[quote=“leanandgreen, post:59, topic:1377”]

In order for Medinah (the public company) to accurately report its equity stake, it would need access to the private company (AMC’s) books

[/quote]We are currently only slightly undervalued by the market. Market Value1 $18,033,496 a/o Jul 05, 2016.

The AURYN share certificate shows 100M shares issued that are valued at $100M dollars, so we currently have certs worth about $30M. Once we start producing and having a positive cashflow we’ll need to increase PPS about 7X to get back to our original $100M option agreement. The positive money flow will be increased with surface gold production, including the Fortuna, Merlin 1&3. Clearly, there are still hurdles yet to be cleared. Allowable tonnage at each site will only go up with new permitting increasing the number of ounces we see produced. Most shareholders with positions have resigned themselves to putting this in the sock drawer for the time being. Having such a pessimistic view I wonder how you’ve managed to keep this investment. You will have an opportunity to voice your opinion where it will count for more than it does here at the SHM.

I would like to hear CHG thoughts on these new photos

You’d have to see it to believe it!

Really? I thought after my previous speculation stumble my pic interpretation career was over. Well,

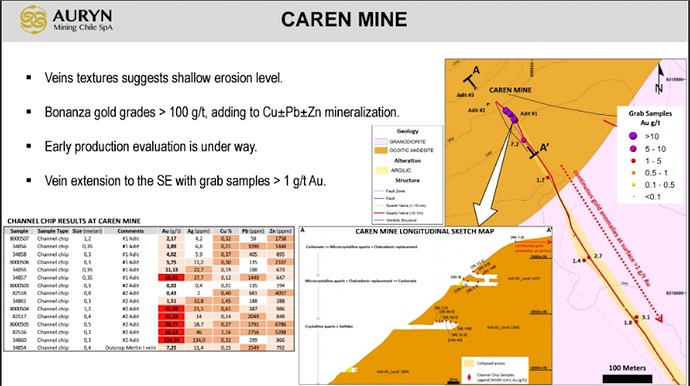

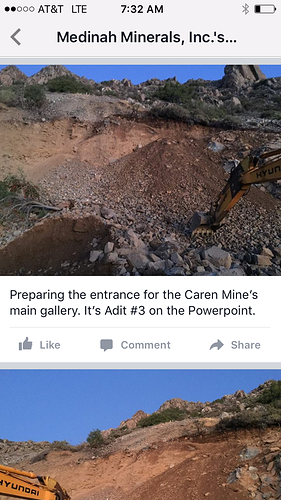

1- The captions speak of the “main gallery”, and then note “Preparing the entrance for the Caren Mine’s main gallery. It’s Adit #3 on the Powerpoint.”

1A - First, the definition of “gallery”:

DEFINITION:

a : a long and narrow passage, apartment, or corridor

b : a subterranean passageway in a cave or military mining system; also : a working drift or level in mining <1>

1B - We are talking about the 3 adits on the north side of the plateau. The most interesting part is that they claim this is “Adit 3 on the PowerPoint”. I’m sure this is the PowerPoint on the Auryn Projects Page. Recall that we were given sample results in Jan 6 and Jan 27 2016, but these all came from Adit 1 and Adit 2. <2>

1B-1 This is interesting because the “Bonanza grades” disclosed to date came from Adits 1 & 2, primarily Adit 2, the one farther down the side, or deeper down from the plateau. <3>

1C - Adit 3 is about 40m farther down the side (according to Auryn’s slide), but it is the level where the road comes in at from the side. See the Google Earth image below - that side road comes in from the left. You can see from the excavator picture that this is the location o the work - see the sharp rock ledges above and the large worked area on the satellite and on the picture.

COMMENTS / QUESTIONS: It was my impression Adit 3 was too much of a mess to go into, aka collapsed, and thus there were no sample results from that Adit. In fact, this is shown as such on the Auryn slide.

So does their caption mentioning Adit 3 just mean that’s where the picture is taken, or does it actually mean that will be the main “gallery” or working level? It seems fairly clearly to intend the latter. So what did they find in that level that made them choose that level instead of the very nice results from Adit 2 shown in the slide below? Or is it simply because the current road comes in at that level?

2- Also note the comment on the one picture that the Caren main gallery (aka Adit #3) will be notably larger than the adit shown in the LDM adit picture.

3-Also a side comment to note how narrow the vein is. The Adit two samples indicate something on the order of 0.2m to 0.5m most of the time, perhaps up to 1m. This is similar to the characteristics of the Fortuna mine.

These days equipment and methods are all geared towards maximizing tonnage, even in underground mines, with large equipment etc. The difficulty with narrow veins is effectively mining such a narrow vein. You don’t want to dilute your ore with lots of non-anomolus rock and you don’t want to spend time and money digging non anomalous rock you don’t need to.

So you have to dig just enough to keep room for operating and yet have some level of decent ore rate. “Narrow vein” mining thus presents some non-typical complexities for modern machine mining. There are a few companies out there that sort of specialize in narrow vein mines. One can probably safely speculate this was a large part of the need for the Peruvian “specialists” or “experts” - someone who has experience in these non-typical conditions.

CHG

-

See Slide 12:

and viewed via Google Earth from the sky looking south:

- Jan 6, 2016: http://aurynmining.com/discovery-of-bonanza-gold-grades-at-caren-mine-within-the-altos-de-lipangue-project-2/

Note Auryn refers to Jan 6, “2015” - but that is a mistake

[quote=“leanandgreen, post:68, topic:1377”]

I would think that $1 per share is more akin to a par value

[/quote]I could agree with that. It is what is shown on a stock certificate. Par value is generally set low to minimize any potential tax consequences. One might think of it as what is put in on your balance sheet. Anything more is shown as paid in capital. At least, that’s my understanding of it. It’s fairly meaningless. A company puts in the amount of money needed to get things moving. This says nothing in the way of “valuation” for the future potential of the mining operation. You are a CPA. You should know this, so not worth bothering to ask. A private company is private for a reason. MDMN is a speculative stock with an equity interest in a private company. Once money flow from early mining exploitation starts and is announced the market should start to remove it’s time and risk factor reflected in the current PPS.

It looks like the underground methodology chosen is “shrinkage stoping” with adit #3 being the transport drift where the chutes and the drawpoints are located.

Shrinkage Stope Mining

Shrinkage stope is a generic term used in mining to portray the process of mining upwards from a lower to an elevated horizon, leaving broken rock in the excavation created. The broken rock acts as a working platform and assists to stabilize the excavation by supporting the walls.

Is the person in grey vest anybody of importance or just the main boss over others in red vest?

I remember Auryn employees from past photos had vests like that on

That’s what I was thinking also…but can’t see logo on vest clearly

OTC just updated/changed MDMN’s Business description to the following:

Business Description

Medinah Minerals (MEDINAH) (OTC Pink: MDMN) is a publicly traded company. At this time MEDINAH is primarily a holding company. Our primary assets include: a 25% equity position (25,000,000 shares) in the private company, AURYN Mining Chile SpA (AURYN), a 5 year option to purchase 5,000,000 shares from AURYN for $50,000,000.00 US, and a 15% equity position in NUOCO, a private company of which AURYN owns the remaining 85%. AURYN is the owner of the Altos de Lipangue (ADL) project, comprising over 10,500 hectares. The ADL is adjacent to Lampa, Chile and about 30 kilometers northwest of Santiago, Chile. MASGLAS, AURYN’s parent company has an executive summary of the ADL Project and further details can be found on AURYN’s page at http://aurynmining.com.

Is someone trying to indirectly convey the idea that valuation of AURYN is anticipated to exceed $1B US within a 5 year timeframe? So is valuation of MDMN’s “valuation” via it’s equity interest in AURYN in the $250M to $300M within 5 years? What is a shareholder to infer from this?

sorry, i misread the post above.