We have everything except…

The Lumina Copper example was a copper, gold, moly porphyry of great size, 2000MT.

You already seem to have the answer you want. Just ignore my examples. The truth will be revealed on the day an offer is made and accepted. I hope to not be here 10 years down the road though so you’ll have to take account on your own.

Hi hulk,

I’m not sure where FQM’s current strategies lie as to acquisitions but their corporate history could have similarities to Medinah’s. I was with FQM (then FM) for 16 months way more years ago then I’d like to admit. Back then we had plans to develop a simple tailings facility called Bwana Mkuba in Zambia. We had very little access to money except through Investec and Standard Bank. Back then Keith Neumeyer in Vancouver and Clive Newall (from Cyprus Amax) in London and two 7 foot tall brothers from Zimbabwe and the RSA ran the show. We also had a very fiesty negotiator from Australia.

We raised a few pesos and put in an SXEW plant at Bwana Mkuba. This put us on the credibility map. From then on out the story was that of a parlay. The SXEW plant funded exploration and the acquisition of the Luanshaya deposit. Two deposits became four and then eight, etc. The hurdle that was the toughest to clear was getting Bwana Mkuba into production. There were tons of permitting issues, bureaucratic issues, abusive naked short selling issues out of Europe, etc. Success in this industry necessitates putting a run or two on the scoreboard (getting into production) and then all of a sudden you’re cruising on the Autobahn. What I’ve learned over the years is that it’s all about credibility and you can’t fake your way into production. There are way too many hurdles as the statistics suggest.

Once into production, then the world was their oyster. Everybody wanted to hang out with you. We had the UK prime minister’s wife as our legal counsel. Lots of JV opportunities were presented and the banks were lining up. There was no deep-pocketed AMC group to lean against in a “big brother” capacity.

I see AMC as supplying a very powerful technical capabilities and financial wherewithal TRAMPOLINE once the trucks start rolling. Then Masglas/AMC/Medinah (if Medinah is still around)is going to be the darling of the Chilean mining industry. Masglas will no doubt build a medical clinic in Lampa to serve those in need. The phones that aren’t ringing now will be ringing off the hook. I feel that Medinah’s strategic advantage is serving as the portal in which any investors wanting a piece of the action at the mining district have to enter.

How much was AAPL worth the day before it launched the IPOD in 2001? Can’t we just assume $100B?

CHG, I applaud your attempts at answering these types of questions but if you aren’t willing to ponder hyperboles or talk about the NSS your noble responses are going to be lost on folks looking at the ground for their winning lotto ticket.

This is what any competent businessman would do … the do-it-yourself scenario for as long as possible and then explore other scenarios. This is something I was espousing for MDMN a couple years back - Auryn/Masglas is doing it for us and we’re riding their coattails, which is even better, as they have been able to parlay the proper expertise. Only a person who doesn’t want to get a full return on his investment would prematurely sell something he truly believes will turn out to be a WCD and provide dividends for a long time to come, dividends which can be used to distribute to shareholders and fund additional exploration. Oh, I’m sorry, I’m being way, way too positive here.

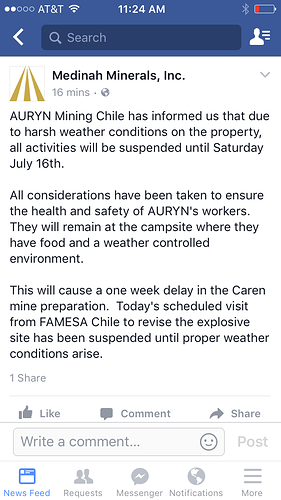

The 3 to 6 day forecast for the Alto calls for 20" or more inches of snow and over 100" to fall in the Andes:

The snow level will be rather high so only the very top might be affected. (or not at all.)

Another new week is a head of us so let’s start the week on a positive note. The future looks bright for Medinah Shareholders just a little more patience.

“The expected production for 2017 is conservatively set to be over 25,000 troy ounces of gold. After the first full producing quarter at the maximum allowed capability we will be able to forecast a more precise production estimate for 2017.”

AURYN is also preparing the required mining application in order to obtain the required permitting for an open pit at the Fortuna de Lampa historical mine site."

After permitting is obtained, the mine preparation will follow, and production is expected to start during 2017. Actual production from this site has not been taken into account for our preliminary 2017 production estimate. We will update as soon as we have this data available."

Notice how many times 'Production" is mentioned on the above excerpt with gold starting another Bull run we are well on our way to making money!!. Don’t listen to .05 - .10 take overs when there is great demand for a product no one can predict how the stock is going to react!

The formal end of Juan’s and Les’s involvement in Medinah.

MEDINAH Reports on Dissolution of Medinah Mining Chile S.C.M.

Press Release – July 11, 2016

Las Vegas, Nevada – MEDINAH Minerals, Inc. (MEDINAH) (OTCMKTS: MDMN) announces that Medinah Mining Chile S.C.M. (MMC) is transferring all of its assets to MEDINAH. These assets include a 25% equity stake in AURYN Mining Chile SpA (25,000,000 shares) and a 15% equity stake in NUOCO S.C.M. (150 shares).

MEDINAH has named Mr. Andres Merino, a Chilean mining and corporate lawyer, as the sole trustee and representative for MMC in order to accomplish this process. Subsequent to completion of the transfer MMC will have no other assets or corporate activity and will be dissolved.

Submitted on behalf of the MEDINAH Minerals, Inc. Board of Directors

Investor Contacts

Investor Relations

Website: http://medinah-minerals.com/

Phone: 702-605-4715

Email: info@medinah-minerals.com

The house cleaning continues. It should simplify things some.

I’m looking a little closer at the weather conditions on the mountain to determine if we see any delays this week on the work on the new mine.

This cross section shows temperature, relative humidity with time in the vicinity of the Alto. The bright greens show the moisture with height in the atmosphere as a surrogate for precip on the ground.

If you look carefully,you can see the model freezing line (0 C) in red generally at or above 2000 meters until early Wednesday morning when drops to 1500 meters.(Mountain top at 1900 meters) So some moderate rain is likely today with moderate snow Wednesday. I would think wet or snow covered road could cause a couple days of delays minimum.

The timeline starts on the bottom/left at Oz( 8 pm) yesterday evening.

Reminder that summer in the US is winter in Chile. There is a reason AURYN has chosen the Caren underground adit besides just the unusually hi grades of AU encountered. The timing for underground work is seasonally favorable, IMO. Better than deep snow at higher elevations.

Wow, I’m starting to sense some serious efforts being made to keep us informed of exactly what is going on whether it be good news or bad. Good stuff!

It’s ok a few days delay most other mines in Chile completely close for the season we have great infrastructure.

How significant is this event?

The delay is big deal, there will others, mining in the winter (surface or underground) during the winter is not really pleasant. Have to say, I do like the updates.

[quote=“mdmnholder, post:123, topic:1377”]

Have to say, I do like the updates.

[/quote]I have to say I do like the updates, also. The presentation by AURYN is something everyone here should be looking forward to just 81 days from now. 5 days in the overall scheme of things is not a big deal, accept maybe for those looking at this as a botched day-trading stock. Instead, those looking at MDMN as a speculative investment, which it has only recently turned out to be … with much lower risk than at any other time, are not looking at a 5 day delay with great significance.