If the plant is being built now why not give us some pictures of the progress?

The floatation plant will produce a single concentrate. It’s way too basic of a flowchart to have multiple circuits (for multiple metals). They will get credit for the gold and silver (maybe the copper depending on grade but not likely). If AUMC is able to reach production they will work with an offtaker (Trafigura, Traxys, Glencore, or probably someone a lot smaller given the miniscule size of production). This offtaker will negotiate a discount to the current spot price of gold and silver, In return they will deal with the logistics and ultimately the refining of the con (which is where they make their money). There will not be any dore as that would require some sort of smelting capacity.

Alternatively they will send the concentrate to their friends at Enami (who will take all of their discounts/expenses) and hope for a better deal.

While I doubt that the new financier is going to be able to take $20M over five years, because it is “capped” (unless production ramps masssively) they will no doubt be getting their pound of flesh. You also have Maurizio getting paid back what he’s owed. Without knowing the specific terms of the financing this is not an investable stock. Based on their production guidance its highly likely that this company will not be netting any profits (after meeting its “debt” obligations) , for several years, which would make the current $35M valuation extremely expensive.

If the company decides to disclose the terms of the financing and they turn out to be more “dovish” vs. “hawkish” that could change the thesis. If the company executes on this first phase of production and, in a few years, is able to guide to a more robust production/profit forecast that would change the investment thesis.

As of today, the company has officially clarified to investors that the “pie in the sky BS” that has been slathered all over this board was simply misplaced, misinformed optimism. BUT it would be a lot more helpful if they provided transparency on this debt/preferred equity overhang.

(Edit personal comment)*

. Building a plant is undeniably progress. If they can start to provide detailed updates on progress (it takes a long time for permitting and ordering critical equipment) that would be an excellent confidence booster (as long as expectations on actual production and profit potential remain grounded).

[Edit. ]~~~~~ MC & BOD need to keep their promise about being transparent with us. I believe we’ll all still profit greatly from Auryn (MDMN), but they are taking far too long without providing real answers to our reasonable questions.

Send them an email and ask them for pictures of the flotation plant’s progress, they might even answer you.

In theory means it is not a proven outcome. May not even be probable and worst case not possible.

I could not believe this when I saw it.

5.77 Million shares of MDMN were traded for 1 MILLIONTH of a dollar ! (or 1 ten thousandth of a cent !!!)

The total trade value of the 5.77 Million shares was $5.78 !!!

=5772800*0.000001=$5.7728

Time Price Chg Vol

15:19:16 0.000001 -0.000099 2,500,000

12:45:34 0.000001 -0.000099 500,000

12:21:37 0.000001 -0.000099 1,859,940

12:19:03 0.000001 -0.000099 912,866

PS : I agree with ‘stop the personal diatribes’, just ignore a post you don’t like or agree with. Click on the heart if you like/agree with the post. Also it would be great to have an icon, like the heart, which people could click on if they disliked/disagreed with the post.

Thank you for pointing out the ‘in theory’ reference. I wonder how I missed it. ![]()

Most of us here enjoy reading about the many functions within the mining industry. But with advancing technology & the many finer details involved, opinions & interpretations vary over time.

So, in “theory”, shares of MDMN are not worthless.

Simply tax loss selling which sux for those looking to realize a loss. The decision (or lack of ability) to make the proper filings to keep MDMN on the OTCBB is pretty inexcusable. I know that excuses/theories have been attempted on this board but try telling that to the person who just sold 6m shares for a cup of coffee.

Any posts commenting on personalities will be deleted including any actual points -its too difficult to separate it out- and suspensions will be following.

Is it possible to add an icon, like the heart, which people could click on if they disliked/disagreed with the post.

I can’t get past the “putting expenses aside” in order to contemplate the rest of the question.

I’m going to research back to my decades of saved history (financials, updates, postings, etc. {by the way if anyone wants to write a book, I’ve got it all … right from 1988 on) regarding MDMN & CDCH, etc. to find out how much it would cost to keep MDMN as a reporting stock. There is the listing fee, audit fee, (Not sure if the ‘debt’ to Mario, etc. enters into it) website fee, maybe more. But it shouldn’t amount to less than 5.77 Million shares of MDMN traded for 1 MILLIONTH of a dollar !

That’s quite alright, jds. No doubt it’s cost prohibitive to put all the mechanics of processing the ore in the same area. NOTE: this was simply a non-issue that was unreasonably inflated. My focus was not about the FF, extraction & refining processes while discussing profitability with Rod. I asked about the conversions and why $25M of net profits would take 4 years before they were possible.

FF plant operations vs ENAMI was briefly mentioned when Rod replied to my questions. Here’s my exact comment that was later inflated as an earth shattering issue:

That’s all it was, completely unrecognizable to the distorted claims that followed. I admitted I was wrong even before making the comment, because I was fully aware I had limited knowledge of the FF & refining processes. This was a non-issue from the beginning.

A couple of my friends asked me if they should take the 0 on their MDMN shares for tax purposes. I strongly insisted that they do not do that.

The general plan was made clear in the last 3 updates.

I expect the mill to be operational beginning of Q3 and at full capacity with AUMC self-sustaining by Q4.

I don’t need or expect transparency on the minutiae.

Disclosure: I’ve been accumulating AUMC as others are liquidating. If I could, I would buy MDMN but have not found a way to purchase shares on the expert market.

Here is a brief AI summary for you:

September Update Summary:

• $4M Financing Secured: Enables the construction of a 100-ton/day flotation plant, operational by May 2025.

• Fortuna Site Progress: Access roads repaired, Antonino Tunnel drained, mining camp under construction.

• University Collaborations: Process optimization and water management studies underway.

• Permits: Renewal for Fortuna’s production and flotation plant under Chile’s simplified mining law.

October Update Summary:

• Mining Camp & Tunnel: Mining camp 60% complete; Antonino Tunnel operations advancing.

• Permits & Production: Permit renewal for 1,000 tons/month approved under Small Mining Producers statute.

• Flotation Plant: Progress includes surveys, water studies, equipment procurement, and permit prep for Q3 2025 operational target.

• University Collaboration: Research on regulatory compliance and low-cost water filtration.

Oct 30 Notification Summary:

• Stockpiling & Permits: Preparing 20,000 tonnes of ore stockpile; permits allow up to 1,000 tonnes/month under Chile’s small miner law.

• Flotation Plant: Operational by Q3 2025, aligned with production goals.

• Grades: Testing indicates high mineral grades (57 gpt gold, 978 gpt silver, 3.23% copper); targeting 10 gpt average at plant.

• Sales Strategy: FOB agreements planned with major traders like Glencore and Trafigura.

• Risks: No proven reserves; relying on resource estimates, adding operational uncertainties.

I would agree that its a terrible idea. There is value in MDMN via AUMC shares (yet to be distributed shares).

The problem is that MDMN shareholders holding a $0 value stock (cant liquidate) may need some immediate value, albeit in a tax loss. Thats the unfortunate circumstance of mdmn going dark. Its pretty crappy that happened.

The other thing Kevin that you need to help drive home to MC is this inexplicable veil of secrecy regarding the $20M dividend. It wreaks of insider preferential treatment. The stockpile is of much higher grade than what will be mined and produced on a larger scale in the future. That is because what has been extracted to date has been done with a higher precision to the direct vein material.( BB’s point). We understand Baldys point (confirmed by you and the company) that at large scale 10gpt is the target. The current stockpile is much higher than 10gpt and theres enough there to feed the new plant for over a full 12+ months. So where does all that high grade revenue go? Whats the order? Financer gets that high grade revenue to the tune of the first $20M? For a $4M loan? When does MC get paid back?

These are not trivial questions. Someone deciding to take a tax loss at this point on MDMN shares may want to know these g** d** answers!

Unfortunately, I disagree with you. Currently, AUMC and MDMN have no value. It’s a fact. Look at the price. No market action and no trade ability for MDMN. The market has told us both AUMC and MDMN have no value.

I feel some have a perceived, future value based upon what AUMC currently has, and has not, performed to date. Some have a higher perceived value than others, some have a lower perceived value. Some look at what’s been posted and feel AUMC is going to be the next Rio Tinto, others feel like we still don’t even have the full story on the financing deal, so AUMC isn’t worth anything.

Both views are correct because the people arrive at those views through their own opinions.

Personally, for me, I feel that AUMC/MDMN do have the potential for value; however, too many mistakes and failures to disclose complete details has resulted in both AUMC and MDMN currently being worthless.

I no longer have any desire to look at “next week” (yes, I used the forbidden phrase). I am currently managing my entire portfolio, including stocks and crypto, I have a daughter who is a freshman at Michigan State University (Go Green!) and I have to look at my whole portfolio, not just focus on one stock which I’ve held for too long and upon which I have lost my entire investment. AUMC/MDMN are nothing more than what I use for tax loss selling.

If at some point in time AUMC/MDMN, IMO, get their act together and start producing, and become profitable, and the stock rises before I have sold off my entire positions, then I will consider myself fortunate.

My opinion does not mean I am bad mouthing or trashing AUMC/MDMN, I am just looking at it from a 50,000ft view in conjunction with my other investments.

I will still get the company updates and will still periodically post some font of wisdom. ![]() Because I would keep monitoring any stock or other investment I own. I really hope AUMC/MDMN does have success. I have suffered a loss to date, but others have been hit a lot harder than me. I hope they can recover something, even if I don’t.

Because I would keep monitoring any stock or other investment I own. I really hope AUMC/MDMN does have success. I have suffered a loss to date, but others have been hit a lot harder than me. I hope they can recover something, even if I don’t.

I wish everyone a festive and Merry Christmas and Happy Holidays! Don’t worry about AUMC/MDMN, enjoy the time with your friends and family. (Unless you had them invest in MDMN, then good luck. Just Kidding!!) ![]()

Hi JimmyP,

My advice to you is to put implicit trust in the truthfulness of the updates/press releases provided by management. I’ll be the first to admit that their TIMING is not always precise. Three times they told us that they were just sure that the good-looking vein they just intersected via the Antonino Adit was the DL2 Vein and that this time next quarter we should be shipping high-grade ore to Enami for processing. THREE TIMES they were wrong and the good-looking vein they intersected was NOT the DL2 Vein.

Then, after a lab confirmed that they finally did intersect the DL2 Vein and they sent large samples of ore to both the Enami smelter and to the smelter testing facilities at the Plenge Lab in Lima, Peru, Enami made a seemingly generous offer of 70 gpt “gold equivalent” for the ore, after they deducted their fees. Meanwhile, the Plenge Lab smelter test results revealed that Enami’s SEEMINGLY generous offer was really only 44-cents on the dollar. The actual intra adit “head grade” of the ore sent to both Enami and the Plenge Lab turned out to be approximately 157 gpt gold equivalent when you add in the contributions from the extremely high-grade silver (978 gpt) and the copper (3.23%). The gold alone came in at an off the chart 128 gpt gold. Enami was only willing to pay 57 gpt for the gold component, but they were willing to pay 13 gpt for the silver and copper as “by-product” credits.

Wait a minute, that 157 gpt “gold equivalent” grade figure seems awfully familiar. Well, it should. What were the grades of the initial 4 “channel samples” run of the DL2 Vein at the site where the Antonino Adit intersected it? They came in at an average of 164 gpt gold equivalent. What was the average grade of the second round of channel samples taken to make sure that this 164 gpt gold equivalent wasn’t an error? These came in at 150 gpt gold equivalent. The 2 samplings came in at 157 gpt gold equivalent plus or minus 7 gpt. Plenge’s results came in at 157 gpt for the intra adit “head grade”. Enami was TRYING to charge a fortune for their smelting fees. The Auryn BOD unanimously decided to say “No thanks” to Enami, “we’ll do our own ore processing on-site" via froth flotation.

Already successful people don’t intentionally mislead shareholders on press releases. The society we live in is much too litigious to risk doing that.

JimmyP, you made a great insight into the fact that the grades of the stockpiled DL2 Vein ore is going to be a heck of a lot higher than that “at least 10 gpt” figure that management cited in their 10/30/24 update. What EXACTLY did management say in that PR? They said that the grades obtained in that 2,200 pound “experimental batch” of ore sent to the Enami smelter, which came in at 70 gpt “gold equivalent”, PROVIDED A SOLID BASELINE FOR GRADE EXPECTATIONS for the ore being mined and stockpiled from the DL2 Vein as long as management can continue to MINE DIRECTLY FROM THE VEIN WITH MINIMAL DILUTION FROM THE SURROUNDING WALL ROCK as they have been for the last many, many months, starting in July of 2023.

OK, so 70 gpt “gold equivalent” can serve as a “SOLID BASELINE FOR GRADE EXPECTATIONS” if, if, if we’re talking in terms of, first of all, the DL2 Vein which we have truckloads of information on, in regard to grade expectations. Then, the caveat is listed that this 70 gpt figure only applies if, if, if, management can continue to be able to mine “DIRECTLY FROM THE DL2 VEIN without mining the less well-mineralized ore from the surrounding wall rock.

What are the chances of this occurring? Well, they’ve been successfully mining in this fashion for about 11 straight months. Was this “beginner’s luck” or is it likely that they will be able to continue in this fashion. Who knows? Note that this 70 gpt gold equivalent guidance was VEIN SPECIFIC (pertaining only to the DL2 Vein) and MINING METHODOLOGY SPECIFIC i.e. mining directly from the vein in a minimal dilution manner via avoiding the wall rock.

Was management recklessly going out on a limb by asserting this 70 gpt figure under the caveats outlined? No, on the 10/30/24 date of this update, they had already mined and stockpiled about 12,000 tonnes of ore (an estimate) while keeping on track to have 20,000 tonnes of ore ready for processing by about 7/1/25, when the FF plant is scheduled to be commissioned. Not only are they “mining and stockpiling” extremely high-grade vein ore (the average grade worldwide is 4.18 gpt gold for similar underground “narrow vein” operations), they’re mining it in a fashion that minimizes grade dilution, and they’re mining and stockpiling A SIGNIFICANT AMOUNT OF IT while mining in this “DIRECT FROM THE VEIN” fashion. Management had 20-20 hindsight as to what grades to expect from mining in this fashion from the DL2 Vein, when they made that statement on 10/30/24.

Management went on to say that they were about to “source” the ore for the new FF plant from a variety of other areas at the ADL Mining District in addition to the DL2 Vein, which they know so much about. In regard to these other veins, management admits that they don’t know nearly as much about them. In looking forward, they stated that we could expect grades of “at least 10 gpt gold” ONCE THEY STARTED SOURCING ORE FROM THESE OTHER VEINS. Their knowledge of the grades and widths of the various veins to be mined IN ADDITION TO THE DL2 VEIN is vastly inferior to what they know about the DL2 Vein.

In providing this FORWARD GUIDANCE related to the upcoming multi-sourcing of the “feed” ore, as opposed to the BACKWARD GUIDANCE involving 20-20 hindsight of just the well-known DL2 Vein, management wisely opted to be much more conservative. They even went on to list several “uncertainties” related to the fact that none of these veins, including the DL2 Vein, have ever been fully drilled out and that there were no official NI 43-101 compliant “MINERAL RESERVES”.

What didn’t management tell us in that update? They didn’t mention that there exists probably a minimum of 10 years-worth of ore available to be mined at the DL2 Vein itself. Management couldn’t mention that with 100% certainty UNTIL AFTER THE DEPOSIT HAD BEEN FULLY DRILLED OUT, so they couldn’t comment on that.

They didn’t tell us that the 6 Main Veins present at the ADL are all part of an inter-related “VEIN SET” of similar, mostly parallel-oriented veins that typically have “homogeneity” i.e. similar widths and grades because they are sourced from the same hydrothermal fluids from the same underlying magmatic source. Again, until a vein deposit is fully drilled out, management shouldn’t imply that all of those 6 “Main Veins” should be “homogenous”.

In reality, the “crown jewel” of Auryn is not just a mining district with extremely high grades. It is also the SHARE STRUCTURE. Management could have drilled out the entire deposit and had boatloads of “CERTAINTY”. The problem is that they’d also have perhaps 700 million shares outstanding instead of 70 million shares outstanding. In mining, “CERTAINTY” can be very expensive in terms of the dilution of SHAREHOLDER REWARDS. Without these high levels of “CERTAINTY”, Maurizio opted to bankroll the company all of the way into production without charging a dime in interest. During that timeframe, we shareholders acquired a great deal of “CERTAINTY”, not via expensive diamond drill programs that induce mega-dilution of the share structure during the EXPLORATION PHASE, but by the results acquired during the DEVELOPMENT PHASE of the project.

Soon, Auryn is going to feed 20,000 tonnes of extremely high-grade ore into their new froth flotation plant. This already extremely high-grade ore is going to be further concentrated by a multiple of between 2-fold and 20-fold as per the worldwide averages for FF plants. The results will provide EXTREMELY high levels of “CERTAINTY” to anybody paying attention. “CERTAINTY” can be provided by spending truckloads of money on diamond drill programs during EXPLORATION and this is the norm. Mega-dilution of your SHARE STRUCTURE is the norm.

“CERTAINTY” can also be provided by having management advance all of the cash needed to go into PRODUCTION, resulting in zero dilution of the share structure, and you actually get PAID while acquiring that “CERTAINTY” instead of being DILUTED to death. That tight share structure, which is the direct result of management’s generosity, is the gift that keeps giving for the life of the company.

The only problem is that until a company like Auryn goes into PRODUCTION, nobody pays any attention to the ultra-tight share structure. Until there are “EARNINGS” in front of that “PER SHARE” figure, nobody pays attention. You’re just one of those other 2,500 junior explorers that will probably never make it into production. NEWSFLASH: When you have 20,000 tonnes of extremely high-grade ore stockpiled and ready to go into a new FF plant, YOU HAVE ALREADY BEEN IN “PRODUCTION” FOR QUITE SOME TIME.

The Auryn/Medinah story is a bit of an enigma from the point of view of the typical junior explorer, developer, producer. The shareholders never had a shot at share price enhancement related to sexy drill hole results. With the approach taken, the SHAREHOLDER REWARDS get pushed back in time, but they can get greatly enhanced once payday does arrive because the ever-present DILUTION of the share structure gets avoided and the EARNINGS PER SHARE figure, which is the basis for SHAREHOLDER REWARDS, takes precedence. If you get a free minute, take a look at the last 30 quarterly filings by Auryn. That line item citing “SHARES ISSUED AND OUTSTANDING” has said 70 million shares on each of those filings. I’ve never seen anything even remotely resembling this.

The elphant in the room is still that the 20,000 tons of high grade stockpiled is going to be pillaged by the financer (related party). We have to assume that to be the case until they state otherwise. This secrecy is deceptive and unprofessional. Its almost as if they are gauging the tolerance of the shareholder base on how much resistance we will put up to being squeezed on the initial (5 year) revenues.

Some people on this forum are very smart. Others not so much. Some are too trusting and some are too skeptical etc etc. We’d all prefer Auryn to give us the financing terms straight and eliminate the frustration so we can all start getting excited and positive about this investment finally! Its taken forever and a year to begin a revenue stream, and now that has to be tainted by some unclear BS on dividends terms? Thats not acceptable. We are talking $20M for a $4M loan! You said it yourself BB, that stockpile is worth a fortune and its collateral. Why are we paying a $16M finance charge?

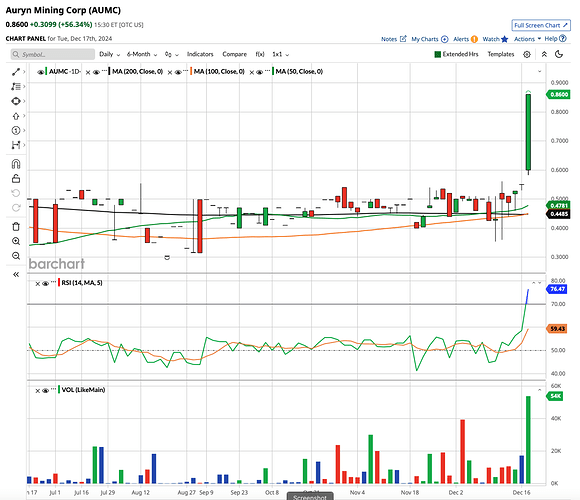

Is something up? Hoping there is which moved the SP like that.

What gives? And what’s up with MDMN shares