This coming from someone who has consistently attacked those with critical (yet ultimately totally accurate) analysis & opinions as being “paid bashers”? Sadly, it is obvious who has been right and who has been wrong over the years, regardless of how we wished things worked out. If one has courage in their convictions, then by all means, logically debate Baldy. Silencing him is cowardly.

Tail dragger I do not know you nor do you know me. I have not consistently attacked anyone. You obviously have me confused with someone else. If you ever want to verify something about me with me PM me and we can keep things real. I have called out John bald eagle for his attacks on Doc that have been personal and have no place on this board. I let bald eagle go on and on for years with his incessant attacks of Doc and finally grew weary of his agenda. If you go back and look at Doc’s posts over the years you will find bald eagle coming right behind within minutes or days and trying to undermine Doc personally and professionally. That is an agenda plain and simple without one apology to Doc. This board should be about pro and con about the stock not about a personal attack on someone. Even my post addressing bald eagle ask him not to come here anymore because he adds nothing to the discussion was a request and not an attack. I used facts and addressed him personally. The Debbie Downer comment is to say that every time he posts it is a Debbie Downer to this board and it adds nothing positive as many many posters feel the same. His posts are ad nauseam over and over again which we’ve all heard and read for years. If he wants to address things and not be personal with Doc then I would be more than willing to not say a thing about his posts. He sold long ago and he has an agenda which is very apparent in his posts. I wish him well as I do everyone here. I have spoken to him personally on the phone many times addressing these things with him but him attacking Doc on a public forum is uncalled for and anyone remaining silent condones his behavior. Have a great day

Thank you wiz! That pretty much sums it up.

Ok I’m going to throw my hat in the ring to get it shot at.

I have never had a bone to pick with Baldy. And I have read “ALL” of his postings. I can’t say as so much, for the ones after his though. As I knew what road most were to go down.

I respected that he challenged the thoughts of many as to, “just WTF” the old MDMN owners, Less and JJ were up to at times. Turned out he was right on most of it.

That is where much of my respect for his postings lays. I will leave the other parts alone.

He still brings to the table some hard facts, hard to swallow for some…

Such as, this is still a small operation out there in the mining world.

What some gold seekers call : a “family mine”. [You pull together your family, some good buddies, a good mechanic, a cook/gopher, get backing from who ever will listen, and start moving dirt.] there’s more to it then that. But you get the drift. Nothing bad about starting like this, better then nothing. Or the old track record; (Quote; Baldy)A ragtag operation that’s been around for 30 years and managed to fill less than one truck with ore and has no defined resource and is “attached” to a public vehicle (MDMN) where there’s not a single shareholder who knows how many shares are outstanding post settling accrued liabilities. **I think you could say thats true?

That’ Is why I read his posts. C.s. A Realistic optimist

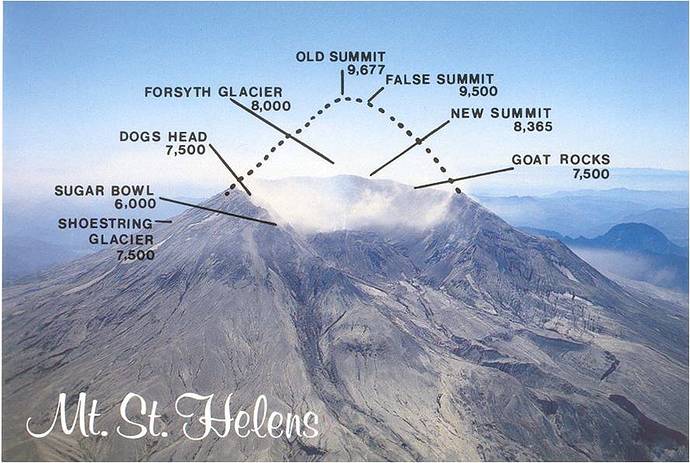

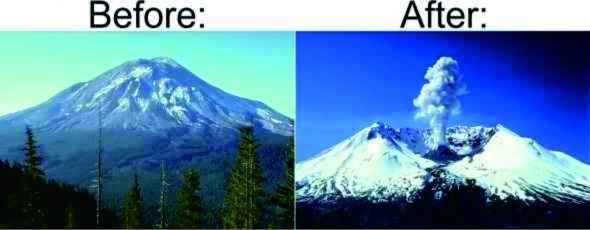

One can look at these before and after pictures of Mount Saint Helens to see what happens to the top of mountains when De Volcano Blows.

So Mountain Helens bulged then ruptured out of its side. Blowing its top away and all in its path on that side for miles. But on opposite side, hardly any damage.

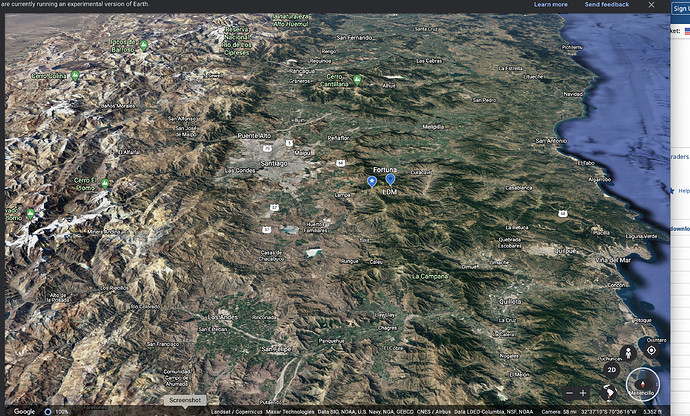

As this happens to many volcanoes, it leaves a half moon shaped crater and send lots of ash and debris to base and valley floor. One can see this on east side of our mountains where it happened 3 to 4 times. That is what helped fill the fertile valley basin of Santiago. Throughout this area of south America there were 2 episodes of tectonic plate upheaval with a pause in-between. When the plates pause they cool and stick for long periods of time. During these dormant times, the lid is on the pressure cooker, all the goodies under it have time to load up and concentrate. After which they tend to be violent when they break loose again. Our area was a squeeze zone also. One can look back out at the coast line and see the V area along it. A concentration zone.

So this is one of earths honey holes. And we have guys picking some of it out for us. Thank you guys. Cs

JCN, in the past, you’ve attacked those with critical opinions by terming them “paid bashers”, a clearly ad hominem attack unsupported by any evidence. You didn’t like what was said, so you attacked the author. I’ve been in this investment way longer than you have been posting, and I’ve lost a ton of $ and don’t believe there’s much of a chance I will recoup my losses. I generally don’t post in here due to the immaturity, inexperience, hyper-sensitivity, and lack of critical analysis that has been the norm for over a decade. Baldy’s logical question to Doc “why do you write novels about Medinah without ever spending time talking to the powers that be” is especially relevant and consistently unanswered. I’ve read about naked short selling and all the other insane explanations as to why our criminally mis-managed company wound up in this essentially worthless situation for 20 years now and see it for what it is. “Doc” deserves no insulation from critical critique as he has never been correct, regardless of the length of his dissertations, or the “goodness in his heart”. No offense to him, tip of the hat for the effort, but let’s recognize myopia when it is evident. Even if honorable folks try to put this sham back together, the endeavor will be exceedingly challenging, which is the point Baldy has been trying to hammer home for the last four years. Should you have specific issues with my general argument, I am all ears. Otherwise, I wish you well, and pray most of your investible resources are allocated elsewhere. Good luck!

Not sure why all the weekend discussion gyrations. We have been a rock bottom for years. It can only get better from here.

Yes, caution is still advised especially since Auryn has had 2 or 3 false starts on getting production off the ground. Another quarter from now should tell the tale. If they complete the production tunnel into the high grade mineralization, get their needed permits, get production to 40+ tons per day, become cash flow positive, I think we are good to go.

I foresee that they will be able to scale up to a sufficient level to leverage a very good financing option later by outlying a resource. They should also be able to use profits to further explore other parts of the mountain as well for additional potential JV’s or restart of the Hochschild JV etc.

The pandemic and lack of supplies I believe is a dam holding back demand and massive inflation and when that dam breaks it will probably be good news and bad news for gold stocks. Bad for costs but good for the price of gold. Just hoping price moves further and faster than costs.

JCN. The beauty of this board is the archived posts. Hard to escape the actual history of what went down. Before you shed too many tears for BrecciaBoy I’d encourage you to read this post he made in November of 2015. Not only did he slam my theory of illegal selling of shares (which we know is true) while defending Les, the BOD and the transfer agent, but he also attacked my family who had made similar accusations to Les in years previous.

"Recently you witnessed some selling. At first you said that’s Les Price selling. Then the story became that its not only Les Price but he’s actually ILLEGALLY selling RESTRICTED shares. Why was it illegal? You told us that he was not filing the forms that an insider needs to file if they are a 5% owner of shares. You told us that Les had been doing this ILLEGAL selling since September. Later the story became that Claro too was ILLEGALLY selling RESTRICTED shares without filing the appropriate forms. Then you told us that Medinah’s BOD has been doing this all along. Your certainty level was its usual 100%.

Let’s slow down a bit and review the TRUTH that somebody not needing to scratch an “anger itch” on a daily basis might say. First of all, there is no 5% ownership laws demanding the filing of any forms. There is a 10% law BUT IT ONLY APPLIES TO CORPORATIONS REQUIRED TO REPORT TO THE SEC UNDER THE TERMS OF SECTIONS 12 AND 15 OF THE '34 SECURITIES EXCHANGE ACT. These are SEC Forms 3 (initial),4 (any changes in beneficial ownership) and 5 (late reporting of a Form 4) that are supposed to be filed. Medinah is NOT one of these “SEC FILING” corporations. As an OTCMarkets Pink Sheet company “current” with the “alternative reporting requirements” Medinah disseminates public information by filing 211 (a)(5) reports accompanied by an “attorney’s letter”. There are 9,800 companies trading on the OTCMarkets. The reporting requirements of SEC registered issuers involving 10 Q’s and 10 K’s are vastly different than 211(a)(5). BUT WE KNEW THAT OR SHOULD HAVE KNOWN THAT BEFORE BUYING OUR FIRST SHARES.

Thus there are no 5% ownership “filing requirements” for Medinah affiliates/control persons nor are there any 10% requirements to file Forms 3,4 or 5. Further, as far as Les allegedly ILLEGALLY selling RESTRICTED shares there is no way you or anyone else can detect the sale of RESTRICTED securities in our markets. If your allegation is true, this would involve the COMPLICITY of Medinah’s Transfer Agent (for illegally removing restrictive legends)and their Corporate Counsel for falsifying the attorneys letter needed to remove a restrictive legend.

John, your pattern of DECEPTION in these matters is so clear that you must, as an investment professional subject to all kinds of codes of conduct, realize this. Recently you engaged in a campaign to solicit funds from Medinah shareholders in order to pay the legal expenses to audit the sale of shares of insiders that you already informed us in a declarative fashion have been going on. Did the cart accidentally get in front of the horse? To my knowledge and that of several of my colleagues, there is no legal theory available to compel compliance with such a demand. Who’s going to tell the donors?

You made the suggestion that the results of this campaign might even end up in Les Price being forced into the open market to buy REGISTERED securities and it might even result in Les going bankrupt. Notice the scratching of that “anger itch”. Shouldn’t you pay the legal expenses involved in seeing if your assertions of ILLEGAL behavior are true or not and shouldn’t the results of any such audit antecede your accusations. John, you just can’t engage in DECEPTION like this in conjunction with the purchase and sale of securities of issuers whether “registered” with the SEC or not. The same goes for soliciting the funds of others under false pretenses. That’s why 10b-5 is called the “omnibus anti-fraud” rule.

I think it’s time you came clean with the forum participants that have been making buy/sell decisions based on your allegations. I would include the legal issues involving your family and Medinah as a starter in order to provide some context to your behavior. Why do I request this? It’s because your actions have put me into an ethical “no man’s land”. My faith does not allow me to engage in the type of behavior you have undertaken. I brought your Dad into this deal. He has the exact same tempermant that you have. He made the exact same accusations you are now making and in a similar fashion. Medinah had no choice but to handle it in a legal fashion. In a derivative fashion, I am responsible for your behavior and your Dad’s which bothers me a lot. You brought this upon yourself, not me. What’s amazing to me is that even knowing that management is transitioning out you actually have accelerated your campaign. One question I have for you is don’t the clients that you put into this deal have recourse to recoup any investment funds lost when the party that suggested the investment has done everything in their power to crush the invested in company due to personal family issues?"

As a matter of perspective, it is worth looking at gold grades at other mines around the world as they compare to the Fortuna’s Mine. (40 + grams/ton). As you can see, it compares very well further boosting the notion that the Fortuna mine will be able to generate good positive cash flow.

https://www.kitco.com/commentaries/2020-11-27/Highest-grade-underground-gold-mines-in-Q1-2020.html

Interesting analysis CS. Thanks for the St. Helens’ images. I can see on the google earth view there is a ring-shaped feature surrounding Santiago with the Southside blown out suggestive of the remnants of previous volcanic activity. (I chose this orientation as though I was looking down South at Chile from the US).

In my earlier post, I did throw out the meteor relevance to the origin of some economic precious metal core bodies. It only reminded me of the appearance of a meteor crater on the rim towards La Palma. Meteor strikes explain an origin theory of why some of my investments in different parts of the globe have resulted from the shock waves produced by high impact meteor strikes fracturing the underlying rock structures. I did go off focus from the main point I was going to make and I’m glad you brought things back into focusing upon the ADL and it’s mineralization. Although gold is the surest shorter-term path to monetary exploitation. It is the low hanging fruit.

I fully agree that during different times in the past two major seismic shocks occurred ( and many smaller ones) which was the major point of my previous post. Regardless of whether Tectonic Plate shifts or Volcanic activity ( or even the possibility of a meteor strike - unlikely?) occurred from different central points, these shocks gave rise to the resulting numerous fractures evidenced on the ADL. The resulting cracks in the underlying rock intersected and concentrated as seen in the area of the flattened mountain top. This is clearly shown by the opposing veinlet structures (and major veins) that reached the surface and have largely “weathered” away over the years. These parallel and opposing surface deposits have been pointed out in numerous posts. These multiple fracturing events over the years have resulted in a much higher concentration of ore deposits reaching out and up from wherever the magma bulged up to allow the epithermal processes to evolve over the last 100 million years or more.

Recall these excerpts from an earlier Feb 3, 2016 post by breccia boy:

If you want to zoom in a little bit into Figure 1 on todays AMC PR you can see how linear the arrangement is of those high grade moly showings. The line extends to the NNW. If you continue up the page (NNW) you smack into the Gordon breccia. If you go a little further NNW you run into the Merlin 1 Vein which continues across the plateau heading NNW until it runs into the ultra high gold grade Caren Mine. This is one extremely straight linear arrangement of very high grade ore.

Recall that Perez’s hyper-spectral satellite imaging survey detected a 7 Km long swath of about a dozen intrusives oriented in a SW to NE fashion along this very same southern downslope off of the plateau. This faulting would be at about 90-degrees to the NNW lineal fault.

Also, one should remember from early on, the underlying real prize of the ADL is the copper porphyry, if it can be defined. After reviewing the most recent satellite imagery of the Pegaso Nero, I conclude little or no work has been performed, other than earlier surface sampling and mapping. Rock samples by measuring Re/Os data indicated the Pegaso Nero mineralization is about 91 million years old. Porphyry copper deposits are the major source of copper and significant sources of molybdenum, gold, and other metals. There is hope for the PN to be in play someday, but from all appearances that is some time distant in the future.

Refer to Cornhusker’s comments and map from Aug 2018 (along with partial excerpts):

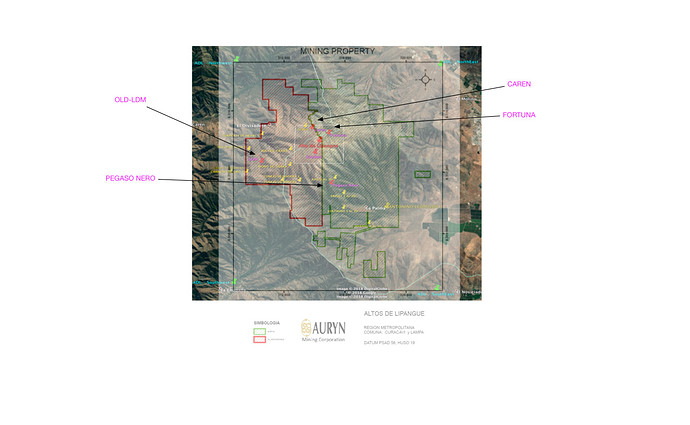

Going by the coordinates on the map, it looks to me they basically split the mountain in two. What they are calling the ‘LDM’ is basically everything that isn’t the Caren and Fortuna and associated stuff to the south. This is the map I came up with. It’s not exact. But I think you can assume the Caren forms the upper left point of that jagged diagonal line, which probably follows the Merlin 1 vein.

Pretty clearly, the original ‘LDM’, the Pegaso Nero, and probably the Gordon Pipe area are all included in the JV (3000 hectares). All of this is titled the “currently named LDM project” in the PR. Yellow marks indicate those new claims that were published this past May, obviously filling in some properties for the JV.

In fact, you can note they basically split the south side of the mountain in two. If there is a porphyry right there where the Pegaso Nero is pointed, the property of both companies would obviously be involved in any future JV / mine etc. having to do with that target.

This stock “investment” will remain in my sock drawer until there is actual cash flow that is reported for at least several more quarters. If, as suggested by CHG, 40 tonnes per day of 45 g/t can be mined, and processed, this could add up to an annual $30M gross. Could this be sufficient to justify releasing the restricted AUMC shares? I note from the annual report that there are 100M shares authorized and 70M shares outstanding. There are also only 3,989,277 shares in the public float. That is a very tight float. The primary reason to unrestrict the AUMC shares is to use the 30,000,000 treasury shares currently held in reserve to fund aggressive mining and production. At least, that’s the way I see it. I expect there will be a delay in unrestricting the AUMC divvy shares until there is some definitive valuation that can be assigned from progress being made and widely publicized. Unfortunately, without promotion it is unlikely shareholders will see these unrestricted divvy shares anytime that will satisfy anxious shareholders.

For context I just wanted to add the following information concerning the PN. Click on the link to see the area (Fig. #1) that was sampled. It is the same area I examined in the most recent satellite images referred to in the previous post and failed to detect any new signs of exploration activity.

Preliminary Exploration at Pegaso Nero Target Suggests the Discovery of a Copper Molybdenum Porphyry System within the Altos de Lipangue Project.

February 03, 2016 @ 09:12

Highlights

- A soil molybdenum anomaly area with 3.6 kilometers by 1.2 kilometers was defined surrounding the known tourmaline-specularite breccia.

- Rock sampling returned up to 1.2% Cu, 860 ppm Mo and 0.12 g/t Au in the hydrothermal breccia.

Re/Os dating in the breccia returned 91 ± 0.4 Ma, representing a Cretaceous Porphyry System similar to Andacollo Mine and others.AURYN Mining Chile SpA (“AURYN” or “the Company” or “AMC”) is pleased to announce results from the first phase of soil geochemistry sampling program on the Pegaso Nero Moly-Copper area, located within the Altos de Lipangue project, in the Cretaceous-aged belt of central Chile.

The soil geochemistry program detected an important Mo – Cu anomaly surrounded by Pb, Zn and As anomalies. Inside the area containing high molybdenum values on soil samples, it was recognized a hydrothermal breccia with tourmaline – specularite and associated copper oxides.

Mineralization observed at Pegaso Nero target is related to a very well defined structural controlled alteration system that has only been partially explored by AURYN. This system hosts an important number of outcrops of hydrothermal tourmaline – specularite breccia with molybdenum, copper and gold mineralization.

A total of one hundred and thirty-six soil samples were completed at the Pegaso Nero prospect. A large molybdenum anomalous area was detected, with extension almost 3.6 by 1.2 kilometers and still open to the east. Moreover, there are two sectors with strong Cu-Mo mineralization identified to date within the molybdenum anomaly area, named the Moly Zone and the Copper Zone, where Copper is located 2 km south of the Moly zone. (See Figure1) …

(Preliminary Exploration at Pegaso Nero Target Suggests the Discovery of a Copper Molybdenum Porphyry System within the Altos de Lipangue Project. - AURYN Mining Chile)

Without getting into the specifics of grades, production level, and revenue etc, we can get excited touching on a few very important points.

Majors have been interested for a long time. Sillitoe’s involvement and most recently Hochchilds interest in JV’ing confirm the legitimacy of the potential.

That’s where MC and company have flipped the switch in our favor. Potential only gets you so far and Majors still hold all the leverage when a junior simply has potential. They can stall and tie up negotiations endlessly with the benefit of knowing they have something in their back pocket. Now that we started cashflowing this ourselves, leverage begins to shift. If Majors see that we are willing and able to continue doing this operation on our own, they risk paying more and/or losing out entirely. As Auryn, gets this off the ground, debt financing should fall into place as CHG suggested in his post. That will give us another leg up in leverage as the Majors will see that we don’t need their massive dilution option to forge forward. The further we go at this on our own, the higher the payout. If gold catches a nice rally and soars over $2,000, the anxiousness of Majors to lock down promising discoveries intensifies.

We have a lot to look forward to.

Hi EZ,

I think the exciting aspect of that PR you cited has to do with overlaying the results of the hyperspectral imaging satellite survey of C.S. Perez with the extensive sampling done on that ridge crest by Auryn. That satellite survey only detects surface alteration. The satellite shoots electromagnetic waves of a certain wavelength and then recaptures the reflection emitted from surface back to the satellite. This results in a “signature” recognizable by the analyst. The different types of alteration like propylitic, potassic, phyllic/sericitic, etc. all have these “signatures” which are recognizable. Potassic alteration often presents as a pinkish surface on the survey.

Since it’s the ultra-hot rising hydrothermal fluids and gases that do the “altering” of the surface rock chemistry and these same fluids carry the sought-after metals then surface alteration indicates the presence of a favorable “plumbing system”. This way it is easier to detect and to hopefully mine the ore. Perez’s survey detected a 7 Km long swath of “about a dozen” detectable intrusives. The ridge crest surface sampling program you cited in that PR evaluated the westernmost terminus of this swath. At a ridge crest there’s no trenching involved. That grade of ore was present right at the surface. The initial inference might be that if the ore detected at the westernmost terminus of this swath has average grades of “X” and if the satellite survey indicates similar alteration patterns 7 Km further east then perhaps similar grade ore might be present at the eastern terminus. This, of course, would need corroboration from surface sampling on the eastern terminus.

Since the magma chambers that once hosted all of these hydrothermal fluids and gases are fairly homogenous due to mixing while in a molten state are GIGANTIC then maybe, just maybe, the ten or so intrusives in the middle of this swath have similar grades and character to that found at the westernmost terminus. There are no guarantees, however. Confirming the diagnosis of this being a copper-moly porphyry system is going to take a lot of drilling which will no doubt have to be done by a major or a consortium of majors with those kinds of budgets. With copper trading at a 10-year high and almost an all-time high then the chances for the economic development of the Pegaso Nero are improved but it’s the extremely high grade gold opportunities that will garner most of the attention in the near term.

I agree, Jimmy,

Your posts have been quite sparse, but very accurate.

From your very 1st post more than 2 years ago back in May 2019:

…mining company. They will promote their company properly when the time is right. It seems like forever for suffering shareholders, but they have been very methodical in building this monstrous undertaking. The priority of burying the Medinah soap opera before moving forward with promotion cannot be overstated. Doing otherwise would be questionable strategy.

Information from the company should improve from quarter to quarter moving forward.

News will flow at the time Auryn is ready to promote this to increase share price. It makes no sense to unrestrict all shares until there is sufficient cash flow and progress being made…

guess we just figured out who is selling.

I also appreciate the counter view that is Baldy. Thanks for sharing the info/DD you have that I’ve been too lazy to do myself.

Unfortunately Hochschild has the Las Dos Marias project tied up until Aug 2023. I personally was extremely disappointed in the LOI because most earn-in agreements will call for a minimum investment for Year 1, Year 2, etc. (and/or some cash for the owning company). We negotiated for none of that. The ppty is tied up for 5 years with $0 minimum investment required during that time up until the end date, then the $7M.

"August 22, 2018. AURYN Mining Corporation (OTC: CDCHD) is pleased to announce the signing of a binding Letter of Intent (“LOI”) with Hochschild Mining PLC, for the Las Dos Marias project (“LDM”). Please note, the currently named LDM project is a consolidation of over 3,000 hectares and is significantly larger than what has historically been known by our shareholders as the LDM (see the graphic included below.)

This LOI gives Hochschild the option to invest US$7,000,000.00 into the LDM project over a 5-year period to earn a 51% joint venture interest in the LDM properties. An option to invest an additional US$23,000,000.00 is available to Hochschild to gain an additional 9% interest. If all US$30,000,000.00 is invested, Hochschild will own 60% of the LDM project with AURYN holding the remaining 40% as a joint venture partner. The LOI is subject to further due diligence and the signing of a definitive agreement."

Rod, the end of the option agreement may actually be the date it was signed, but that is a little unclear, as are many things as this company progresses. (see December 2018 - Shareholder Update | AURYN Mining Corporation) From the Q Report ending March 31, 2019:

At Hochschild’s request, the Company granted them an extension to sign the final contract on or before December 15, 2018. The contract was ratified on December 12, 2018.