Ok, just making sure because I’m not focused on MDMN today. And yes, I agree!

Annella, I spent the past half-hour coming up with a much wordier explanation (below) of what you’ve nailed in one short paragraph. But we’re thinking on the same lines. I’d love someone more knowledgeable than me to tell me why your (or my) scenario is not possible.

— madmen

I have, I believe, thoroughly demonstrated on this site my virtual ignorance of things financial- and/or stock market-related. With no reputation to lose, let me pose the following scenario and ask some of you more knowledgeable folks to please tell me how it is messed up:

— First, let’s assume that the pink sheet market is absolutely corrupt, that it is absolutely open to manipulation, and that the more money you have, the easier it is for you to manipulate that market.

— Let’s say that some party with a billion dollars in cash at his or her disposal – could be Auryn, could be one of Auryn’s friends or a friend of a friend of a friend, or it could be some smart and ruthless independent party – has identified MDMN as a pretty good play. This party has identified the huge DISCONNECT that is so often discussed here, has insider knowledge, and has decided to try to exploit things.

— Let’s says this party decides that his or her best strategy is to identify the brokerages that are holding the most air shares. (Let’s imagine that a small group of retail shareholders may have trouble getting its hands on such information, but let’s imagine that if you’ve got a billion dollars, you might be able to buy such information.) Let’s say that this party with the billion dollars approaches one or more of these brokers who are eyeball-deep in airshares and proposes a deal:

— “I know that you have 500 million air shares (or some other number) on your books. I will buy all 500 million of your air shares over the course of the next five, or ten, or twenty days – however long it takes for you to give me all of them legally, on the open market. I know you sold these air shares for five or eight or ten or nineteen cents each and you thought you were going to get to keep all that money. I also know with one hundred percent certainty, because I have inside information, that at some time in the very near future, you are going to have to pay in excess of twenty-five cents per share to cover those air shares – shares that you never imagined you would someday have to cover. In fact, you’ll probably be lucky to get them at twenty-five cents per share – you may see the price go past one dollar per share, maybe several dollars per share. I am connected. I have a billion dollars. And as soon as I – along with my friends, who are waiting to hear how you respond to my offer – decide to pull the trigger, we are going to control a mine worth tens of billion dollars. Trust me – this two-cents-per-share stock is not going to sit here for very long at all. If you are still holding your air shares six months from now, you are going to be holding them under a bridge somewhere. You are going to be screwed like no one has been screwed in the history of screwing. But before the price of this stock goes through the roof and forces you into – at best – bankruptcy, I will buy all 500 million of your air shares. You will make another small fortune. But to make this thing look legit, on any given day I will not pay you more than a twenty-five cent premium over the previous day’s closing price. Are you going to sell to me? Or are you going to go bankrupt…? Yes, that’s what I thought. Get ready, the plan rolls out on Tuesday, February 9.”

OK, miningplay readers. There’s my morning day dream, while trying to come up with a reason for how there can be so much good news, how 19 million shares can change hands in one morning, and the stock price stays stuck in a narrow range that is less than half of this stock’s (already pathetically low) twelve-month high.

Please tell me (nicely, please) why my scenario is not possible. I’d like to know.

Thanks.

– madmen

Hi Mad,

If they sold 500 million “air shares” into the market then they don’t have anything to sell to this big buyer. If they sold another 500 million “air shares” then they’d be naked short 1 billion shares. I should have intervened a while back when people were talking about MMs selling from their “inventory”. They have no “inventory” (long positions) in Pink Sheet companies clearly under attack-ZERO. Carrying “long positions” or “inventory” over night would eat into their “net capital reserves” which they could ill-afford to do and still act as a MM for the exchange traded stocks.

I’m not sure if Annella was kidding or not with his comment but I actually think it might have merit. If AMC goes behind the scenes too much corralling blocks of Medinah shares they risk tripping the “Wellman factors” threshold. If you do that then this triggers the “Williams Act” mandating that these “unconventional tender offers” are actually technically a tender offer. Triggering the Williams Act triggers the “you need to treat all shareholders equally” clause. AMC could theoretically be forced to offer the same terms of their highest behind the scenes bid to all of us. Open market purchases are much safer to use and can provide the buyer a relative “safe harbor” from getting your hand slapped.

It would be interesting to see the playing field from AMC’s point of view while standing in their shoes. They’re sitting at their desk with a check for $100 million-plus in front of them with Medinah’s name on it. I think the evidence suggesting they are going to exercise the option is beyond compelling by now. There is a stock certificate in front of them also with Medinah’s name on it for 15% of AMC’s shares at the moment the option is exercised. AMC’s geos and money guys look at the high grade near surface early production opportunities and the grades found in these locations and they note that most are on Medinah’s properties as are the new Cu/Mo porphyry showings. They’ve probably already run some pro forma cash flow projections for Medinah’s share of the early production opportunities.

They look at Medinah’s market cap and see a market cap of a little bit over $20 million. They scratch their head in disbelief. They might not understand the obvious DISCONNECT but they say to themselves it is what it is. Their legal team coaches them as to when they can purchase Medinah shares and when they can’t. It’s usually predicated on any nonpublic material information they are in possession of being released and disseminated. They need to release it before buying and give it a couple of days to be disseminated.

Medinah has agreed to cap their number of shares issued and outstanding during the duration of the option. This way AMC knows for a fact that if they have purchased perhaps 50% of Medinah’s shares (many real and many fake) by the date of the option exercising they will in essence get back half of the $100 million, snag half of the cash flow from the early production opportunities allocated to Medinah and half of the 15% stake in their own “dream company”. I would think that the dilemma for AMC becomes how high do you chase the Medinah market cap before you STOP buying.

What’s interesting is that they have 100% visibility of whether or not they’re going to exercise the option, the approximate NPV of Medinah’s early production opportunities and the NPV of a 15% stake in AMC. It’s tough to estimate the value of the Cu/Mo porphyry at this stage. You could search for market comps or just go to the statistical averages (Mutschler) and figure that this bad boy is going to weigh in at somewhere around 500 MT. To AMC with all of this visibility, the “savings” on the cash portion of the purchase price, the “earnings” on the early production opportunities and the “clawbacks” on the 15% AMC stake are pretty much FREEBIES as it were after subtracting the cost of the share purchases. They can buy the milk at retail prices or buy the cow for next to nothing.

WHERE’S THIS TRAIN HEADED?

At the risk of being pilloried by a barrage of tomatoes, I’m going to post this article yet one more time. Page 4 informs us that THERE ARE NO NEW DISCOVERIES. Page 7 informs us that the average amount of time it takes from the commencement of exploration until the first day of production is now about 25 years. The majors aren’t exploring and the juniors can’t get funding to explore. Production levels are peaking even though the metals prices are so-so. Something’s got to give. The cherry on the top is that MAJORS MUST EITHER REPLACE THEIR CONSTANTLY DWINDLING RESERVES OR DIE.

I don’t pretend to know what AMC’s plans are and if they’re capable of developing the porphyries or not but one of the big Cu/Mo players is going to be taking on the porphyries or at least take a run at acquiring them sooner than later.

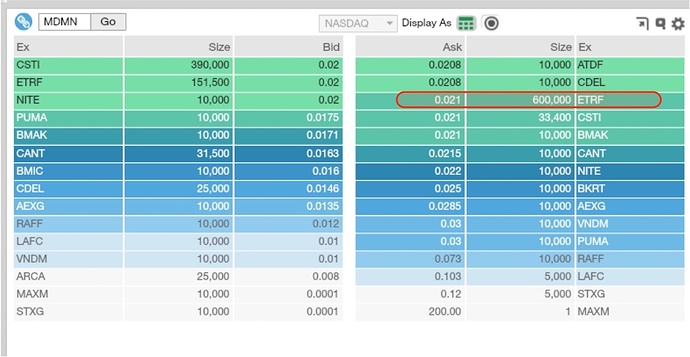

BMAK sure wants to keep the price down still showing 10k after a million went through

And now Etrurd comes up with 600000 on the ASK @ .0210

Exactly, Doc. I was not kidding actually, as I know how it needs to be done, having done a few large simultaneous buy sell between prearranged parties back in the day.

Half full: any volume spikes while we stay in the green are very welcome, especially given the anemic price action as of late.

Half empty: most names in the space are 30-75% off their lows. We clearly don’t have much correlation to the PM space but gold breaking out doesn’t seem to be hurting.

Half full: it’s hard to imagine anybody outside of AMC buying this many shares (please ignore any nonsense coming from Les re: the London Group,etc.). If, big if, AMC has begun buying there should be a lot more behind it.

Half empty: it’s taking a lot of shares just to take us to a level we we’re trading at a couple weeks back and it looks like it’s going to take a lot more to break us out of this range.

Other than the one 600K ASK, look at the ridiculous ASK stack - there are no share amounts showing for sale. Of course there could be hidden orders at prices behind those shown but still …

19.8M on the day. Must have worn out buyers and sellers

Don’t forget BMAK millions of shares have gone through him and I wonder how many more. He is one of the main reasons we haven’t passed .021.

Now when is little Carlito going to run OUT?!

Disappointing that 21 million shares only increased our SP 3/10ths of a penny. That is my glass half empty view.

For all you MM haters out there. Here’s a little fuel for your conspiracy imagination:

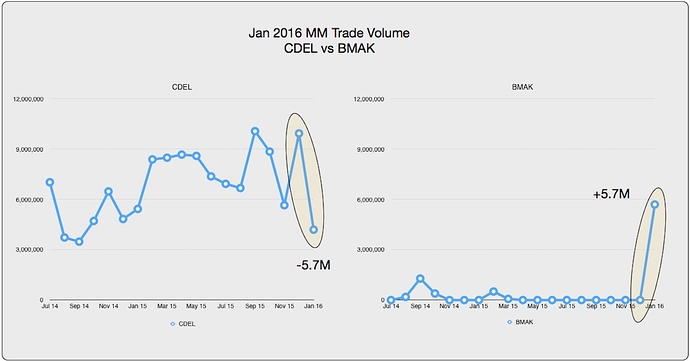

Jan 2016 FINRA volumes are out. 34M total shares - down from 54M in Dec, 44M in Nov which was tax loss selling IMO

The most interesting thing is the sudden decrease of CDEL volume to the amount that was typical in pre-2015, and the sudden emergence of BMAK volume in almost the exact same amount that CDEL declined by, and this when BMAK throughout all of 2015 barely registered. Is this related to the sudden ‘not selling anymore’ rumors from Chile at the end of 2015? Very odd. But hard to be certain about anything.

BMAK looked to be a bad boy today, I agree. I don’t think it was “millions” necessarily but he sat not the ASK showing 10K for long periods esp. at $0.020 and $0.021 when certainly hundreds of thousands if not a million shares traded at that price, without moving. It definitely looked similar to the old MDMN trading days watching NITE demonstrate that behavior.

Just making an observation not an accusation. On the other hand, if the shoe fits …

MM volume ranks for Jan 2016:

ETRF - 7.5M

CSTI - 5.9M

BMAK - 5.7M

NITE - 4.9M

CDEL - 4.2M

The lowest for CDEL since Sept 2014!

I’m looking at the result of the share trade for MDMN and find that only 15.7% shares were short sold. That puzzles me in light of watching a millions shares go off on the ask when only 10K shares were up for the offer. Then the blatant trade of .0191 after the bell at 16:00.2 showing as the close for the day. Any thoughts anyone?

Just a “wild” thought and a couple of questions. Suppose MDMN (or even CDCH) just landed some cash. Would MDMN have to announce a buy back program in order to retire some shares under current OTC tier reporting requirements? Would CDCH be allowed to buy-into a stake of MDMN on the open market if their only mining properties in Chile were just “acquired”, i.e. 100% of the Fortuna and Lonco Millarepu mining properties?

(Just trying to think outside the box here - not even a WAG, really.)

Close is .02 that is what I show

I was neck deep in all the NS talk/debate for about a decade starting in 2003. I have no doubt that it and other market manipulation occurs, but the only way I can see to beat it is for a company to persevere and attain financial success. I don’t engage in the NS discussions anymore because I haven’t seen any good point to over that decade. If shares were NS’d today, (or however Doc would prefer it be callled), they won’t show up in any “short sale” columns, imo.

As for the after hours trade at .0191, it was likely settlement of a trade that occurred earlier in the day.

Thanks for your response. It just looked like pure manipulation.

that indicator is a wildly inaccurate measure of actual short sales occurring in any given day…

Does anyone think that 62 million share bid was part of that 21 million shares traded today?

Is it Wednesday yet

Best I can tell, no buying came from Auryn, Medinah or Cerro today.

The most popular rumor about the selling points to Claro directly or indirectly due to the shenanigans being played by the criminal enterprise that is his offshore broker in the Cayman Islands. They have an office in Santiago Chile and are connected in some way to well known entity in NY that Medinah visited last year.