“Fortuna” in this case is a completely different claim area in a different part of Chile from the more familiar Fortuna/Lampa mine area located on the Alto.

Thanks Mike

Hi Mike,

Nice find to put it mildly! I sense a lot of corroborating evidence confirming how confident management is with the grades found at the Merlin 1 Vein. Recall that the smartest of the smartest guys, when it comes to knowledge of the value of the assets especially at the Caren Mine/Merlin 1 Vein were buying Medinah shares out of the open market at huge multiples of today’s share price. Up until about a week ago it was at 100-times the share price of Medinah. What was going on at the time? The buzz at that time was learning that the trenching program at the Merlin 1 Vein revealed a WEIGHTED AVERAGE of 26.9 gpt gold derived from 200 SEPARATE SAMPLES. Clearly the top border of that sheet of plywood called the Merlin 1 Vein was loaded with gold RIGHT AT SURFACE.

If you make a discovery like that, what’s the first thing you’re going to do? You’re going to tie down the mining concessions downhill from that area in the watershed that drains this area. Remember we’re dealing with 100 million year old Cretaceous Age rock in an area subject to erosion. A once conical stratabound volcano is now featuring a plateau. The high-grade gold that was contained in the “outcrops” on the top of that mountain is now in those placer claims that AMNP tied down. This is another “hint” that management is very impressed with the Caren Mine and its Merlin 1 Vein. A lot of the trenching results I’ve studied over the years featured 1 or 2 gpt gold.

What’s the second thing you’d do if you were super-impressed with the Merlin 1 Vein results and you’ve already tied down the placer claims within its watershed? You’d go across that watershed area (which is north of the ADL) and start QUIETLY tying down concessions in the upslope of the adjacent mountain. Maurizio already did this a couple of years when he bought the Empress Caballo deposit at the Colliguay properties immediately north of the ADL. Remember those 6 north to south oriented regions of Chile that feature “belts” of similar deposit types. Maurizio has been QUIETLY tying down all of the Cretaceous Age porphyry, epithermal, Lacustrine stratabound copper deposits and now apparently IOCG prospects. Since AMNP decided to be compliant with the informational disclosures of the OTCMarketPlace it had to reveal what Maurizio has been up to. He used his MASGLAS entity to do the originally tying down of concessions and now he’s placing various assets into his AMNP, Medinah and AUMC entities.

He already told us that he wanted to become a mid-tier gold producer (300,000 ounces per year minimum) on his way to becoming a mining major. We might expect further rounds of consolidation due to economies of scale. Rick Rule is constantly harping about the need to consolidate in order to minimize the S,G and A expenses on a per asset basis. A mining firm can manage 20 properties just as easily as 10 properties and save a bunch of money on an “SGA per asset” basis. It looks like Medinah owns about 11.65 million shares of AMNP. I assume (no promises) that those shares might be distributed to Medinah shareholders in a pro rata basis. The rough math would be that each Medinah share would earn .0041 shares of AMNP but this is only a guess. This would give AMNP perhaps another 3,000 (a guess) or so shareholders on their rolls which might carry some strategic importance.

Somewhere in this puzzle I sense the presence of Dick Sillitoe making certain recommendations. Hochschild already told us that they were following the attack plan on the ADL developed by Sillitoe. He hardly needs another feather in his hat with many, many dozens of huge discoveries credited to him, if anybody could help build a new major mining firm it would be him.

If you go to this link:

look at Fig. 6.5 showing the famous cu-mo porphyry belt in Chile. See #9 labeled “Colliguay”. Tiger Woods could hit a drive and a 5-iron from the ADL plateau to the Colliguay deposit. It would fly over AMNP’s placer claims. Will the Pegaso Nero cu-mo porphyry become deposit #10?

Now scroll down to Fig. 6-10. These are the volcanic hosted stratabound Cu deposits in Northern (and Central) Chile. This is the deposit type at the LDM. I refer to it as a “Lacustrine sediment hosted stratabound copper deposits” because I like to type. You could call it “manto” deposits but where’s the fun in that? The ADL is at about 33.5 degrees S. Latitude. Deposit #17 is the El Salado deposit just to our north. Deposit #18 is the Lo Aguirre deposit IMMEDIATELY to our south. Will the LDM become deposit 17-B?

Once again, in Chile when going from west to east there are 6 different N to S oriented regions containing well-defined “belts” of very similar deposit types. The ADL is in the westernmost 100-million year old Early Cretaceous region. Within it are 3 well-defined Early Cretaceous “belts” of very similar deposits. They are the Early Cretaceous Copper Porphyry Belt, the Early Cretaceous Stratabound Copper Belt and the Early Cretaceous Epithermal Vein Belt. All you need to do is look to the north and south of the ADL to get a pretty good idea of what any deposit type on your property is going to look like. You can learn from your neighbors about what to do or not do in developing your deposit type. It’s the same rock formations that underly all of these deposits i.e. the Veta Negra, the Lo Prado, etc.

All of these deposits formed the same way because of how “subduction” works. The Nazca Oceanic Plate underlying the Pacific Ocean near Chile while moving eastward slid under (“subducted” under) the western migrating South American Plate. The Nazca plate dove down deep into the earth’s crust where it is very hot. The crust melted and formed magma which parked in gigantic magma chambers in a molten and gaseous state. Periodically these magma chambers would belch up ultra-hot metal bearing hydrothermal fluids and gases. Because of their buoyancy, these migrated upwards to surface through the various cracks and fissures in the host rock. When they made it to surface, they formed N to S oriented lines of stratovolcanoes. Since the earth’s surface is not flat but curved, they refer to these as “volcanic arcs”. A variety of mineral deposit “types” are found in these volcanoes. The ADL Mining District is a bit odd in that it hosts a variety of these deposit types all in one area.

Throughout over 100 million years, this “subduction” process going on underneath Chile had 6 different timeframes when it was very active. This set up those 6 different N to S oriented arcs of stratovolcanoes each specifically featuring various types of mineral deposits.

Mike, thanks for the great find in regards to AMNP. A lot of puzzle pieces got assimilated because of your efforts.

Allow me to offer an non-BB “this might be the last piece of the puzzle for the next 30 bagger” scenario. It’s very possible if not probable that the company is doing some house keeping so that the shell may be used in a reverse merger for a completely unrelated company. Happens every day with companies like AMNP where the value of the shell exceeds the value of the underlying assets.

Today’s 200% move brought the stock back to where it was trading a couple months ago. One thing I can say with a high degree of confidence: watch the price action and volume in AUMC as a barometer of things to come. The “smart” money will start accumulating AUMC well before MDMN or AMNP. The fact that only 5% of AUMC is freely trading has no relevancy to insiders willingness or ability to issue promotional PRs and this is where the money will rush to if/when something is on the horizon.

Doesn’t really make sense. If they thought of it as a shell, why bother to put new properties in it such as what was received from Masglas? (i.e. keep them in Masglas or otherwise stop paying the taxes on them.)

I think it more likely that they are preparing for some type of JV/financing for one or more of the properties from a public company or perhaps selling the placer properties to AUMC to consolidate all the claims at the Alto. (Okay that is stretching it…as Masglas could have given the properties to AUMC directly and not bother with AMNP.)

The timing of it and the couple of recent statements from Medinah management suggesting that we are simply waiting on something to happen prior to moving forward hints at a connection of some sort especially since all the players involved are the same among the 4 companies.

Fair point but it also doesn’t make sense for AMNP to waste the time and money to get current on their filing given their size and the value of their assets. I’d add that they added those assets all the way back in 2017. Things can change over a 3 year period. Many times the companies will get current to increase the value of a “clean shell.” This company has always been a mystery to me. It used to serve as one of Les’ “slot machines” but clearly that is no longer the case. Time will tell.

From AMNP’s Ohio attorney

In its Annual Report year ended July 31, 2019, the Company indicates that it is not a “shell company” as it has been pursuing an identified business plan; maintains assets valued at $5,305,138.00; and operating expenses of $12,162.00. Though the Company has never generated revenue, it has maintained mineral property assets and has always been pursuing an identified business plan with a management team in place; therefore, I conclude that it is not currently and was never formerly a “shell company” as defined in Rules 405 of the Securities Act of 1933 and 12b-2 of the Exchange Act of 1934.

I have no idea how the extra posts happened and the “cancel” button doesn’t seem to work.

Sorry about that.

Recently we learned that 4 of Masglas’s approximately 23 groups of mining concessions/”prospects” (the Poseidon, Mali, Fortuna and Llano concession groups) were placed into American Sierra or “AMNP”. The total hectarage of the 4 groups is about 11,500 ha. AMNP already owned the Caren and Pangue placer property claims of unknown hectarage. We also learned that “AMNP” got caught up on their filing requirements in order to become “current” with the informational disclosure standards of the OTCMarketPlace.

AMNP now owns properties in the Copiapo region of Chile surrounding the recent Antalida discovery and the Inca de Oro deposits, as well as near Vallenar, Chile in proximity to the recent Dominga discovery.

When it comes to Medinah/AUMC, it might be helpful to figure out how Maurizio appears to develop mining properties. Developing a mining property often starts with the actions of a “prospect developer” or a PD. A PD will typically have expertise in acquiring mining concessions within one or more mining jurisdictions. “Masglas” appears to be acting in the capacity of a PD. These people will keep a close eye on the local “mining gazette” that details mining concessions and which properties may have become available perhaps due to a different miner intentionally or unintentionally not paying the necessary annual taxes or “patentes”.

Other times the PD will study new discoveries in an area and try to opportunistically stake any concessions that might have their value augmented due to the discovery and their proximity to the discovery. The party making the discovery, especially if operating as a private corporation, will often have a leg up on any opportunistic PDs because they will typically not release any news about the discovery until AFTER they have tied down any surrounding properties of potential value. This is why this industry is so secrecy-obsessed. Often a PD will function as a PRIVATE corporation (like Masglas) so that they don’t have material public information disclosure requirements. These acquisitions were made 3 years ago. The question becomes, what (if anything) has transpired on these properties over the last 3 years.

The geological work done by a PD will often be relatively inexpensive and broad scale in its extent. One of the keys for a PD is to recognize when it’s time to cut your losses and stop putting money into a project via exploration or the payment of property taxes. If the initial results are promising and its time for some big checks to be written for exploration/development (perhaps drilling which is expensive), then the operators of the PD may “vend in” the property to a publicly traded corporation capable of accessing the markets for raising funds. The PD will typically be paid in shares of the publicly traded firm to compensate it for the expenditures it has made as well as the risks it has taken. This often leads to the PD acquiring a controlling stake in the publicly traded firm. In order to minimize dilution, prior to the raising of any funds, it would be helpful to have promising news to release. We do not know if this is the case here.

In the case of AMNP, somewhere along the line, it appears that Masglas got a heads-up as to the Antalida discovery of Minera Inmet near Copiapo, Chile. They were able to “box in” this discovery by acquiring the Poseidon, Mali and Platon groups of mining concessions surrounding the discovery as well as being in proximity to the Inca de Oro Mine. The Poseidon and Mali concession groups were vended in to AMNP as were the Fortuna and Llano concession groups located near Vallenar, Chile near a different discovery referred to as the Dominga discovery. It is not immediately clear why Masglas’s Platon concession group did not accompany its Poseidon and Mali neighbors during the vend-in. Acquisitions made near recent discoveries are said to have “strategic” value whether or not the PD makes significant exploratory expenditures or not.

Because of the “subduction” process in Chile and the existence of 6 regions where known “belts” of various deposit types exist in north to south alignments, it is prudent to acquire concession groups to the north and south of any recent discovery. The Poseidon is due south of the Antalida discovery and the Mali is due east. Masglas’s Platon property is due north. (Note that Maurizio made a similar move when he acquired the Empressa Caballo group of concessions at Colliguay due north of the ADL discovery and AMNP’s Caren and Puange placer claims. I would suspect that the simple knowledge that in Chile these deposits line up in a very tight north to south fashion has made a lot of people a lot of money. The faults that host many deposits, like the Atacama and Domeyko faults, also occur in similar north to south alignments.)

It is not clear if Maurizio/AMNP intend to “sit on” these two concession groups and watch the Antalida discovery play out or to aggressively develop them. Medinah owns approximately 11.65 million shares of AMNP in addition to its 24% stake in the ADL Mining District. The fact that management of AMNP went to the time and expense of bringing all of the financials up to speed suggests that AMNP may be going “into play” but there can be no guarantee of that. The Masglas website has stated and continues to state that at the Mali and Poseidon concession groups “Masglas exploration works are underway”.

AUMC management has recently informed us that they now have permission to release the AUMC shares sitting in Medinah’s coffers. They have stated that they will do this “at the appropriate time” when certain “work” has been completed. For me, the question arises as to whether or not this “work” needing completion has something to do with the recent AMNP financial disclosures. Was the work of an accounting nature?

The other question that arises is now that Medinah might appear (no promises) to have a second viable asset, if Medinah is wound down how will these AMNP shares be dealt with. A lingering question I’ve had for a long time is what is to become of the $40 million to $50 million tax loss carry forward that Medinah has on its books according to its previous accountant? If the AMNP assets have the ability to produce profits, might it be wise to keep Medinah around until those tax loss carryforwards are utilized?

Sounds like a plausible thing to wonder. Too bad we cannot see all there is to see no matter how hard you look. Take the Hermann-Hering illusion as a visual example. Try counting all the black dots.

That’s why corporations hire attorneys and CPAs. I have no background on this matter, but if there was a way for AUMC to use this provision to advantage, perhaps a circuitous way was figured out in advance. There would have to be profits anticipated for a tax allocation agreement to have been drawn up in advance. The terms of the agreement would determine and specify it’s use. I would think that prior to the corporate consolidation by allocation of MDMN’s assets and liabilities into AUMC (AUMC shares will be allocated to MDMN shareholders), such an agreement would have been drawn up by the corporation’s attorney’s and CPAs. This may be the main reason for allocating AUMC shares to MDMN’s shareholders instead of merely receiving AUMC shares as a dividend.The following reference seems to indicate that use of MDMN’s tax losses may actually be allowable as a loss carryforward, or not. Let the CPAs figure it out.

Consolidated Group Tax Allocation Agreements

How to Handle Tax Attribute Carryovers

By Michele Frank, PhD and Charles A. Lenns, JD, CPA

In Brief

When several corporations are consolidated into one large group, the parent company deals directly with the IRS, paying the tax liabilities for the group and receiving any refunds. Tax allocation agreements are often used by the members of a consolidated group in order to determine how to allocate and distribute such funds.

… To ensure that members receive adequate compensation for the group’s use of their tax attributes, and that their assets are not depleted by excessive tax payments to the parent, many tax advisors recommend that groups enter into legally binding tax allocation agreements that specify how cash tax payments and refunds will be settled among members. Having a written tax allocation agreement in place is particularly important when a group includes members that are regulated entities, have minority shareholders, or have external debt with separate company financial covenants.

Provisions Related to Loss and Credit Carryforwards

A consolidated net operating loss (CNOL) is created whenever consolidated group members’ losses exceed profitable group members’ taxable income. Under the TCJA, corporate NOLs that are generated in tax years ending after December 31, 2017, cannot be carried back, but instead can be carried forward indefinitely.

Compensating Members for Use of Tax Attributes

… One advantage of filing a consolidated tax return is that members’ losses can be used to shelter other members’ income; if a member’s loss is absorbed by the consolidated group, however, the member will be unable to use that loss to shelter income that it generates in the future.

Consolidated Group Tax Allocation Agreements - The CPA Journal

Hoping “at the appropriate time” arrives sooner than later. We all would like to see some profits here!

The appropriate time will be revealed at the appropriate time.

Vark

yeah, NEXT WEEK!

Lately, I’ve been playing with the concept that in order to help us figure out Medinah’s future perhaps we should be looking over the overall game plan of Maurizio, Masglas, Auryn Holding Corp. (the financiers), Auryn, Medinah, AMNP, etc.

Usually well thought out and in-depth game plans like this are carried out in phases. When you look at Masglas, they’ve tied down about 23 large groups of mining concessions within Chile and Peru. They are very well diversified in terms of deposit types. They’ve bought a huge chunk of Medinah shares both from Quijano and out of the open market. They’ve spent untold amounts of time and money buying properties, exploring them and paying the annual property taxes on them. However, I can’t see where they’ve ever “rung the register” and got paid.

Most mining groups buy assets and increase the “value” of those assets by hopefully successful exploration and development processes. The annual property taxes are a way for a country like Chile to make sure that mining entrepreneurs don’t tie down and then “sit on” concessions. The host country would like the mining concessions to represent employment opportunities and some revenue flow from earnings back to the government. This creates a sense of urgency for mining entrepreneurs.

The consolidation of individual disparate mining concessions into a contiguous group of mining concessions necessitates the expenditure of a lot of time and money based on an overall strategic plan. This process creates “value” especially in the eyes of any major miner needing to replace the ounces it mines annually. From an accounting point of view, the value carried on the books is often tied to historical expenditures. In the case of the 4 groups of mining concessions purchased by AMNP the figure was a little over $5 million. In Medinah’s case, I believe the figure is somewhere around $50 million.

The “value” of the ADL Mining District might also be estimated via a “replacement cost” methodology with a big asterisk appended to it. If a different group of mining entrepreneurs were to start tomorrow morning, what might it cost them in terms of time and money to consolidate 10,500 hectares of mining concessions that close to Santiago with the same results in exploration and development and the same proximity timewise of going into production. The asterisk would denote “if it could even be done” which of course it couldn’t. Masglas has already tied down most of the remaining promising prospects in the Chilean Coastal Cordillera where the POWER and WATER issues are so much more favorable than those in the Atacama Desert or High Andes.

We don’t know with a great deal of certainty who is behind “Masglas”. We do know that Maurizio plays a key role. Acting as a private corporation affords a great deal of anonymity. We don’t know any details about any contractual relationships that may exist between Maurizio and other mining groups. Might Maurizio be at least partially acting as an “agent” on behalf of others. What we do know is that somebody, whether they be behind the scenes or out front, is writing some very large checks for the purchase of mining concessions, exploration and development programs as well as share purchases ostensibly with the purpose of gaining “control”.

Unless the people behind the scenes are ultra, ultra-wealthy, at some point in time, somebody is going to want to “ring the register”. This might be through the sale of assets to others, through cash dividend flow, through royalty agreements, etc. When I saw the news about AMNP buying 4 of Masglas’s assets I immediately wondered if this might be the first phase of somebody wanting to “ring the register”.

By way of fate, the Medinah shareholders have become part of this overall plan. In studying the various Masglas assets, it appears to me that putting Medinah/Auryn’s Caren Mine into production might represent a way for many to “ring the register”. Maurizio has already publicly commented that Auryn will evaluate the appropriateness of cash dividends AFTER the first full quarter of production at the Caren Mine. I can imagine that the people behind the scenes at Masglas, Auryn, etc. wouldn’t mind “ringing the register” for the first time during this overall campaign.

For mining entrepreneurs executing on an overall mining plan, “ringing the register” often involves selling some of the properties that it has been nurturing for many years during the value enhancement years, to a publicly-traded company in exchange for “control” of that company. In studying the various Masglas properties, I’ve noticed that the 4 properties vended-in to AMNP all surround recent discoveries. These are the Antalida and Dominga discoveries. The Antalida discovery is also in close proximity to the Inca de Oro discoveries.

Within the mining industry, one of the quickest ways to gain “value” is to either own or tie down a property near a mining discovery. This is sometimes referred to as an “area play”. The rationale is that if the discovery goes into production it might want to build its own mill facility to process the ore. A substantial amount of CAPEX might be deployed during this process. Any discovery will have a finite mine life and usefulness for the mill. A property near a discovery gains “value” because it might represent an extension of that finite mine life and usefulness of that mill facility. This helps justify the CAPEX put into the mill.

When it’s time to “ring the register” for those around Masglas, I’m going to assume that they might want to vend-in to an entity like AMNP properties that have a large amount of “value” enhancement over the years and behind the scenes. Value enhancement can easily accrue QUIETLY when a property is held by a private or nonreporting company. I’m only guessing that these 4 properties were chosen to be involved in the first phase of “ringing the register” because of their proximity to recent discoveries. Recall that “discoveries” in the mining sector are at a 32-year low and major miners are craving new discoveries in order to augment the dwindling amount of Mineral Reserves/Mineral Resources (MR/MR) on their books. Gold containing discoveries are especially in demand.

In a recent press release I reviewed on this forum, Maurizio commented that he wanted the Medinah shareholders, of which he is the largest, to become DIRECT owners of the ADL and he wanted to provide them with LIQUIDITY. In studying the overall Masglas scenario and the stages of development of its various properties, Medinah and to a lesser extent AMNP, appear to be the quickest route for all concerned to “ring the register” especially with the proximity of Medinah going into production. IN THE MINING INDUSTRY, THERE IS NO DEVELOPMENTAL STEP THAT CAN RIVAL GOING INTO PRODUCTION AS A MEANS TO ENHANCE VALUE. As far as monetizing the various other Masglas assets, I’m going to assume that they are destined to be vended into some type of public vehicle in order to maximize the rewards for those behind Masglas.

Exactly where are the placer claims located on the map? I was unsuccessful in locating these claims some years ago. Has any work progressed there over years to define value beyond speculation? Does anyone on the forum have a clue? Your suggestion that AMNP may be going “into play” with the addition of the the Poseidon, Mali, Fortuna and Llano concession groups is well reasoned. The question that comes to mind, now that AMNP is caught up in filings; "Will AMNP be up for sale to have seed money to begin production at the Caren Mine (adits #1, #2 & #3)? Shareholders would like to see the possible production from the Lampa / Lo Amarillo and Larissa / Merlin targets progress and come to fruition.

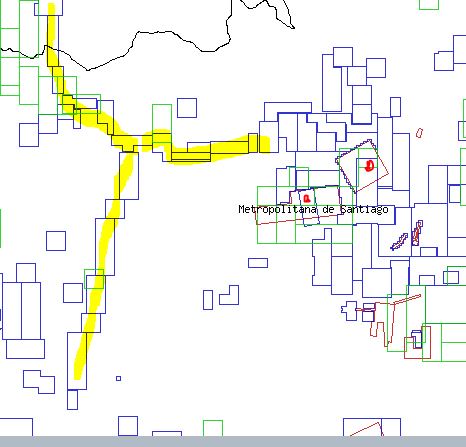

See attached. I’ve marked the Caren/Pangue placers in gold. I marked the LDM & Lampa mine area as red dots. Hope that helps.

RECENT EVIDENCE MDMN ISN’T GOING BELLY UP:

(1) Raul said they’re waiting for the right time (my opinion - if things weren’t looking good, I think Raul would have opted to say NOTHING).

(2) Buying up placer claims surrounding our properties.

BETTER EVIDENCE THAT I AM A PATIENT MAN:

(1) Own shares of stock in MDMN.

SOME EVIDENCE I COULD BE A CANDIDATE FOR INTERVENTION:

(1) Been averaging down on MDMN.

Hi EZ,

Like Mike’s map suggests, those AMNP placer properties are at the base of the northwest and western downslopes off of the ADL plateau. It represents a significant portion of the watershed from the ADL plateau. Many of the various deposit types present at the ADL “outcropped” at surface over the last 100 million years and the erosion process brought the gold contained in those outcrops down the downslopes and into the rivers that seasonally formed in the watershed.

Due to its high density (19.3 g/cc or almost twice that of lead), the gold sinks to the ancient or current river bottom and tends to accumulate at bends in the river where the water flow slows down. Many placer deposits are found in “paleochannels” from ancient rivers that no longer flow. In one isolated spot of these concessions, Medinah’s geologist Paul Jones found some nice grades but he encountered some issues with boulders. He was operating on a shoestring budget and so this project got shelfed but it was apparently considered worthy of keeping up on the annual tax payments/”patentes”.

I shared a cab ride with Paul Jones many years ago after a mining meeting. He told me about doing work on those placers and looking up towards the ADL plateau realizing that there were some very rich outcrops historically that got eroded and the contents now sit on the bottom of old river beds as a placer deposit. This is 100 million-year old rock so there was plenty of time for the erosion process to feed those river beds. It’s hard to say how much work was done recently, if any, because AMNP was not filing quarterlies and Masglas (a private corporation) didn’t have to disclose much of anything at all. As Mike’s maps show the hectarage is significant. I don’t know this to be a fact but it appears that somebody at AMNP or Auryn has added to the number of concessions. I don’t remember the hectarage being that large in previous maps.

We do know that these placer properties have strategic value in that they connect the ADL to Masglas’s Empressa Caballo property at Colliguay to the north. Common sense would suggest that there must have been a reason to pay the annual “patentes” (property taxes) for all of these years. In a secrecy-obsessed industry like this, keeping up with the tax payments gives us a little glimpse of potential value at least to the payers of the taxes. These taxes increase as the development stage of the concession moves from the pedimento/manifestacion stages to the mensura stage wherein exploitation is allowed. The hectarage of these claims looks significant.

We have to keep in mind that at the ADL, a once conical stratovolcano now features a plateau. The gold contained in the missing top of that mountain now resides in the bottom of the rivers that form the watershed of the mountain. Because of gold’s density, it doesn’t move too far from its source. Management wanting contiguity between the ADL and Colliguay to its immediate north makes sense otherwise some opportunist could tie down the intervening land and hold it for ransom.

Maurizio’s Colliguay property features gold/silver high sulfidation epithermal veins that, if economic, could conceivably share a common processing facility with the ADL. The southerly drainage off of the mountain at Colliguay appears to tie-in with this river system and these placer prospects. It would be interesting to find out exactly WHEN these various placer prospects were tied down and just how much work (hopefully resulting in value enhancement) may have been done QUIETLY over time (if any).

We might as well get used to the fact that Maurizio is thinking many steps ahead of us in this chess game but the actions of management that we can follow are worth studying. This might include tying down more concessions even though they add to the annual tax expense. For example, if management is busy tying down new concessions to the west, then there is probably a good reason for it that we wouldn’t necessarily know about. Open market purchases of Medinah stock by management at 50 to 100 times the current price is also interesting.

The best indicator of what might be contained in those placers is probably best estimated by studying the gold grades found at the Merlin 1 Vein AT SURFACE in the bedrock trenching samples where erosion takes place. That was 26.9 gpt gold along a 1.6 Km north to south stretch. THIS IS A “WEIGHTED AVERAGE” INVOLVING 200 SAMPLES AND 25 SEPARATE TRENCHES. That is some serious gold especially if the recovery is over 90% from using a simple gravimetric system involving what amounts to be a centrifuge. It is the overall ECONOMICS that need to be concentrated on. The key ingredients would be the price of an ounce of gold and the all-in sustaining cost to mine and process an ounce of gold. It is the low grade oxide ores that need to be heap leached with a nasty cyanide solution that the environmentalists and the Chilean permitting authorities don’t like.

In retrospect, I think a lot of us, INCLUDING ME, pretty much slept through the 9/17/15 press release that revealed the insane results of that particular trenching program at the Merlin 1 Vein/Caren Mine. Over the years, I got so used to reading impressive trenching results that they went in one ear and out the other. The problem was that many mining firms report the “HIGHLIGHTS” of their trenching program. That’s not what an investor wants to know. An investor wants to know the “WEIGHTED AVERAGE” of the trenching results wherein, in this case, each of the 200 samples and each of the 25 trenches is referenced. “HIGHLIGHTED” trench sample results are misleading artifacts. They have nothing to do with ECONOMICS. An “AVERAGE” grade refers to the arithmetic mean of ALL of the samples. The WEIGHTED aspect refers to an intersection of “X” width counting twice as much as an intersection of “.5X” width.

The one fact in the history of Medinah/AUMC that I always had trouble reconciling was the fact that management bought a very large number of Medinah shares out of the open market in the 5- to 10-cent range. They warned us of their intent to make open market purchases and after the fact they reported their purchases in a very professional manner. This is back when the Caren Mine and Merlin 1 Vein were starting to take center stage. Shortly thereafter they started buying every concession group in sight in the ADL area. Then shortly after that, they announced stellar grades in the various Caren Mine adits including “bonanza” type grades at Adit 2A.

In my opinion, the Caren grades attained by both trenching and the channel sampling of the adits, are critical because we already knew that there were 5 main vein systems on the ADL plateau mostly striking from north to south. The Fortuna Centro Vein has very high- grade gold and represents the easternmost of the 5. The Fortuna Mine featured 7 different levels. Now we know that the Merlin 1 Vein (Caren Mine) has extremely high-grade gold. It is the westernmost of the 5 vein systems. We know that the trenching program identified over 5,000 meters of epithermal veins having made it all of the way to surface. We can see plenty of “blind” veins under the surface from the IP/IR studies. We know that these vein systems are remarkably intact (not eroded) because all 4 of the various depth levels of vein systems is still in place. We know that these 5 vein systems are “related” and that they probably share a common progenitor magma chamber.

QUESTION FOR BRECCIABOY: Not intending to meddle in your personal business, but I sure would like to know exactly how and when you happened to find out about MDMN and the ADL. As you know, I do appreciate your perspective, which I find valuable.

Hi mrb,

I had a patient that was a broker that just did mining deals. I’m not sure how he got started into Medinah. He took me under his wing and taught me a bunch. Your timing in asking this is interesting. It’s about 8:30 AM my time right now and in about 10 seconds another geo-mentor of mine is about to walk through the clinic door and yell out, “hay doc how’s the porphyry doing”. He’s been the head of a local university’s Geology Department for a gazillion years and teaches internationally representing Stanford University, his alma mater.

Over the last 40 years I’ve found the mining community to be very supportive of a nerd like me that does nothing but ask too many questions. Many moons ago, I came upon an article talking about a new software that identified areas within regional mining districts that were ripe for a new discovery. In Chile, the hot spot was near the 33.5-degree South Latitude area which is where the ADL is. I have no clue how the software creates a list of these “likely” spots for new discoveries.

If you go to the authorities in this sector which are Dr. Theresa Moreno and Dr. Victor Maksaev, you’ll learn that everybody and their brother figured that the Early Cretaceous Copper Porphyry Belt ended well to the north of us at Llahuin. The big star of this belt was the Andacollo Mine with its 91-million-year-old rock. Auryn’s Dr. Ray Jannas (a Harvard grad smartie pants that ran Goldcorp’s South American operations) took a sample from the ADL ore and had it dated via a Re/Os test. Lo and behold it came in at 91 million years of age. The evidence for a Cu-Mo porphyry at the Pegaso Nero is beyond compelling.

For me, the dating of the rock is critical because the Andacollo Mine is a true “hybrid deposit”. You’ve got the porphyry there, in this case a Cu-Au porphyry, but then you have very high-grade gold surrounding it occupying a 5 Km radius. The similarity to how the Caren and Fortuna Mines surrounding the Pegaso Nero Cu-Mo porphyry is very interesting. Back in its day, in Chile there were 3 main deposits. You had the Chuquicamata, the Collahuasi and the Andacollo. Within any of those 6 north to south oriented mining regions of Chile, Mother Nature just has a tendency to repeat itself with certain deposit types.

Yes, the “dating of the rock” - you’ve mentioned that many times. I guess a layman like me doesn’t quite grasp the profundity. So, in “regular”, non-mineral-bearing rock it would have been formed in an earlier or later time period? Does the rock change immediately from one type to the next? Or, is it more of a gradual change?

Now that I’m in, the major thing that KEEPS me in is the fact that Mr. Mauricio bought in (for a LOT more than me) at prices between 5 and 10 cents. If he bought in at 5 cents and he has about 200 million shares (I don’t know exactly how many shares he has), then he spent $10 Million of his own money. I’m thinking he will figure out a way to make this profitable for him. It may not be tomorrow, but he will at least make a go of it.