SOME THOUGHTS ON THE JULY 15, 2025, AURYN QUARTERLY UPDATE

Being a huge fan of the “Lassonde Curve”, what this update did for me was solidify the fact that Auryn had indeed entered into the all-important “Construction Phase” for their new mine complex. There should be no doubt in anybody’s mind that this is going to be a MINE, and that’s a very big deal for a variety of macro reasons pertaining to TODAY’S mining sector. As indicated in the “Lassonde Curve”, entering into the “Construction Phase” represents the “sweet spot” for investments in this sector. Why is this? It’s because this sector can be most accurately characterized as investors (really speculators) assuming ULTRA-HIGH RISKS while seeking ULTRA-HIGH REWARDS.

The statistical odds for a junior mineral explorer/developer to accomplish what is necessary to advance a project into the “Construction Phase” of the Lassonde Curve and then “Production” is about 1-in-1,000. It really, really, really is that RARE. Part of the significance, in the case of Auryn/Medinah, is passing the scrutiny of an institutional investor, capable of doing in-depth due diligence beyond anything we shareholders could ever dream of, and then agreeing to cut a $4 million check to fund the “Construction Phase” under extremely generous terms i.e. a rate of “SOFR plus 4%” (about 8.33%), no payments due for 10-months, and a 5 year payback schedule. The terms of any mine financing tell a lot about the merits of the assets. In essence, the “Smart Money” has spoken. In the junior explorer/developer sector, landing a debt financing with an institutional lender is really, really, really RARE. When really, really, really RARE events occur, we need to pay attention.

As far as the update goes, for me, the picture of the skeletal infrastructure for the new “warehouse” was very compelling as was the fact that they’re pouring the concrete floor for the new FF plant. Landing a $4 million DEBT FINANCING with an institutional investor with extremely favorable terms had already confirmed in my mind this “Construction Phase” reality, but it was nice to get a few more details.

In my experience, junior explorers pretty much NEVER qualify for a debt financing from an institutional investor. On my long checklist of items needing to be checked off on to confirm a new discovery of significance, I got to check off on the “capital adequacy” box, which I find to be crucial. In this phase of mine development, a lot of money can be spent in a hurry and there is going to be a sense of urgency because all 3 of the metals being mined by Auryn, gold, copper, and silver, are trading at or near all-time highs.

I no longer get too wrapped up on the exact timing for making certain accomplishments in this “Construction Phase” of development. I’m aware of how slow developments seem to be in this sector when working in Latin America. I’m more interested in checking off on the next box coming up.

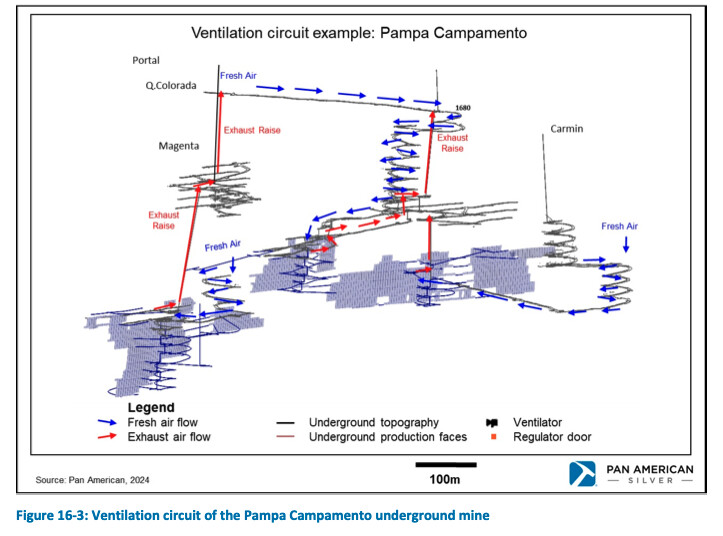

Auryn’s plan to put the CAREN MINE (Larrissa Adit) into production in the very near term, was a welcome surprise. They had successfully gained access to high-grade ore there several years ago. Then SERNAGEOMIN, the Chilean permitting authority, mandated the construction of I think it was 3 vertical ventilation/safety egress “raises”. “Vertical mining” is difficult. This seemed to put this project onto the back burner APPARENTLY ONLY TEMPORARILY, and since then all of the attention was focused on the DL2 Vein which already had 7 vertical ventilation raises and 5 ventilation chimneys in place that were constructed by the artisanal miners. That had to save Auryn upwards of perhaps $10 million and several years of work.

I was pleased to learn that the “technical plan” to expand the production capacity at Fortuna from 1,000 tonnes per month to 3,000 TPM had been completed. Both the northern aspect of the Merlin 4 Vein and the southern aspect of the Merlin 4 will add 1,000 tonnes per month EACH to the production profile. Opening up the Caren Mine (Larrissa Adit) will add another 1,000 TPM. Auryn expects to receive the Caren permit “in the coming weeks”. Auryn mentioned that they will evaluate the feasibility of scaling up capacity at the Caren Mine based on “operational data and performance”.

It appears that the plan at the Fortuna (DL2 Vein and Antonino Adit) is to put in an incline ramp going upwards from “Level 3” at around 1,860 meters or so above sea level to “the upper level historically referred to as Fortuna 1913”. “Fortuna 1913” refers to the mining done at the 1,913 meters above sea level elevation within the “old works”.

This might allow Auryn to gain access to closer to surface “oxide ore”. Management noted that: “It is important to clarify that these extensions do not involve vertical mining or structural changes to the historic mining layout.” I interpret this to be that in this phase they will not be doing any SUB LEVEL STOPING which is a method of “vertical mining”.

I mentioned in a previous post of the comments made by the former Head of Underground Operations at Yamana Gold’s (now Pan Am silver’s) gigantic El Penon Mine in Chile, Sr. de la Torre. He predicted that Auryn’s vein mining operations will end up being VERY SIMILAR to those at El Penon. At El Penon, they too are mining approximately 7 Main Veins contained within a “Vein Set”. After about 25 years of mining that deposit, you can see how the 7 Main Veins are now totally connected via many, many horizontal “cross-cuts”. From this recent update, you can now sense Auryn’s project heading in that general direction. In recent updates you have read about the role of the Merlin 1 Vein, the Larrissa Vein, the Merlin 4 Vein, the DL2 Vein, etc.

I’m going to guess that once the concrete floor of the FF plant is poured, they’ll be able to bring in the froth flotation “cells”, “banks of cells”, and “columns” and possibly also the gyratory crusher and new ball mill which were delivered several months ago.

Management noted that the construction of the “Tailings Storage Facility” or “TSF” will start in September of 2025. This will be an environmentally friendly “dry stack” facility. All in all, I sense a lot of progress being made on a lot of different fronts and I have no doubt whatsoever that Auryn has indeed entered, well-funded, into the “Construction Phase”.

SO, WHAT’S THE BIG DEAL ABOUT GOING INTO PRODUCTION AT THIS PARTICULAR TIME?

The significance has a lot to do with TIMING and some of the macro issues in play in the mining sector RIGHT NOW. What blows me away on this particular deal, is how fortuitous the TIMING is and how many stars have come into alignment:

We are at the phase of a bull market metals cycle in which the generalist investors are just now getting off of the couch and looking for miners that have yet to move upwards in share price. These investors probably realize that incremental gains in the price of gold tend to drop to the bottom line in this sector. THE UNIVERSE OF POTENTIAL INVESTORS IN THE JUNIORS IS COMING TO AN APEX AT THE VERY SAME TIME THAT AURYN/MEDINAH CAN NOW DISTANCE THEMSELVES FROM THE OTHER 2,999 JUNIORS IN THIS SECTOR. That’s good timing.

The question for new investors becomes, are there any “about to become junior producers” that are out there whose share price has not yet moved yet BECAUSE EITHER NOBODY HAS EVER HEARD OF THEM OR THAT THEY HAVE SUCCESSFULLY DEFIED THE DISTANT ODDS AND ARE JUST NOW GOING INTO PRODUCTION.

Auryn/Medinah is about to produce EXTREMELY HIGH-GRADE GOLD, COPPER, and SILVER. ALL 3 of these metals just so happen to be trading at or near their all-time highs RIGHT NOW. That represents insanely good TIMING. “Polymetallic” deposits are in extremely high demand. At the ADL, gold represents about 80% of the value of the metals.

Risk and reward are always in balance in every sector. The junior mining sector is characterized as consisting of speculators assuming ULTRA-HIGH RISK because only 1-in-1,000 junior explorers/developers ever make it all of the way into production. The junior mineral exploration sector has always featured ULTRA-HIGH REWARDS to balance out this ULTA-HIGH RISK. It’s the potential “10-and 20-baggers" that probably attracted us SPECULATORS to this sector in the first place. We probably didn’t realize, at the time, that the companies earning the “20-baggers” had to dodge an awful lot of bullets. If you have successfully beat the 1-in-1,000 odds you have theoretically already earned a shot at the ULTRA-HIGH REWARDS. If you just so happen to have beat the odds when the price of the metals you are selling are trading at all-time highs, then that is a very good thing in regard to augmenting the size of those rewards.

Because of Maurizio’s willingness to act as a “bootstrapper”, Auryn only has 70 million shares outstanding AND MOST OF THESE ARE SEMI-RESTRICTED FROM RESALE DUE TO RULE 144. The potential EARNINGS PER SHARE, if, if, if Auryn can successfully get into high-grade production, are significant.

Wait for management to confirm this, but IMO Auryn’s ALL IN SUSTAINING COST (AISC) is likely to come in at around $800 per ounce of gold equivalent produced. With the price of gold at $3,300-plus, this means that Auryn could be in a position to have “MARGINAL PROFITS PER OUNCE” well over $2,000 per ounce. From an historical point of view, this represents uncharted waters for this industry.

Extremely high-grade ore producers (like Auryn), almost by definition, have extremely low AISC’s per ounce produced. Junior producers with their own on-site ore processing facilities (gyratory crushers, ball mills, and froth flotation plants) also have extremely low AISCs INDEPENDENT OF THE GRADE. Junior producers with BOTH extremely high-grade ore and their own on-site ore processing facilities, will have EXTREMELY LOW AISCs. This translates into them having EXTREMELY HIGH MARGINAL PROFITS per ounce produced. (price of gold minus AISC).

Junior producers that have already successfully conquered the 1-in-1,000 odds of becoming a junior producer (which typically leads to ULTRA-HIGH REWARDS) that just so happen to have EXTREMELY HIGH MARGINAL PROFITS per ounce produced due to EXTREMELY LOW AISCs, and that also just so happen to have an EXTREMELY LOW NUMBER OF SHARES OUTSTANDING (due to “bootstrapping”), have the potential to generate EARNINGS PER SHARE figures that are exceptional. This is especially true if the 3 metals they are producing are ALL TRADING AT OR NEAR ALL-TIME HIGH PRICE LEVELS.

Share prices in any sector, tend to trade at industry-standard “multiples” of EARNINGS PER SHARE or “EPS”. In mining, the average “multiple” is 31.1. Half of the companies in the sector will tend to trade at a “multiple” above this average and half below. Junior producers can generate very high “PRODUCTION GROWTH PROFILES” through time, especially when they first go into production. These companies tend to get awarded higher than average “multiples” because of their superior “PEG RATIOS”. A “PEG RATIO” adds the PRODUCTION GROWTH factor to the standard EPS ratio. The major miners typically cannot generate dynamic “PRODUCTION GROWTH PROFILES”. Their production levels tend to plateau out with time unless they “acquire” new ounces of production through M and A activities. When the price of gold is breaking out to the upside, the level of M and A activity always accelerates partly because the “currency” of the majors (their share price” is extremely high and therefore acquisitions are less dilutive to their share structure.

Maurizio and the Auryn Board of Directors had the foresight to mine and deliver to the area of the ore processing facility, 20,000 tonnes of extremely high-grade ore prior to the commissioning of the new facility. One could argue that Auryn has actually been IN PRODUCTION for the last 2 to 3 years. They haven’t sold that which they produced because if they “froth float” that which they are producing, they will make a lot more money than if they simply sold raw ore. Much of this ore was mined with percussion hammers (without blasting) so as to avoid “dilution” of the grade of the ore within the vein proper by avoiding mining the less well mineralized wall rock surrounding the vein. This stockpiling program will help ensure that the ore processing facility will be kept busy at a time in which the metals prices are extremely high.

Currently, the 3,000 junior explorers/developers active in this sector are having a very difficult time in getting funded. As a result, very few new mineral discoveries have been made, let alone put into production. The “SUPPLY” of junior explorers with promising mineral prospects is currently de minimis. The problem for the majors and mid-tier miners is that they have to replace the ounces they mine annually by either drilling out or purchasing more ounces of production from others.

Recently, Auryn qualified for a rare (for the juniors) $4 million “debt financing” with an institutional investor at very favorable terms including an interest rate of “SOFR” plus 4%”, spread out over 5 years with no payments due in the first 10-months. It’s important to study the terms of any financing in this sector. The terms will tell you a lot about the merits of the deposit. It is not clear if this institution can be relied upon for further financings, if needed, to ramp up the production profile in a quicker manner, so as to take advantage of the high metals’ prices. If Auryn was looked upon as being a favorable RISK prior to their having their own ore processing facility, then I would imagine now they would be an even lower RISK to any financier.

In regard to Auryn’s shares, there are two “bragging points” that Auryn has. The first is the incredibly low number of “shares outstanding” i.e. 70 million. This could easily be 700 million if Auryn fully drilled out their 7 Main Veins. An extremely low number of shares “O/S” means that the share price will tend to hyper-react to any given level of buying because the “supply” of shares is so low.

Of equal importance is the “SHARE OWNERSHIP STRUCTURE”. When management owns 62% of the shares in a semi-restricted fashion due to Rule 144, management has to file a Form 144 pre-warning investors that management is contemplating selling some shares. The amount they can sell per quarter follows a formula. The financial incentives of management and the average shareholder are much more tightly aligned when management is by far and away the largest shareholder. We saw this with Maurizio’s willingness to “bootstrap” the corporation. When management was cutting checks right and left, the “COST OF CAPITAL” for Auryn was zero. So too was the “DILUTION RATE” associated with raising capital. In the last 7 years, all 28 quarterly filings of Auryn had the same figure in the “NUMBER OF SHARES OUTSTANDING” line-item entry. It was 70 million shares each and every time. Maurizio all but promised this many years ago at that “informational meeting”, promises made promises kept.

The minimizing of share structure dilution due to “bootstrapping” lasts for the entire lifetime of the corporation. The worst part of investing in the junior miners is that they do nothing but spend money EARLY ON WHEN THE SHARE PRICE IS LOW. This is because they never (hardly ever) qualify for debt financings. The ULTRA-HIGH-RISK nature of this sector results in willing financiers DEMANDING steep discounts to the prevailing share price levels. This is partly because any shares being sold out of the Treasury have to be “RESTRICTED” for a certain period of time. Nobody is going to pay retail prices for RESTRICTED SHARES. This reality induces “hyper-dilution” of the share structure of junior explorers that don’t have a willing “bootstrapper” like Maurizio.

Maurizio has the RIGHT to be paid back once the profits start flowing. If you own 62% of the shares and the profits start flowing, early on you would also have the OPTION to put those profits back into the company and ramp up production that much quicker which might make that 62% share ownership worth 5-times the amount management was owed in the first place. What do you think that somebody like Maurizio might opt for if the purchase of a “jumbo drill rig” might have so much “MECHANIZATION LEVERAGE” associated with it that the increase in the value of his shareholdings from the enhanced production levels might dwarf the amount he was entitled to be paid back?

After going into production, it is Auryn’s stated intention to become fully-reporting to the SEC and seek a higher listing on a superior trading venue. This could open the door to institutional investors, many of which cannot buy shares in a “PinkSheet” company, opting to invest in the company.

Yet another example of fortuitous timing for Auryn has to do with what is going on in the smelter industry worldwide. A froth flotation ore processing facility produces what is known as an ultra-high grade “float concentrate”. The next step in the ore purification process is nearly always “smelting”. Historically, the charges for smelting averaged in between $85 and $100 per tonne smelted. China recently built many, many billions of dollars worth of smelting facilities that they can’t keep busy. There is a worldwide lack of supply of “float concentrates”, which is exactly what Auryn will be producing. Worldwide smelting fees have dropped down to the $10 to $20 per tonne range and some smelters are actually PAYING THE PRODUCERS OF “FLOAT ONCENTRATES” for the right to smelt their ore i.e. “negative smelting rates”. This is because it is extremely expensive to mothball a smelter and lay off all of the workers. This phenomenon drives down the ALL IN SUSTAINING COSTS (AISCs) to produce an ounce of gold EVEN FURTHER. China has been approaching the producers of “float concentrates” in South America and West Africa offering them EXTREMELY GENEROUS long term “offtake agreements” in exchange for commitments to allow them “exclusivity” to smelt a producer’s “float concentrate”. This supply-demand imbalance in regard to float concentrates and smelting capacity is expected to get even worse in the next couple of years. Yet again, the TIMING seems to be somewhat fortuitous for Auryn.

What is critical for Auryn right now is to continue to keep their nose to the grindstone and show progress on their mine plan. For investors without a lot of familiarity with the mining sector, it’s tough to recognize PROGRESS as it occurs. If you don’t know the individual steps needing to be checked off on, it’s pretty tough to keep a list and check off on it as PROGRESS is made. Sometimes it’s a good idea to review the various boxes that have been checked off on over the last 20 or so years.

When the cash starts flowing then the VISIBILITY will be greatly enhanced. Everybody knows how to speak EARNINGS PER SHARE whereas not many have much familiarity with the “sweet spot” on the “Lassonde Curve” being entering into the “Construction Phase”.