JCN,

You might take notice of the 5 figures EZ recently posted. Here is a copy of a note that I haven’t posted yet that might help out your due dili.

Hi EZ,

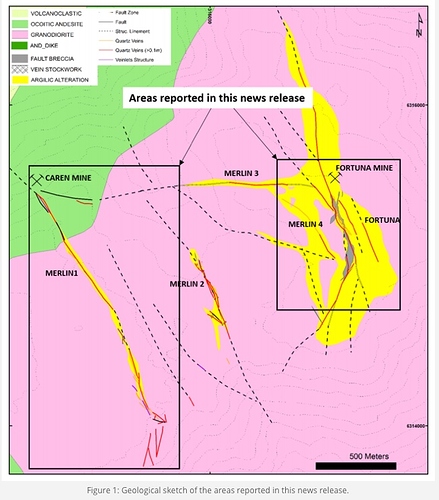

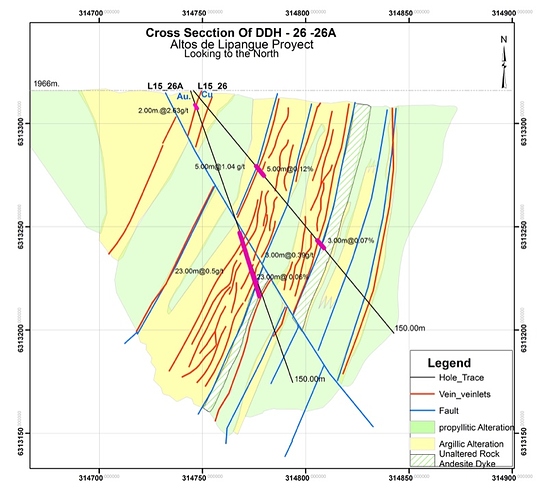

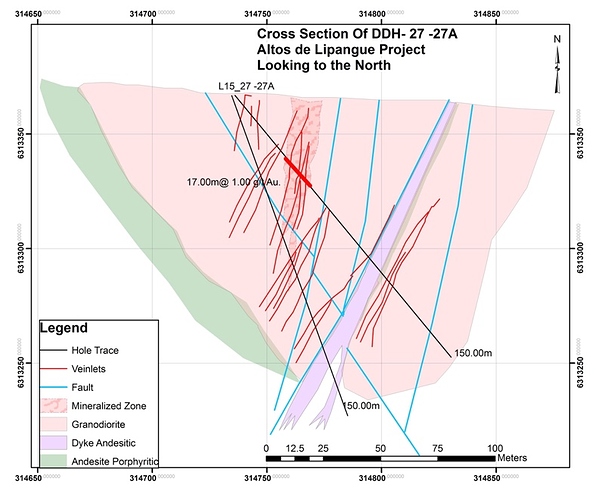

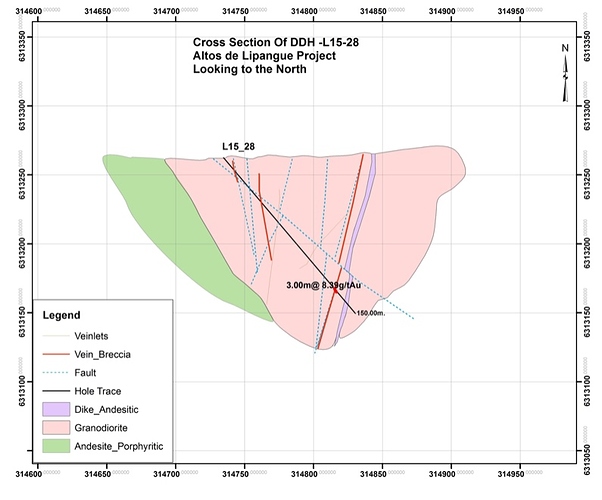

Thanks for the 5 figures reviewing prior work done at the ADL. I think figures 1 and 5 are the key ones to focus in on. Figures 2, 3 and 4 review some of

the holes drilled by Auryn back when they were holding an option on the ADL. Those 3 figures basically show the successful extension of the gold zone

associated with the “Gordon breccia” which Medinah discovered and defined back around the year 2000 by drilling 18 holes. The earlier work done at the

Gordon breccia located in the center of the ADL informed us that something interesting had gone on there in regards to gold bearing hydrothermal fluids

migrating upwards from underlying magma chambers. The explosivity involved converted once solid rock into gravel which created spaces allowing these fluids

to percolate upwards, cool and then solidify the gravel into a “breccia”. A “breccia” is basically angular rock glued together by a much finer grained matrix

of cooled and solidified hydrothermal fluids.

The artisanal miners over the centuries that were exploiting the extremely high grade gold veins at the ADL did a lot of the heavy lifting from an

information providing point of view that today’s geoscientists took advantage of. The artisanal miners didn’t have the technical capabilities to put

together the entire ADL picture from a geologic point of view. They merely saw mineralized outcrops and chased them down. Although more drilling will

definitely be need to further define the assets, channel sampling of the adits drifted by the artisanal miners as well as those by Medinah, Nuoco and Auryn

provided a tremendous amount of information as to how to make a buck in exploiting these assets. The grades found in the epithermal/mesothermal(?) veins are

so high that it appears that management is turning full circle and taking over where the early miners left off at the Fortuna and Caren Mines and extending

their exploitation efforts.

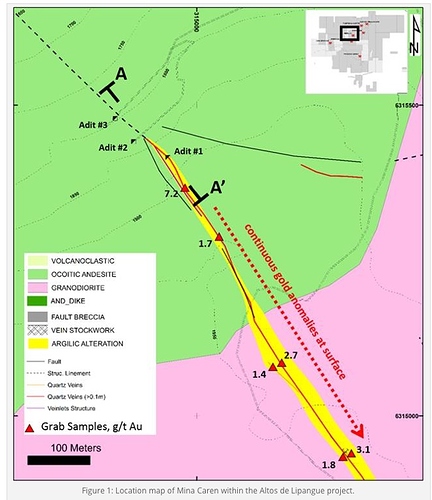

EZ, in regards to your first figure: First of all, the pertinent information enclosed in simple geologic maps is huge but you need a little bit of

background knowledge of geology in order to access some of that information. For example, the “ocoitic andesite” colored green is an example of an "igneous

extrusive" rock type. “Igneous” means it was formed from the cooling of liquid magma. “Extrusive” refers to the fact that it was “extruded” onto the

surface through a volcanic vent. Most of us know this as “lava”. The granodiorite rock colored pink is an “igneous intrusive” type of rock. It was derived

from liquid magma but it only “intruded” upon the overlying rock and never made it to surface. The reason it is located at today’s surface is because of

“erosion”. Keep in mind that these “stratovolcanos” were once conical in shape. The erosion process took off the top of this particular mountain and left a

flat plateau which thankfully is a lot easier to work on than a steep downslope.

On the left side of the figure you can see how the “Merlin 1” vein crosses from the pink granodiorite into the green andesite. This means that the crack or

“fault” in the rock that got filled up with gold bearing hydrothermal fluids that later cooled and became a “vein” came AFTER the andesite and granodiorite

were laid down. The green andesitic rock was laid down in the “Lower Cretaceous” time period. The pink granodioritic rock is of an “upper cretaceous” age.

This means that the green andesitic rock is older and that it was “extruded” onto the surface BEFORE the pink granodioricic rock “intruded” into the rock

overlying the magma chamber it was derived from.

All of those dotted lines are what are referred to as “structural lineaments”. These are continuations of the faults which you can see from an aerial view.

No trenching or prior adit drifting has been done here so you can’t with 100% certainty say that the vein continues on within these “lineaments” but the

supposition is still there.

What’s striking about this figure is how much wider the yellow “argillic alteration” (made up of clays) is in the Fortuna Vein system than in the Merlin 1

Vein area. Since it is the extremely hot hydrothermal fluids that both carry the gold upwards towards surface and do the “altering” of the granodiorite rock

into clay this much alteration necessitated a well-functioning “plumbing system” to act as a conduit for this upwards fluid flow. This is a very good

thing. To a prospector, massive amounts of argillic alteration at surface functions as an “X marks the spot” type of indicator where to concentrate your

exploration efforts. From a geological point of view, this figure suggests that this eastern plateau region was very, very “busy” from a hydrothermal fluid

flow point of view. The grades found at both the Caren/Merlin area as well as at the Fortuna Mine area were pretty much off the charts. The density of the

vein pattern and the lineaments in the right hand side rectangle suggest that a low cost open pit approach might be possible but by no means a certainty.

These veins are extremely high grade but narrow, often measuring in between .5 and 1 meter in width. The Fortuna Mine was successfully exploited in between

1940 and 1970 when the POG was $35 per ounce but the cost of mining has gone up a lot since then. In Chile, the key to mining success is currently access to

WATER and POWER. The ADL is in very good shape in both regards. The proximity to Santiago and the relatively low elevation are also positives. Most of the

mining in Chile is being done at very high elevations in the Andes or in the Atacama Desert where water is scarce. In the high Andes, the indigenous people

have been competing with the miners for access to the water from seasonally melting glaciers. The government is siding with the indigenous people. In the

High Andes, miners have been resorting to pumping in water all of the way from the Pacific Ocean and building desalination plants.

Auryn’s trenching program identified over 5,000 meters of veins having made it all of the way to surface. This was an exceptional result.When you see a

nexus of veins this dense, the first question becomes just how deep might these veins go. Interestingly, vein outcroppings have been identified well down

the southern and northern downslopes off of the plateau lending some credence to the theory that these might be “mesothermal” veins instead of the typical

“epithermal” veins. “Mesothermal” veins not only extend downwards up to 1 to 1.5 Km in depth, they also tend to widen with depth. The parts of Chile cited

in Theresa Moreno’s “The Geology of Chile” famous for hosting “mesothermal” veins is the next door neighbor to the north i.e. the Colliguay Mining District

part of which (namely the Caballo Empressa Mine) Maurizio recently purchased as well as the Curacavi Mining District which borders the ADL to the west where

Hochschild has a JV relationship with Auryn in developing the Las Dos Marias Mining area. Hochschild is one of the premier underground mine developers

specializing in vein deposits.

In regards to your 5th figure, this shows the Merlin 1 Vein. You can see that including the vein already identified to date and the structural lineaments of

that vein, the figure shows a minimum of 1,000 meters of length and the fact that the vein is “open” (extends beyond) both to the north and south. The

figure shows the 3 main adits on the northern downslope off of the plateau. A fourth adit was later found in between adits #2 and #3. This new adit

featured “bonanza”

gold grades of up to 100 gpt gold. Due to the unconsolidated rock found there, it was unfortunately deemed not safe to directly produce from at this time.

The plan became to go after this ultra-rich vein through adit #3, the “Larrissa adit”. SERNAGEOMIN, however, mandated the construction of 3 separate

vertical safety/ventilation vertical “raises” prior to commencing production. Since the Larrissa adit exists at the 1,800 meters above sea level and the

plateau at 2,000 “masl” then this necessitated the construction of 3 separate approximately 200 meter tall “raises”, not an easy task. Recently, it appears

that Auryn management shifted gears and might be going after the Fortuna Mine first and working from east to west instead of the reverse as earlier

anticipated. This Fortuna Mine (known also as the “Los Amarillos Mine”) already has 7 different production levels. There are 156 meters of vertical shafts,

162 meters of of safety/ventilation chimneys and 535 meters of drifting and access levels. The mine has been successfully dewatered and the walls are being

rehabbed. In the last 3 years of production circa 1970, the average grade mined was 92 gpt gold. A more realistic figure given by one geoscientist was to

expect somewhere around a very respectable 17 to 20 gpt gold over an average width of about .5 meters.

With this density of veins found at surface, the obvious question becomes how deep might the average vein extend to. Luciano Bocanegra did a preliminary

estimate of ounces of gold contained in just 2 of the 5 main vein groups found at surface. He came up with 664,000 ounces of gold just in between the

surface and the 200 meter depth level. The IP/IR study of the area clearly shows the veins extending deeper than that. His calculation did not include the

gold held in various “bosses and plugs” that did not make it all of the way to surface.