Great to have you back on the forum, Rich.

Guess you made it through the hurricane OK, was concerned for ya!

Hope everyone else near the southeast coast is coming through unscathed.

Hi cabezon…

I never actually left. Just re-prioritized.

All I have had to endure in this weather is a little wind, which we’re finding quite refreshing after I don’t know how many months of hot and humid. The folks on the other coast are getting the brunt of it, but it appears that so far the eye of Matthew is staying off of the land so as to lessen some of the devastation that was anticipated. Hopefully that will remain the case as it continues. I appreciate the concern, but it’s not necessary. You should save all the energy you can for keeping the natives here in line! LOL

Also Madmen,

My response to you wasn’t meant to be as brusque as it sounds in rereading it. I was just writing in a matter-of-fact tone so I apologize if it came off terse or disrespectful which was not my intent.

Thanks,

Rick

Question if les sold a good majority of his shares how can there be a clawback now that the shares are on the open market

Any of it that was preferred stock cannot be converted to common at this point.

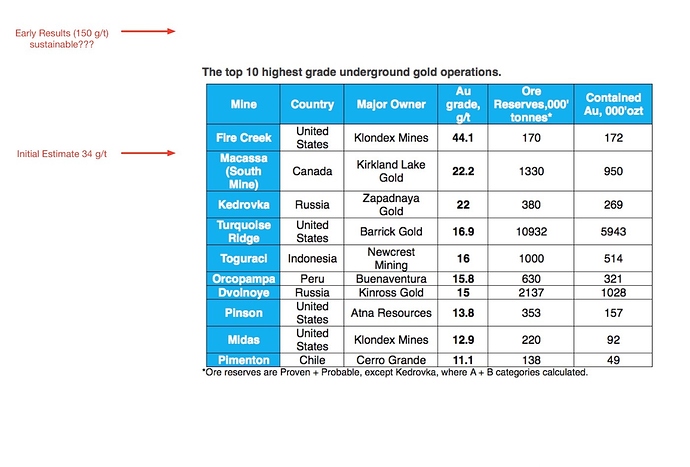

MG has shown this chart before.[1] I have placed the grades associated with the Merlin 1 / Caren on the chart. In the following couple of posts I will demonstrate how Auryn clearly believes the Caren grades would top this chart and the power of that grade, which leads to Auryn’s excitement over the discovery. I will also discuss the power of distributions / dividends in terms of future SP based upon the numbers Auryn has provided.

NOTE: This chart is based on formal RESERVES. Since Auryn does not intend to do formal reserves on the Caren, the mine would never actually appear on this chart (see the note at the bottom of the chart). However, it still serves my illustration purposes for the following posts.

1. http://www.mining.com/the-worlds-highest-grade-gold-mines/

Are you 100% sure of that? We’re talking about les here the master manipulator

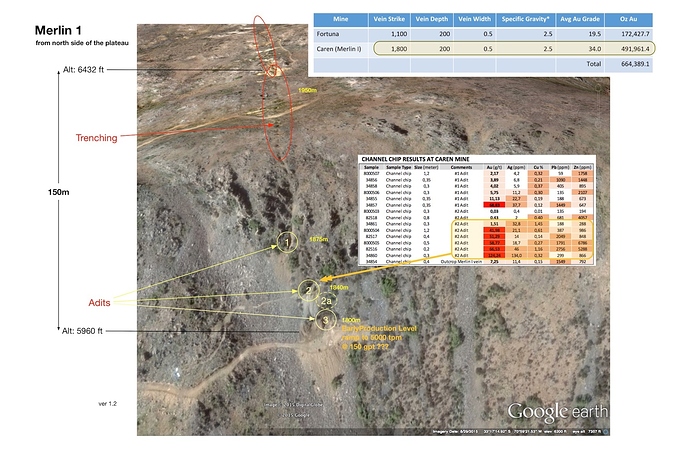

Here is an updated version of my old marked up Google Earth image from the north side of the ADL including data provided by Auryn in their older slide deck and now the new one on their website.

NOTE THE OLD:

-

The current production adit is 150m below the plateau / the plateau entry of the old Caren mine.

-

The “bonanza grades” Auryn provided in the old deck come mostly from Adit #2. They include one assay above 120 gpt but the rest of these high grades assays are in the 41 to 66 gpt range. This is 110m below the plateau. This implies the grade improves substantially at depths below the Adit #1 level.

NOTE the NEW:

-

Auryn’s initial estimate is that there are 200m of mineable vein depth at an average grade of 34 g/t and 0.5 m in width.

-

At surface we know it is around 3 gpt from trenching. And from the provided data, the grades at Adit #1 are well below the grades at Adit #2 level, on average. This is 75m below the plateau. At Adit #1, there is one assay above 68 gpt but the others are not much above the grade at surface.

-

Auryn believes this 200m @ 34 gpt of mineable vein extends clear across the plateau and is thus 1800m long.

-

Auryn estimated (at the time of the estimate which was earlier in 2016 - I think they removed a date from the slide as it was presented at the meeting) that this 200m of mineable vein thus includes just short of 500 KOz of Au.

-

Auryn told us that their very early results at Adit 3 include ore at 150 gpt and some bonanza grades above 200 gpt. This is clearly is better than the 34 gpt estimate average grade. But is it sustainable???

Nobody is sure of any details other than the bare minimum already reported. That’s why expensive lawyers and investigators are being hired so that we can become sure.

-

Auryn / Luciano Bocanegra have told us that the 200m of estimated mineable Merlin 1 has an initial estimated average grade of 34 gpt. But it is obvious from the other data, and this is entirely typical, that the grade toward the top of that 200m is lower than what is at the bottom as stated earlier.

-

Auryn / LB did not say exactly at what depth they started their 200m, that is, what level is the ‘top’ of the 200m block. It could be at surface as I have shown on the diagram. It could be at Adit #1 level and basically ignore what is above that.

It actually does not matter as the results do not change all that much. But I will conservatively assume that the Adit #1 is on average about 10 gpt and it is the ‘top’ of the 200m. This will give us a slightly lower estimate of the grade at the ‘bottom’ of the 200m.

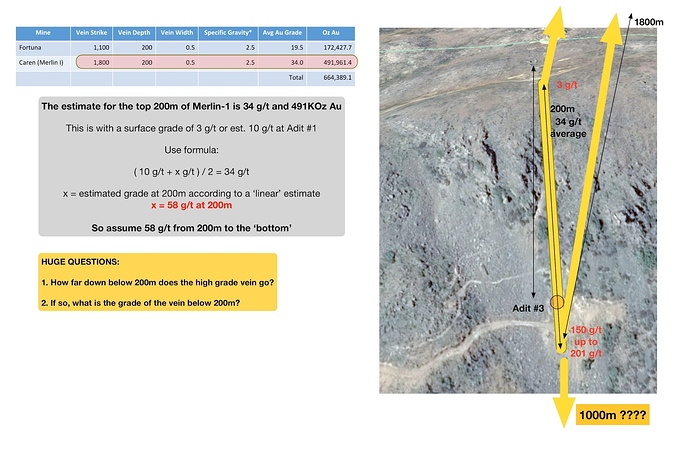

- Simple math then says that if the top of the 200m is at 10 gpt and we assume that the grade changes linearly over that 200m and the average grade is 34 gpt: THEN THE GRADE AT THE BOTTOM IS 58 gpt.

And every block that is 0.5m wide, 1800m long, 200m in depth, and has an average grade of 58 gpt would hold about 837 KOz of Au!

-

58 gpt is a VERY NICE NUMBER. But it does not match the early 150 gpt numbers spoken about at the info meeting. I am going to conservatively assume that the 150 gpt will not hold up on average and that 58 gpt is closer to the actual average. But one can always substitute the 150 gpt into the model I will present shortly and get an even more impressive result. I will note that the assays at Adit #2 level, match up with this estimated ‘bottom grade’ quite well. So it is quite unlikely that I am over estimating the grade. I am probably underestimating, perhaps by quite a bit. There is still risk, of course, that as they mine across the plateau this average falls off. But that is not indicated by the surface trenching. Nevertheless, this remains a risk.

-

We will want to keep ‘mine life’ in mind. For example, if we have 500 KOz as per Luciano’s estimate and we start mining 25 KOz / yr as per Auryn’s stated plan, that implies about 20 years of mine life. That’s just to demonstrate the calculation.

-

Now → note the huge questions:

How much deeper does the high grade vein go? This is important for several reasons. But one of them is that now the ‘top’ of the mineralization below 200m starts at 58 gpt, not 10 gpt. This means that in the next 200m of vein which may exist below Luciano’s estimate, there will likely be much more gold than that first 200m. (Assumptions: the vein on average is about the same width and depth going across the plateau)

What is the grade below 200m? Impossible to say at this point. It is safe to say that at some level it will peak and then start to drop off. This depth could be 200m. It could be 400m, 600m, 1000m. We don’t know. Underground gold mines at 600m or even 1000m are not untypical.

If there are 500KOz in the top 200m and there is much more potentially in each 200m below that, then these are big questions. That is why Auryn will drill and attempt to get an idea as to the answers even though they are not chasing formal resources / reserves.

In the next posts, I will just ignore the potential below the current mine. That is all just a big potential bonus. I am going to look at cash flow instead of asset value, as I have done in the past. If the average grade remains constant and the mining rate remains constant gold production remains constant no matter how much or how little is below, at least until you run out (aka: mine life)

[lunch break]

Note I added the summary text:

And every block that is 0.5m wide, 1800m long, 200m in depth, and has an average grade of 58 gpt would hold about 837 KOz of Au!

above

Hurricane Rick wrote: “I think you meant to address that to me, not Trader Rich.”

True, yes, sorry — I went dyslexic there on my Rick and my Rich… My apologies to both of you and anyone else I confused.

— madmen (brad)

excellent reading as usual CHG. Publish your results already!!!

Hey CHG, how long is this lunch break?!? Are you eating an entire cow?

Please don’t keep us on the edge of our seats…

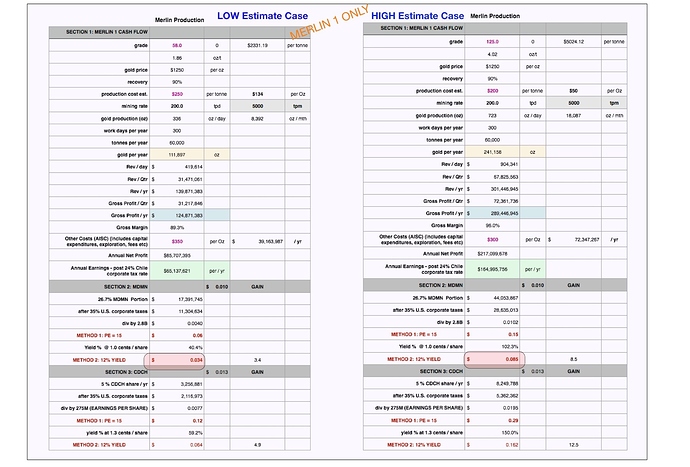

IMPORTANT NOTES:

-

I am not interested in making predictions. This is not a prediction of a SP! Thus the image below presents a wide range of potential outcomes by showing a LOW case and a HIGH case.

-

This is calculated using Auryn’s data given to us not pure conjecture

-

The only three parameters I am changing are shown in purple.

i) I have given justification for the GRADE in the previous posts.

ii) The production cost is per tonne: I have used a range of $200 / t to $250 / t. Typically you see things like Cash Costs of $650 to $750 per Oz. I have provided a “per Oz” translation in the box next to the “per Tonne” box. That number is very low because of the very high grade. Simple math.

In mining costs are mostly associated with moving tonnes of rock and processing tonnes of rock. This represents labor, fuel, equipment rental, etc. The translation to Dollars per Oz is a convenience in order to make it easy to calculate margins: POG (per Oz) - Costs (per Oz).

My value of this number is actually quite high. If you used $200 / tonne for 5 g/t rock you would have a Cash Cost of $1244 / Oz, which would obviously not be commercially viable in today’s world. But since Auryn will be moving low numbers of tonnes, I have chosen to be quite conservative on “per tonne” costs.

iii) “Other costs” are those not typically included in operations such as capital expenses for equipment, exploration expenses, etc. This number is the most variable from company to company. I intend this number to be the difference between what you normally see as “Cash Costs” and “AISC” per Oz. Thus this number is given "per Oz. I think it is very typical and viable in the range of $300 to $350 per Oz. Note this leaves AMC between $39M and $72M in cash before distribution! Plenty.

DISCUSSION:

The results are quite broad. That is intended. It is not a prediction.

What is important is the “cash flow” or “yield” model of valuation as opposed to the “asset value” model of valuation. The “asset value” model is based upon conjecture of “future cash flows” and what someone would pay for that. The “yield model” is based upon what the asset is producing NOW and how much people are willing to pay for that yield.

The most important things to understand:

-

There is tremendous cash flow enabled by the high grades.

-

If all of this were distributed post expense and post taxes as shown, and MDMN distributed it, they would have a yield of between 40% and 102% with todays SP! That’s ridiculous! People will buy for that yield IF YOU CAN CONVINCE INVESTORS IT IS GOING TO CONTINUE FOR A FAIRLY LONG PERIOD. Even if MDMN keeps 25% of it for corporate purposes, the lesson is the same.

-

People will buy the stock for this cash flow esp. if it turns into a dividend. If people buy MDMN, the SP goes up. So how far would they push the price up? Well, Yield (equivalent of “interest rate”) is dividend divided by share price (Div / SP). To get the yield down to say 12% (12% “interest”) the SP would have to go to something between 3.4 cents and 8.5 cents depending on where you are in the LOW to HIGH production estimates. 12% yield is still plenty to induce risk taking.

Alternatively you can see the PE = 15 estimates method.

- 10 cents for MDMN implies AMC is valued at around $1B. That’s a BIG number. But it’s big number primarily when you try and justify it via drilling and increasing the asset value by traditional exploration / report / reserves methods.

It’s not nearly as crazy when you are generating this kind of cash. Your SP / free cash flow numbers are still in the high but reasonable zone. The argument that “no other stock to be found has that kind of valuation on that kind of limited tonnage production” - is not a bad one. But the counter is: no one else is producing that much gold on that limited amount of tonnage.

Now, “mine life” will be important. If you can produce lots of gold, but only for a couple of years, then you will not get people to buy into the yield because of fear of losing their invested capital. People need to be able to get in, collect dividends, get out, without major loss of capital. Auryn will have to demonstrate the longevity of any dividends.

Remember all these numbers are Merlin 1 ONLY. No Fortuna. No Merlin 2, 3 etc. No PN. No LDM. No speculation about being acquired by a major is necessary. And this is only 5000 tpm on Merlin 1 on the first 200m of gold!! It’s very impressive. [I am assuming in the “low case” that you can keep up an average of 58 g/t by starting at the current level and either working up or down. This remains to be proven.]

SUMMARY: my assertion is the grade and depth of the Merlin 1 veins and the same on Fortuna (etc.) will be the most decisive factors for the SP for the next several years. This is guaranteed by: no formal reserves on Merlin / Fortuna, a JV of 7+ years on the PN, the LDM needing so much exploration work. Nevertheless, there should be optimism that good returns are still possible from here, even likely, given the amount of cash that can be generated by such high grades. Once we sweep out the Les mess, this thing is good to go.

Of course there is always risk! I have tried to note some along the way here. Do not mistake this for risk free. Fortunately, none of the above production numbers depend on anyone sitting under the MDMN tent.

I always appreciate you wrapping your head around all things MDMN Mark. Thanks!

In that table, I have assumed Chile taxes AMC and then the U.S. taxes MDMN / CDCH. There’s a lot of money that gets left in the hands of the governments. From conversations in the past, I am assuming that’s what it would look like - it’s not my area of expertise.

That may be enough at some point to try and figure out an alternative different method than just pushing cash across tax boundaries whatever that may be.

Can’t TMP give whoever this guy is a break along with others banned another chance (perhaps Manglson as an exception as long as it’s just a temporary cooling off period thingy). After all, how many chances have we given MDMN to work out for us? Is this site where the Kool-Aid is poured and the other site the other extreme? That, to me, is similar to CNN vs FOX and their coverage of the two POTUS candidates. I want information and news without bias or censorship. To that end, if there’s any chance Les is a poster here…please ban him.

It’s all talk at this point. When MDMN or CDCH announce their first cash dividend date, then it will move. Until then, not so much.

Even if Auryn puts out great production news, I think it will be tough to get people to buy into the stinky-Pete that is MDMN in order to get to AMC, unless they know that cash is on the way. Even then the past will hold it back to some degree.

This is another reason I tend to think that if the results are as good as the early indications, if the market holds up for gold stocks, Masglas will eventually go public with the ADL/AMC as their prime asset and MDMN and CDCH will get sucked into that process and we will get stock in the new entity, trading on U.S. exchanges, in replacement of MDMN and CDCH. And that will be the end of the MDMN story - queue the book and movie rights claimants (Les from jail? ![]()

Then everyone will be able to cash out as they like. If AMC is generating such returns, it will do fine in an IPO. A JV with a major on the PN would be a great IPO supporting story as well.

If we get a market decline before any IPO they just keep digging up gold and selling it until there is a recovery.