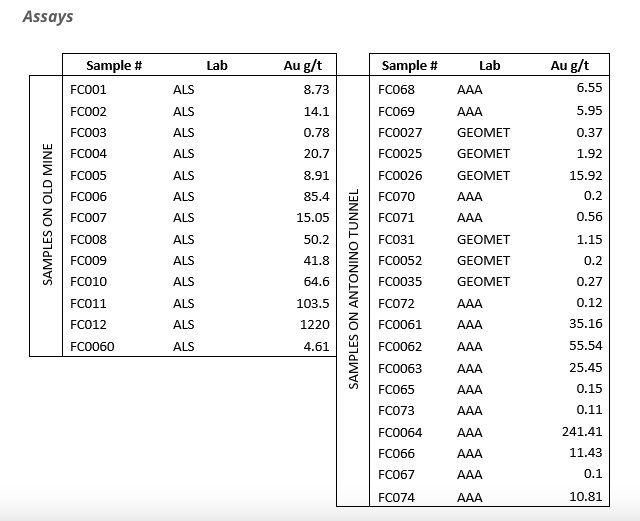

Sixth, On July 19th, Auryn dispatched an experimental batch of minerals to ENAMI’s direct smelting plant. The settlement results, received today on August 9th, are as follows:

• Gold (Au): 57.5 g/t

• Silver (Ag): 978 g/t

• Copper (Cu): 3.23%

Yet once again, the assay results corroborate the HISTORICAL SHIPPING GRADES as well as a vast array of previous sampling measures. These are “settlement results” which are sometimes referred to as “liquidation results”. Any penalties for contaminants have already been removed and the grade lowered. On site, Auryn currently has no “beneficiation” methodologies available other than visual sorting. Not including the copper, the “gold equivalent”, factoring in the silver component, is right at 70 gpt gold for unbeneficiated ore.

Seventh, Auryn has officially COMMENCED EXTREMELY HIGH-GRADE PRODUCTION.

With the COMPREHENSIVE METALLURGICAL ANALYSIS now completed for the DL2 Vein ore, any interested potential OFFTAKE PARTNERS can now throw their hat into the ring for consideration. The goal for Auryn is to find a buyer with better terms than Enami offers and to land a partner willing to advance the cash needed to ramp up production which would be of benefit to BOTH Auryn and the OFFTAKE PARTNER.