Totally agree. If I believed there was a $20M profit on the horizon I’d be long the stock .

Hey Mr. B,

I really don’t know how much dilution is coming via AUMC deducting/selling a portion of the shares owed to MDMN for expenses accrued. It’s probably not a big number. My point is that equating shares to a pecentage ownership in an asset has been exactly the wrong approach in this investment for the better part of two decades. MDMN gave up 75% of the “asset” in exchange for new leadership and, post several years of waiting, a small scale effort to move things forward. Percentages of assets is a moving target. Keep in mind that MDMN is currentlly trading at a market cap equivalent to ~10 cents post the explosion of share issuance (legit and otherwise) and not much has happened to the actual asset. Point being, the value of the mountain is not the same as the value of shares and investors simply don’t know what they don’t know. At least you know the cap structure of AUMC. You don’t know why its taken this long for MDMN to receive their portion of AUMC shares. You don’t know if there is a group trying to take control of the shell (you know there was an attempt). And you don’t know anything about the true value of AMNP as the company hasn’t bothered to file anything since 2015. BB may offer some speculation on the assets held by AMNP but he doesn’t have a clue on the equity representing the owership of those assets. Its an important distinction if you actually care about what you’re buying vs. writing essays on the merits on the geo/assets.

I believe there is a lot more than that coming. And it will seem very quick relative to the time some of us have suffered.

Right, it probably not a big number, Going back a couple of days to answer my own question, “Someone refresh my memory on just how MDMN settled it’s loan with AUMC (AURYN). Did AUMC accept shares of MDMN in repayment, or was it just the newly created restricted AUMC shares?”

With the reverse stock split, Medinah’s investment in AUMC through its ownership in AURYN decreased from 1,652,420,000 shares to 16,524,200 shares. On October 1, 2018, Medinah transferred 600,000 of its AURYN shares to the Board of Directors for Medinah in exchange for services performed, reducing their share ownership to 16,104,200 and reducing its percentage ownership to 24.217%.

In addition to shares in AURYN, Medinah owns 9,950,000 shares of American Sierra Golf Corp (AMNP) and 96,000 shares of Auryn Mining Corporation (AUMC). Through a settlement with Leslie Price, Medinah will own an additional 1,700,000 of AMNP and 195,500 of AUMC which are expected to be converted to Medinah’s name in Q2 2019.

Once converted, Medinah will own 11,650,000 shares of AMNP and 291,500 shares of AUMC.

Apparently, MDMN has quite a few freetrading AUMC shares in it’s “treasury box” which were converted from Les’s CDCH shares. Are these now being used to settled any debts owed prior to unrestricting AUMC shares preparing the way for distributing shares to MDMN shareholders? It seems as though this might explain some of the unusual higher volume trading in AUMC shares we’ve seen lately.

Expected dilution?

Here’s what Wizard had to say ca. 06/10/2021:

"I am not anticipating any dilution in AUMC or MDMN. I didn’t sit through interviews with the SEC while CEO of MDMN to make sure we didn’t get halted and delisted for nothing. I believe all of us MDMN shareholders will receive AUMC shares, proportional to our holdings in MDMN and MDMN’s holdings in AUMC. I don’t know exactly when or how that will occur. However, I still keep the same factor in my mind. When I look at my MDMN shares, I don’t think about the price. I simply count them as 0.005 shares of AUMC for each share of MDMN I own (and I own a lot of MDMN.)"

I think I’ll go with the man who was sitting at the table and has impressed me as level-headed.

After that, the question becomes whether Auryn will be able to turn a profit and ramp up production at the ADL. Correct, there are things we do not know - but I’m willing to bet that the people who are running this operation and who also by the way own a LOAD of shares in MDMN too (read aligned with MDMN shareholder interests) are going to do their dead level best to make it happen. Maybe I turn out to be wrong - but I like the odds.

By the way Wizard, thanks very much for your services - and I’m glad you got compensated for it.

Here. Waiting. Just spent a week in the Florida Keys not thinking about Medinah Minerals for a hot minute…

Hope you found some time to try some of those delicious stone crab claws that the Florida keys are famous for, or if not, the snapper and grouper are excellent!  Everyone needs a break from this stock!!!

Everyone needs a break from this stock!!!

I checked off all of the above Easy.

Hmmmmm … AUMC had abnormal volume today (100,000 sh traded) and its closing price was 1.00.

it was 100 shares at 930 open. MM just trying to draw some attention. IMO

Personally, I’ve been somewhat concerned with what I’ve been reading about the political situation in Chile (read “political risk”); c.f. the nightmare that Chile could decide to pull an “Ecuador”. I came across the following interview of Alex Black, CEO of Rio2 Ltd, which is currently developing a mine in Chile (5 Million+ ounces). I guess the good news is he doesn’t have a BAD attitude about continuing with the mining business in Chile at this point and believes that the waters are navigable - but he admits he does not know what will happen. His personal belief is that Chile is transitioning into a government more like that of Australia or the UK, not that bad considering hat Australia for example is a Tier 1 mining jurisdiction. I also found the parts about the big mining players in Chile very interesting (Yamana, Kinross, and Gold Fields being the current major players) - Mr. Black knows what he’s doing.

I’ve been looking at Rio2 for awhile now. Almost paticipated in the private placement last week at 65 cents. It’s a great deposit and now they are fully financed to build a plant with 90k + ounces annually for well over a decade. No doubt the jurisdiction has been a heavy weight on the stock but I always assumed the bigger overhang was the burden of finalizing a financing package that could get them to the finish line. Keep in mind that AUMC already trades at 50% of RIO’s market cap ($140M). Clearly RIO’s enterprise value is considerably higher. The precious metals market is a fickel one.

Maybe since Rio2 has just obtained financing it is just at the end of its orphan period (and at a low point) on the Lassonde curve? And maybe investors perceive that MDMN, which has some evidence of TWO potentially very valuable porphyries, is in the pre-discovery/discovery phase (and trending up) of the Lassonde curve? Maybe I’m wrong, but when people start seeing MDMN (Auryn) carting truckloads of 45 gr/ton ore they’re gonna start thinking a “discovery” has been made? When the money starts hitting the bank account, reasonable people will come to that conclusion. I think the Lassonde curve can be a very valid explanation of the roller coaster nature of the precious metals sector.

Going forward, I think Rio2 will be an excellent, conservative investment (and is under-valued at this time) - probably at least a 10-bagger. I wonder how long it will take them to build the appropriate plant.

I think MDMN is even MORE under-valued. Approval for up to 5,000 tons per month - which means they could work 4-5 faces at the same time at about 40 tons per day. If the grade holds up at 45 grams, I think we will be pleasantly surprised, and that’s an understatement. Run the numbers.

Hi Mrb,

As always lots of good points. For mining development stage corporations that trade on the OTCMarkets or on the Canadian exchanges, I look at the mining industry as being a race. The winners are the ones that can get positive cash flow the quickest. Positive cash flow provides SHAREHOLDER REWARD GUARANTEES. Markets often don’t. Some mining corporations need to raise money while their share price is low so that they can drill and block out Mineral Reserves and Mineral Resources (MR/MR) so that they can get noticed by the big boys. If you can gain the attention of the big boys in order to attract money to advance the project, then you’re going to cut a deal with the big boys while your share price is weak and end up either diluting your share structure via an equity deal or diluting future profits via a royalty streaming deal.

The ideal scenario would be to not be forced into cutting a deal until after your share price advances and then you’ll have more “optionality”. You might be able to keep all of your ownership intact and your share structure intact if you can self-fund or at least sit at the negotiating table with that option in your back pocket. It is true that self-funding might decrease the pace at which you advance the project. The difference between these two scenarios has to do with whether or not your project has EARLY PRODUCTION OPPORTUNITIES or not. Rio2 is an open pit scenario. They had to do a ton of expensive drilling in order to not only block out MR/MR in order to gain the attention of a suitor but also to be able to come up with the most economic pit design. The market is notorious for not rewarding ounces of MR/MR in the ground. Many development stage mining corporations are FORCED into doing it by necessity.

Auryn doesn’t have to do all of that. They can go straight into production and access those SHAREHOLDER REWARD GUARANTEES and block out MR/MR via the combination of trenching programs and drifting adits while making money. You bypass the dilution in ownership and the dilution in share structure especially if you have the major shareholder owning 70% of the shares writing checks and not demanding any interest. Maurizio doesn’t need to draw the attention of a major to help out on the mesothermal veins. He doesn’t want to share that asset. As far as the 2 porphyries and the Pegaso Nero project, sure Auryn will probably cut a somewhat standardized deal as he explained at the Las Vegas “informational meeting”. But the race to GUARANTEED SHAREHOLDER REWARDS will have already been won. If the market undervalues Auryn shares then management can simply buy back and cancel ridiculously cheap shares and thereby make any future cash dividends that much more generous on a percentage of share price basis.

Later on, management could still drill out the mesothermal vein systems and design a plan to attack it with a vengeance if they wanted to. You wouldn’t go to a royalty streamer; ENAMI has a generous program to help Chile’s development stage miners. But why would they want to for now. Any person with the ability to fog a mirror could tell right now that the mesothermal veins at the ADL represent an ABSOLUTE MINIMUM of 1 million ounces. Would it be worth spending a bunch of money now to determine if the final number came in at 3.72 million ounces or 4.54 million ounces? No. You want to get the money from the sale of those ounces into the bank stat. Putting those ounces of MR/MR onto the balance sheet doesn’t do you any good unless you NEED the help of a major to go to the next stage of development. Auryn doesn’t.

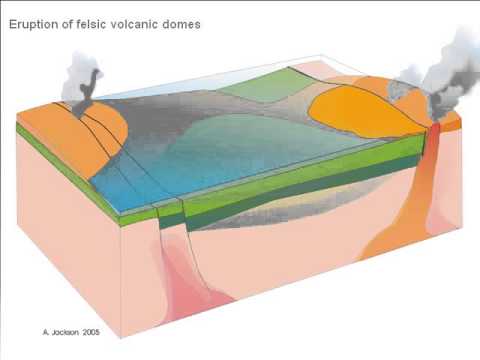

Below is a link to a video on mesothermal deposits. Medinah’s mesothermal vein deposit is not one of those 2-billion-year-old greenstone, craton-related types mentioned. It’s only about 91 million years old. They are rare but they stand heads and shoulders above the typical “epithermal” vein system in both GRADE and TONNAGE.

Here is the link:

If you don’t have much time, you might go to the 4:25 mark or so to see how the average grades dwarf the grades in an epithermal vein system. Their size dwarfs the size of the average epithermal vein system by leaps and bounds as they often extend to about 1,500 meters in depth. Within a “meso” system the grades can go ballistic with any “boiling zone” encountered. These zones feature a rare form of quartz called chalcedonic quartz which is exactly what we have at the ADL’s meso system. “Boiling zones” extend from 50 to about 800 meters in vertical width. Their average vertical width is about 300 meters. No promises but that could represent a very wide vertical dimension of insanely high grades. The average grade in a meso is about 8 gpt gold as the video shows yet our grades are well above that even in a 9-tonne sample which showed 45-gpt gold.

QUESTION FOR BRECCIABOY

Thanks very much for that perspective.

So, from reading what you wrote, it seems that the available low-hanging fruit from the mesothermal vein (read near surface) is what we’re going after at this time - to get the money in the bank and either save it up for leverage over a major or distribute as dividends now (or both). We can then LATER make the deals to drill out the rest of the epithermal/porphyries (with that leverage).

QUESTION: Are mesothermal veins usually found ON TOP of such epithermal/porphyry deposits? If so, it seems that we would DELAY any such deals until after we have exhausted the low-hanging fruit (so as to not get in the way of a major drilling out our property). If not, then it seems we could proceed with deals once we get the needed leverage with money in the bank account.

Maybe I’m looking at this all wrong?

Hi Mrb,

Mesothermal deposits form below epithermal deposits. They form in temperature environments around 300-degrees Celsius. Epi-deposits form in environments around 200-degrees Celsius. Porphyries form just below the mesos. The epis and mesos telescope into each other. There’s no fine line of demarcation. As far as cash flow, typically even successful underground operating producers can’t issue cash dividends right from the get go UNLESS their grades and widths are exceptional. What you do with the cash depends on the share price and whether or not the stock is undervalued. If there is a severe undervaluing by the market then management should buy back and cancel shares. This supercharges a later cash dividend distribution because a given amount of cash available to distribute will be allocated to a lower number of shares and the dividends will be that much more generous on a percentage of share price basis. An extraordinarily generous cash dividend will drive the share price up to a level at which the cash dividend is moderately generous.

Any major that inks a deal on either of the 2 porphyries will know exactly what we have at the mesothermal vein deposit. That leverage is already in Maurizio’s back pocket. The insanely high grades found in the mesos probably came from a magma chamber with extraordinarily high gold grades. The “porphyry” that underlies many epi- and meso- deposits, is simply the relict magma chamber plus the area around its old roof/carapace. I’d cut a deal for the Pegaso Nero now unless management figures that a little bit more exploration/development on Auryn’s nickel might improve the terms of the deal significantly.

For me, the $64,000 question is this: might the grades associated with these veins when they are 2-meters thick, like the 2 “massive veins” Auryn has been referring to because they are over 2-meters wide at surface, be significantly higher than the 45-gpt grade associated with that 9-tonne sample sent to ENAMI. Let’s think about it for a minute. We’re in a “Low Sulphidation” (“LS”) vein system. This means that the gold ore stays pretty much contained in the vein proper and doesn’t go into the adjacent wall rocks. That 9-tonne sample was taken from a vein that was only 0.5 meters wide. However, the average grade all of the way across the working face of the tunnel found in the rubble post-explosion was 45 gpt gold. Wouldn’t the grade within that vein proper have to be about 6-times that 45 gpt figure in order to make the AVERAGE grade in that 9-tonne sample 45 gpt gold? That would suggest that the 0.5 wide vein was carrying 270 gpt gold which seems absurdly high. If that 1/6th was running at 270 gpt gold then the average would indeed be 45 gpt gold. What we don’t know is how much visual sorting, if any, was done by the geoscientists so that only the fancier stuff got sent to ENAMI. But when you’re dealing with a pile of rubble, it’s tough to tell the good from the bad. When that ore is sitting on the working face you can make out the outlines of the vein but after the blast, who knows? We know that management has no concentrating facilities in place on site.

If you look at the 3-meter-wide working face of that tunnel, 5/6ths of it was worthless gangue and 1/6th had lots of gold. We now know that 6/6ths of that ore (all of it) graded an average of 45-gpt gold. Now let’s take the example of a 2-meter-wide vein consisting of that very same 270 gpt gold but with only 1 third of the working face being worthless gangue. Now the average for that pile of rubble post-blasting would theoretically be 180-gpt gold. Let’s go one step further. If the two “massive veins” that were 2-meters wide AT SURFACE were 3-meters-wide at the 150-meter depth level below the plateau where the new adit is. Shouldn’t they average the full 270 gpt gold?

I’m going to assume that some sorting must have been done post-blasting because these numbers are just way too high to be credible. I know from the literature that mesothermal veins existing in a “boiling zone” where gold grades can indeed get a bit insane, can reveal some pretty nasty grades. I personally am buying Medinah now but waiting for more corroborative data before getting aggressive. I can sense that Kevin is about to pee his pants so I keep running through scenarios that might be playing out in the background. One way to envision this is to assume that the hydrothermal fluids and gases emanating out of the magma chamber are bright yellow and the native rock in the area is white. This bright yellow stuff rises through the rock strata and the material on the one side fills up a crack that is 2-meters wide and the material on the other side fills up a crack that is 0.5-meters-wide. Either way the working face of the mining adit is 3-meters-wide. If you have a bright yellow 0.5-meter wide-vein in the middle of a 3-meter-wide working face and you blast it you’d get a whitish-yellowish rubble that grades 45-gpt gold. If you have the working face of an adit with a 2-meter-wide bright yellow portion and 1-meter of white material the resultant rubble is not going to be the same shade of whitish-yellow (grade) as was the case for the narrower vein. I’m not going to make any predictions or any investment recommendations. My advice would be to stay tuned for now but not be surprised if that insanely high 45-gpt grade might get higher as the widths get wider.

So you’re basically saying that RIO is a spec play that has been crushed b/c of dilutive financing (even though they debt financed the plant) explaining why it’s only trading at a $130M market cap (even with 5M in measured reserves and a very attractive path to producing 90k+ ouces for over a decade). While AUMC is more of a “sexy play” b/c they are working towards 40tpd, have no defined resource, and have bought a truck…while supporting a $70M market cap while trading on the bulletin boards.

You coneniently leave out one point: Maurizio spent the better part of three years pursuing streamers, the “big players”, ect to fund this project. The generous, small loan, was only tapped b/c all of the other players, who evidently couldn’t fog a mirror, passed. I’m not saying this might not work out as a blessing in disguise, but I’d avoid making it seem like this was part of a grand plan. The project hasn’t been collecting dust for no reason.

I understand the Lassonde curve but its worth pointing out that stocks typically resume the “hockey stick” as they knock on the door to production, similar to the one experienced during the explosive discovery phase.

I’ve never debated BB on “geological matters” but when it comes to the market and actual investing, I admittedly struggle with BB’s analysis. A compare and contrast between AUMC and RIO are not even in the same league (with the exception of market cap). But that’s what makes a market!

Wow!!! That is some very specific inside information that you just let loose. Please tell us the source and when this was disclosed to you.

If you do not respond to this question we will know that this is just your opinion of what you think took place and not actual fact.

We look forward to your detailed response.