Nice to see 4 Million Share BID @ .0044

That is right I don’t know if she has any savvy about trading . She is tired like the rest of us.

Thanks very much. he will be sorely missed by all.

Was he posting on miningplay?

I must be having a senior moment since when did it drop from the February Number of 27.5%. I will probably remember when it is explained, but at this point I am not sure!

February 16, 2017

Quote:

Medinah Minerals, Inc. (Medinah) (OTCMarkets: MDMN) is pleased to report the sale of its 15% interest in Compaa Nuoco Mining Chile S.C.M., to AURYN Mining Chile SpA (AURYN) for 645,000 shares of AURYN. This brings Medinah’s total interest in AURYN to 27,469,000 shares or 27.5% interest.

Directors/Kwvin took compensation from Auryn shares.

From the Q2 financials:

- Describe the Issuer’s Business, Products and Services

A. Business Operations & Legal Proceedings.

Business Operations

Medinah is essentially a company that holds stock in different companies.

Medinah has no business operations other than owning a 26.469% equity stake in AURYN

Mining Chile SpA (AURYN) and smaller stakes in two additional public companies.

https://www.otcmarkets.com/financialReportViewer?symbol=MDMN&id=176189

Interesting I was unaware of that especially when :

October 18, 2016

The Board of Directors (the “Board”) of MEDINAH Minerals, Inc. (MEDINAH) is pleased to announce the appointment of Kevin Tupper as President and Chief Executive Officer of MEDINAH effective immediately. Mr. Tupper will also serve on the Board. Gary Goodin, the former Chief Executive Officer and President, remains on the Board and has been appointed Chairman of the Board.

In support of MEDINAH’s desire to limit any further dilution and improve its capital structure, Mr. Tupper has agreed to serve as a volunteer while MEDINAH reduces its expenses and seeks to achieve a positive cash flow.

I did too, Karl, but HR pointed to what was spelled out in the Q2. The riddle is answered in Note 6 – Directors Fees:

The Board of Directors passed a resolution on March 1, 2017, to compensate Board Members and Corporate Officers with a total of 1,000,000 shares of AURYN stock. That compensation is for corporate governance through the anticipated existence of the Corporation.

This is the missing 1% equity interest in AURYN.

I missed that one too. I need to follow this closer, specially when I was very disappointed that we gave up our interest in Nuoco for about a 1% increase in Auryn and now in essence that 1% went to the directors. So we basically got nothing for Nuoco. It seems like everyone looks out for their own personal interest first and that is sad to say. Yes, they might deserved it, just disappointed they do not do what they say in their own press releases. I guess they did not want MDMN shares! Just never heard of a company compensating their directors with stock in another company. Just when I thought there was not going to be any more disappointing news. As much as things change they always seem to stay the same. Just hope I am wrong!

HR, You’ve really been a real sleuth when it comes to providing details many shareholders may have missed on Medinah and Cerro. From the article you pointed out to the forum here a while back a couple of other interesting “breadcrumbs” were hinted at. The property is not the widely 10,500 ha formerly noted but now appears to have expanded to 11,000 ha.

It comprises 11,000 ha of concessions and contains resources equivalent to 1.5 Moz Au.

http://cexr.cl/wp-content/uploads/2017/10/CER56_ENG_FIN.pdf

The 1.5 Moz AU is much greater than the conservative estimate provided at the Informational Meeting. Was this expanded due to Sillitoe’s internal report, or something from additional exploration revelations in the Caren adits? It appears AURYN is quite confident in more than doubling it’s previous estimate from just a year ago.

I forgot about that document!

This was openly discussed here in March/April.

The task of legal wrangling and keeping the company afloat became much more lengthy and pretty much a full time effort. Kevin couldn’t continue to save our butts for free for a whole year. He didn’t get us into this mess but stepped up to the plate and worked for free as long as he could afford to. (I have no idea how the board split it up, maybe it will show on one of the financials.)

If you think about it…Medinah still owning a 26% stake in a World Class gold/copper deposit after all that is happened is amazing.(I’m not going to begrudge the 1% since it was spent cleaning up the mess left by Les.)

Got to get that cash flow going from the Caren mine to forestall further dilution. A partner will a big purse to kick start exploration into overdrive would help. The bonanza grades that are hinted at in the Caren could turn the tide very quickly if Auryn finally pulls the trigger and goes full bore on the mine as early as November and the deposit itself pans out as expected.

No he did not post here, he left that up to me.

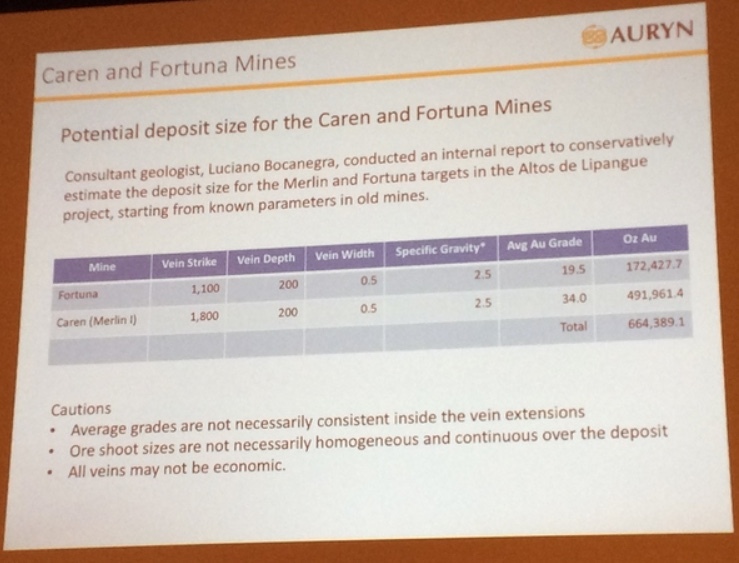

The 1.5million equivalent oz of AU in the article was referring to the entire ADL. The photo is pertaining to the Caren and Fortuna mines only.

Not begrudging just stating I never heard of an executive getting his compensation as stock in other company. No cash flow at this point since Auryn is not liquid, so why not get MDMN stock? It would have been a better show of confidence in what he is accomplishing, if he got stock in the company he was saving, JMO. My real point is that I believed we gave away our share in Nuoco for a lousily 1% of Auryn and then to throw that 1% away to the MDMN executives was like adding salt to the wound. I said my peace and I know it is done just wanted to express my opinion.

I was not aware also until someone posted on ihub. I agree with you Karl why not get compensated Mdmn stock? Instead of Auryn that is a private company.

Yes, that slide is what Luciana had estimated early on from what had been documented for the Caren and Fortuna mines only. Maybe “resources equivalent to 1.5Moz Au” was Maurizio’s way of saying we have a World Class Deposit within the ADL region. I consider that great news! However, I also I note the emphasis that Mr. Cordova places on the near term production opportunity under way:

A vein nearly two kilometers long has been recognized running from north to south and Auryn Mining intend to explore it from end to end. Mr. Cordova said “We have identified 300m of this vein, and we are now moving up.”

This was clearly pointed to in January’s informational notification when a 42m section of high grade vein in the Larissa Adit was first identified. AURYN expected that this intersection extends vertically at least 30 meters in each direction. It was further stated work was proceeding to map and evaluate levels 1 and 2. It is clear AURYN desires to expedite exploitation of the Caren in order to fund and expand it’s exploration and possible exploitation of the Fortuna and LDM. It is more than likely the estimates presented in the slide will be exceeded. We are not likely to see formal resources proven and inferred come forth any time soon, but I do expect there will be news of expanded production on the Caren vein in the near term.

Optimisim that funds will become available (either from the IPO or exploitation?) also seems to be hinted at with permitting apparently under way for the Fortuna de Lampa.

Mr. Cordova remarked "If possible, we would like to begin operations next year, including the processing plant.”

That, I would like to know why Hulk.