[quote=“leanandgreen, post:279, topic:929”]

How bout that seller yesterday that posted he sold 1.5M? Would he have sold if we were told publicly that the broker was forced to buy back in?

[/quote]And just where have you ever seen that a broker was forced to buy back in that was publicly announced? I’d sure like to see that so I could capitalize on it!

Hi EZ,

If Medinah would have made a PR stating that Bogdan and/or Claro’s Cayman Island firm are going to have to buy-in a gazillion shares out of the open market the stock would have been halted within 10 seconds. Medinah counsel’s recommendation would probably have been to treat this as a “private matter” if anybody asks and definitely don’t be tempted to use it as a promotional tool. Could you imagine the potential legal repercussions if a PR like that did go out, a bunch of buying was induced and no buy-ins materialized?

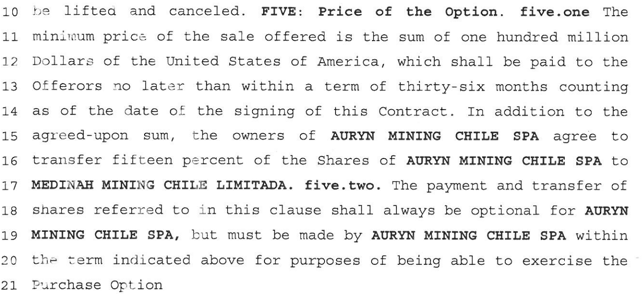

There’s no puzzle here. The 15% has nothing to do with and FCI or NSR (this is not an opinion). As stated in the contract and reiterated through updates MDMN will have 15% UNDILUTED EQUITY in AMC. Our dilution could/would come through AMC’s ownership in Maglas which is most likely the entity that will be going public.

Refer to my example post above:

Pan American is paying $8M cash + $8M in exploration costs plus $2M investment in Kootenay shares for 75% of of a property that has 92M Oz of Ag in formal M&I already (approx $1.4B).

That is, Kootenay is Masglas / AMC. And they are selling 75% of their $1.4B reserves for $18M. How much do you think Kootenay paid the company / property owners they consolidated all the claims from (i.e. Medinah’s role)? It wasn’t $100M and they didn’t give them 15% (or 30%) their Kootenay subsidiary in compensation either.

The problem for everyone is capital and expertise. Medinah had none. They got what in this market looks to be a pretty good deal. Auryn has more of both but eventually will run out too. Short term production will delay the coming of this day. But when it comes they will sell most/all to someone else with lots of capital and more expertise (more staff / capabilities).

If Auryn can do enough production to fund exploration till they have substantial and profitable formal reserves and wait long enough for the market timing to be correct they will do very well (assuming the mountain plays along), and should MDMN still be around they could do 15% or more of “very well”. Is the “more” of “very well” worth $100M (or some part of it). Only time will tell.

It’s quite possible / likely that $100M plus what they have already spent plus construction of production facilities is stressing Auryn’s financial capabilities. And they obviously would rather not have to turn around and sell part of the ADL right now on the cheap to get capital.

So it is reasonable speculation they are trying to find a “win win” with Medinah that enables the two to mutually conserve as much ownership as possible for what they hope will be a better future market when the ADL is proven up much more formally (multiple years from now) and metal prices have recovered.

In the meantime, explore and potentially enjoy some dividends which for shareholders amounts to getting paid to wait for the bigger payout.

Bam ^^^^. True that ^^^^.

This is all Great news CHG! Problem is this stock still has No floor as were are retracing again.

No floor without strong retail market. No strong retail market without trust. No trust without results. Most of us in or stuck in at much higher cost basis. We won’t invest more. The market has seen multiple occurrences of MDMN’s pattern. It won’t be fooled again. AMC isn’t a household name. As far as anyone on the street goes, this is no different than Amarant.

Produce in real quantities and pay dividends or exercise the option with real money and the equation will start to change.

Without going back to read the contract I seam to remember that it says equity and not shares. Shares, much better, it would get me off the hook for capex. for sure. moo

Lot’s of ideas, strategies, alternatives being discussed here, which is great.

But for me, at this time, I am sticking to the contract, $100 large and 15% of some privately held sub.

JMO, people can talk about the arbitrage between owning a large percent of MDMN and bascially paying your self should MDMN dividend out the proceeds. I just don’t get it why AMC wants to even fool around with owning shares in MDMN. Assuming the initial 150MM shares were bought at an average of $.07, that’s $10.5 million tied up not doing anything. Well it is doing something as that $10.5MM is now worth about $3.1MM.

Frankly, I wouldn’t beleive they even bought shares, but they pr’d themselves, so it is true. Just makes no sense.

It says shares.

BTW - the above is speculation to be sure. But the limits of the speculation are starting to converge on the rumor and what we see Auryn announcing.

In addition, that line of thought outlined there is exactly what people like Sprott, First Mining Finance, and Kootenay, people with real long term PM market experience are thinking: this is going to turn, the majors who have to cut back right now because of debt and share price problems, are going to come in as buyers of good assets when the market turns. The Letts / Auryn are thinking the same thing and trying to get good assets on the cheap now. The ADL looks to be a great asset, but not so cheap - calling for some creative thinking, enabling MDMN to tag along for the next stage of development enabled by Auryn’s skills / pocketbook.

[BTW, If you listen to that video the reference was made to an earlier company that followed this pattern and consolidated properties, had a $35M market cap with the end of the consolidations, but had a market cap of $2B by the market peak. That’s the game being played.]

In light of that, one may speculate that one part of their hurry is that they actually need to get the mountain in sellable shape by then. So if they are thinking say in 3 years or 5 years or 7 years they need to have as many reserves in place as they can afford and manage to get into place, they need to get moving. This thing is getting started late in the down cycle.

They have their consolidation almost done except for “one option agreement.”

They have their exploration for short term production pretty much complete (apparently no need for much drilling)

BUT they have barely started their long term “reserve making” exploration which will focus on the big porphyry story - Medinah told the story for years; Auryn has to make it real, real enough for a major to write a check, a big check. And this will take multiple years of work. But there will be plenty of meaningful milestones (and SP improvements) along the path.

And what happens if something prevents this finalization from occurring in April?

Makes perfect sense and realistic. My only disconnect is that mdmn mgmt are rumoured to want a liquidity event to cash them out. If that’s true, i hope they don’t get it while the rest of us are required to wait

Someone with strong hands and a deep pocket buys 60M shares from someone else who had hands so weak that they couldn’t hold on for 2.5 cents and your view is “more shadiness arrives”. I look at it to believe we now have 60M shares that will not be coming out of the shadows to slow down the advance of the share price once we start hearing about funds moving into Medinah. Positive change continues to come to Medinah each week. Some can enjoy it while others will continue to fail to recognize it.

I thought we were going to  have significant news this week.

have significant news this week.

You’re listening to the wrong people.

Been doing that for the past 14 years.