That pile is worth a fortune! ![]()

This seems appropriate. Happy Saturday!

"Chilean flamingos, native to South America, face several threats in the wild, including egg-harvesting, tourism disturbance, and habitat degradation due to industrial mining operations."

This isn’t the first time, and it won’t be the last — mining be damned! ![]()

![]()

![]()

Hulkster,

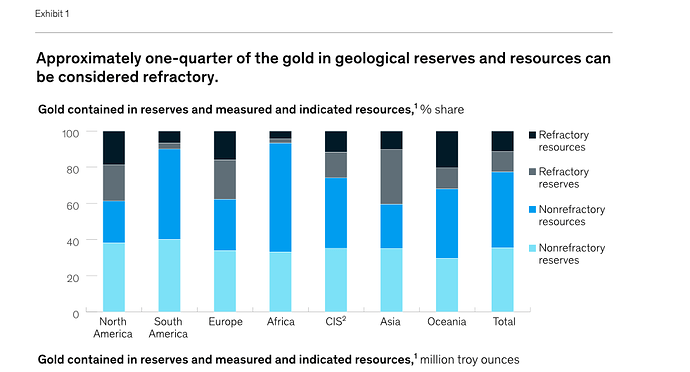

I’m not that certain that everything is dependent on the $4M loan and financing package being finalized. The $1M loan does seem to have been finalized as $500,000 has already been received. Just how is this going to purchase a $10M FF plant? I think there is optionality that has been overlooked because it not part of the conversation that has been assumed that all ore is considered refractory.

You’ll note from the above graphic there is only a very small portion of economic ore in South America that is considered refractory, and the much larger portion is actually nonrefractory in nature. You’ll recall when it was reported in the early days when mine preparation was underway for exploitation of the Caren-Merlin high grade gold veins with production estimates of:

5,000 troy ounces in 2016

25,000 troy ounces in 2017

AURYN had looked at these figures and concluded that a process was available that could extract this gold content economically. Just what was the process being looked at? There is no doubt that the most profitable method on the Fortuna mine will involve froth flotation to obtain the credits for all three minerals present in the main vein, gold, silver and copper. That decision has been made. That vein extends vertically downwards to an as yet undetermined depth. The Don Luis vein will be fully pursued and exploited using a froth flotation process. Caren’s Larissa adit was in a 60 meter horizontal mineralization zone extending across the LDM, that although it contained all 3 minerals, it was largely the free milling gold portion that appeared to be abundant, of interest, and being pursued.

We are all speculating here, not investing. Millions were spent on the Caren development through late 2016 when things started to grind to a halt. Networking with experts to facilitate solutions is a strength shown by management. We’ve spent years slowly inching forward to a very promising stage that is nearing completion. The permitting and funding for the FF facility is all important. What if the permitting is more complicated than simply putting in a 100 TPD FF plant? What if there is another option to come up with the anticipated $10M for the FF plant that hasn’t been presented yet. The $1M loan and $3M financing is not going to cover the cost of purchasing the turnkey FF plant. How much gold would need to be mined to come up with $10M saleable gold concentrate and how could this be accomplished in record time? Perhaps the permitting is being presented as a 2 step process that involves a stand alone gravitational concentrator followed by construction of an FF plant for further processing the leftover “tailings” that would contain the largest portion of the mineral content in the ore. Where would this unprocessed “tailings” be stored until the FF plant was built? What would the permitting look like for this 2 step process and how long would it take?

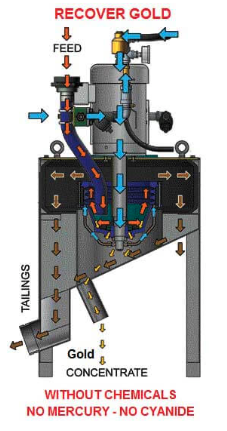

I have thought about and repeatedly mentioned a gravitational process that may be considered as part of an integrated FF plant, but also because there is apparently a large percentage of visible gold I’m questioning if this can be successfully concentrated in a standalone gravity concentrator to actually fund the buildout of the FF plant. How many ounces would be required? How many tonnes of ore would need to be gravitationally concentrated to produce that amount of gold in concentrate? How many truckloads of concentrate would need to be sold and transported? Could the same estimates as made in 2016-2017 for the Caren mine be met or exceeded today? These are things I’m thinking out loud about here.

Gravity Concentration in Artisanal Gold Mining

In artisanal mining many gravity concentration processes consist of a single pass of the feed ore through equipment a gravitational concentrator. Depending on the gravitational force (G) applied to the feed gold particles result in a concentrate being collected. These methods often do not provide high gold recoveries, particularly with respect to fine gold particles.Conventional mines typically place centrifuges in closed-loop grinding circuits, either at the discharge of the mills or the underflow of cyclones to remove coarser gold grains from the circuit before the ore enters the flotation and/or cyanidation circuits. In many cases, the rinse cycle occurs between 20 and 120 min of operation. The mass of concentrate in a centrifuge is typically much less than 0.1% of the original feed.

… As centrifuges operate at high G-Forces, they are less sensitive to gold particle shape than other gravity concentration equipment and accept larger variations of particle size than other concentrators. The maximum feed grain size is 6 mm but it is recommended to only feed particles smaller than 2 mm. Some centrifuges can operate with extremely small particles, as fine as 3 µm (Sepro, 2019)

It was observed in the field, in an artisanal operation in Ecuador, that by feeding 2 tph of ore with 4 g Au/t in a centrifuge, in 30 min of operation, 1 kg of concentrate analyzed 3000 gAu/t.

… A single pass of ore in a batch centrifugal concentrator can provide relatively good recoveries for some ores.

(Minerals | Free Full-Text | Gravity Concentration in Artisanal Gold Mining)

The above value was from a small artisanal mine. A 4 tph unit would process 100 tonnes/day. This is an incredible reduction of the volume and weight of concentrate to be shipped for sale. I would note that the above was from around the 2014-2015 time frame and gravitational efficiencies have been much improved. An 80 tonne/hr from an Knelson XD20 Concentrator can handle 6.0 mm feed but is typically run at 2.0 mm for a coarse grind with a 5.5-7.5 kW motor size range.

see:

NO CHEMICAL GRAVITY GOLD RECOVERY EQUIPMENT

(NO Chemical Gravity Gold Recovery Equipment)

also see:

(Centrifugal Gravity Concentrators - Sepro Mineral Systems)

2 MINS READING TIME

In the last 20 years, advancements in the design and operation of centrifugal gravity concentrators have made them the predominant method for gravity concentration of gold. Further advances in recent years has expanded the use of this technology for the recovery other heavy minerals. Sepro Mineral Systems manufactures Falcon Gravity Concentrators, one of the most common units used in the industry today.

Excerpt from paper:

Gravity concentration, where applicable and effective, has the lowest installed and operating costs when compared with other beneficiation technologies. It tends to also have the lowest environmental impact as gravity concentration does not require the use of chemicals and reagents.

In January of this year Cornhusker correctly stated, “A meaningful amount time remains before this thing is an operational 100 tpd mine. Financing, permitting, construction → time." I’m just wondering here if our experts have looked at all the possible solutions to getting this project to the point where they can tell us where we are at in all this. The numerous delays are certainly disappointing . I do have an expectation management will be successful and shareholders will be rewarded. I am open to be pleasantly surprised sooner, rather than later.

EZ

Thanks for the in depth analysis. We will just have to wait and see but sometimes I say where is old Lester so he can pump the shit out this so we can get the hell out dodge and let the newbies take over another 20 years. On a side note it looks like BB’s post are starting to rub off on you, lol.

Be nice…

Something is starting to smell again! I pointed out that someone was selling over 200,000 shares a couple months ago. If we were that close why sell? Could they know something we don’t? It’s time we get some answers from MC as to why we have not heard from the company.

Trying to figure out how to spin this insider deal to us.

Ya think! Come on we have heard for way too long that we have the stock piles etc. Gold prices are at the highest……just sell some rock and get on with it already. There is a mountain of it we keep hearing.

After twenty years of this crap it’s time for us to see a light!

Keep on eye on this one. Massive volume and a new high for Spartan (SPR:ASX)

The company I’m involved with in Peru finally received their last set of permits, after 10 months, and are now in a position to start drawing down on a $7M debt facility to start the construction of the 350tpd plant. Current estimates are for completion by October of 2025. These things take time.

Nothing smells on a desiccated corpse. We can only hope MC has enough cleric or bard levels to cast resurrection.

Resurrection

7th Necromancy

Casting Time: 1 hour

Range: Touch

Target: A dead creature that has been dead for no more than a century, that didn't die of old age, and that isn't undead

Components: V S M (A diamond worth at least 1,000 gp, which the spell consumes)

Duration: Instantaneous

Classes: Bard, Cleric

You touch a dead creature that has been dead for no more than a century, that didn’t die of old age, and that isn’t undead. If its soul is free and willing, the target returns to life with all its hit points.

This spell neutralizes any poisons and cures normal diseases afflicting the creature when it died. It doesn’t, however, remove magical diseases, curses, and the like; if such effects aren’t removed prior to casting the spell, they afflict the target on its return to life.

This spell closes all mortal wounds and restores any missing body parts.

Coming back from the dead is an ordeal. The target takes a −4 penalty to all attack rolls, saving throws, and ability checks. Every time the target finishes a long rest, the penalty is reduced by 1 until it disappears.

Casting this spell to restore life to a creature that has been dead for one year or longer taxes you greatly. Until you finish a long rest, you can’t cast spells again, and you have disadvantage on all attack rolls, ability checks, and saving throws.

Below is a link to a series of papers that might help explain what has been going on behind the scenes at Auryn over the last couple of years:

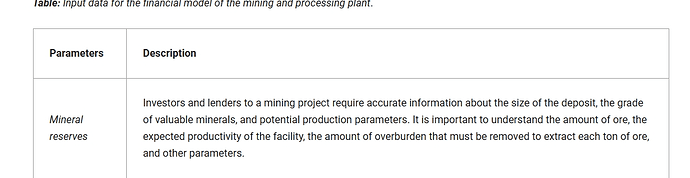

One of the recent quarterly updates cited how management chose to temporarily cease their “mining and stockpiling” efforts in order to concentrate on producing “DETAILED CASH FLOW MODELS” regarding the DL2 Mine and the incorporation of a froth flotation plant, a new tailings storage facility (TSF), and an on-site assay lab. The development of high quality financial models is what some of us know as the conducting of “FEASIBILITY STUDIES”.

In a nutshell, the goal of FINANCIAL MODELING is to determine if the proposed project can provide a sufficient return on capital for the funders and provide profits and additional value for the project’s owners. You might recognize some of the terms used in these modeling efforts like NET PRESENT VALUE OR “NPV”, DISCOUNTED CASH FLOW ANALYSES, INTERNAL RATES OF RETURN, DISCOUNT FACTORS, ETC.

For those that don’t use these terms on a daily basis they can sound like a bunch of gobbleygook but since the CAPEX of some projects extends into the billions of dollars, it makes sense to spend a relatively small amount of money in determining if the overall project makes economic sense.

Auryn has completed these “DETAILED CASH FLOW ANALYSES” (not that they’re ever 100% completed) and the results have been shared with the proposed funders but not yet with us. Maurizio wants to run a lot of tonnage through the FF plant before sharing Auryn’s projections. In his words he does not want to “make guesstimates based on incomplete data”.

From the point of view of a TMP forum participant, this information represents THE TRUTH that all of us have been seeking all along. The more we familiarize ourselves with the concepts of FINANCIAL MODELING FOR MINING PROJECTS, the more confident we can become in the merits of our investment.

BB. Unfortunately in life and investing you “don’t get your cake and eat it too.” In other words, you don’t get to incessantly fixate on the 70 million shares outstanding AND pretend that AUMC has anywhere near the required data to consider a feasibility study (or even a basic mine plan, DCF, NPV, etc.). If AUMC had spent the time and money (and shares) as anyone, in retrospect, would agree would have been the right course of action over the past seven years, they may have enough drill results to map out a resource. They did not pursue this path so you still get to elate as to the miracles of a tight capital structure (let’s just pretend the layers of debt and obligations don’t exist) BUT there is NO way to map out a mine plan nor build a financial model. This is exacatly why it has taken over a year to land (expensive) financing.

Pretending that a 200lb assay, 50 year old historical mining results, and some “grab samples”, constitue a “resource” is either naive or intentially misleading. Nobody in their right might would try to predict the “size of the deposit” but the potential, for some, may warrant an investment (at a highly discounted rate). It appears as though Maurizio found an investor who’s willing to take that risk. The massive “reward” (the terms of investment) are reflective of the massive risk.

I would agree that AUMC can, and hopefully has, been working on the engineering, design work of the FF plant. This is a necessary step preceding the various permits. I haven’t spoken to Maurizio recently but do know he’s working on several other projects so his plate is full. I’m still guessing that the delayed update is tied to AUMC wanting to provide something substanitive (a binding deal).

One of the recent quarterly updates cited how management chose to temporarily cease their “mining and stockpiling” efforts in order to concentrate on producing “DETAILED CASH FLOW MODELS” regarding the DL2 Mine and the incorporation of a froth flotation plant, a new tailings storage facility (TSF), and an on-site assay lab. The development of high quality financial models is what some of us know as the conducting of “FEASIBILITY STUDIES”.

Another fascinating take. So you believe that AUMC stopped their “mining activities” so they could focus on building a spreadsheet based on a 200lb sample? As a point of reference, I’m invested in another company that recently sent their material (a smelted concentrate) to the Plenge Laboratory (coincidentally enough). It was considered a small representative sample. It took 5 days to get the assay on 15,000 pounds. It supposedly took AUMC 5 months to get the same assay on a bucket of material.

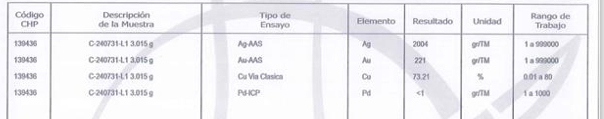

Here’s a screenshoot. Imagine trying to build a DETAILED CASH FLOW analysis simply based on these numbers.

Keep in mind that a simple assay on mined ore only reveals a fraction of what is needed. Drill assays are needed to understand lengths/widths of mineralzation at various depths. Simply taking the material from the vein to be assayed, and saying its 1000gpt material has almost zero value from a modeling/mine plan standpoint.

I’m trying to picture a handful of guys, emerging from the adit, dusting themselves off, to sit down and work on “detailed cash flow models.”

Gentlemen, “picks and shovels down, laptops open”.

I guess multi-tasking is a dying art.

They may have stopped mining (many, many months before the 200 days you randomly cite) because THEY DIDN’T HAVE ANY MORE MONEY and knew that pile of unassayed rock had no value untll they could build a plant to process the same. IF, IF, IF they could have sent the mined ore to Enami for ANY profit they obviously would have done so. They would have generated enough profits over the past 10 months to build a 500tpd FF plant. Unfortunately, but undeniably, the transportation costs alone would have made shipping ore to Enami an unprofitable endevour. The EXACT same reality that was faced at the Caren Mine.

While I commend Maurizio for his tenacity and the tough decision he ultimately made in pursuing on onsite plant, I don’t understand why this decision (the only decision) wasn’t made six or seven years ago after the false start at Caren where the cutoff grade was determined be over 10gpt (primarily due to transportation costs and the challenges of chasing a narrow underground vein).

Back of the napkin math, using the Peruvian project I’m involved in, the cutoff grade will probably drop to as low as 2gpt if AUMC is able to process at site. Assuming AUMC is able to mine at an average 8-12gpt this has the potential to be a decent, albeit small, cash flow generator. This cash flow will/would support advancing the balance of the assets (like a real drill program). There won’t be dividends but, for those who think that AUMC is sitting on a WCD, this will be the lever to prove that out.

You are criticizing those making unbased assumptions yet you engage in the samething. Why are you assuming we get the lions share or thats its anywhere near 80/20?

Can you provide an example of a company that does not have a technically defined resource, rather only historical mine data, that trades at that multiple?

Not soliciting shareholders for $4M but willing to pay $20M raises at a minimum some suspicion. With all of the fronting of interest free loans, its not crazy to wonder if this was the mechanism intended to clawback some opportunity costs back for himself.

It also raises questions when a trusted shareholdder claims that the stockpile is sufficient collateral for a loan. If the stockpiled collateral when gold is trading at all time highs is not sufficient for a loan, why are we suppose to believe a year or two of positive production and profits will convince the broader market to value this company like it has a defined resource? In other words, if the resource is as good as “technically defined” due to assays and historical mining activity, why can’t they get a cheaper loan? Your logic is not consistent.

IS MAURIZIO TAKING THE CORRECT APPROACH TO BUILDING AURYN?

If there were a glaring reality in today’s junior mineral explorers/developers industry it would have to be that there are way, way too many junior explorers/developers in existence today. The exact number is somewhere around 2,500. The problem for the juniors is that there is a finite amount of interest in the investment community in investing in the juniors but when you divide that interest level by 2,500 choices then there’s not much to go around. With gold trading near all-time highs, the DEMAND levels are increasing but it has a long way to go to match up with SUPPLY.

What’s the solution in an environment like this? The answer for a junior developer is to somehow distance itself from the competition. With the POG trading where it is, the obvious answer is to do whatever it takes to go into production. This way a junior can DIRECTLY take advantage of those high gold prices. History has clearly shown us that when the POG breaks out to the upside, it is the PRODUCERS that move first.

The problem is that a junior explorer/developer doesn’t simply GO INTO PRODUCTION. The amount of boxes needing to be checked is insanely long. Thus, TIMING is everything because one just doesn’t know how long the POG is going to be breaking out to the upside. In an environment like this, without having a valid discovery that is indeed ready to go into PRODUCTION, you just can’t PROMOTE your way to a higher share price. The DEMAND/SUPPLY fundamentals just won’t allow it.

This being the case, what else can a management team do in order to provide SHAREHOLDER REWARDS proportionate to the accomplishments of the corporation? The answer is to target CASH DIVIDENDS as the preferred method to provide SHAREHOLDER REWARDS. This is not the norm by any means but then again, these aren’t normal times with 2,500 juniors out there competing for attention.

If management becomes convinced to take this approach, then what becomes the key goal to target. The answer is to KEEP THE NUMBER OF SHARES OUTSTANDING TO A MINIMUM AT ALL COSTS. This way, for a given amount of cash available to be dividended out, the CASH DIVIDEND PER SHARE figure can remain high.

How does this affect the type of mineral deposits to target? Being that open pit deposits absolutely, positively need to be fully drilled out in order to design the most economic pit design, and the fact that diamond drilling is EXTREMELY EXPENSIVE, you would obviously shy away from open pit types of deposits. If you already have open pit prospects on your property, you would either defer exploration on them or do a joint venture with a partner who would be responsible for all costs. HIGH DRILLING COSTS EQUATE TO HIGH DILUTION RATES FOR THE SHARE STRUCTURE WHICH IS ANTITHETICAL TO THE OVERALL GOAL OF BEING ABLE TO PROVIDE GENEROUS CASH DIVIDENDS.

The ideal deposit type would become a vein deposit and preferably one that has had enough work done on it already to circumvent the need to drill it out. This means a vein deposit that has already been in production and that has historical production records and exploration work that would clearly indicate that the deposit is indeed ECONOMICALLY FEASIBLE. With the POG trading at all-time highs, this threshold comes down quite a bit especially if the deposit is a high-grade deposit. THE GOAL IS TO ESTABLISH ECONOMIC FEASIBILITY WITH AS LITTLE DILUTION TO THE SHARE STRUCTURE AS POSSIBLE.

Might there be more RISK to an approach like this? Absolutely. If Auryn had fully drilled out the ADL Mining District by selling shares to fund the drilling, Auryn would have been able to intersect the DL2 Vein via the Antonino Adit in less time. BUT ONCE PUT INTO PRODUCTION, THE EARNINGS PER SHARE/POTENTIAL CASH DIVIDENDS PER SHARE WOULD HAVE BEEN, LET’S SAY, ONE-TENTH AS MUCH IF AURYN ENDED UP WITH 700 MILLION SHARES OUTSTANDING INSTEAD OF 70 MILLION. Clearly, there’s a trade-off. Auryn got lucky, they were able to intersect the DL2 Vein and confirm the off the chart grades achieved by the artisanal miners without further dilution. At times, it wasn’t pretty, and it took a long time, but that is in the past and they sit today with 70 million shares outstanding, and they’ve already been producing for over 200 days before temporarily halting production in order to concentrate on the permitting and financing of the froth flotation plant. They have accomplished what needed to be accomplished in order to put themselves into a position to declare and distribute generous CASH DIVIDENDS (based on the % of today’s share price.) As far as the timing goes, I cannot predict when the first cash dividend might be declared and distributed. Auryn currently owes about $5.6 million to Maurizio for advancing the cash needed to make all of this a reality. Again, with 2,499 other junior explorers in existence, you can’t reliably promote your way to providing SHAREHOLDER REWARDS.

But what about all of this criticism about the lack of formal MINERAL RESERVES/MINERAL RESOURCES and the lack of a formal BANKABLE FEASIBILITY STUDY (BFS)? It’s the lenders of capital that might require “X” amount of ounces of MR/MR or a BFS. If the funders of the froth flotation plant confirmed ECONOMIC FEASIBILITY without Auryn diluting its share structure to death by diamond drill programs and producing a several hundred-page BFS, then that’s a success. Once the cash starts flowing, the need for lenders will be greatly diminished. The primary goal is to get to a position in which there is positive cash flow WITH AS LITTLE DAMAGE TO THE SHARE STRUCTURE AS POSSIBLE.

While Auryn was clumsily searching for the DL2 Vein, what did they come upon? They intersected 24 new “structures” (mineralized veins and faults) that they previously knew nothing about. This, in addition to the fact that there are a total of 6 Main Veins, helps address potential MINE LIFE. You don’t need diamond drill results to project potential MINE LIFE. The 5,000-meters of veins that made it all of the way to surface as revealed during Auryn’s exhaustive trench sampling program, directly addresses potential MINE LIFE. What else did Auryn find while drifting the Antonino Adit? They found over 100-meters of solid alteration induced by the “upflow” of metal-bearing hydrothermal fluids from an underlying progenitor magma chamber.

CHANGE OF PACE

Clicked while flying past the distant Bingham / Kennecott Rio Tinto Mine at 70 mph, south of Salt Lake City, Utah, earlier today…

– madmen

Drove up there 10 years or so ago while staying at Park City. It was worth the view.

I took down a bunch of squabbling, sorry if we lost some actual solid info but please keep it objective.

The simplest answer, although not so simple, is undoubtedly YES!

5 Pyrite gold-bearing quartz vein ore

The mineral composition of this type of ore is similar to that of a small amount of sulfide quartz vein ore. The difference is that the sulfide content is high (5% to 15%). Metal minerals include pyrite, pyrrhotite, galena, sphalerite, chalcopyrite, and porphyrite, but pyrite accounts for more than 80%. The gangue minerals are mainly quartz, followed by calcite, feldspar, chlorite, sericite and the like.

Natural gold has a very close relationship with pyrite, so this type of ore is very suitable for flotation treatment, and the recovery rate can reach 93%~96%. If the ore contains coarse particles of free gold, it should be gravity separation before the flotation. When there are refractory gold-containing sulfide mineral particles in the flotation tailings, they can be recovered by the gold shaker.

7 Flotation – cyanide process

This combination is mainly used to process gold-bearing quartz vein ore and quartz-pyrite ore those have close symbiosis relation of sulfide. Compared with the cyanidation process, the flotation – cyanide process has the advantages as following:

does not require a fine ground particle, saving consumption; lesser washing and mixing step; smaller area required, low investment.8 Flotation – gravity separation

It is mainly based on flotation, and is suitable for the ore that is closely symbiotic with GOL and sulfide, and can only be recovered by smelting. Due to the small amount of non-floating sulphide ore particles (mostly pyrrhotite) in the flotation tailings, it needs to be recovered by using a gold shaker table, spiral chute and cyclone.

In summary, the choice of gold processing flow is closely related to the nature of the ore. For some complex gold-bearing ores, especially refractory polymetallic gold-bearing ores, it is technically necessary to select or develop a combination of the gold processing methods in order to maximize gold recovery and efficiently recover various useful ingredients.

(5 Easily Extracted Gold Ores and 8 Processing Methods - JXSC)

One way or another, I have confidence Maurizio’s collaborate team of experts is going to make this happen! I’ve already waited this long, I’m going to continue to wait for it.

EZ

Because this logic is flawed. Anybody who chooses to label this contributor as “trusted” is either not paying attention to the dozen of previous false predictions or choosing to lean on false possitive narratives b/c it makes them feel better about this investment. While we haven’t had to read as much about the “$5000 Economic Impact” as of late, its important to remember that this was a constant narrative. As was the notion that AUMC could send material to Enami as an “attractive back up option.” The argument was that AUMC didn’t want to give up any upside by sending material to Enami (something they had always aspired to do as stated in almost every quarterly update). Instread the decision was made to lose another year to pursue extremely expensive financing. It’s not consistent because its flawed analysis (again).

Investors haven’t received much detail when it comes to assays. Yes, the 200lb sample taken DIRECTLY from the vein had some very attractive grades. Obviously!! But nobody in the real world would use those numbers to forecast production or influence a mine plan.

I would argue that the January 2022 Shareholder update is one of the most significant in terms of the details provided along with the implications of those details.

Specifically:

During the last week of October 2021, AURYN shipped 3 trucks of ore selected from several structures encountered during the development of the Antonino Tunnel as a test production run. In total AURYN delivered 48 tons of ore for processing. This included ore from the new structure intercepted on June 23, 2021, with assays of 15.92 g/t Au, 47 g/t Ag, and 5.3% Cu announced in the Q3 2021 update.

Unlike the 200lb sample of the vein, this “test production run” involved a respectable 48 tons of ore which had very nice grades that would be more representative of what AUMC might be able to acheive during a normal mining operation.

Additionally:

On November 30, 2021, AURYN received a pre-liquidation value from ENAMI for the 48 tons shipped. The accepted total was 15 g/t Au, 31g/t Ag, and 3% Cu with an anticipated liquidation value of $36,207. AURYN expects to receive final payout from ENAMI in January.

Another set of granular details on the $$ received by Enami for the 48 tonnes. In this case AUMC anticipated at toal of $36,000 or $750 per ton of material. If you factor in the costs for AUMC to mine and then transport a ton of materal it would cost at least $1,000 a ton. In other words, at 15gpt material, they were losing money when sending to Enami.

Also worth noting:

AURYN still has approximately 50 tons of ore on site to ship to ENAMI.

In January of 2022 AUMC had extended the Antonio tunnel approximately 255 meters. At this point they had found and lost the DL vein on multiple occassions but this is not relevant. The point worth noting is that over 255 meters of “mining” the company had generated 100 tons of ore worth $75,000 (based on the liquidation value cited above).

By July of 2022, the tunnel was advanced to 350 meters. Another 60 meters over the following 6 months ultimately led to finding the DL Vein (announced Dec 2022). If the company gerated 100 tonns of ore over 250 meters or .4 tonnes per meter the wouldn’t have had a stockpile of much more than 100 tonnes (150 tonnes total) by the time they found the DL. Again, based on the values that the company disclosed this stockpile ore from the first 400 meters of drilling would have been worth ~$108k (150t, at 15gpt).

Fast forward to April of 2023

Another 80 tonnes of material was mined during the building of a gallery at the intersection of the Antonio tunneld and the Don Luis vein. Even if you assume this ore, given the proximity to the vein, was 60gpt material the value would still only be $100k-$200k and doesn’t include all of the barren rock.

During the construction process, 80 tons of mineralized material was accumulated, which still require sorting to discard any waste.

In August of 2023 we received the assays on the “experimental batch” of 57gpt with promises of imminent “financial reports” from all of the material being sent to Enami. The gold ofttake with Goldlogic was officially dead and the first hints of a floatation plant were offered. No mention on how much, if any, ore was mined.

October was the pivot. “Armed with the compelling data” from the 200lb sample and the superior results coming from the Plenge lab, AUMC decided that shipping to Enami, the goal for the past three years, was not feasible.

Post October 2023 there was zero information provided as to what if any ore was being stockpiled. In April 2024 the company admitted that they were on care and maintenance.

Bottom line, the logic offered on this board re: the value of the stockpiled ore isn’t just inconsistent it fatally flawed. Even if we, graciously, assign a $3M value to the stockpile this would not offer much more than $1M of security (loan to value discount). This is why AUMC has struggled to find “normal financing”. IMHO

I asked mdmn mgt how they were being compensated since they have no money.

The response:

The BOD has not been compensated for about 6 years but we will and it will

be determined at a future date, thanks,