Wait and watch.

rgver I know you hold a very big position with Medinah but please base your comment of “Wait and watch” to what your hearing

This line intrigued me from the February 25 shareholder update and has been questioned by several shareholders when the announcement was first released:

As this potential “world-class” deposit of copper and separately of high-grade gold, Medinah shareholders benefit significantly on earnings as a 15% interest holder in the project.

Why the different wording from previous announcements? We don’t know the exact specifics of the CDCH March 7 shareholder update which stated:

As a result of these meetings, the Company is pleased to announce an agreement by and between it, Sociedad Contractual Minera Cerro Dorado Chile (“CDC”) and AMC which has resulted in the transfer of CDC’s ownership of the Lonco Millarepu and Fortuna claims to AMC in exchange for a 5% equity ownership of AMC and, in turn, all of the claims now owned by AMC on the ADL.

CDCH looks to be a longer term play now, but after such a long period “going dark” it is a relief to know that 5% equity ownership of AMC will likely result in a TO once there is substantial MR/MR proven up. So far as the remaining yet unexercised ADL option agreement, I wouldn’t be too surprised to see a much smaller (<$100M) cash purchase to exercise the option for 100% of the ADL, and an accompanying offer for the 15% interest holder turned into a standard 2-3% NSR for all the properties. This would in essence turn this into a LEGACY investment and complete the idea of Medinah as a Capital company (which was hinted at in the past). This would allow for continuing dividends sometime in the future. I still hold the strong opinion that MDMN will continue as a company past the time all options from AURYN have been exercised. Is this why we see continued selling (from insiders or other friends of insiders) by those who are not willing to wait longer for production to turn to a sustained cash flow? How long will JJ continue to hold his shares if AURYN has withdrawn it’s offer to purchase (the 350M shares)?

We will ride on Auryn’s coat tails until the option is exercised. Post option exercise is a whole different matter. Medinah will have some sort of royalties, interest or equity position and a newly negotiated cash influx to do as it pleases. I’m sure some will find that disconcerting. Blame JJ for that reality. Or not. There are Rumors (post option) of a shareholders meeting to get the pulse of shareholders. JMO.

Any predictions of share price??? .05 in 90 days??? That is my best guess…

mangelsen go back and read MG post from yesterday that should answer your question

One needs to take a step back and appreciate the irony of a “Medinah Update” ala the “Enquirer” when robbers (inferred to be Bogdan) tried to take JJ’s life. This investment has always been more of a psychological fascination over a sound investment. One shady character trying to kill another equally shady character for shady shares (which we own) in a penny stock. Will the long-term defenders of “Senior Q” ever admit their almost adolescent infatuation with a man who ultimately resembles more of a con man than a legitimate geo?

As Wiz and others have pointed out, we should all be thankful that the underlying asset remains strong enough to outshine scumbags like Les and JJ who have literally abused this investment opportunity from day one. I’m not sure how anyone can still justify speaking to “the Noise from the North”. The bottom line: the ship has been tightened. As has been stated for years ,find humor over substance in Lespeak, try to ignore “dividend disconnect carnival” regurgitated here on a regular basis. Take a breathe and enjoy what should be a good performer over the next 6-9 month.

I know you love endlessly rehashing your dislike for Juan and the rest of Medinah but really how is that relevant to the current time? Juan has been gone for something like 1 1/2 years and his shares are all locked up and handed over to Les for safe keeping until the end. Auryn is moving full speed ahead at a rate that Medinah is struggling to keep up with. The current composition of the Board is more than adequate to complete the sale of the Alto and wrap up the investment and giving shareholder the best value for their investment dollar that is still possible.

You are also aware that Les isn’t the only source of rumors for this investment yet you seem to imply that any rumors you don’t like must be coming from him?

Production is about to start at the Alto. There will be profits coming from the Caren. Medinah will be getting their fair share of it. There is no doubt of this.

There remains some uncertainty on just how good the ore grade will be, the amount of it and how fast, when will the Fortuna go online, and when drilling will start on the porphyry target but the smoke should clear shortly on all of that in the near future.

There should be some definitive news coming from Auryn prior to the anticipated trip to Chile in the middle of April which will help those that seem hopelessly out of touch with current events and are still shivering with fear since the share price hasn’t caught up quite yet to the new realities in our investment. Meantime, I suspect all the required paperwork should be completed by Thursday (end of the month). I think some buying may start to come in now at anytime to front run the big Alto sale…something Medinah investors have been waiting for since the 1990’s!

I guess my main problem is that Les (yes, your primary source) is still peddling his nonsense through a handful of shareholders. See quote above or predictions of news at PDAC, or, or,…). You should have “next week” tattooed on your back. It is my opinion that the constant rumour mongering coming from Lester through various sources has created immeasurable damage to the credibility of this investment. We are witnessing this damage firsthand today as the market is numb to any positive updates coming from MDMN or AMC. The damage is evident in the existence of three message boards that spend their days deciphering Lesspeak. For some people this has been a losing investment for others they are the investment.

I’m guessing our boys will negotiate a crappy deal involving less cash in lieu of more shares in AMC (which is impossible to value). All of the talk of early dividends seems to originate from people who don’t understand the scarcity of capital (read: money will go back into the mountain). However, none of this really matters because as soon as AMC believes there is enough underlying value in the mountain they will quickly move to tender the shares of CDCH and MDMN and the door on this mystical ride will finally be shut.

I wouldn’t use premanent ink on that tattoo.

This statement is classic Leapeak by the way. It’s one of my favourites. I’m sure that JJ and Claro have both entrusted their shares to Lester and he’s swallowed the key. LOL

Can you help me understand the gap between when AMC believes there is enough underlying value to exercise the option and buy the mountain but not enough faith in the mountain to tender for the shares?

I thought Clarito took Daddy’s shares and started selling them on the open market

Your response is also classic. Your let your disdain of Les cloud your better judgement. Juan’s shares are locked up and any number of LOL’s from you doesn’t change that fact. I didn’t include Claro in the same category.

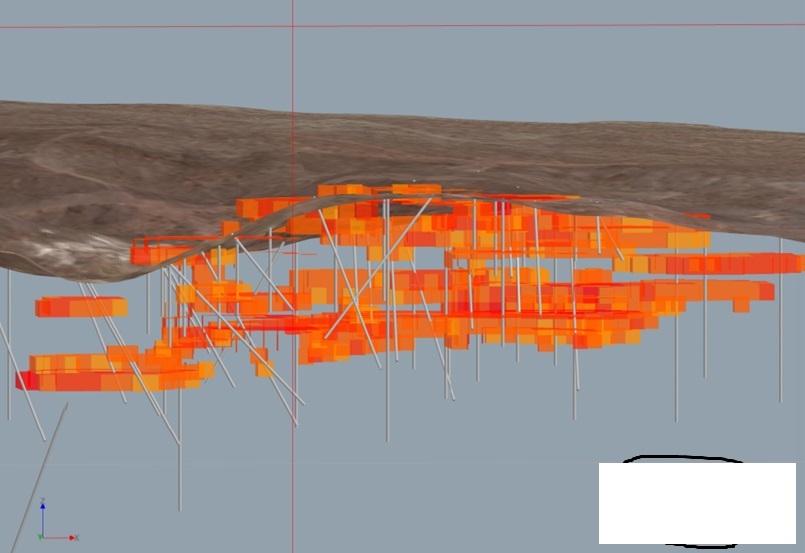

Newleaf, maybe I can add some insight to your question. To come up with value for the CU/Moly claims, substantial drilling needs to be performed. below is a “block model” for a project I am working on. It is a small gold project, that has had substantial testing and over 200 drill holes. The data from the drill holes is put into a 3-D model and shows where the ore is. Each line you see is actually a drill hole and when opened in the software program, allows you to see where every drill hole and the grades at each depth. From there, you know where the ore is and you then use a separate program to design pit models. By using pit design models, you can determine the size of the pit and where to start mining, the purpose being to eliminate as much stripping of overburden (non ore bearing dirt) as possible. The engineers and geo’s need to desgin the pit models, then the engineers can determine the cost of mining that area to make sure it is economic, and a value is derived.

I think that is what needs to be done on the CU/Moly claims to be able to market the property. Just my two cents

Mdmnholder, thank very much for this and your other contributions - you obviously know what you’re talking about. We may not agree on a few points, but I definitely appreciate your time, effort, and perspective.

QUESTION: Given that Auryn is a shareholder in MDMN and presumably wants the value of its ownership interest therein to increase, do you think THEY think the best way to approach this would be to drill out the CU/MO porphyry to a point that they are at least confident in its existence and THEN think about entertaining bids for the project? The point is why would THEY want to sell THEIR interest in MDMN prematurely? Also, I know it would involve a LOAD of money for infrastructure, but could it be that they believe they could accrue enough income from “early opportunities” to FUND the infrastructure? I think we have been presented with a map before which shows a footprint of our CU/MO structure that is 3-4 times larger than the largest such mine in the world (the Chiquicimanta, right down the road from us). To an admitted layman, this smacks of “why sell when you don’t have too”?

MB, if we agreed on everything, it would be quite scary.

I can’t really answer your questions, as I don’t know the financial backing Auryn has. So far, the few properties they picked up were for a few millions, but had substantial exploration work (i.e. bargain hunting). When you do a big drill program like the Cu/Moly claims need, it is usually done over a few years. You drill a number of holes during a season, run assays, plug in the info in the Block Model, then plan where to drill the next set of holes of the following year and on and on. The drilling is very expensive, as is all the personnel to analyze the data and make plans for the next set of holes or phase of the project.

Having said that, if I were Auryn, I would do everything to keep the mountain under its control, hit the near term gold opportunites, build out processing facilites at both the Caren and Fortuna first. And with some cash flow from the Caren & Fortuna, start drilling the ADL cu/moly.

Conversely, if they could get a JV partner to Farm In for 15-20% (given the potential size of the deposit), I would go that route. Hopefully copper will have recovered and time to flip. Farming In is a two edge sword, the company farming in will want total control of the project and I am not sure AMC will allow that. In the alternative, having another firm work the ADL, allows AMC to dedicate it full resource on the near term opportunities.

Again, JMO, hauling raw rock to Enami or some other place for crushing and leaching is not ideal and has to be very short term. They need to get a processing facility up and running asap.

I know that does not answer your question regarding their MDMN ownership, but I never understood why they bought shares in the first place, unless the original plan was to do a 100% buyout which is more economic today given the share price.

Auryn is already well ahead of you. They have not been idle.

Thanks - it just seems once Auryn exercises the option they will be TOTALLY aligned with MDMN interests and would be reluctant to take a course which is contrary to their own interest all in the name of screwing MDMN shareholders.

Not disdain. Distrust. And that distrust has so many layers of confirming actions that I lost count many moons ago. The only clouding of judgement I see is the seemingly desperate need for new rumors by those who “need” this investment to work. This desperation is what Lester feeds on. Whether he’s selling shares to pay bills or simply trying to stay relevant. This has been a 25 year career for him and he’s had many “executive assistants” along the way all too willing to spread his gospel.

Just my opinion. I’ll continue to take my direction from what AMC decides to update us on.

A few comments . . .

Along with mdmnholder’s comments, technically AMC isn’t exercising the option. They and MDMN are negotiating a new purchase agreement. At this moment, if they knew for certain the economic value of the porphyry was worth more than enough to pay the $100 million and keep 85% in house, they would do so. But they don’t until it’s proven, thus alternate terms. There are plenty of reasons for MDMN to agree to alternate terms as well (imo.) Not everyone agrees with that. But my analysis indicates MDMN moving forward today with a deal is a far better move than waiting 18+ more months for the possible option exercise.

As soon as the project is 100% owned by AMC I believe you’ll see them doing what is necessary to aggressively go after the Pegaso Nero. AMC’s will prove it up at least 500MT of CU @ 0.5%+.

By the time they get there, hopefully we are experiencing a bidding war between the few companies capable of handling such a project. Then it becomes a matter of diminishing returns as more is spent blocking out a larger resource. At some point AMC sells the Porphyry and retains an NSR. That will be AMC and their advisors’ call. MDMN won’t be part of the decision making process since it has no value add (expertise) and only has a minority share of AMC.