I often wonder why someone who is so self acclaimed smart as you is even bothering with mdmn and AUMC.

I’m sick of listening to you.

Go troll somewhere else

Anyone who’s been investing for awhile should make a habit of journaling their successes and failures to evolve their process. Obviously the MDMN saga would be in the failure bucket but I still enjoy following the story, learning and observing. I’ve also kept a dialogue with Maurizio in the off chance that an attractive financing option (unrelated to equity) may come to the surface. No luck as of yet.

However, when folks like yourself spew an emotional response to a post it should highlight an obvious red flag to many investors here that objectivity is clearly absent amongst a large slice of the investor base. Typically a very bad sign.

It’s not emotional

I’m fine financially but your arrogance is through the roof

You disappear when the news comes out and price goes up

Price goes down and you magically appear

Why such a smart guy hangs out on this board is a mystery

It would seem someone with all that intelligence would be doing other things

Personally I think you’re not worthy

“I’ve also kept a dialogue with Maurizio in the off chance that an attractive financing option (unrelated to equity) may come to the surface. No luck as of yet.”

Sorry to disappoint you but highly unlikely even if there was a financing option that Maurizio would give any kind of info. to you.

Also lately there are penny stocks that are running from .0001 to .60 with no fundamentals, yes Baldy NO FUNDEMETALS!

Quite honestly, anyone who would invest in a 750 tpd operation with a $35m market cap is not investing in a company with much potential. You need to make it a habit of journaling your failures and start shifting over to companies with more obvious prospects. You went with a company with 2 grams per ton of production and passed on a company with 45 grams per ton coming right up. You should come out of it all right if you’ll sell that loser of yours and shift over to Auryn next week before you miss out on the next leg up in the POG starting next week.

And as far as that little blip down in MDMN’s price. The market makers will very often take the price down to the midline of the Bollinger Bands when it’s riding the upper line of the Bollinger Band just to perk up the volume. You should see that happening next week. Mark that down in your journal.

You never answered this post I guess you were shocked that you were wrong. lol!

“Here you go Baldy similar stock like AUMC, it was trading at .54 in 2018. Did they wipe out the shareholders and start clean?? No they started small just like Auryn.”

Well that’s a solid Investment foundation: other stocks are going up on a non fundamental basis so let’s HOPE we are lucky enough to benefit from the same.

Maurizio is actively looking for a way to finance this company. There’s no secrete. And he’s been unsuccessful (read: mining 9 times tonnes). I manage a fund that finances mining operations. Sorry to disappoint but…

The insecurity and defensiveness of the longs here is pretty tangible. Some may need to remind themselves that it’s just a piece of paper. Albeit one that is essentially worthless.

When the news gets out that some little rag-tag outfit down in Chile is producing 45 g/t on its own, then all SORTS of options will present themselves. Personally, I like the do-it-yourself mentality - yes it will take a long time, but just take the first step and you will eventually end up at your destination.

A ragtag operation that’s been around for 30 years and managed to fill less than one truck with ore and has no defined resource and is “attached” to a public vehicle (MDMN) where there’s not a single shareholder who knows how many shares are outstanding post settling accrued liabilities. It’s coming…

At the risk of missing the fireworks I’ll check in again next quarter and look forward to the constructive feedback on all of the exciting developments. Maybe we can overly examine some blurry satellite images of a new hiking trial on the mountain.

UNDERSTANDING BALDY:

The picture is clear now. Baldy manages a fund that finances mining operations. He divested his interest in AURYN/MDMN so that he could attempt to negotiate with Mauricio about his fund providing needed capital ( Non equity per Baldy ). Remember Baldy’s comment from an earlier post about wiping out the existing shareholders?

It is obvious that Baldy knows the incredible value tied up in the mountain and he is apparently trying to convince Mauricio that he will be much better off economically with his non equity financing than he will be continuing to carry us MDMN shareholders.

Note how Baldy refers to the operation as a “RAGTAG OPERATION THATS BEEN AROUND FOR 30 YEARS AND MANAGED TO FILL LESS THAN ONE TRUCK WITH ORE AND HAS NO DEFINED RESOURCE”

Note his final comment as well:

“MAYBE WE CAN OVERLY EXAMINE SOME BLURRY SATELlITE IMAGES OF A NEW HIKING TRAIL ON THE MOUNTAIN”.

Baffling comments from a fund manager trying to work a financing deal with Mauricio.

“Well that’s a solid Investment foundation: other stocks are going up on a non fundamental basis so let’s HOPE we are lucky enough to benefit from the same.”

And we will benefit when Auryn starts a string of PR’s that they are mining, cash positive and a few large gold nuggets on the side. Those pictures of those rocks on Auryn’s site from the Don vein are more than spectacular!

When is the last time you spoke with MC?

I exited my positions (thankfully), years ago b/c I came to the conclusion that the equity wasn’t worth anything. You are correct in that I believe the “mountain” has some value. I’ve been pretty consistent in saying that it’s critically important to separate the piece of paper you own vs the fundamentals on the hill. It’s hard enough to make money on a mining penny stock. It def doesn’t help when the company’s BOD issues a billion fictitious shares. Lester put a nail in this coffin. Back to the “asset” I’m not pursuing any alternate financing options for MC/MDMN. Yes, he’s been pursuing options for several years but I wasn’t able to come up with a viable solution given the risk profile (read: no security, very early stage, no working capital, etc, etc, etc). I haven’t spoken to MC in over 3 months so it’s possible that he was able to find some financing. However, highly unlikely as there has been no disclosure of the same and barely any progress on the hill over the past two years. I think MC is stand up guy and it’s possible he’s throwing a couple pennies toward the project to avoid the collection of dust. Add to all of the other accrued liabilities that will ultimately lead to a dilution in MDMN’s share of AUMC.

Dude get lost!

Do us all the most incredible favor Debbie Downer. Don’t ever check in again we don’t need your self promoting non-expertise opinion. Move on to something that would work for you and let us be the captain of our own ship and destiny. We don’t need you trying to row our boat. We will do just fine if we don’t EVER hear from you again. Have a great life nothing personal no emotions just move on. Any preconceived credibility you once had has long since expired. Enjoy your life outside Medinah land. You sold your shares long ago and your continued attacks on Doc and others disingenuated you from all of us.

One would hope that a counter point view would be welcome on an investment discussion board. Unless the only point is to promote the stock (which doesn’t seem to be working). You can probably tell from my posts that I’m not looking to make friends here and credibility is empircal if you are involved here to make, or avoid losing money. The score board speaks for itself, as do the defenisve nature attacks of my posts (without the ability to dispute the points I’m offering). See you in the third quarter!

And yet here you are posting negative dribble! Why would you keep posting here?

BE raises the legitimate question: How are all those guys working on the mountain being paid? They aren’t working for free. There are several pictures of the bobcat that mention “overtime”. So some operator is being paid overtime. In addition, all that equipment that Auryn mentions in their update: someone is paying for that. And Auryn Mining Corp is not paying for it out of their own resources because they have none. The bank account is empty. These are basic legitimate questions. We do not have the answers at this time.

My own suspicion is that MC directly or indirectly (via Masglas or something) has secured financing or is fronting the money via a loan to AUMC. The approach they are taking of putting the Caren on hold and starting with Fortuna which they claim will lead to 40 tonnes per day at 45 g/t plus during this quarter implies to me that they chose the very cheapest and fastest way to bootstrap even though production levels will probably remain limited for quite a while. Maybe this is bootstrapping capital is $1M to $2M plus or minus given the limited scale of the work. It probably is not $5M or $10M. This loan or whatever it is will have to be repaid. We should know more with the next financials.

Given this though also puts into context the 40 tonnes per day at 45 g/t plus. This would amount to around $30M / year revenue at decent margins most likely. (This remains to be seen but obviously MC thinks so. And I think $30M / yr at good margins would probably compare well to other $50M / mkt cap comparisons). If this is the case then it most likely will not be a large issue to repay whatever form of financing has been arranged. Questions remain how or where they go from here. If they just live off profit from here it will probably be a slow steady ramp of production and capabilities and exploration. So yes, it could take multiple years plus before they really ramp to some kind of more serious production levels, e.g. 15 KOz -> 50 KOz or more. But as long as POG remains high it can be done. If we would have a crash in POG, all bets (and possibly progress) would be off.

The above is actually true for me. While I hope for the best, I value the voice of experience and the educated contrary opinion. I’ve been here long enough (close to a decade now) that I can easily remember friends I had introduced to MDMN being run off this board for the crime of opining that the company’s previous management was clearly a bunch of low-life scumbag lying crooks, which turned out to be accurate.

It seems obvious that there are gazzillions of dollars worth of ore in the Mountain. It seems almost impossible to believe that it might not get developed someday – by someone! – and make a lot of money for any investors fortunate enough to live that long. But it very well may not be any of us.

During my near-decade here, Baldy has for me always functioned as a good reminder of the risks involved, and, like brecciaboy and many others, of the long timeline and numerous other complications involved.

– madmen

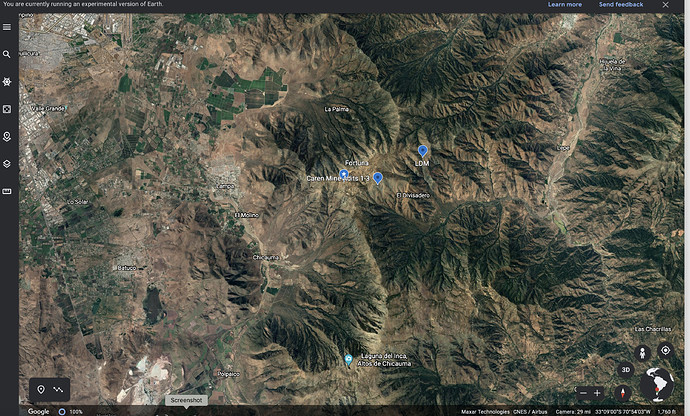

Wow awesome image! It looks like an image of an explosive volcanic eruption. I noticed the ADL is actually centered between two converging semicircular ridge lines. I don’t know that much geology, but I believe these mountains were generally the result of uplifting by two converging tectonic plates. That would mean erosional forces wore down the tops of the mountain, but why is there curvature in the imaged ridgeline near La Palma? (I’ll show that below shortly.) It reminded me of something I recently read in a few articles about a new impact crater about 40 miles NE of Kalgoorie found in Western Australia. It is not even visible from the surface, but was found while searching for gold while undergoing geomagnetic mapping in the area. (Drilling for Gold Uncovers Unexpected Treasure | Spaceaustralia). What made this interesting is that it is well known that Vredefort-Witwatersrand and Sudbury are areas associated with high impact meteor strikes hosting some of the most economically precious metal deposits on earth. The resulting deposits were from completely different processes.

“Many large meteorite impact structures throughout the world host mineral resources that are either currently mined or have the potential to become important economic resources in the future.” (https://www.univie.ac.at/geochemistry/koeberl/publikation_list/265-Economics%20of%20craters-Impact%20Tectonics-2005.pdf)

I don’t think the ADL is at the top of an extinct volcano, although there may be one or two nearby.

There is no doubt that brecciaboy knows his geophysics better than anyone else on this forum as exemplified by his many posts over the years on this forum (and earlier versions that preceded it). Back in Sept. 2018 as Hochschild was entering a binding letter of intent with the newly organized Auryn Mining Corporation DOC wrote:

The metal bearing hydrothermal fluids that came out of the magma chamber underneath the LDM ran into horizontal layers of limestone and siltstone. They drove out the limestone and “replaced” it with calc-silicate rocks known as a “skarn”. In the areas where siltstone was encountered they “replaced” it with cross-cutting sulfide veins and layers of massive sulfides. “Andesitic porphyry” (of the copper-gold variety) rock also intruded volcanoclastic rock with quartz-hematite veinlets at the LDM. In porphyries, the sought after metals are typically found in these tiny “veinlets” or in “stockworks” of these tiny veinlets. Mining these types of areas is what Hochschild specializes in i.e. skarns, veins and porphyries. Maurizio promised us a “massive” exploration effort by “specialists [PLURAL] in the types of deposits found at the ADL”.

To the southeast of the LDM, the area was intruded by a quartz monzodiorite porphyry of the copper-moly variety. “Porphyries” (as well as IOCGs) are the elephants of the mineral deposit types. “Copper-moly” porphyries are the biggest of these elephants. This area is probably going to be developed by a “consortium” of majors.

For me the significance of the Hochschild deal is that a major miner basically said that we think that the hydrothermal fluids and gases coming out of the underlying magma chamber are pretty special. We already suspected this by the grades of gold, copper and moly already encountered all over the ADL Mining District both at depth and at surface. These magma chambers are beyond gigantic so it’s kind of nice to know a little bit about the metal bearing nature of the hydrothermal fluids emanating out of them. From an investment point of view, the Hochschild deal represents news flow for a very long period of time.

The signed option agreement does not conclude until the end of the 5 year period in December 2023, provided certain conditions are met.

I’ve begun to get a little off from where I was going with this post, so I’d like to try to keep this as short as possible by presenting a couple of google earth images. The 1st is an “upsidedown” view (North is at the bottom) of the ADL with La Palma in the background.

This second image shows the ADL is neatly centered between two semi-circular mountain ridges. These were either likely remnants of volcanic activity, or perhaps even a meteor strike a couple hundred million years ago. In either case, tremendous stress induced shock waves that converged on the ADL from opposing directions. These stresses would create cracks allowing thermal/hydrothermal activity and geological changes to occur that DOC so aptly described in many of his posts over the years. Also, recall the parallel nature of the many veinlets reaching the surface. These are primarily running in two opposing directions where these shock waves would have intersected. Anyway, I thought this was quite interesting, but what I’d like to know is where that magma chamber is centered from where all these veinlets originated!