This could well be a winning strategy for MASGLAS to gain a majority share position of Medinah. As it currently stands, a repurchase of less than 540M shares would leave MASGLAS/AURYN in majority control. This would complete the picture of circular ownership where the apparent number of shares in the OS greatly outnumbers the effective number of shares. This situation would make any future dividends extremely effective in increasing the the PPS in a very short period of time. MASGLAS and Medinah shareholders would benefit the most from this situation in each cashflow positive Quarter. It is unlikely this could be accomplished with $10M as PPS would have to average less than 0.0185 for the entire repurchase. MASGLAS would need to also buy on the open market during the repurchase to gain a majority share position, but it would be less expensive and gain greater long term benefit than a TO.

If I assume you’ve been stuck, I mean invested here for 10 years and we use a 15% discount rate for MDMN (which is wildly conservative given the risk profile), $10k invested should be at around $40k in value…meaning your 2 cent cost basis is actually 8 cents when including opportunity cost. If you’e been here for 15 years you would need something closer to 16 cents.

I’ll admit that this is a bit of an “institutional” analysis but it’s remarkably similar to what our BOD actually received on the $1M+ they lent to the company which, after compounding double digit interest rates (similar to the discount rate I used) received $8M+ in preferreds.

AMC has provided us with mining/production plan for the next 12 months. Even if those projections are eclipsed we should not be expecting dividends until the end of next year at the earliest. I’m hoping the 7-8 cents level has been surpassed by that point but it won’t be through distributions of dividends.

If we were to model 100koz of production with a $800/oz cost this would equate (pre-tax) to a penny (0.01) dividend. This is assuming that no money would go towards self-funding exploration/production expansion. I’ll leave it up to the “experts” to predict when we can achieve that level of volume but, if you think it’s next year, you might as well join BBoys fan club.

A TO still presents the most upside within a reasonable period of time. No doubt that there’s a lot more room for higher prices if people are willing to wait 3-4 years at which point the POG will probably closer to $2500/oz. IMO.

I am leaving all the Friday night quarterbacking and strategy suggestions aside. I’m hoping others can stop the internal bickering as well.

MASGLAS and AURYN are in charge of their own companies. They’re not soliciting our opinions regarding how they should run their business. They’ve brought their companies this far. They’ve been able to consolidate the entire ADL district. They’re preparing for production. They saved our butts from having to sit around for another 3 secret company NDAs and 1.5B more shares issued. They can manage this.

MASGLAS is the largest shareholder in MDMN. My best guess is they have at least 35+% of the shares. Between them and a handful of other significant shareholders, they have a controlling position. The evidence is the makeup of the new BOD.

Let’s let AURYN and the new BOD go to work for awhile and enjoy what they’re doing.

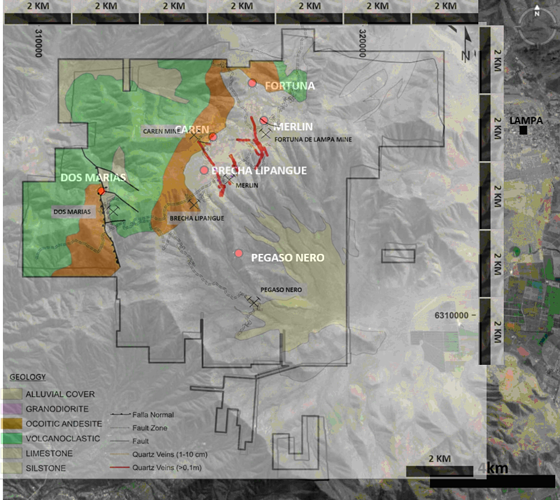

For the fun of it I took two images from the Masglas site and overlaid them. They don’t fit perfectly because one is 2D the other 3D. Nevertheless, it will give you the scope of things.

The contiguous claim blocks are enormous – ~ 13km x 10km!!! 10,500 ha is about 40 sq miles for those not use to metric! Only 25mi from Santiago!!! Production starts late summer / early fall.

Let them get early production started. Let them tell us their plans at the shareholder meeting. Let them get the first full quarter of production at maximum levels and give their forecasts.

Pretty simple Roberto. Consider track records of past loooong time contributors (I’m not referring to my own), what AMC has told us publicly, assign somewhat reasonable production and capex projections over the next 24 month and you’ll have something close to the “truth” or, more specifically the most realistic opinion.

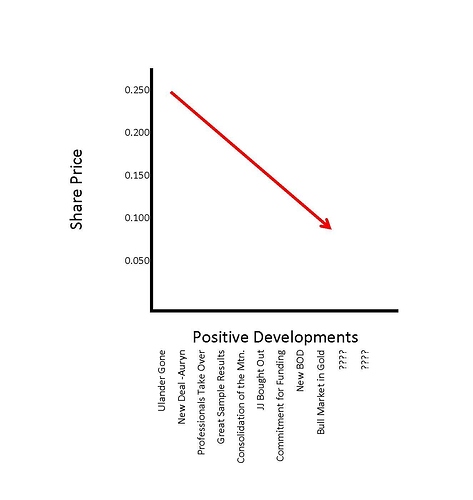

The last one was down to $.10. I’ve tracked the predicted TO price against recent developments below.

Was that 25 cents starting or 2.5 cents?

I think 10-15 cents is reasonable. Your graph doesn’t seem to include anything on how we gave up $100M for more equity. I totally agree that the leg needed to be amputated to save the patient but the cash component of the option was 7-8 cents.

Looking at your graph it looks you only include positive developments (all of which I agree with) vs. TO price targets. Wouldn’t it be neat if the market worked that way?? Unfortunately, we also need to adjust to the negative developments (necessary or not) as they evolve.

I wouldn’t mind waiting that long for higher prices but I also understand I belong to a very scarce and rarefied minority…

Regarding your answer to my previous post on where stands the truth, while I wouldn’t mind your exit scenario at all, it is my opinion that at the AGM we will have a much better understanding of Auryn/Maglas’ game plan and we’ll be able to make predictions that will be closer to reality, whichever it is.

I respect other peoples opinion no matter how aggravating sometimes it can become. I truly believe there will not be a TO not in the foreseeable future. One only needs to read the news releases by Auryn/Masglas and make an informed opinion on their own.

Does this release give any indication of a TO?

MASGLAS, a significant Medinah shareholder, will work in concert with Mr. Goodin to accomplish a comprehensive analysis of Medinah’s books and records to ensure the continued integrity of Medinah’s financial statements. During this process all of Medinah’s assets and liabilities will be scrutinized in detail. The goal of this effort is to improve the effectiveness with which Medinah communicates its results and financial condition to the investment community and the mining industry.

[quote=“Baldy, post:1211, topic:1280”]

I totally agree that the leg needed to be amputated to save the patient but the cash component of the option was 7-8 cents. … Unfortunately, we also need to adjust to the negative developments (necessary or not) as they evolve.

[/quote]Yes, and over the next year, all $30M (or more) anticipated from early exploitation is to go to expenses and exploration, not dividends. Once there is a revenue stream and permitting for open pit mining on the Fortuna and Merlin 1-3 do you think a TO of $225M (cash) will actually be offered? I would think further accelerated exploitation and exploration defining the value of what is contained in the claims is more likely. Pay as you go approach makes more sense and reduces risk. Perhaps a partial sell off of the percentage interest in AURYN earlier on, once there is positive cash flow, would be used to pay out a dividend to MDMN shareholders. We’ll have to wait at least until the SHM to see what unfolds at the AURYN presentation and the agenda put forth to shareholders.

[quote=“Baldy, post:1206, topic:1280”]

No doubt that there’s a lot more room for higher prices if people are willing to wait 3-4 years at which point the POG will probably closer to $2500/oz. IMO.

[/quote]There are shareholders here that are not as anxious as you seem to be to exit at the earliest possible time. You seem to be defining a reasonable period of time as a year to 18 months. AURYN has only been grinding it’s gears on this for 2 years. What came before that time is disappointing, but largely irrelevant now as the project moves forward on multiple fronts.

Good point Hulkster. An audit of MDMN’s balance sheet clearly suggest a TO is more likely. Understanding the outstanding share count, legitimacy of accrued liabilities, and the potential to return some shares to the treasury would be a necessary step before acquiring the company.

Dunno. AMC will have the best insight into the potential value of the mountain so they would be in a good position to offer $225M even if the announced results didn’t support that valuation. I can’t see any scenario where AMC is going to buy back partial ownership (from the 25%) to give MDMN an opportunity for dividends or a buyback. Instead AMC would simply buy shares more aggressively in the open market to take advantage of any disconnect and increase their interest in the public vehicle. They won’t be agreeable to anything that benefits MDMN shareholders over their own. If it only cost them $10M to increase their ownership from 35% to 70%, as an example, it makes sense for them to pursue that option at the appropriate time. Any suggestion that they would instead give that $10M to MDMN so that their current 35% would go up in value, flies the face of very basic, risk/reward analysis.

This is just my best guess as how things unfold. I have no urgency to bail on this investment. It’s in the drawer. The speculation on timelines has a lot more to do with how long AMC is going to tolerate having a minority holder (MDMN) tied to their efforts and capex. There will come a point where acquiring the 30% (MDMN & CDCH) will make sense from a cost of capital standpoint. The quicker they advance the mountain, the quicker they will look to own the asset outright.

I appreciate that my opinion may not be popular with some of the “lottery ticket crowd” but, as is evident by the share price, MDMN has gone from a “penny story stock” to a legitimate mining play that requires a lot more than “fluff/Lespeak” to regain momentum. It’s important for people to start weighing traditional fundamental factors and realistic/comparative valuations to better understand this investment’s potential.

You never give up do you? We wait and see .

“Yes, and over the next year, all $30M (or more) anticipated from early exploitation is to go to expenses and exploration, not dividends.”

I wish whoever keeps making statements like this would stop.

It is complete baloney from start to finish. It has no basis in fact. It is NOT what Auryn is going to do.

[quote=“Baldy, post:1216, topic:1280”]

I can’t see any scenario where AMC is going to buy back partial ownership (from the 25%) to give MDMN an opportunity for dividends or a buyback. Instead AMC would simply buy shares more aggressively in the open market to take advantage of any disconnect and increase their interest in the public vehicle.

[/quote]As far as I know, Medinah has a share certificate representing it’s percentage ownership in AURYN. Are you 100% sure part of the shares in AURYN (a private company) could not be sold off for cash to someone other than AURYN or MASGLAS? I agree with the new BOD this is not the most likely course, but there is a fiduciary responsibility towards Medinah’s shareholders that has not been represented for far too many years and needs consideration. A part of any sale of this ownership would infuse MASGLAS with additional cash as well as Medinah. Both companies could benefit immediately and longer term.

[quote=“MikeGold, post:1218, topic:1280”]

I wish whoever keeps making statements like this would stop.

It is complete baloney from start to finish.

[/quote]I’ll concede it’s more of an assumption based on a news release and what I believe Baldy’s firm position is on the matter. I could have phrased it better.

Cash flow generated from production at the Caren Mine project will provide the funding required for the aggressive exploration program at the high-potential porphyry mineralization at the Pegaso Nero target, as well as further drilling at the Merlin-Fortuna targets.

AMC is pleased to announce that Mr. Gary Goodin has been appointed director, effective immediately, to the AURYN Mining Chile SpA board of directors.

Whatever the cashflow is, not all of it will be going towards the PN exploration and drilling. I’m open to some very pleasant surprises in the upcoming year or two as things unfold. The SHM is something that I’m looking forward to. I don’t think many shareholders will be disappointed at the direction that the company is taking now that AURYN is making decisions on how and what gets prioritization. I’m not of the opinion we’ll see a TO in the next year or 18 months, in case I didn’t make that clear.

Silver just went through $20 / Oz.

One would think it is due for a short term pullback pretty soon.

Went up above $21, but has fallen back to $20.35 as of this late hour