Know anyone who’s participating in the rights offering?

So you are getting your information from management or is this your guess as to what is going to take place?

Details of just how things will go are still being worked out. The new CDCH will be tradable as before, with a reduced OS after the R/S. Payback on the La Serena Project was reported to be 1 year. Things will move quickly after that. We won’t know until an official announcement is made with a date of record. As far as I can tell, CHG had the best explanation several weeks ago…

I don’t have much more insight beyond those comments at this time. But I did find that some retail brokers, e.g. Schwab, will actually hold private company (i.e. non-publically trading) shares for you in your brokerage account if you want. But of course there is some type of fee involved. So that would be a slightly different alternative to having a cert and sticking it in a desk drawer.

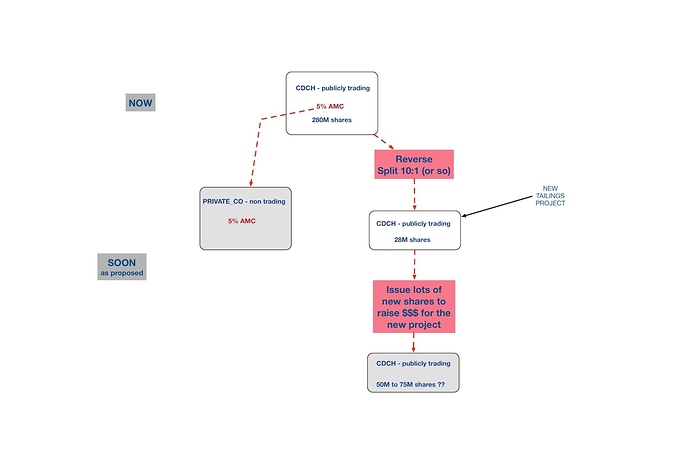

Roberto: you will still have CDCH shares but they will represent ownership in this new tailings project / company rather than ownership of the 5% of AMC. CDCH shares will remain publicly trading. It is the ownership in the 5% of AMC that is being split off into the PRIVATE_CO and will NOT be publicly trading if things go as suggested by votes at the AGM.

Thank you both, Easy & CHG.

OK Mark, help me with this, please. If, like you say, CDCH shares will remain publicly trading, why all this talk about being “locked up”?

If such shares are publicly trading anyone could sell them at the push of a button, or not? Will any added value on the property being reflected on the share price?

If the shares represent ownership in something that is private and not tradeable, how could the shares remain publicly tradeable?

What am I missing?

See if this helps.

-

Right now a share of CDCH represents ownership in the 5% of AMC that CDCH owns - that’s 5% of the “mountain”

-

The proposed process would move that value out of CDCH the publicly trading vehicle, and move it to a Private Company that does not trade on the public exchanges. You would be issues new shares of ownership in this PRIVATE_CO which represent your pro-rata ownership of CDCH shares. You can not sell / buy these sales as easily (i.e. loss of liquidity). But these new shares are your property. If you can find a buyer you can sell. But finding the buyer is what is hard compared to the public markets. Auryn is the obvious long term buyer. But maybe BE will buy your PRIVATE_CO shares from you.

Anything that happens with the mountain or with AMC will reflect upon the value of your PRIVATE CO shares, not your CDCH shares. CDCH has nothing to do with the mountain or AMC after this event.

- The publicly trading vehicle CDCH, those shares in your brokerage account, will be reverse split, the price will go up, they will issue a bunch more shares, the price will go down. They will have a new project and try and create new value for those CDCH shares.

BTW - to summarize the WHY: the reason for doing this is so that the value represented by AMC, the 5% of the mountain, does not get diluted to smithereens for current shareholders when they issue all those new CDCH shares to raise money. That would be a big waste for any of us who currently own CDCH shares. This process is to keep our ownership percentage in the mountain from being diluted / destroyed by the millions of new CDCH shares that will be created ‘out of thin air’.

Good summary. To keep it simple. The public shares of CDCH you will own, post spinoff, are free money to you. An asset will be dropped into an otherwise worthless shell. If George executes you will be paid for something you don’t currently own. Unless you are looking for an early exit on the value of AMC (liquidity), CDCH represents a better value (more upside) than MDMN. IMO

(Assuming you own shares of CDCH early enough to receive the AMC spinoff)

As you stated, the private company will consist of present CDCH shareholders once the date of record is announced and completed. The private company will represent the 5% AMC equity interest holders only. These shares are in a private company and cannot be removed until a TO takes them out. It is unclear the mechanism for distributing any dividend that may occur prior to a TO. These same shareholders, and any new shareholders will still have free-trading CDCH shares that are only tied to the La Serena Project and any future projects. If the $1.75M is not fully raised privately, then treasury shares will make up the balance. The new CDCH will have money flow from the tailings reclamation. This should start to bring the PPS back, even after any dilution that occurs. New projects are also in the pipeline and being looked at. Shares of the “new CDCH” post R/S can be sold at anytime without losing any value held in the newly formed private company. At the SHM, it was stated that a goal of the BOD would be to minimize any share dilution after the R/S, and hold it to less than a doubling of the 20M-30M post R/S. Hope that helps.

Does anyone see an issue with continuing to hold my CDCH shares in my Etrade account?

I still have not paid to have my dividend MDMN shares converted due to the price of a share and the fee Etrade wants to charge to convert.

I have no doubt that my CDCH shares in my Raymond James account will be taken care of but I have no faith in Etrade to do the right thing.

OK, Mark, John & Richard, I can see clearly now, the rain is gone!

Actually, I am flattered by the cornucopia of responses. Thank you.

If my understanding is correct, we will have two sets of shares, the existing CDCH and the new ones that apparently will only be sold when a TO will take them out.

Once the process is done CDCH shares and private company shares will have no relationship whatsoever between them. The private company shares will represent our 5% in AMC and the CDCH shares will represent whatever new project is undertaken.

Selling the CDCH shares at any given future will not impair our 5% ownership in Auryn.

Did I get it?

![]() Yes

Yes ![]()

Exactly right, Roberto

Just make sure present shares are not sold before a date of record is announced if you want to retain what amounts to a non-dilutable “long term call/leap on AMC” as BE phrased it.

John, now that I believe I got your (including Easy & CHG) explanation I have a question for whoever would like to answer.

Why such a set up has not been taken in consideration for MDMN to avoid dilution of our 25% ?

I am not looking at an answer like: “Because Medinah BOD is not up to par” or something of that sort, but to a more complete and elaborated answer.

Should such a scenario be recommended/necessary/unrelevant/superfluous/not needed/not advisable/inapplicable for Medinah?

CDCH is going this route because they are expanding their own mining operations and doing so with new funding. The new funding would be dilutive without the separation into two classes of stock or separation into two companies. Everyone wants Medinah’s operational needs scaled down to near zero. In thory MDMN’s allocated share of development costs of AURYN will be funded by loans MASGLAS initially and then with proceeds from the gold veins later - no dilution.

So, does MDMN have the same financing structure as AURYN on these loans?

Financing for operations will continue to be secured by MASGLAS until AURYN becomes cash flow positive. The terms of the financing are extremely favorable for AURYN. Any required cash is interest free until July 2017. After that interest will be LIBOR plus 4%, and debt repayment will occur with a portion of the revenue generated by the early production. Capitalization and conservative money management is a key pillar of the AURYN business plan.

Zero interest rate appears to be the same as the original expiration date of MDMN’s option agreement with AURYN. Coincidence?

I guess I didn’t express my thoughts very well - I believe MASGLAS is only lending to AURYN and Medinah benefits because otherwise it may have to pony up. Point being there will be no/little dilution unless the BOD goes crazy lavish.

Liquidity and, to Newleaf’s point, nobody is looking to use the MDMN shell to pursue other opportunities. I’d rather have MDMN stay as a holding co as long as we can make sure the dilution is controlled and the exiting BOD gets the boot.

One more reason to stay public and another possibility that I wouldn’t rule out: a claw back of shares allocated to previous directors. Now that AMC is a 20% owner it would be in there best interest to initiate an internal audit, supported by exiting MDMN shareholders, with the possibility of returning shares to the treasury. This would be no different than what CDCH referred to in their latest update.

Not sure how Les and JJ would return shares they no longer own but I’m not losing any sleep over it. Karma is a peach… or something along those lines

On the contrary, you expressed things very well. The point I was making, with MASGLAS owning 65% of AURYN (a subsidiary of MASGLAS), all the funding to complete the mining concession option contracts came from MASGLAS through AURYN. This is now evidenced by now having Maurizio Cordova, the Executive Chairman of both AURYN and MASGLAS.

It is reasonable to assume Medinah has the same loan structure as was set with AURYN for the initial phases of exploitation.

Slavedriver,

I also have an Eturd account. My restricted shares were converted by them a couple of months ago. I did not pay them to do it since the fee was much more than the shares were worth.

Perhaps you should contact them and find out why yours have not been converted.

I too have/had many shares in e-trade account, they said that they were going to charge, I had to file the paper work, they converted the shares but never charged the account.

What will be interesting is if there are any short positions in CDCH. Will the shorts now be forced to cover or will some people end up without certificates in the private company or get screwed like in Medinah Gold merger with certificates that are worthless! It will be interesting to see how all this is going to work out!