Any assay results

Are you using ‘google earth’ , ‘google earth pro’ or something else ?

Hi Whatever,

We’re waiting on a couple of things. One is the grades and tonnages of that which has been shipped to date. Most of these results will be from the old Fortuna Mine workings from levels 1 and 2 of the historic Fortuna Mine/DL1 Vein. Some of these will be from the ore taken out via the Antonino Adit down lower in the DL1 Vein structure. My attention will be on the vein widths and assay grades taken from the area in close proximity to what management feels to be the intersection of the Antonino Adit and the DL1 Vein at about the 1833 meters above sea level area.

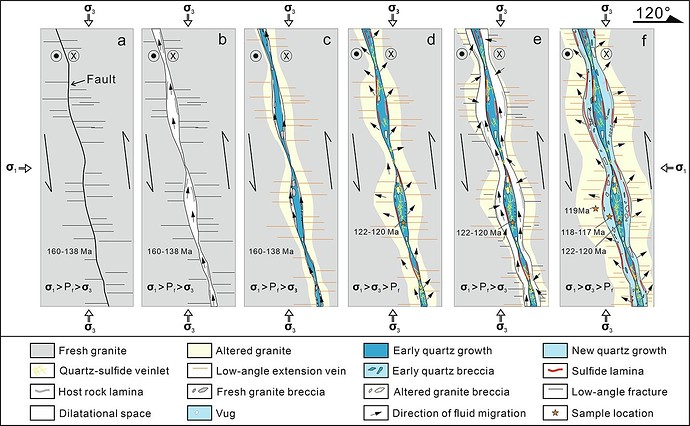

The widths of the DL1 Vein FORTUNATELY will be tough to estimate because in our area the mesothermal veins tend to present in what Maurizio refers to as a “Rosary Bead” fashion. The chain of the Rosary would be the thinner areas of the vein and the “beads” would be where the vein dilates out in width periodically. For computational purposes in estimating an average width, we’re going to have to factor in the beads and the chain portions. An enormous sheet of “bubble wrap” might be the easiest way to picture it. The overall structure is still “planar” like a sheet of plywood. At surface the strike length is about 1.7 Km. This is a little bit over 1 mile. The average depth of a mesothermal vein is somewhere around 1,000 meters or .6 miles. The average width and average grade is what we need to estimate. Mesothermal veins are famous for widening with depth, extending to enormous depths and bearing higher grade ore with depth. I can’t emphasize enough the size and grade differential between the average near surface “epithermal” vein and the average “mesothermal” vein. It’s night and day.

In Chile, one of the most famous “belts” of mesothermal veins is in between our next-door neighbor to the SW i.e. the Curacavi Mining District and our next-door neighbor to the north i.e. the Colliguay Mining District. The reason for this is partially associated with the fact that within Chile, there are 2 areas designated as a “First-order boundary between tectonic segments”. One is centered smack dab on the ADL Mining District and the other is just north of the famous Candelaria Mine to our north in the Maricunga Belt. Immediately east of the ADL Mining District is the famous Rio Blanco-Los Bronces mega-mine which also sits in the “First-order boundary” area. What happens in these regions is an excess amount of faulting and fissuring of the host rock. This “extra” amount of tectonic activity creates the “splays” that come off of the main faults and give rise to these “Rosary Beads”. Maurizio refers to these “splays” as “ramifications”. Los Bronces is composed of 7 very large but somewhat rare “tourmaline breccias”. Auryn has its own “tourmaline breccia” within the Pegaso Nero porphyry area.

Below is a link to a paper describing the genesis of these “splays” that cause the “Rosary Bead” presentation:

Below is a link to an Australian paper showing the relative size and positioning of mesothermal versus epithermal veins. Notice the association with underlying porphyry structures:

The link below leads to the ACA Howe report on Auryn’s Fortuna Mine. The last paragraph on page 21 explains why these “Rosary Beads”/splay zones of dilatation are such good hosts to high-grade gold. These dilated zones allow gold-bearing hydrothermal fluids to rapidly cool, “boil” and thereby sever the bond between the gold and the sulfur it travels with and thereby “dump” the gold in these dilated zones:

Boy there are some games being played right now watching level 2, first at 9 mil sell order at .0035 appears and a buy for 9 mill at .0033 pops up as soon as someone took at a small order at .0034 the 9 mil at .0035 disappears and so does the other 9 mil buy. Now we are at .0037

That’s the status quo in the OTC world Taff. Lots of fake supply that disappears as soon as an order to buy it comes up.

Whatever it is or the reason, I always view volume as a positive. We are close to the next next level up, .004 -.006 range should be on the horizon. These prices are a gift. If you are a believer in this investment, you clearly are considering an exit above the penny level. I get that people have sunk a ton in way too early, but that shouldn’t influence today’s decision to cash in on a holiday bargain.

Why don’t we have our AUMC shares and why won’t they provide an update on the status?

Not a word for a very long time!!

Dentman, I’m patient with these fellows because they will do the absolute best thing for us since THEY own a boatload of MDMN. All in good time!

Someone wants to drop $81k for Aumc

18 yrs of patience here and getting thin.

You would think they could let us know something about the shares rather than stone silence.

I’m with you, brother - but I can’t say how HAPPY I am that things are at least moving along in a GOOD direction.

Things appear to be moving along great for Auryn of which I don’t have converted/dividend shares of.

It was reported Mdmn has them in possession but no word of distribution for a very long time now, Why not?

I’ve asked but the only answer I hear is either focus on AUMC or I don’t have anything to do with Mdmn anymore,

Until we have AUMC shares, we’re stuck with Mdmn and who knows where it will end up.

Wish they’d exercise their fiduciary duty and inform us!!!

I am guessing that they are waiting until positive AUMC news gets the share price up. I suspect they don’t want to release all these shares while the price is this low. Just my opinion.

We were also told it will be done at a time that is more beneficial to shareholders. What was implied from that statement is that when AUMC is trading higher, Medinah will need to sell less of the AUMC shares to cover the outstanding debt that remains before the rest can be dividended out to shareholders. The higher the price on AUMC therefore means the best rate of converted/dividended shares you will receive. That passes the logic test and aligns with being told that they are waiting for the the most beneficial time for shareholders.

Now, why can’t they just come out and officially say that it is the reason? It would be nice if they did confirm the reason publicly but instead we received the above paraphrasing in someone’s communication with Raul, CEO.

Perhaps there are still some legal entanglements that they don’t feel like getting into publicly right now. Wiz seems pretty confident on the 200 to 1 rate so that makes many of us less anxious. AUMC will rise rapidly and quickly along with MDMN when they start releasing production numbers and financial forecasts as was outlined as their objective in the last quarterly update.

Shareholders have speculated on what the company is doing for years.

Mdmn could simply say they will be issuing the Aumc stock when the time is right.

I don’t want to hear what their intent is but rather the stock is forthcoming when the time is right!!

That is exactly what this says . . .

January 2021 Shareholder Notification | Medinah Minerals, Inc. (medinah-minerals.com)

Medinah Minerals, Inc. owns 16,104,200 common shares of AUMC received from AURYN Mining Chile, SpA. These shares are currently restricted. The Company intends on removing the restriction, selling a small portion of its shares to satisfy corporate liabilities and legal expenses, and allocating the remainder of its AUMC shares to its shareholders, pro rata, in the form of a dividend payment. This is subject to a final recommendation by our securities attorney and approval by regulatory authorities.

The timeframe for these actions is to be determined and is based on the Company’s desire to maximize the number of AUMC shares it is able to retain and allocate to its shareholders.

Getting these shares cleared post LP fraud is not as easy as you think. Nor is the process of getting FINRA to approve an allocation or dividend or however it has to be done per attorney’s recommendations.

It will be done when it’s done. The company should not say another word about it, in my opinion, until they have an approved and unobstructed path with defined timelines.

The stronger and more solid AUMC becomes the easier it is going to be to get this done. When AUMC achieves consistent production, audited financials, and proper reporting it will be much easier for MDMN to execute on the plan outlined in the aforementioned shareholder notification.

Thanks WIZ, I agree with everything you just posted. Probably one of the most important recent posts on this forum’s current thread. Also, I’ll add that we will all get our AUMC shares distributed one way or another when the regulatory path is clear as either an allocation or dividend from ownership in MDMN. It makes no sense to promote Auryn until MDMN shareholders can directly benefit from ownership in MDMN in a substantial way that benefits all shareholders (i.e. both former CDCH owners and present MDMN holders). There is no reason to primarily benefit only the relatively few current shareholders of AUMC (there are actually only about 2.5 M freely trading shares in the float) who can directly benefit from increased liquidity and trading today if information was aggressively publicly promoted. Strategically it just makes sense to bring value to AUMC through free cashflow, quarterly disclosures of mining activities, regulatory progress of increased permitting, and the clear path with defined timelines to distribution of unrestricted AUMC shares to MDMN shareholders.

But it is really no surprise given all that has occurred since in Dec 15, 2017 when AURYN Mining Chile SpA sold it’s mining claims to Cerro Dorado. There was a tortuous process to bring us to where we are today with this investment. Yes, looking forward is where we should all be looking, but it is important to remember discussions and expectations we had at the time that were speculative, and still are, but to a much lesser degree. There is probably good reason for not allowing previous direct quotes from previously closed Quarter discussions of years past. I know most everyone here has lived through this adventure and doesn’t like bringing up the past. But at the risk of recalling our history, I think it would be of benefit to reread some of the lively posts from the 2018 Q2 General Discussion that occurred prior to the company’s name change and the dreaded “cone of silence”.

Then, as now, I see illiquidity as quite likely strategic and purposeful. When I look back, what I see is a carefully mapped out strategy to navigate the regulatory requirements needed to eventually file with the U.S. Securities and Exchange Commission and become a fully reporting company. Then the question that was being asked at that time will be answered. “Does AURYN still intend to move onto the OTCQX® or OTCQB® tier of OTC markets?” I believe that is where management is steering this company. That’s the company I want to own!

Speaking of one Mr. LP, did he ever pay his court mandated fines? Is he behind bars, if not, why not? Also, I apologize if this is taboo for this forum.

I think you are allowed to trash LP all you want on this forum!

Late afternoon volume came in. Reached .004 again. The next positive update should move us above .004 and hold.