So now my question is, what is the likelihood that we see any of it?

It is likely Les saw this judgement coming and promptly filed his BK. IMO

At least that ties up one of the loose ends that remained pending.

Haha, screw you he whose name I shall never mention!

I have not seen the judgment, but if any of MDMN’s counts go to any type of fraud, misrepresentation, then Price would not be able to discharge under a bankruptcy (as a general rule).

This judgment does allow MDMN, if it desires, to begin post-judgment collection proceedings. Either wage garnishment, non-wage garnishment, and/or citation to discover assets. MDMN could also begin third party citations to discover to others who are holding property of Price. This would allow MDMN to freeze Price’s accounts and freeze any assets third parties hold on behalf of Price.

Fantastic. Unlikely to move the SP needle but a wonderful day for Medinah.

Another fine example of Kevin’s leadership and accomplishments while serving as CEO. Thanks KT!!

Question. Can the Judgement be brought to and enforced in Canada?

Yes. I do not remember when, but we had a detailed on this forum a while back about reciprocity with other countries and enforcing judgments from other countries.

Both US and Canada are signatories upon I believe a UN treaty which allows the enforcement of judgments from one country in the other. I remember I found the info on the Dept of Justice website. I do not know the steps involved exactly as I am not licensed to practice in Canada; however, it would most likely be similar to what would happen in the US. You have to get a certified and exemplified copy of the judgement. Then you bring a petition to register the judgment in the Canadian court as a foreign decree. Price would receive notice of this request and would have the right to respond. The Canadian court would then grant the petition as a foreign decree. The Canadian Court would then open a new case and accept the US judgment as a judgment issued by the Canadian court. At this point, MDMN could then enforce the US judgment under the Canadian case number, pursuant to any Canadian collection laws/rules against Price.

I and I hope others on here really appreciate your legal input on some of these issues! It is a little enlightening!

This of course is the way to approach it if he cannot/will not pay the judgement, there are still ways for him to drag this part out unfortunately…

The great part is if he screws up discovery… then he could be held in contempt and thrown in jail… then Bubba will make him pay

Just a reminder of what all the legal matters have cost shareholders in terms of the free flow of information coming from AURYN. Before the exposure of 1.5 Billion fraudulent shares in Aug 2016, things were progressing relatively swiftly to explore and exploit the ADL by AURYN. It appears to me, despite the silence from AURYN, that progress on the mountain is moving toward full production goals for the Caren, as well as planning the best course in exploiting the Fortuna and LDM claims areas. Recall and read carefully Medinah’s significant news released April 2016:

AURYN Mining Chile SpA has already secured required environmental permits that allow production operations on the ADL this year. Additionally, AURYN has initiated several applications for expanding production goals with each of its acquisitions on the Altos de Lipangue Plateau. Chilean Mining Laws demand applications for increased production tonnage as well as environmental impact issues from mining operations. AURYN has already made several anticipatory applications, in this regard, to the Chilean Ministry of Mines.

As the 25% equity owner of AURYN Mining Chile SpA’s capital structure, MMC/MDMN will now benefit from their share of production rewards from several properties, not previously owned, including the Fortuna de Lampa (CDCH), Caren, Pegaso Nero, Columbo, Mambo, and the LDM/NUOCO claims. MDMN would also have a like 25% equity holding in other properties that AURYN may add to its portfolio.

AURYN Mining Chile SpA has multiple world class P.Geo’s, Geologists, and Mining Engineers that have analyzed the data from their ADL drillings and trenching discoveries and determined that various claims targets are assaying results referred to as Bonanza Gold finds. Several Mining Engineers and Mining Geologists have also reported the evidence of Copper and Gold Porphyry structures on the Altos de Lipangue Plateau that are yet to be fully drilled and explored. Recently, AURYN officials uncovered a 1.7 kilometer gold vein at surface that they assayed over one (1) meter intervals. The results of these activities, as determined by the AURYN geological team, have expressed US billions of dollars of commodity values. AURYN Mining Chile SpA has initiated site locations for early stage production activities on the Altos de Lipangue Plateau. Further, AURYN has conferred with Enami, Chilean state production/processing locations, concerning transportation and receivership of the high-grade (Bonanza) gold to their facilities.

After having endured many years of struggles and challenges as a Company, the Medinah Minerals, Inc. Board of Directors considers this MOU to be very significant and a major milestone event. In addition, given the very difficult commodity markets, the global rout in the market cap of the world’s junior and major mining companies, and the collapse and drying up of capital for the junior mining industry, MDMN is extremely pleased to have a well-funded, professionally run and highly competent partner in AURYN Mining Chile SpA.

Things changed drastically not after the Okanadian “scrivener’s error” was revealed early in the year, but after additional Canadian lawsuits were filed in early 2017. AURYN went immediately into the “run silent and deep” mode of operations on the mountain. There were significant but very limited news releases during the year by AURYN. The Canadian lawsuits were recently (see Q2 - June 30) announced in the process of being dismissed “with prejudice” meaning they are final and no refiling is possible. Significant news will start to be released by AURYN again, as in the hiring of the new Corporate CEO, Mr. Conetta from Liderman (The Carlyle Group Company). Mining on the moutain is moving forward. News will be forthcoming most likely after MDMN (and CDCH) file their required Q3s covering July1 thru September 30 with the OTC. I look forward to a timely filing with the OTC.

I would have thought by now with all of the pieces of the puzzle nicely fitting together, that a 6 million plus share day would be pushing our share price north…

Think nothing of it. Somebody unloaded early in the day…and then little action since.

There is no immunity in the Big Bubba household!

Here is another interesting statistic:

Resource Sector Digest: Production Delays Are Very Common In The Mining Sector!

Source: Royal Bank of Canada

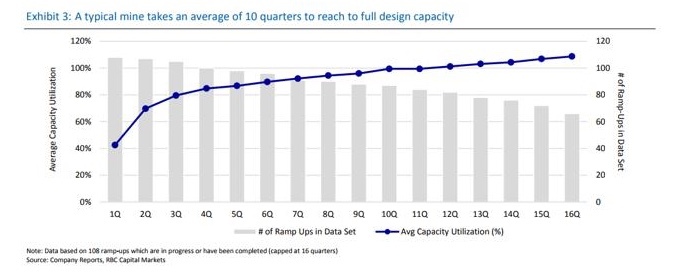

And a final chart: it takes a new mine (on average) 2.5 years before it reaches the nameplate capacity.

… So, the next time one of your investees has to deal with some teething problems, cut them some slack. It’s really not easy to commission a new mine and reach the commercial production status.

https://seekingalpha.com/article/4111048-resource-sector-digest-production-delays-common-mining-sector

AURYN announcement May 16, 2016:

As we progress toward full scale production AURYN will provide updates regarding costs, mine life, and reserves.

I think it is safe to assume we are not yet at full scale production. It would be nice to know at what time “the clock” starts so we can start measuring off the 10 quarters to see where AURYN compares to the average. I don’t at all think AURYN will show itself to only be average once the official clock on mine production starts. Does it start once AURYN becomes publicly trading, or has it already started?

Why did they stopped production at the first place ?

I realize for every sell there is a buy. I also understand people need to sell some here or there for needed money.

What I don’t understand is why we have large blocks continually being sold at this point in the game.

LP is a POS and has never had an honest day in his life IMO

I don’t want to start any crap here but is it coincidental he now owes large sums of $ and large blocks keep going off?

I sure hope its something else.

If an IPO is going to happen be end of year…what time frame is normal to hear something or news about it before an IPO actually happens… what’s the earliest they can IPO after an announcement or do they even have to give an announcement and can go straight to an IPO? just trying to figure out what is the earliest they can IPO after an announcement? Just some questions I had for anyone that wants to answer…

FWIW I bought about 1,000,000 shares this week - seems to me you can’t beat it at this price. I’ve been wrong before …