Yep, I’ve long been a do-it-yourself proponent, even if the only reason is to prove that production on the property is possible. Nobody could expect us to produce numbers like Barrick or Newmont, obviously, but the specter of a small outfit doing it on their own and making a profit will certainly draw attention, not a bad thing. And may the Lord God smile on our generous benefactor.

LOL. I’d hope you trust M’s expertise over mine but I’d be interested in seeing your model on how you arrive at a $20M profit. Go it alone can be a great option but it also takes a long time. I’d like to see how much is actually being lent to MDMN at zero interest. My guess is well under $1M but nobody knows as they aren’t reporting this liability on the balance sheet. It’s also worth pointing out that M has been looking for “dilutive” financing options for over three years. The go it alone strategy is the best option because it’s the only one available. If you think that AUMC would turn down an egregious stream or $10M equity financing at a steep discount you don’t know what you own.

I always find it fascinating how insecure and defensive many of the members on this board tend to be if there is any perceived negatives in my or anyone else’s posts. I value opinions contrary to my own a lot more than those that agree with my thesis as they stress test my conviction. It seems like most here would rather read the “warm blanket” BrecciaBoy posts regardless of how wrong for how long they have been.

No need to attack someone for providing some objective, fundamental points that should be weighed/considered vs automatically rejected b/c they don’t jive with your desperate quest to break even. If you aren’t innately skeptical for anything related to MDMN you haven’t learned from past mistakes. The knowledge I gained from my losses in AUMC/MDMN, and the associated flags to watch out for and avoid, has saved me more than what I lost here (well, almost).

I hope this goes to the Wizard’s $10 (AUMC) price target but spend some time understanding how much time, luck, financing, and execution is required to reach that size market cap. A reverse split doesn’t count.

Not attacking. Just saying that investors here trust Maurizio’s plan and aren’t in it based on your opinion.

The company is reporting that they are capable of production at 40tpd without dilutive financing. We are trusting that. You have even recently refuted that.

The 40tpd at the grades uncovered will get them up to $20M profit annually by as early as calendar year 2022. That will cover a down payment on that processing plant you talked of as well. All falling into place, hence why management is bullish.

These developments in mining can be painfully slow, we all have been victimized by that. However on the other side of the coin, it escalates quickly when you are producing and turning a profit on high grade ore. We have arrived. Let that sink in.

Yeah, and a $20M profit (if that’s what we’re looking at) could translate into a per share profit of .0714.

$20M Profit/70M shares in Auryn x approx. 25% (MDMN’s portion) = .0714 per share

Multiply that by the number of Auryn shares you think you’ll end up with.

When the market “learns” this, the share price should move up, appreciably.

Not bad, I’ll take that for starters - I get my money back, and a good bit more.

But I will agree with Bald Eagle on this: Painful Lessons Learned Here + this has put other investments I have made in much better perspective.

40 tons per day

x 50 grams per ton (seems conservative from the reported samples)

x 90% recovery rate

/ 31.1 grams per troy ounce

x 900.00 per ounce profit

x 350 days operation per year

= 18,231,511 profit ?

90 grams per ton turns that into 32,816,720.

Baldy, you make it sound as if there have been no offers presented to Mauricio. Maybe he has received offers and chose to reject them because they way under estimate the potential value of our holdings. If you know for a fact that there have been no offers please elaborate and provide the source.

How do you come up with $900 profit per ounce? What are your operating costs?

1,800 current price per ounce - 900.00 cost per ounce

Reasonable?

Bubba What is not reasonable is to assume that it will cost $51,300 per day to produce 40 tonnes, equivalent to around 57 troy ounces… That is $1,283. per tonne. The problem is we have no idea of the vein widths nor of the grade continuity. I suspect that the veins are VERY narrow and thus the limiting factor in the low daily tonnage. 40 tonnes per day is just a couple of truckloads. With a reasonable vein width, say 2-3 m, a couple of guys with a jackleg or stoper, depending on the mining method, could easily break a couple of hundred tonnes per day. Unfortunately, with the limited information available, any estimate is just a wild ass guess. I would take the published grades with a grain of salt until we see to what widths these extremely high grades can be applied to.

Help me with how you get to $20M profit. I’ll just assume 40tpd is doable even though they have about 4 tonnes so far

40tpd equals about 12,000T a year

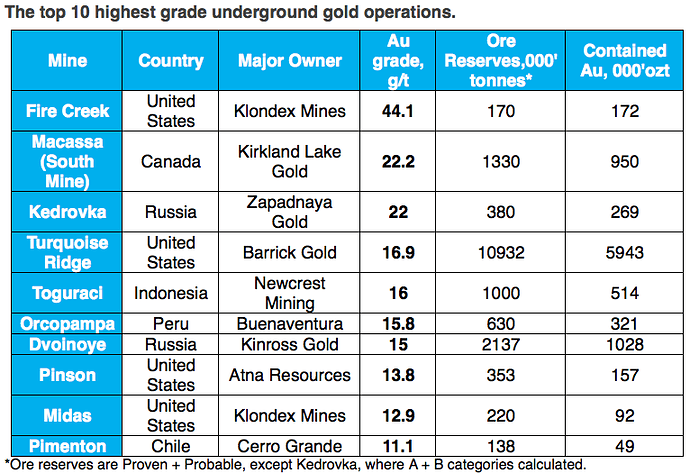

Even if you assume a very aggressive 30gpt on average (which is way higher than the highest grade mine in the world)

You end up with 11,250 ounces of annual production

Mining costs without mechanization, a plant to process, etc are, at a very generous minimum at $1200oz

Today’s margin = $600oz

$600 x 11,250 ounces = $6.75M in a perfect (undiluted scenario). AUMC currently trading at 11X that perfect scenario. A significant premium to the industry average with considerably more risk

I’d be interested in seeing your numbers

You choose to ignore the below and use a 30 gram figure. That’s fine. When 40tpd is ramped up much higher, 30gpt will be plenty to get us to $20M. I’m expecting 40tpd to commence before 2021 is out, and that figure to increase by 2022. We’ll see whose closer come 2022 year end.

$6M or $20M. By the way $6M-$10M profit next year would still be a great success and given the size of the deposit they are sitting on plus the copper potential should not have you scratching your head at a $50M market cap. Everyone respects your intelligence, which is why we scratch our heads when you make statements like you do. It’s almost like you have a chip on your shoulder.

As announced AURYN sent 9 tons of ore to Enami for processing with a result of 45 grams of gold per ton. The remaining ore has been stock-piled and will be processed once AURYN begins regular shipments of ore to Enami.

All indications are that grades are increasing, and the structure is getting wider as it gets deeper. This is consistent with a mesothermal deposit and lines up with previous reports provided by Robert Cinits (A.C.A. Howe) and Richard Sillitoe. Management’s outlook for the future is extremely bullish.

We do have some good prior information on vein widths, grades, continuity, mineralogy of the ore etc.

Refer to this report: Geological Report on the Fortuna Gold - Cerro Dorado, Inc.

Then match it with this report: Mapping and Trenching Program Results Indicate High Grade Gold Mineralization in the Epithermal Vein System at Merlin and Fortuna targets in the Altos de Lipangue Project | AURYN Mining Corporation

The first report has a lot of interesting details and is worth the read. For instance, on page 29 for the year 1952…the AVERAGE grade of the ore mined was 129.7 grams/ton with the average grade over all the years with a mining record was 64 grams/ton. I see no reason why not to expect similar grades from Auryn. It appears higher grades are to be found probably a level or two below the previous workings which were really not accessible as there was too much water for the local miners to be able to deal with effectively. (I suspect the water table has dropped considerably since the 1950’s so water problems will likely be less now.)

It should be noted that ENAMI subsidizes exploration(i.e drilling)/production/gold recovery costs for small size miners and Auryn will be able to utilize these to their advantage.

Based on the information, the veins are indeed narrow near the surface but get wider with depth in the 2+ meter range. Auryn will be targeting where veins intersect each other for areas of bonanza grade ore. The second report makes it clear that there is a very large high grade mineralized system(5+ kilometers known veins for instance) located near the surface just waiting to be exploited. The previous miners only scratched the surface of it.

Ok. Let’s almost make the assumption that MDMN will be the highest grading gold mine in the world. Why not!

Now you’re up to $10M in profits annually.

I agree with Carlos. Way too many unknowns as the grades do no reflect blended averages of actual mining (all the worthless rock mined as they go after the vein, etc.).

4 (10t) truckloads a day is not a big ask but “high grading” 40 tpd is a different animal and requires more work/men/money…

We’ll see how things play out.

Unfortunately we don’t know the details of the deal with the ‘generous benefactor’ except that the expenses are recouped.

I don’t think he/they are doing it for no gain. So why aren’t we given the details ? It is a public company so any deals or JV information should be made public to the shareholders.

Percentage profits over expenses ? Percentage of claim ? Some other deal ?

At first, pretty sure the 40 tpd will only be high grade material that is trucked offsite. Lower grade material will be stockpiled and processed onsite when they build a concentrator at some future date. (They will likely have a permit in place then that allows for much higher production rate numbers.) When they do that, then the grade average for all the mined material of course will go way down and they won’t be the highest grade mine in the world.

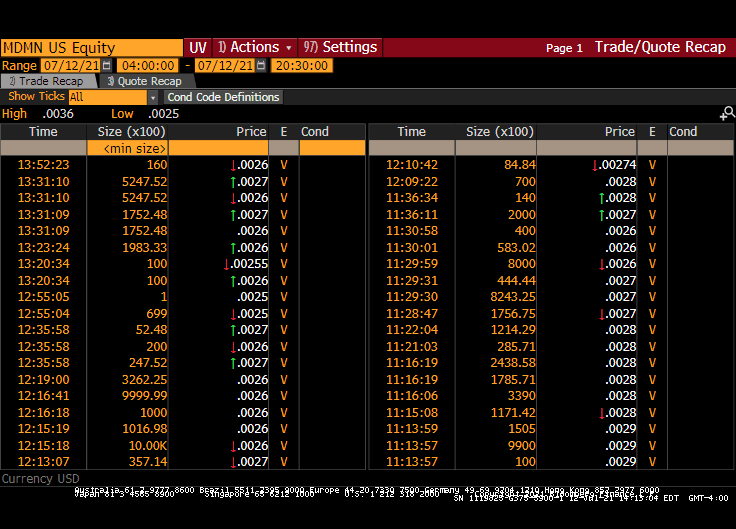

Another high volume day…already over 40 million traded.

We have an idea of who is buying all these shares but who is selling is another question unanswered? Auryn? MMS covering for upcoming mdmn share distribution?

This type of volume with little price movement looks to be arranged and unlike the market the rest of us trade in!

If I read it correctly, it is completely off book. The 3rd party is picking up the tab on expenses with no guarantee of anything in return. AUMC has no money in the coffers so it’s not paying. On a handshake the 3rd party believes it will be reimbursed by AUMC, $ for $ off production.

This isn’t much different than MDMN getting support from AHC, but we had an agreement. In this particular case it appears that the control block of AUMC and the 3rd party are satisfied with “your word is good.” All you have to do is think about it a bit and you can figure it out.

Why would someone do that for no profit? Because they’re generous, they have family and friends that are in this and have suffered greatly, they believe in the property, and they want to right the wrong that LP did to their friends and family. That’s my educated guess.

Meanwhile, it looks like they are getting the jump on accomplishments for Q3!

AURYN Mining Corp on Twitter: “Two members of our team out shopping for some assistance.”

Lots of washed trades today…but it smells like the market is anticipating the next court date on August 3rd

Why are they still going after the company? I mean it’s active now. Move on!!