There’s 10 tonnes of good looking rock. Just gotta make sure the drivers aren’t drinking too much driving down that road.

I will wait for the conversion…

Good luck Wizard.

Hi MrB,

That new video provided by Kevin was taken outside of the portal to the new Antonino Adit. Auryn intersected the Don Luis 1 Vein there 90 days ago so I’m not sure if that stockpile represents the first fruits of that intersection or not. You can see from some of the old gallery pictures how that Sullair 185 compressor sits next to that little pole structure with the black 55-gallon drum next to it. That older gallery photo was taken back when they were working on the entrance area to the new adit. This is located about 150 meters below the plateau surface. All of the production to date was taken from the old Fortuna Mine up higher in elevation. We know that about a year ago management sent in 9 tonnes of ore to ENAMI that came back with an average grade of 45 gpt gold. We also know that about 10 months ago the gallery on Auryn’s website showed Italo behind 54 tonnes of already crushed ore grading in between 62 and 85 gpt gold. We haven’t been told how many “working faces” were involved in this production effort at the old Fortuna Mine.

We also don’t know how much ore was stockpiled over the last 10 months after that picture of Italo was taken. Management’s projected goal was to be producing at the rate of 40 tonnes per day over that time period but they told us that they couldn’t match that projection until AFTER the new Antonino adit intersected the Don Luis 1 Vein. This was accomplished on June 23, 2021 which is now 3 months ago. So, there could be quite a bit of ore already stockpiled outside of the old Fortuna Mine as well as the new Antonino Adit. The new intersection with the DL 1 Vein via the Antonino Adit should provide 2 new “working faces”. One would be oriented towards the NNW and the other towards the SSE. Management also cited the plan to advance the Antonino Adit to the SSW past the intersection with the DL 1 Vein in order to intercept the two “massive veins” they found at surface during the trenching program. By “massive” management said they are referring to a vein over 2 meters wide at surface. Either one or both of these veins had 10 gpt gold ore within the trench.

The first of these two “massive” veins was located in close proximity to the DL 1 Vein and may or may not have already been intersected. I personally have mixed feelings as to whether or not I want management to concentrate on producing out of the DL 1 Vein through the new adit or advance further and go after the bigger veins. The DL 1 Vein (Don Luis 1 Vein) used to be referred to as the “Fortuna Centro Vein”. It was exploited from 1940 to 1970 averaging 64 gpt gold. All of these somewhat stellar grades that we keep reading about shouldn’t be that surprising. Averaging 64 gpt gold over the course of 30 years is what it is i.e. pretty darn impressive. Mesothermal vein grades tend to blow the grades of the much more common epithermal veins out of the water. The added bonus with the meso’s is that they widen with depth and they extend way, way, way deep. This sets up the potential for some very long mine lives.

We also need to keep in mind that at the ADL this is a VEIN SYSTEM. A VEIN SYSTEM involves a grouping of “related” veins that share the same characteristics and behavior. They are often oriented parallel to each other which we see at the ADL except for Merlin 3 which crosscuts the others. The fact that they are “related” has to do with their sharing of a common magmatic source/magma chamber as well as fault structures and parallel fault structures. Keep an eye out for the widths and grades of the DL 1 Vein at the 150-meter depth level. If it widens nicely with depth versus its width closer to surface and shows clearly better grades with depth then the same behavior can be expected with the other parallel veins that we know less about. The Auryn trenching program revealed 5,000 meters of veins having made it all of the way to surface. This doesn’t count the subparallel veins, bosses and plugs that didn’t make it to surface. “Crosscut adits” like the Antonino Adit can be expected to pick up some of these subparallel structures. Management noted intersecting two new vein structures early on during the drifting of the Antonino Adit. This is a very busy VEIN SYSTEM.

Being “mesothermal veins”, all of the veins intersected at surface would be expected to widen with depth and also often be richer in grade with depth. Management recently took 19 samples from the DL 1 Vein area. Twelve were from Shaft #1 of the old Fortuna’s 7 pre-existing shafts. The grades within the shaft clearly improved with depth and management noted that the structure was indeed widening with depth. This is the hallmark of a mesothermal vein. As the exploitation efforts proceed through the Antonino Adit (now acting as both an exploration and production adit) the geoscientists will get a much clearer 3-dimensional picture of this sheet of plywood-like planar structure known as the DL 1 Vein. The historical production efforts taught us all about the top border of this sheet of plywood. The recent shaft sampling taught us of how the grades and widths behave with increasing depth along the side of the sheet of plywood. The recently initiated production efforts will tell us how this sheet of plywood looks at the 150-meter depth level below the plateau surface. This allows the P. Geos to block out Mineral Reserves and Mineral Resources (MR/MR). This information might then be extrapolated towards the veins that we know a lot less about with varying levels of statistical certainty.

It’s critical to keep in mind that we also know a lot about the Merlin 1 Vein and the Caren Mine well to the west of the DL 1 Vein BUT WITHIN THIS SAME VEIN SYSTEM. At surface it looks an awful lot like the DL 1 does. From surface down to the 140-meter depth level from the plateau we know a lot about what’s going on because of the 3 adits drifted there. At the 140-meter depth level we know a lot because of the Larrissa Adit work that has been completed. What did they find in the Merlin 1 Vein at these various depths below the plateau surface? They found the same type of “bonanza” grades that they’re finding at the DL 1 Vein. This is how VEIN SYSTEMS tend to act. Might one expect the veins in between these westernmost and easternmost members of this VEIN SYSTEM to behave similarly?

From a production/future earnings point of view, the one mining industry term that jumps out at me is SCALABILITY. How much work would it take to go from, let’s say, 40 tonnes per day production to 80- or 120 tpd in production? The number of “working faces” being simultaneously mined as well as the number of shifts per day during which the mining occurs is what provides the SCALABILITY. Transitioning from one working face being mined on a one shift per day basis to 6 working faces being mined on a 3 shift per day basis represents an inordinate amount of SCALABILITY. The other thing that jumps out at me is the need to periodically step back from concentrating on just the mesothermal veins and put on the telephoto lens. This extremely rich VEIN SYSTEM is in turn part of a much larger HYDROTHERMAL SYSTEM that is the backbone for the overall ADL MINING DISTRICT. The magma chamber and the area above its roof/carapace that generated all of the hydrothermal fluids and gases that filled up these veins later becomes less active and solidifies. It becomes what is referred to as a PORPHYRY. These are usually relatively low-grade and their ECONOMICS are supported by their immense size and ability to be exploited via low-cost bulk mining methodologies.

Developing a PORPHYRY or TWIN PORPHYRY deposit is a totally different animal than exploiting extremely high-grade near surface veins. There typically aren’t many early production opportunities associated with porphyries. Instead, there is a very methodical process that needs to be engaged in with the goal of proving up the ECONOMICS of the deposit for later exploitation. At the informational meeting in Las Vegas about 5 years ago, Maurizio made it very clear that Auryn had the financial wherewithal to put the veins into production but that the porphyry opportunities would need a major miner or perhaps even a consortium of majors and mid-tier miners. It is the characteristics of the magma chamber itself that is the common denominator for both of these efforts and the development of the vein aspects of the mining district should provide a window of learning for those interested in the deeper structures.

That Brecciaboy was one of the finest explanations of a (our) mining site I have read. And I have read a lot. This type of post is what new investors that do not know much about mining need to read .Easy enough for even a financial advisor to understand even. (I’m referring to one I “had”)

He did not like having the OLD MDMN on the books in his /MY portfolio.

That Minus 75 to 80% did not make him or his bosses happy.

I finally told him to go take a hike and pound sand up where the sun don’t shine. The advisor I have now follows the A/M discussion board.

And might be hooked on this same stuff we are.

So again; thanks brecciaboy for another great chapter in the MDMN book.

Stay well and vigilant. C.s.

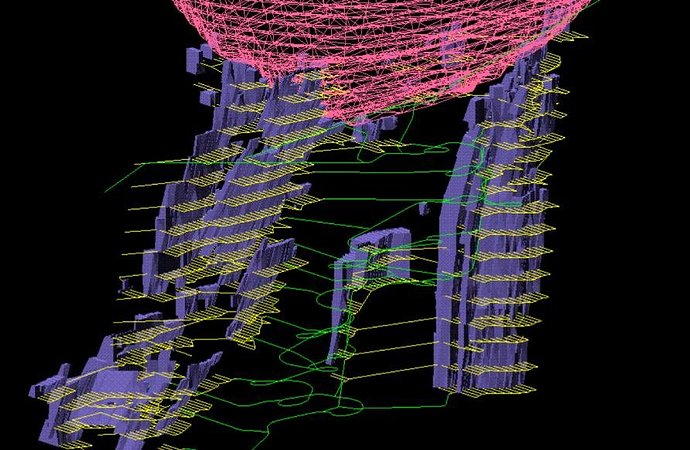

*This picture is of a large open pit mine that has pit dug as deep as feasible, and now is tunneling down deeper into its “plywood” type veins in pursuit of ore. It gets $$ pretty crazy $$ to do this. This is their proposed road/ mining system.

Beautiful picture, Coldsnow, I think we have a LONG way yo go before we get there, but that might bode well for us with all the VEINS we might need to exploit/money to be made.

On or about September 9, Wizard suggested production (#1 on the list of goals) had not commenced as of yet, but that the first three items on the list could be achieved pretty quickly. Then, a few days ago, he posted a video of a tractor moving some rock. I’m guessing at least SOMETHING has started over there. Maybe. But, if it has, then just maybe items #1 through #3 might be completed pretty soon - or at least they’ll have an idea about when they will. Hopefully, a quarterly update will be informative. Following are the first three items:

(1) Modestly improve the scale of its operations.

(2) Improve its public reporting and communications.

(3) Pay back its financial backers, dollar for dollar, no-interest, no dilution.

With new machinery on site, and people getting used to running it, production is most likely picked up some. This team is probably getting into a rhythm by now of drill, blast, safety ceiling, and haul out. The speed picks up only so much, as drilling is a slow process, clearing the air after blasting also. This all gets longer as the tunnel gets deeper. This is “if” you are working but on one shaft at a time.

If they open more then one production can only go as fast as ore can be removed. One does not want to crawl/work over to many blastings.

I would think they might need another escape shaft also very soon.

This all doubles if they are to pursue another are of mining. Personnel and equipment doubles.

I like others, would like seeing some updates, and public reports soon.

I don’t think it would hurt anybody to give us some respect for waiting in the shadows so long. Good luck to all…

**Desert storm gold stopped at a check point.

*one of Russians gold reserve;

They have been consistent with their quarterly updates. Why not let them do that?

From my last chat with MC, I still think people are a bit ahead of where the company is development-wise.

Speaking of Gold, See this latest chart review from the guy TradeRich recommended recently — Greg Savage

I go over my notes and read Brecciaboy’s recollection of the historic production of average 65 grams per ton (?) at the Fortuna mine over thirty-some-odd years (in the late 1900’s).

And then other posters speculate that we could be in for even higher numbers.

But then I read news today from another stock I am in, Newfound Gold, where they announce a 2.1 meter intercept of 64.94 grams per ton.

True, NFG has announced nothing but stellar results for quite a few months.

But one MUST connect the dots here - if our guys start producing 65 grams per ton ore, we are in for one nice ride from the current fraction-of-a-cent share price.

“Soon”.

Maybe.

With this in mind, it makes we wonder whether our guys actually need some more CAPITAL to get things started. My bet is there are a few existing shareholders who might be glad to advance some funds to help get things going - while the price of gold is still very advantageous.

We need a shareholder from the NYC area to meet Kevin’s train when it arrives. Then we need you to follow him wherever he goes. I’ll donate a pair of those glasses with bushy eyebrows and a big nose so that you won’t be detected. Always hide behind a newspaper but be careful that the print isn’t upside down; that would be a dead giveaway. Good luck!

Hahahaha - maybe on your next trip to the Dollar Tree you can grab some of those glasses!

Paragraph revised in Medinah’s attorney’s letter:

REVISED PARAGRAPH 9/29/21 LETTER

Currently, the Company serves solely as a holding company with equity ownership in Auryn Mining Corporation, a publicly traded mining and exploration company with ownership and control of an excess of 10,500 hectares of mining claims comprising the Altos de Lipangue mining district and American Sierra Gold Corp., a publicly traded precious metal mineral acquisition, exploration and development company. In its Quarterly Report period ended June 30, 2021, the Company indicates that it is not a

“shell company” as it has been pursuing an identified business plan and maintains assets valued at $11,451,250.00. In its Annual Report year ended December 31, 2020, the Company indicates that it is

not a “shell company” as it has been pursuing an identified business plan and maintains assets valued at $3,775,030.00.

ORIGINAL PARAGRAPH 9/13/21 LETTER

Currently, the Company has no business operations and serves solely as a holding company with equity ownership in Auryn Mining Corporation, a publicly traded mining and exploration company with ownership and control of an excess of 10,500 hectares of mining claims comprising the Altos de Lipangue mining district and American Sierra Gold Corp., a publicly traded precious metal mineral acquisition, exploration and development company. Therefore, I believe the Company is currently a

“shell company” as defined in Rule 405 of the Securities Act and Exchange Act.

New quarter. Let’s see what Auryn has been cooking and what to expect for quarter 4.

https://aurynminingcorp.com/october-2021-shareholder-update/

Also on OTC:

https://www.otcmarkets.com/stock/AUMC/news/October-2021---Shareholder-Update?id=323565

In case one wants a good reference for the El Peñón gold and silver deposit referenced in the update:

Seems to me the discovery of two additional veins is a good enough excuse for having failed to commence production - should add to the life of the mine. Should also add to the working faces. We’ll see.

The update coming the first week of January should be interesting.

ONE ISSUE: They reference a trenching program update, but the link takes me to an update, dated December 28, 2015, and there is nothing clearly marked UPDATE on that update. Maybe I’m missing something.

Obviously you can not take the El Peñón comparison too far at this point, but some fun facts:

- As of December 31, 2020, the mine had processed approximately 23.7 million tonnes (Mt) of ore grading 7.46 g/t gold and 202.7 g/t silver, producing 5.4 million ounces (Moz) of gold and 134.0 Moz of silver [1]

- Current reserves / resources are about 900KOz of Gold at 5 to 6 gpt [2]

- Current AISC is about $850 / Oz Au and they are producing about 220 KOz / yr [2]*

- Over the years, they have drilled 3,000,000 meters! [3]

- Current mine life visibility is still 10 years.

-

p. 26 - 27 of the technical report.

-

Yamana corp. website and presentation.

-

p. 2 of the technical report.

OCTOBER 1, 2016 – Grim times at the Shareholders Meeting in Las Vegas:

– “Prepare to never see a penny back from this investment…”

– “But we believe we see a glimmer of a viable way forward, and we will do our very best…”

– “Nothing here will happen quickly…”

OCTOBER 4, 2021 – Have Maurizio and Wizard and Everyone Else involved delivered so far, or what?

BRAVO!

– madmen

PS — The three “quotes” are off-the-top-of-my-head, but I believe I could find quite similar wording or quite similar sentiments in my notes from that day.