Most here have skin in the game, so many of the sour grapes crowd have sold and moved on, so you are a singular stand out in that regard. I don’t particularly see much wrong with the many that post here frequently. We are all admittedly biased to a degree by choice or circumstance, and opinions do change over time. Time will tell how this “unwise investment” from looong ago will turn out in the comparatively not so distant future for some still here. It is beginning to look quite interesting for any newcomers that have come to the forum, and for them it may be a very profitable speculative play.

Jesus my boys are 13 and Les price promised me a college fund when they were born. I can’t buy a happy meal all these years later…… still holding waiting for real progress seems like out of the 20 years here this year was progress. Looking forward to regaining and making serious coin. But what missed opportunities……

I hope you took a good look at LWLG and put in on your radar…

That’s because I have been one of the few people here that still speak the truth. Everyone else like Leanandgreen was forced off the board by all the loyal puppets that weren’t interested in another point of view and he happened to be right about EVERYTHING he posted. I paid my dues here after 10 years and lost my ass probably because I paid too much attention to the cheerleaders. My mistake and I take full responsibility for that. I gave the board a gift for a stock (lwlg) that has gone from 2 bucks to 18 in 6 months and is going much higher. I thought some people might have been interested in getting back some losses from this POS. But feel free to remain buried here. Your choice. Just sayin’

Once again took advantage of the dip today, not a loss until I sell. Mangelsen good for you for your gains but I’m sure everyone has gains on other stocks also but this is only one of many investments I hold and at this point I’m happy where I’m at and where this will heading. Sounds like you moved on best of luck.

Guy’s, everyone here has a different story and are in different situations.

This site was not set up to pump this stock but to keep open communication and analysis. To do this we continue to invite all that have had Medinah impact their lives, mind you we will not tolerate individual attacks or maniacal responses which have cost some the opportunity to post on this forum.

Positive or negative it gives perspective and I hope many learn everyday from all sources. We have some very informative and intelligent individuals and I cringe just a bit when I hear anyone try and silence other’s.

You may not care for what some have to say but we all have our opinions…

Thanks GC.

GCC is right that we all have different life stories and this thread should ideally revolve primarily on things Medina and Auryn. Sometimes it is easy to get a little sidetracked, but a silent board is not of much interest, either. Lightwave Logic is definitely not in the mining sector. Mangelsen did point out the importance of having a diversified portfolio. Thanks. Everyone has different situations, especially when it comes to investing. The hot tip from July was not at two bucks when it originally was posted, but it has done very well. Not sure why it was brought up again so many months later. Similarly, Baldy showed how he avoided a concentration in two closely related stocks. I think we all like good stocks, and hopefully other sectors and investments. For me, I still have MDMN in the sock drawer, neither buying or selling.

I had mentioned before that over the years I acquired incrementally both CDCH and MDMN in roughly equal dollar amounts, so I have a number of free trading AUMC shares. Would I sell them right now? For me, the answer is no, but that is subject to change once AUMC starts having cash flow from production. There are a large number of speculative mining stocks that have taken a big hit, partially due to Covid, and other factors. The PM sector is currently not in favor, especially as tax loss selling is in full swing. Many of the miners have bottomed, or are close to a bottom, and many are showing signs of coming back with new discoveries or drill results. I’ll include both MDMN and AUMC in the category of a disappointing speculative play from years past that is showing definite signs of coming back in a big way. I feel patiently excited that this investment may finally be on the way to becoming a profitable trading stock worthy of continued growth and investment.

The company is not hyping this stock, but I do look forward to frequent “Notices to Investors” when there is newsworthy progress and eventually, worthy of wider circulating PRs.

I think we’re forgetting how to define the subsector of the mining industry that Auryn, and especially their mesothermal vein discovery, belongs in. This is not the typical junior explorer scenario wherein the company raises funds, goes out exploring, makes a discovery and then does what it needs to do in order to attract the attention of a major. What the company needs to do is to DERISK the project from the point of view of the major and its Board of Directors and shareholders.

This means you need to go out a raise a whole bunch of money, often tens of millions of dollars, and then drill out the deposit and perform an extremely expensive series of studies. The first is a “PEA” (Preliminary Economic Assessment) or “Scoping study”. If this goes well then you move onto a Pre-Feasibility Study or PFS. If that goes well then you go to a full-blown Feasibility Study or “FS”.

After 6 or 7 years of drilling and performing this sequence of studies, the corporation will have raised and spent somewhere around $30 million by selling shares at often steep discounts to lousy chare prices because you haven’t proven anything to anybody yet. If all goes well with the drilling and these studies and you successfully attract the attention of a major or mid-tier, then you earn the right to sit at the negotiating table with the major or mid-tier and have them screw you six ways from Tuesday.

The major knows that they have the junior by the ying-yang because they can simply “slow play” the negotiations and make the junior service their monthly burn rate by selling even more shares. If a deal is ever done, then the benefits to the shareholders of the junior explorer are negligible because they now have maybe 700 million shares outstanding. This is how the game is played and this is how I want it played by the majors whose shares I own. All of this applies to the typical discovery with NO NEAR SURFACE HIGH-GRADE EARLY PRODUCTION OPPORTUNITIES.

Auryn has been blessed with the opportunity to play a different ball game because of their HIGH-GRADE EARLY PRODUCTION OPPORTUNITIES, THEIR MANAGEMENT WILLING TO ADVANCE THE FUNDS NEEDED TO GO INTO PRODUCTION ON A ZERO INTEREST BASIS AND THE MINE ALREADY BUILT BY “SMFL”. There is no need to pay for $30 million worth of drill programs and studies in order to attract the attention of a major. You don’t need a major or a royalty streamer to steal your profits if you can just get into profitable production.

In a vein deposit like this, you simply do an exhaustive surface trenching program and identify the location of the veins at the surface. Then you go down the mountainside maybe 100 meters or so and drift a “cross-cut” adit that will intersect the maximum number of veins indicated during the trenching program. As you identify targets your “exploration adit” gets converted into a “production adit”. Until you get the data needed to design your own on-site mill and processing facility you sell that which you produce to Enami in order to keep you from having to go to the market to raise funds by diluting your share structure to death. With this approach, there is a split TV screen to keep an eye on. The left screen shows mining developments and the right screen SHOWS THE SHARE STRUCTURE. A MODERATE AMOUNT OF PROFITS FUNNELED INTO A COMPANY WITH A SHARE STRUCTURE TO DIE FOR WILL PROVIDE PLENTY OF SHAREHOLDER REWARDS. You don’t have to crank up production into the stratosphere in order to provide extremely generous shareholder rewards. The SHARE STRUCTURE does that.

Every corporate decision is made by carefully studying the effect of any decision on each of the two sides of the split-screen. IF A JUNIOR EXPLORER/DEVELOPER DOES NOT HAVE EARLY PRODUCTION OPPORTUNITIES THEN MANAGEMENT DOESN’T GET A SPLIT SCREEN. PERIOD. They need to keep diluting the heck out of their share structure until the phone rings from an interested major which can’t wait to get to the negotiating table in order to screw the shareholders of the junior explorer on behalf of their own shareholders. That’s their job.

I keep hearing the argument that until a junior explorer has drilled out a deposit and blocked out a bunch of ounces of Reserves/Resources then they don’t have diddly. That’s a crock for a company with EARLY PRODUCTION OPPORTUNITIES. I’ll admit that maybe only 3 to 5% of junior explorers with a decent discovery have EARLY PRODUCTION OPPORTUNITIES but 100% of the companies studied in this investment forum fall into that 3 to 5%. I keep kicking myself as to why, in the past, I would buy shares of a junior explorer with no EARLY PRODUCTION OPPORTUNITIES.

This is still about how much profit and how fast. If the company can confidently forecast $10M-$15M or more profit annually over the next few years without dilution then we will experience significant pps appreciation.

Clearly there is a difference of opinion on this by posters here on the board. I’m ready for the company to start speaking publicly about financial expectations. Although they are still just expectations, estimates, forecast, call them what you want, they will be much better received than anyone’s opinion on this board.

Auryn, bring on the assay results and financial forecasting!

I wasn’t reading the board when you initially posted it, so I hadn’t put it on my radar. To be honest, even if I had seen it I very likely would not have invested since I am these days primarily focused on swing trading the QQQ and SPY. The only other area I have been investing in is a small handful of jr miners and that’s because of the DD posted here by a couple of guys I know and trust. I have never had the interest and these days not the time to perform DD on companies. Nothing personal and I hope you recovered your losses and more from your wins with LWLG.

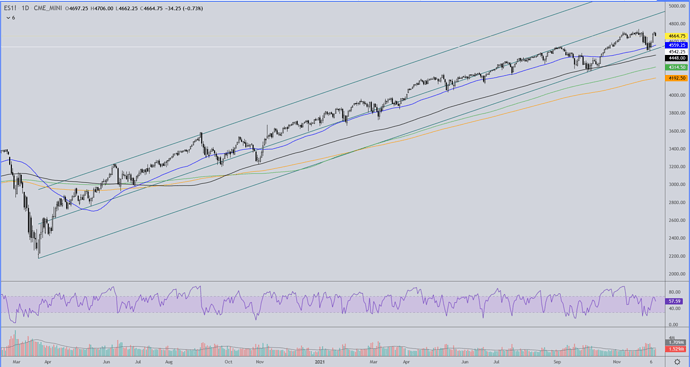

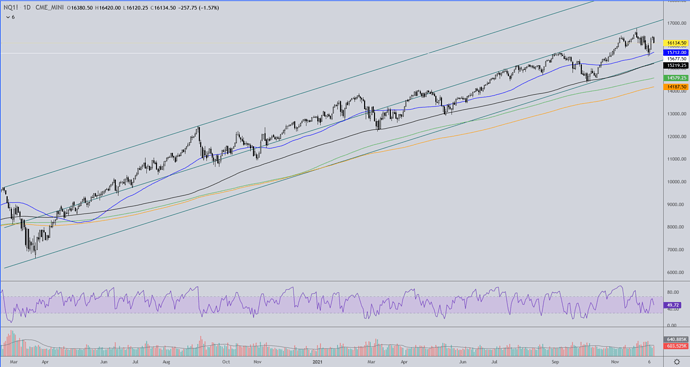

What do you think the odds of SPY rolling over here are? It’s been a crazy run.

I have two charts for you… first the S&P 500 emini futures and then the same for the NASDAQ. The Nasdaq is about 630 points off its high at this time. That could be recovered within a week. The S&P is less than 100 points off its high. Previous swing high support held the last dip and both indexes moved up to their previous highs. So far they have pulled back about 38% of the move from the recent lows. At this time, the only thing on my charts that could be an early indicator of the beginning of a bear market is RSI bearish divergence, but then you have to consider the voracity with which the market rallied off of those last lows. So far this correction is mild. I’m expecting that before the end of the first quarter of 2022 the markets will be at new highs. The two outside sources that I watch are both expecting the same, although there could be a deeper pullback coming before that occurs. Here’s the links to both of their Youtube feeds…

Here’s a good read concerning investing in junior explorers/developers. What jumps out at me is the often-used quote that only 1-in-5,000 to 1-in-10,000 junior explorers will ever get a project into production. An equally dismal statistic comes from the World Gold Council. Even for that lucky 1-in-5,000 junior explorer that makes an economic discovery, it takes an average of 24 years to go from the commencement of exploration to actual production. I think those 2 statistics combined might hint at the significance of a junior explorer actually going into production after successfully conquering those dismal odds and spending all of those years advancing the project and how rare this accomplishment is.

If you can juxtapose doing all of this at a time when new discoveries are at a 33-year low knowing that the majors need to constantly replace the Reserves/Resources they mine annually then the timing of Auryn having made this accomplishment might be looked upon as being rather fortuitous. Has the journey seemed to have taken forever? Absolutely, but we already were given a heads up that it would.

https://www.cruxinvestor.com/articles/junior-mining-companies-failure

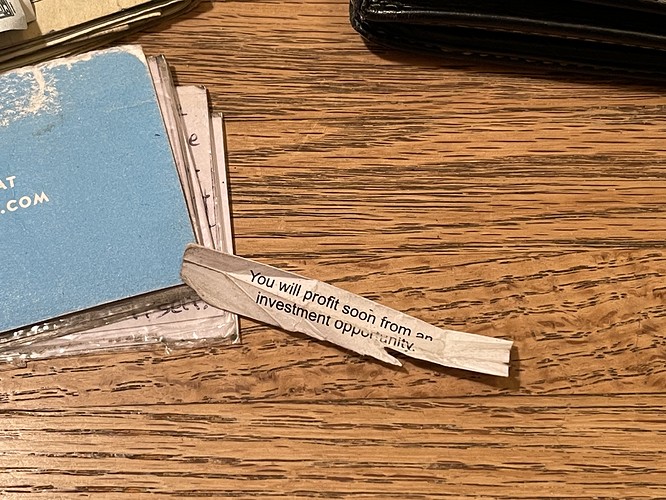

My Most Important Post Ever

Well, maybe it’s a tie with all my others…

But five minutes ago I was sitting here at the kitchen table and cleaning out my wallet when way down at the bottom of an outer fold I noticed a tiny twist of paper, not quite big enough even to qualify as a scrap. I sometimes find old credit card receipts smushed down there, but this was so small I almost didn’t even notice it.

It was crushed in there, stuck, and extracting it took some doing. I finally loosened one end of it with a finger nail and then blew into the fold as hard as I could. Voila! I had it out on the table.

It was ancient, like papyrus, and I was afraid it might disintegrate on me, but I took things slow and gentle until finally it opened up for me.

![]()

– madmen

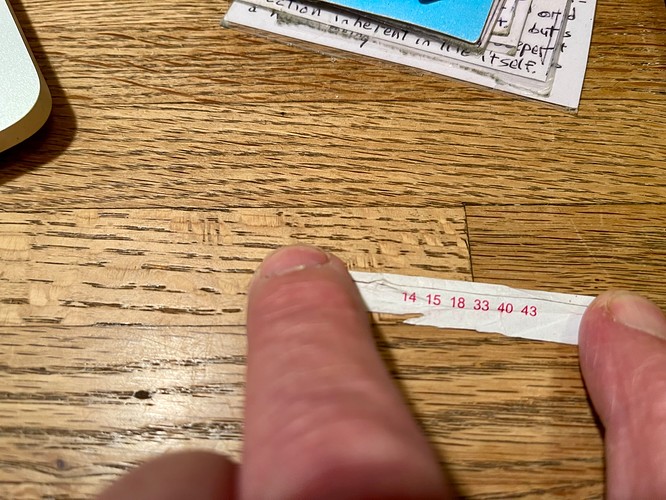

PS: A bonus for those of you playing along at home, here are the lottery numbers from the backside…

I think I have one of those laying around somewhere, too! They never say when “soon” might be  .

.

“Soon” = “Next week”

For us old-timers, this has been sunk money for a very long time.

After seeing up close and in precise detail what LP had done and how one-sided the preferred shares were, I considered this investment a major loss many years ago. After my first interaction with the SEC, I considered it a total loss. I was very thankful to eventually get through the discussions without getting completely halted and delisted. That gave me some hope that perhaps one day I may be able to exit with a portion of my investment returned.

At the very end of last year when I heard they rehabilitated the initial entrance into the Fortuna, and that it was done with no dilution, only to be paid back with future dollars if we produce, I was greatly encouraged.

Are we there yet? No, we are not. We still have quite a bit of work to do. But anyone who has been around for a while who cannot tell the difference between today and the previous regime is completely jaded and beyond repair. It is like bright sunshine vs complete darkness.

At some point, we will hit paydirt. We will be cashflow positive. We will pay back our debt dollar for dollar. We will scale operations. We will have audited financials. We will change tiers. We will issue dividends.

“Soon” is relative. Hypothetically, let’s say it’s Q4 calendar year 2023 before all that happens. Is that soon? If you bought shares in AUMC earlier this year at $0.50, no it is not. But if you have six figures+ invested since 1998, it’s very soon!

All I know is that the work is constant, regardless of normal mining setbacks and delays. It is being paid for in advance of production at no cost to shareholders. We get updates every quarter on the progress. Do I want it to happen faster? Of course. Who wouldn’t? Am I going to complain about the effort and progress? Not at all. I am delighted to see a phoenix coming out of the ashes!

@madmen, “soon” it is!

All good and fair comments.

The other thing we have going for us is that Maurizio, whose interests are aligned with ours, just might have HIS OWN definition of “soon”.

If I’m Maurizio, I’m doing EVERYTHING in my power to turn this business into an income-generating operation ASAP, not two years from now either. I’d be chomping at the bit to get my money back from the loan and to make profit in the form of dividends going forward. Just saying. But we’ll have to see what they say by about the middle of January.

Good to see you.

If they’d tell us how much shipments are generating and it’s good, flippers wouldn’t be manipulating the pps IMO