I notice that the Cerro Dorado shareholders are invited on Oct 1st., but there’s no informational presentation. I’m feeling pretty comfortable with the CURRENT BOD of Medinah. I still need a little more information about the CDCH directors before I assign that same level of comfort to their current BOD and do any shifting.

[quote=“Baldy, post:1285, topic:1377, full:true”]HR it surprises me that you would jump to such speculation in the absence of FACTS but, solid point, nonetheless.[/quote]LOL…while the court of law may afford him the comfort of “innocent until proven guilty”, the court of public opinion, and more specifically, the victims of Les’ criminal self-serving and greed at their (our) expense, understandably won’t be offering him the same. As you said, Les is guilty as sin.

PS - Your suggestion regarding searching/saving e-mails to/from Les is something shareholders should definitely pay heed to.

LOL - and my expectations too.

yes I agree. I have an interesting letter dated x / xx / 1998 from Les Price that can be added to the collection.

How about George’s emails that he would paste from les? Those were the best! My 10 year old daughter can spell better than ole Lester.

George you still have them?

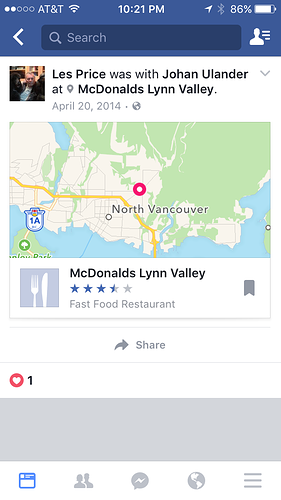

Here is some good proof of 2 criminals meeting with each other in 2014

This here should of been the Red Flag for many here

FWIW: It is likely in retrospect, whenever the treasury stock of the company was in-appropriated, it was accompanied by shareholder manipulation. Certain company officials released exaggerated claims and misinformation to promote buying.

Over the years there were rumors propagated to con greater investment in the prospects of the company and unwarranted dilution, both open and hidden dilution occurred, the scope of which remained hidden from investors until just recently. The BOD are those responsible for the fiduciary responsibility to shareholders.

Simply stated, cooking the books with the release of purposely inaccurate information to the OTC

website, such as occurred, is commonly known as fraud.

At the time “discrepancies” were first uncovered, did AURYN negotiate and gain the ADL claims as “collateral” against all the purchases made by MASGLAS backers on the open market? Who was it that was keeping what I’d call two sets of books; those open and those filed publicly … and those hidden in secret transactions? How and when were the discrepancies uncovered? Will there be a RS that will basically continue the scam run by certain former BOD members? (I doubt it.) Will there be claw-backs of illicit gains and stock? (I believe there will be.) Will any cash claw-backs be used to buy back and retire stock on the open market (held by CEDE & CO)? What shares, if any, can be revoked at this time.? It appears much of the required paperwork was not filed at the time treasury stock was issued, and was purposely hidden behind forward looking statements and exaggerations. Only the company can speak directly to facts. Shareholders need to hear the facts, and hear directly from the company what can be done to correct past improprieties. I hope to see former BOD members, like a bunch of rats, chewing on each others tails “squealing” to get the full story out and avoid possible legal consequences.

I fervently hope shareholders realize there is nothing to gain from shareholder class actions

suits. The current BOD, with the assistance of AURYN and MASGLAS will provide the only leverage for any claw-backs that are possible. Claw-backs will only come from promises to not pursue putting the responsible Fraudsters in jail, no matter how much THEY DESERVE IT! IMO

I won’t loose any sleep or tears to find I’m wrong on that last one if someone ends up behind bars! Restitution of assets back to legitimate shareholders should be the goal.

Moving forward for shareholders is ALL in the successful mining of claims leading to profitable money flow, and getting the share structure back to as close as possible to the 1.5B upon which “the deal” was predicated. I’m sure there will be shareholders asking and wanting their questions answers at the informational meeting. Who here will not be attending and what questions would YOU like answers to?

Looking back at my involvement in MDMN & CDCH I got an uncomfortable feeling in my

gut telling me that a NONE DISCLOSURE AGREEMENT was preventing us from knowing what was going on. Year after Year . How sad that we let it go on and on for so long.

Is the general consensus for all shareholders to wait until after the informational meeting before pressing forward with any legal action? There has been a lot of talk about “discovery” but when is this going to start? Is it beneficial to begin the process by posting what we have here or is that counterproductive to the process? It might help paint the picture of just what was going on but if it is going to be detrimental to any future legal action, I’d refrain from posting anything.

[quote=“TSXVTrader, post:1295, topic:1377, full:true”]

Is the general consensus for all shareholders to wait until after the informational meeting before pressing forward with any legal action? There has been a lot of talk about “discovery” but when is this going to start? Is it beneficial to begin the process by posting what we have here or is that counterproductive to the process? It might help paint the picture of just what was going on but if it is going to be detrimental to any future legal action, I’d refrain from posting anything.

[/quote]I think that is a wise course of action at this point.

This is what I don’t get. In :May of 2013, MDMN rescinded the contract with Amarant due to non-performance while Ulander claimed it was without merit. Les certainly knew that shareholders hated and blamed Ulander for the whole Amarant fiasco. Why would he still be meeting with Ulander? But what’s worse is why would he “check-in” with Ulander on Facebook and publicize it? Certainly he must know that MDMN shareholders were keeping tabs on him. This behavior is absolutely pathological.

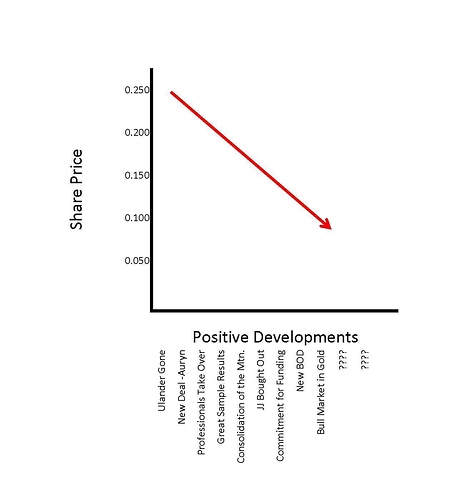

I can’t help but think that if JJ and the BOD had gone with Volcan in the first place, we might be looking at a .20+ stock right now. And JJ and Les would probably be making a lot more money the legal way.

Rick,

Just goes to show that most shortcuts aren’t shorter or better than doing things properly.

JeffS

HR, what we could use this forum (or at least a part of it) for, is …

(Edit- see reply below)

sadly I believe I deleted most probably kept anything that was just to messed up to believe. I gotta look

I think you misunderstood HR’s response. I believe he meant it would be a wise course of action to wait for the informational meeting and find out what is going on currently before pursuing any other sh action. Don’t you think the largest sh, Masglas would have something in the works already?

It also has been the forum’s policy not to engage in any attempts to organize action groups. We have previously requested anything like that be done privately and not use this forum for collaborating and possibly expose too much personal or sensitive information in public here.

If circumstances give us reason to consider changing this policy, the admins and mods will have to discuss it.

Given that MASGLAS has the most resources at their disposal and the most to lose, I think it might be beneficial to hear what they have to say about share recovery and legal recourse at the shareholders meeting. MASGLAS made their purchases while there was a 1.5 billion share cap in place. I’m sure they aren’t too pleased and I think it’s important for shareholders to hear what they have to say about this and what their plans are.

That appears to be the wisest course, rather than have this blog be unwittingly used to the detriment of shareholders and any recovery efforts by current management. IMO

Here is a little more that needs to be considered. I heard that Auryn or Masglas was fronting part of MDMN expenses in order to keep a cap on the share count at 1.5 B. I also heard that as soon as the $100M purchase option was changed to 25% equity that the cap was lifted. I would be very surprised if that was completely true, and if it is, how can a company more than double the outstanding share count in a relatively short period of time without full disclosure to the shareholders. Isn’t there some type of reporting requirement when dilution is beyond normal expenses like over 10% that requires public notifications and filings?

BTW I have numerous copies of emails from Les, Chapin, Tenney, and Vittal both directly and indirectly and some that were never made public. One actually includes a Photo of the signing of the MDMN share purchase agreements with the Masglas lawyer and documents indicating 230 M shares in the purchase agreement, fwiw.