Thanks but why did cdch get Aumc shares so quickly and not Mdmn?

CDCH was the “vehicle” for the reverse merger to keep the three companies viable as a reporting company.

They changed the name of the company from Cerro Dorado to Auryn Mining.

Hi EZ, Dent, Trader Rich and Judge,

When you study the moves of Maurizio, he’s about the most dilution conscious corporate executive I’ve run into. Maurizio could have vended the ADL assets into a “shell” vehicle and gone public in that fashion. The problem with that is that the owners of the “shell” would get a piece of the ADL action in exchange for providing the corporate vehicle/shell. Maurizio wisely chose the Cerro vehicle in that they already owned a 5% share in the ADL. There was no dilution experienced. I see that same sentiment being deployed in the distribution of the AUMC shares. Being the largest shareholder in Medinah, he stands the most to lose if the remaining debt of Medinah is paid off via the sale of a small portion of their AUMC shares prior to any good news coming out of Auryn being released.

Trader Rich just posted the quote from management as to why the AUMC shares haven’t been distributed yet. They want the Medinah shareholders to share, in a pro rata fashion, the greatest amount of AUMC shares as possible AFTER paying off any remaining Medinah debt. They have the luxury of doing this because Medinah’s debt, I believe mainly owed to Chapin for paying past legal bills, is noninterest-bearing. The Medinah shareholders have plenty of liquidity in this interim period, arguably more than the Auryn shareholders.

I think Medinah management played their hand very well. Medinah is simply a “holding company”. It has no operations of its own and it simply “holds” shares of AUMC and AMNP. Any bills they run up need to be paid via the sale of assets. Management correctly “went dark” on their information disclosure requirements as per the OTCPinks’ “Alternative Reporting Standards”. This saved them some money. The pertinent information regarding their primary shareholdings, which are in AUMC, are provided to investors by Auryn. They also saved some money by “going dark” with the Nevada Secretary of State’s office. This also saved them some money and like the “going dark” process with the OTCMarkets, this is easily reversible. Converting the “monthly burn rate” to essentially zero was very smart. It did, however, have untoward consequences from an investment point of view. These moves left the FALSE impression to any investor not knowledge of the value of the ADL, that Medinah could be on its corporate deathbed. Why? It’s because development stage issuers that really are on their corporate deathbed, often perform the same two “going dark” measures.

It will be interesting to see how this new September 28 issue with market makers being unable to trade the shares of those issuers that have “gone dark”. This would adversely affect the LIQUIDITY that Medinah shareholders have always enjoyed. I’m going to assume that management will go back to a status of being compliant with the “Alternative Reporting Standards” for the OTCPinks. This will cost a little bit of money but it will diminish the “corporate deathbed” misperception that the market currently has. I think we can safely assume that 99% of the market has no clue as to the merits of the ADL deposit. If this September 28 issue would have never arisen, then I imagine that the plan was to get Medinah back in good stead with the OTCMarkets and the Nevada SOS prior to distributing the AUMC shares but subsequent to a significant move upwards in the PPS of AUMC. It’s a lot easier to distribute dividends when the issuer is compliant with the informational disclosure requirements of the OTCMarkets. Since Medinah is technically an “affiliate” of Auryn, it is almost a prerequisite (as per Rule 144 of the 1933 Securities Act) that Medinah be in compliance with the applicable information disclosure requirements prior to distributing previously “restricted” securities. I still think that management will wait for a pop in the share price of AUMC prior to distributing the AUMC shares to Medinah shareholders but if they had their “druthers” they would have milked the “staying dark” approach a little longer. BESIDES ALL OF THIS SIDE-DRAMA, THE ELEPHANT IN THE ROOM STILL REMAINS THE CASH-GENERATING POSSIBILITIES FOR THE MESOTHERMAL VEIN SYSTEM. Not that anybody pays any attention to silly little things like that!

BB,

In Oct 2017 you had posted a very informative analysis of information from an article appearing in the Chile Explore Report. It was titled " LINE BY LINE ANALYSIS OF THE “CHILE EXPLORE REPORT” ARTICLE ON AMC DATED OCTOBER OF 2017" You also referred to http://aurynmining.com/?page_id=585 in one of your posts which is no longer available, but I’ll assume is this one:

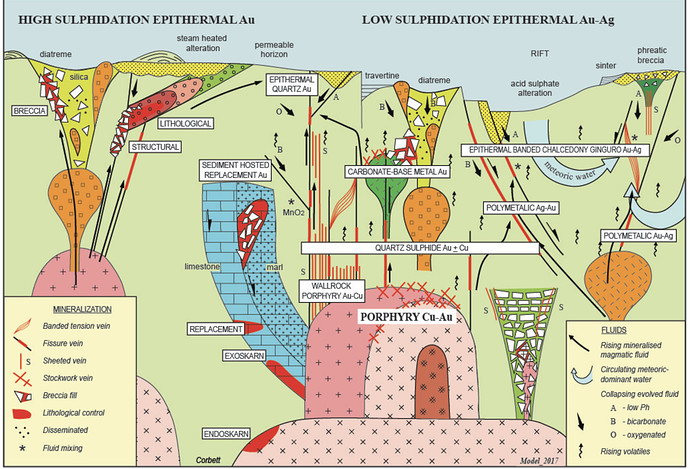

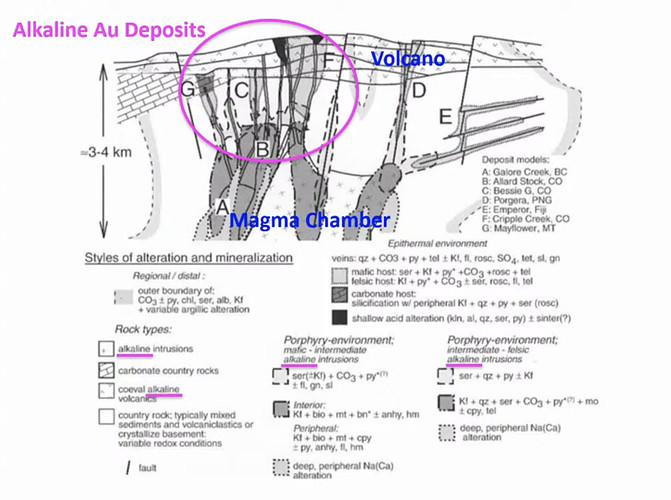

Would you agree that Moly-AU porphyry deposits are confined to igneous rock that is largely low sulphidation? In a recent broadcast Quinton Henigh attributed the porphyry model shown below to geologists Eric Jensen and Mark D Barton of University of Arizona. I think it is primarily describing copper gold skarn, breccia pipe, low-sulphidation epithermal gold, pluton related (mesothermal or orogenic) gold vein system associated with massive deposits. You have so many good geologic comments it’s hard to keep track of them all! lol

Could the model below also be describing the LDM Moly-CU-AU deposit remaining to be explored, but not going to the depth necessary to show the Magma chamber underlying the LDM as shown in the Corbett model? With two porphyries present on the Alto it is difficult to show both a typical Moly-AU model in the same model as a mesothermal vein deposit which I think this model depicts well.

How well does this model fit what is known of the ADL and LDM deposits? I was especially intrigued by the scale shown of the vertical veins extending down a km or more. The branching horizontal veins reminded me of the 3 Caren Adit veins located at about 80, 120 and 140 meters below the surface. The model could also describe what is currently being developed and delineated in the sheeted veins on the Fortuna side of the property. Comments?

EZ

Here are the the two ends of the spectrum:

Hi EZ,

It’s a shame that pictorial you are referring to is not available on line any longer. It took Greg Corbett’s model which you posted and overlaid it with specifics to the ADL. For instance, that blue area of skarnified limestone was labeled “LDM”. Corbett is a brilliant guy from NSW, Australia. This model, however, doesn’t do justice to the differential between epithermal and mesothermal vein systems. Meso’s are rare enough that they often don’t get mentioned in the renditions of classic porphyry models like those of Corbett or Sillitoe. (I’ll warn you that studying Corbett’s lectures on line will drive you nuts because the camera is always on him while he’s wielding his laser pointer at various slides, but he really is good.)

The ADL Mining District is a smorgasbord. It has all of the various adnexal structures seen in the classic copper porphyry model. Where it stands out head and shoulders above most is the presence of a vast low sulphide mesothermal vein system. The “VAST” is important and was corroborated by the trenching program of Auryn, the “LOW SULPHIDE” is important, the “MESOTHERMAL” is beyond important and the presence of a true “VEIN SYSTEM” is important. Almost all gold-bearing lode deposits involving veins is of an “epithermal” nature. These are wonderful and they account for a lot of the gold production worldwide. The analogy often used is that they are like apple orchards whereas the much rarer MESOTHERMAL VEIN SYSTEMS are more analogous to a redwood forest. The meso’s often extend super-deep (often to about 1,500 meters) and more importantly they tend to widen with depth and the grades often tend to improve with depth. The economics of meso’s can blow away that of the epi’s by lightyears.

Auryn management has been holding off on telling us the results of Richard Sillitoe’s 4-and-a-half-day visitation of the ADL. We knew that ACA Howe suggested that we might just be sitting on a mesothermal deposit. Us geo-geeks have been sitting on pins and needles waiting to see if Sillitoe came up with the same diagnosis i.e. a redwood forest and not just an apple orchard. It appears that Auryn management didn’t want to reveal Sillitoe’s diagnosis until they corroborated it via sampling “Shaft #1” at the old Fortuna Mine. Management’s recent update stated that the widths and grades are indeed improving with depth and that we are indeed sitting on a mesothermal vein system. Then they said basically that, oh, by the way, Sillitoe concurs with ACA Howe’s theory.

This is not rocket science. The meso’s form much deeper than the epi’s. Down deep, both the PRESSURES and the TEMPERATURES are much higher than that found near surface. If you start with a half of a meter wide fault or crack in the rocks above a magma chamber, the explosivity down deep can make that a 2-meter-wide crack/fault in a heartbeat. As the hydrothermal fluids and gases rise and cool both the PRESSURES and TEMPERATURES drop. Up near surface where the epi’s hang out, there’s no more lateral pressure left to widen that 0.5-meter-wide fault/crack. Thus, these meso’s widen with depth.

Meso- systems are not that tough to diagnose. Picture the hydrothermal fluids ascending out of a magma chamber as being on an elevator. If the hydrothermal fluids ascending out of a magma chamber are 300-degrees Celsius, and they depressurize and cool as they rise, the molten rock components will solidify when they reach a level that matches their melting point. They’ll exit this elevator as solids and stay at that level. Moly is famous for having a very high melting point. It’s the first guy off of the elevator down low.

So, meso’s are going to be found in association with rock types with high melting points. We know what the melting points of various rock types are. This is why the ACA Howe’s and Sillitoe’s of the world can say, yep you have a mesothermal deposit. It’s pretty much a given that the veins are likely to widen with depth and extend way down deep. This is just physics.

Yes. The gap is wide but I’m willing to admit that I could be wrong and, as previously stated, I’d consider buying AUMC if and when they start delivering. However, at this stage there is a whole lot more that we don’t know versus what we know and, with a ~$50M valuation for AUMC, the stock is just too expensive (unfavorable risk/reward). If the company starts generating $20M on a shoe string budget I’m clearly wrong. I’ve never seen it and referencing a couple super high grade “grab samples” to extrapolate cash flows is ridiculous (to be nice). I don’t question the mertis of the mountain but these guys will need to land some very dilutive financing (after not being able to do so for a looong time) to hit that type of profitability AND this type of underground mining is tough for an army of mining contractors, let alone a handful. Time will tell.

Here’s a nice tidbit I found while trying to figure out why Medinah owed Auryn Holdings Corporation $2 Million Dollars !

MEDINAH MINERALS, INC. - NOTES TO UNAUDITED FINANCIAL STATEMENTS (PAGE 3) - AS OF DECEMBER 31, 2015 AND 2014

NOTE 6—JOINT VENTURE OPTION AGREEMENT

On August 1, 2014, Medinah Mining Chile received and documented, a Preliminary Joint Venture Agreement from AURYN Mining Chile, SpA. The terms and conditions of the contract were negotiated to the satisfaction of all parties, and formally legalized in Santiago, Chile on September 30, 2014.

The Joint Venture Option Agreement extended to AURYN Mining Chile, SpA a three year option period to acquire 85% of the Altos de Lipangue group of mining claims for a minimum price of $100 million.

AURYN Mining Chile, SpA will expend up to $10 million deemed necessary for surveying, drilling, and exploration of the Altos de Lipangue claims, encompassing approximately 4,000 hectares. Medinah Mining Chile will have no requirement to fund any of the activities of AURYN. The exploration program began November 1, 2014, and continues with MORE THAN SIX MILLION DOLLARS EXPENDED TO DATE.

Hi EZ,

Two of the reasons that the mesothermal vein systems are so sought after has to do with the fact that they widen with depth and that they extend way the heck down vertically upwards of 1,500 meters. A 3rd reason is that when you’re that extensive in the vertical dimension, the greater are the chances that the veins will have viable “boiling zones” containing the good stuff. These average about 300-meters in vertical dimension and range from 50-meters to 800-meters. Since the gold within the hydrothermal fluids travels while bonded with sulfur in thiosulfate complexes, in order for the gold to be freed up and deposited locally something needs to break the bond between the gold and the sulfur. The energy associated with these fluids being able to “boil” does the trick and these “boiling zones” can feature lots of “oreshoots” containing extremely high-grade gold within veins with some pretty crazy grades.

What is sometimes tough to picture is that these fluids averaging around 300-degrees NEED TO COOL IN ORDER TO BOIL. The “confining pressures” down low, especially in a mesothermal vein, are so high that these fluids can’t “boil”. You’ve got plenty of TEMPERATURE to promote “boiling” but you’ve got too much PRESSURE to permit boiling. As these fluids rise and depressurize, they’ll find a vertical zone in which “boiling” occurs. In a 91-million-year-old deposit like this (Cretaceous Age), the “boiling zones” can become extremely wide vertically because over the years the “boiling zones” occur at different levels during different phases of the overall magma generating process.

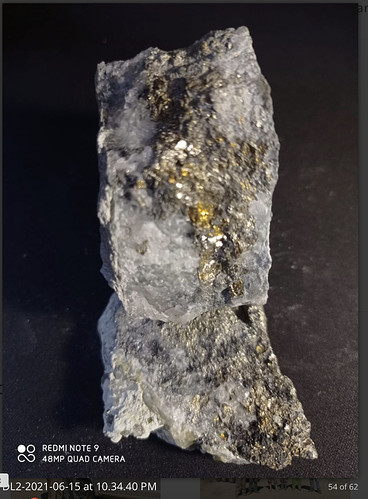

The best way to depressurize these fluids is their rising and naturally depressurizing as well as when they encounter large voids in the rocks where the pressure can drop quickly. These fluids also contain a lot of molten silica which forms quartz when it cools. When this silica cools rapidly, it doesn’t have time to form the nice crystals you see in the textbooks. Under these conditions the quartz becomes “aphanitic”, “cryptocrystalline” or “milk quartz” in which the human eye can’t make out individual crystals. This is also referred to as “chalcedonic quartz”. This is what we have a lot of at the ADL. So, these “boiling zones” end up containing very high-grade gold surrounded by “chalcedonic quartz”. A lot of “boiling zones” are no longer present because they, and the gold they used to contain, got eroded over time. Meso’s go down deep enough to offset the effects of erosion so the “boiling zones” often remain intact. Auryn mentioned in a PR or perhaps on the website that the vein systems remain remarkably intact.

When you study the “Gallery” portion of the Auryn website, look at the usually white-colored quartz and its texture. There are 62 new pictures that management posted. There is a ton to be learned from careful scrutiny of these photos. If we were smart, we’d all put $20 into a pot and hire an economic geologist to study those photos and provide us with a report.

Just give us a name and an address - I’m in.

Look at slide 13 & 14 of the Don Luis - 2. Never seen so much gold in 8 small samples

Correct, Mdmnwork.

I’m an investor in New Found Gold (NFG), a huge STAR in Newfoundland, and the gold in the pictures we see of their rocks appears as tiny little specs - which you can only see if you look hard enough - and their pictures are some of the best seen in the industry. Here they are: Media Gallery - New Found Gold Corp.

Then we have Auryn’s pictures - all one can say is WOW.

Thanks BB, very exciting “stuff” we’ve known about for a very long time. Back in a 2016 4th Qtr post (Sept 16 - 159/1354) you had a very informative and typically long post addressed to geo-geeks. We should all be geo-geeks with this up and rising investment and just relax as things unfold for shareholders. I’ll repost a short excerpt from that post which appeared shortly before the informational meeting held Oct 1 of that year.

The surface trenching program AMC completed was fairly exhaustive. Prior to this campaign Medinah and ACA Howe had identified about 400 meters of these epithermal veins making it all of the way to surface. AMC not only increased this figure to over 5,000 meters of veins making it to surface they (and ACA Howe/Medinah) also identified (via IP/CSAMT geophysics) several underlying “subparallel” veins that didn’t quite make it to surface. In the Fortuna/Merlin area the veins are packed densely enough to justify an open pit primary mining methodology.

Of the 5 veins, we know the most about the easternmost vein i.e. the Fortuna Centro Vein. Production from here averaged 64 gpt gold ( a very large number) from 1940 to 1970. This came from the first 100 meters “down dip” which represents about 70 meters vertically. ACA Howe tells us that nobody has even scratched the surface at these “Fortuna Veins” in total.

The vein we know the second most about is the Merlin 1 Vein at the site of the Caren Mine. The 3 adits drifted into the northern downslope off of the plateau at about the 120 meter depth level below the plateau revealed numerous “bonanza” grades, many over 100 gpt gold across the width of the vein. The Merlin 1 Vein is traceable at surface for at least 1.8 Km and the average width is just less than 1 meter.

We all know the depth of adversity that resulted from a devious fraud that was meant to bury this investment by doubling the share count of MDMN to 3B. Financials need to be brought up to date at this point by any means necessary. Management has methodically, and quite painfully to all shareholders, done everything “by the book” to keep this investment in play and will continue to do so. After financials are brought up to date we need to see MDMN go through the same 100:1 reverse that will bring the share count down to a very attractive share count of less than 30,000,000. Then this will become the trading stock it was meant to be and the AUMC share dividend can be released to shareholders.

What we will see is the high grade Fortuna veins obtain permitting to go into full production and and get that project off the ground with increasing moneyflow coming in quarter to quarter. Then the Caren 1 veins will reopen and double production and money flow. This will all be conventional underground mining that will probably run the clock out to December 2023 when Hochschild’s option play will either expire or be exercised. Then we may be able to start thinking about an open pit where the sheeted vein structures reaching the surface will make this the investment it was always meant to be!

Speaking of elephants, can we address the other one? The talk of scaling production to 6 working faces, becoming a mid-tier gold producer, a cash dividend machine and share buybacks etc implies that AUMC can achieve this on their own without the dilution pill.

Why is it that two very intelligent people in the mining space, yourself and Baldy, are so far apart on this? Can we scale to a 100,000 Oz/year gold producer with reinvestment of our own profits or perhaps an attractive debt financing arrangement after we prove we are profitable?

If the answer is yes, how long do you envision it will take to a) generate a $20M profit and b) reach 100,000 Oz/year levels.

Looking for rough estimates, in your opinion.

mrbubba,

I’m holding a respectable position in NFG as well. As impressive as the volume of pics at NFG are, and they are impressive, their progress is what is really impressive. NFG is very well funded and their share price shows it. If we are just comparing the WOWs in gallery pictures I’d say the Don Luis -2 photos have the ones shown in the NFG gallery beat by a mile!

But we aren’t just comparing pics here. We’ve certainly got the goods, but we are a long ways off from comparing AUMC stock to NFG stock. I can see what we have in the ground on the Alto, followed for years, and I know there’s a lot more. Now it’s up to management to make it happen for all shareholders.

EZ

Interesting . . .

Hmmmm … maybe posturing themselves to search for employees?

Hi JimmyP,

At this stage of development, what you want to do is the grunt work type of due diligence. Set up your matrices involving tonnage and grades now and fill in the blanks as the information flows. When the topic is can Auryn do 100,000 ounces of production per year, you want to be able to envision a pathway to that end result. I agree that 6 working faces being simultaneously mined is a good place to start. That was the initial plan at the Caren Mine before everybody got hot to trot over at the Fortuna Mine. With 6 working faces, each working face would have to produce 16,667 ounces per year. Based on a 5-day work week and 260 working days per year, each working face would have to produce 64 Troy ounces of gold per day.

In a 3-meter wide and 3-meter-high adit with a blast penetration of 2-meters, each blast cycle would release 18 cubic meters of “rubble”. Since our rock is a mixture of granodiorite and quartz monzodiorite the density of the rock is going to be about 2.8 tonnes per cubic meter. This means that each blast cycle would release 50.4 tonnes of ore. For this to equate to 64 ounces of gold per day per working site the average grade would need to be 1.269 ounces per tonne. This equates to 39.4 grams per tonne.

What do we know about the grades of this Don Luis 1 Vein? Auryn shipped 9 tonnes of ore back in Q-4 of 2020 and the average grade came back at 45 gpt. “SMFL” produced from this same adit from 1940 to 1970 averaging in between 64 and 94 gpt ore. The Auryn website shows Italo, back in Q-4 of last year, in front of 54 tonnes of ore averaging “over 62 gpt gold” cited in one spot and “about 85 gpt gold ore” in a different spot. Is 100,000 ounces per year a doable rate of production in the near term? Absolutely.

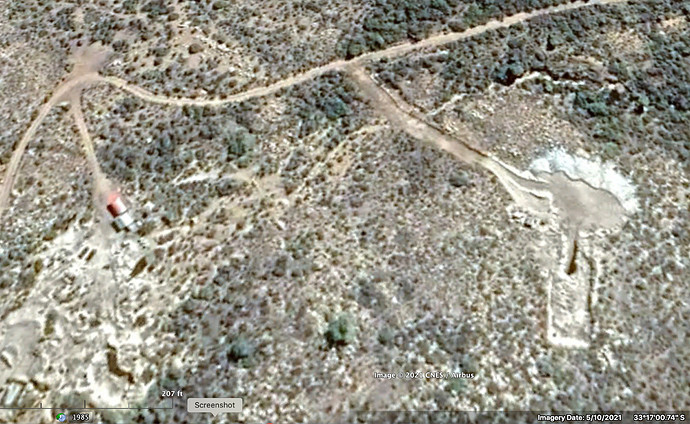

It’s the “crosscut” Fortuna Adit that sets up this scenario. The goal was to intersect the Don Luis 1 Vein in this adit which is 150-meters below the surface. They hit it on June 23rd of 2021. On their way to intersecting it, they intersected two other veins of yet to be reported width and grade. After intersecting the DL 1 Vein, their goal was to intersect two “massive veins” that measured over 2-meters AT SURFACE. One of these, the Merlin 4 Vein is located very close to the DL 1 Vein. The other is 60-meters west of the DL 1 Vein. The DL 1 Vein was intersected 60 days ago.

Management wanted to be producing at the pace of 40 tpd from one working face starting in Q-1 of 2021. They missed that goal and stated that they needed to intersect the DL 1 Vein down deep, at the 150-meter level, in order to open up new working faces in order to meet the goal. Remember that up until June 23, all of the production was from the DL 1 Vein up near surface where the vein was only 0.5-meters wide. All of those 62 new pictures on the website were from the DL 1 Vein up near surface except for the last 4 or so dated June 23 and later. Note that on the picture dated June 23, they showed the entry point of the new adit. It’s kind of like them saying that this is the new start.

All of that fancy looking ore is likely to be found down lower in the DL 1 Vein but hopefully the width of the good stuff, found only in the vein in the case of LS veins, will be a lot wider as is the norm for mesothermal veins. If this is the case, then each blast cycle is likely to produce a lot more than the 64 ounces of gold than what was seen back up high. Why? Because if the new widths are around 2-meters or so, instead of one-sixth of that working face being the good stuff, four-sixths (2/3) will be. Each blast will still release the same 50.4 tonnes but more of the rubble will be the good stuff and thus the “rubble/shipped” grade will be much higher. It seems confusing, but in an LS mesothermal vein system “WIDTH IS GRADE”. By “grade” I mean “rubble/shipping” grade, the only grade that counts.

You do the math if you add a shift, work more than 260 days per year, encounter much wider veins with depth, etc. One good thing about underground vein production is that management can start anywhere they so choose so you can frontload the production. In retrospect, the exhaustive trenching survey identifying over 5,000 meters of mesothermal veins making it to surface told the engineers where to aim the new adit so that the maximum amount of veins could be intersected and the maximum amount of new working faces could be established. The new adit will no doubt continue to intersect previously unknown veins that never made it to surface.

I’ll go through the math later but an easy way to remember things as the news starts flowing is the “40-40-$4” rule of thumb. For every 40 tonnes produced per day at an average “rubble/shipped” grade of 40 gpt should add $4 to the price of Auryn in an incremental fashion starting at zero. The EPS chosen was 20-times and the “All in sustaining cost” to produce an ounce was set at $700. This is the dynamic growth profile that the majors can’t emulate. They need to ACQUIRE these but hopefully not for a long while. The real question we should be asking is how many stockpiled tonnes of rich ore are sitting on the plateau right now over and above the 9 tonnes and 54 tonnes we know about. At 22 working days per month even the measly rate of 40 tpd would yield 880 tonnes per month. From January 1 to June 23 when they intersected the DL 1 Vein down deep, how close to their original stated goal of 40 tpd did they get? Pencil out 10, 20 and 30 tonnes per day and then deduct whatever fudge factor you feel appropriate. Set up your matrices now so that when the information finally starts to flow, you’re ready to do some number crunching. If you guys, with all you’ve been through, don’t deserve “first dibs” then who the heck else could?

By the way, when you study those new 62 photos, the yellow stuff that can be distinguished from iron pyrite (fool’s gold) is fine and dandy, but often it’s the ugly gray/black stuff shaped like a kidney (“colloform”) that is where the goodies hide out. I’ve harped on “boiling zones” a lot but super-vigorous boiling can produce that gray/black high-grade “electrum” which is a combination of gold and silver.

The Distribution of Precious Metals in High-Grade Banded Quartz Veins from Low-Sulfidation Epithermal Deposits: Constraints from µXRF Mapping

Abstract

High-grade ore zones in low-sulfidation epithermal deposits are commonly associated with the occurrence of banded quartz veins. The ore minerals in these veins are heterogeneously distributed and are mostly confined to ginguro bands, which can be identified in hand specimen based on their distinct dark gray to black color. Micro-X-ray fluorescence element maps obtained on representative samples of banded quartz veins show that Au occurs together with Ag minerals in some of the ginguro bands, but Au can also be present in quartz bands that are light gray to white and cannot be macroscopically distinguished from barren bands. The occurrence of compositionally distinct ginguro and gankin bands, the latter being a new term coined here for colloform quartz bands containing primarily electrum or native gold, can be explained by temporal changes in the composition of the ore-forming thermal waters or variations in the conditions of ore deposition. Textural relationships, including the dendritic shape of ore minerals that appear to have grown in a matrix of silica microspheres, suggest that the ginguro and gankin bands have formed as a result of rapid deposition associated with vigorous boiling or flashing of the thermal waters.