Hi Mrb,

We know that the target of the Antonino Adit is the area of Shaft #4 of the old Fortuna Mine/DL1 Vein. We also know that the largest fault in the region intersects the DL1 Vein at Shaft #4 which is referred to as Shaft E in the ACA Howe report. I believe Shaft D collapsed a while back and is no longer being referred to.

In this deposit, the “oxide layer” extends from surface to about 20 meters in depth in pretty much every area EXCEPT WHERE THE FAULTS ARE LOCATED. The broken ore within the faults (fault breccia and fault gouge) allow oxygen carrying meteoric/rain water to penetrate much deeper downwards into the rock structure. This extends the “oxide layer” much deeper than that 20-meter figure. My thought is that since the target area (Shaft 4) contains a “geological signature” (namely oxides in an area that should have sulfides) then maybe the presence of these out of place oxides could act as a ruler to estimate the proximity of the DL1 Vein’s Shaft #4.

I’ve been suggesting to the people in my ADL study club to keep an eye out for a transition from all of these blue-colored very high-grade copper bornite “sulfides” that we’ve been witnessing in a nonstop fashion to transition to more reddish-orangish-yellowish “oxides” when the fault at Shaft #4 (the target) is getting closer. The reddish minerals would probably be the combination of hematite (an iron oxide) and cuprite (a copper oxide with 88% pure copper). The orangish-yellowish stuff will be an iron oxide/hydroxide known as limonite which is all over the place near surface. When pyrite gets “oxidized” it often gets converted into limonite.

The 3 newest photos on the twitter page, especially the view on the lower right that shows the reddish-colored ore, suggests (but does not 100% confirm) that we’re getting awfully close to the target.

https://twitter.com/aurynmining/status/1496655036939649028/photo/3

This photo just screams out “oxide”, but we’re theoretically below the oxide zone unless there is a fault nearby that is allowing meteoric water with dissolved oxygen in it, to do some oxidizing down deep. The various fault zones within this deposit, tend to host several individual veins each. You might technically think of these as “shear zones”. A shear zone is a zone in which shearing has occurred so that the rock mass is crushed and brecciated. A shear zone is the outcome of a fault where the displacement is not confined to a single fracture, but is distributed through a fault zone. Remember also that we are technically in a “tectonic breccia zone” wherein there was a whole lot of “extra” cracking of the rock structures. This is a very good thing. So, when you hear “fault” at the ADL, think of one fault containing multiple somewhat parallel i.e. “subparallel” veins.

Since fault zones/shear zones allow the meteoric/rain water that does the oxidizing to trickle downwards, the oxide zones get extended downwards quite a bit in the presence of a “fault damage zone”. This would be a mish-mash of small veins/veinlets associated with larger vein structures sometimes referred to as “splays” or “ramifications”. These are often not parallel to the larger veins.

I’m just thinking out loud for a moment here but the reason why the vein has been so elusive might have to do with “faulting” that displaced it to the west in the area of the Antonino Adit’s recent locations and at this depth. We know this happened to the DL1 Vein further to the SW near where ACA Howe found that “bowl-like” depression that they thought might be another breccia like the “Gordon breccia”. If this fault displacement is true, then we might expect more oxides to be present in this area which looks like it might be the case.

The photo trail heading down the Antonino Adit up until now has involved all of this bluish-bornite stuff (sulfides not oxides) intermixed with “milk quartz” and a bunch of SHINY YELLOW STUFF. This new reddish ore presentation is definitely DIFFERENT. Something has changed. Faulting might explain a few things like BOTH the elusiveness of the vein as well as the presentation of an oxide look. We’ve had a couple of glimpses of oxides during this trip down the Antonino Adit. These include photos #2,5 and 6 in the Q-1, 2022 portion of the Auryn gallery.

Faults and veins are both planar structures similar to a sheet of plywood. The largest fault near the DL1 Vein strikes at surface in a NNW to SSE fashion. In this regard it is somewhat parallel to the strike of the DL1 Vein at surface

The highest-grade ore is often found in areas of “dilatation” where 2 structures intersect. This could be a vein and a fault, 2 veins, 2 faults, 2 dissimilar types of rocks, etc. The vein in the photo is about 0.5-meters wide or about 20-inches. Up near surface, it was only about 4-inches wide. It’s behaving like a “mesothermal vein”. The DL1 Vein has a history of “pinching and swelling”, both with depth and laterally. Up near surface, the DL1 Vein had several “subparallel (almost parallel) veins” located just meters east of it within its “hanging wall”. This is the wall of rock above an inclined vein.

It makes sense that management would encounter these veins just prior to intersecting the DL1 Vein. One of these might be what we’re seeing in the photo of the oxidized vein. Since we know that the largest fault in the region intersects the DL1 Vein right at Shaft #4 i.e. the target area, then this seems to corroborate this theory.

If we didn’t know about the existence of those two “subparallel veins” located with the “hanging wall” of the DL1 Vein, I might have thought that this photo might indeed be of the DL1 Vein in a region where it had “pinched off” (narrowed) a bit but was about to dilate out wider soon. I’m expecting the DL1 Vein to be over 1-meter wide at the level of the Antonino Adit.

The pictured vein looks very competent and it looks like it could extend downwards for quite a length. I’d be very interested in seeing what kinds of grades this vein is going to carry. The next blast cycle or two might reveal its “partner” (if there is one at this depth). If this vein dilates out quite a bit in the next couple of blast cycles, then it could be the DL1 Vein after all.

Through a variety of geological techniques, management’s geoscientists may have already ruled out this vein as being the DL1. This new oxidized vein may or may not represent a production opportunity that should be exploited in the near term. We need to keep in mind that the best grades obtained to date were found just above where Auryn is working now within the Antonino Adit. This was at the junction of Level 2 and Shaft A in the “old workings”. We also need to keep in mind that one of the primary goals in intersecting the DL1 Vein is to gain access to the fresh air afforded by the system of chimneys and ventilation raises already in place at the Fortuna Mine.

HOW MIGHT THIS RECENT BREAKOUT IN THE PRICE OF GOLD AFFECT AURYN/MEDINAH’S PROGNOSIS FOR SUCCESS?

First of all, the universe of potential investors is increasing. The majors and mid-tiers already in production can’t snap their fingers and ramp up production markedly just because gold is on a run. A new producer that might be able to go from zero working faces being mined to perhaps 6 or 8 within a short period of time is going to be able to generate a much more dynamic growth profile. “The Lassonde Curve” teaches us to expect a pop in the share price at the time of going into production.

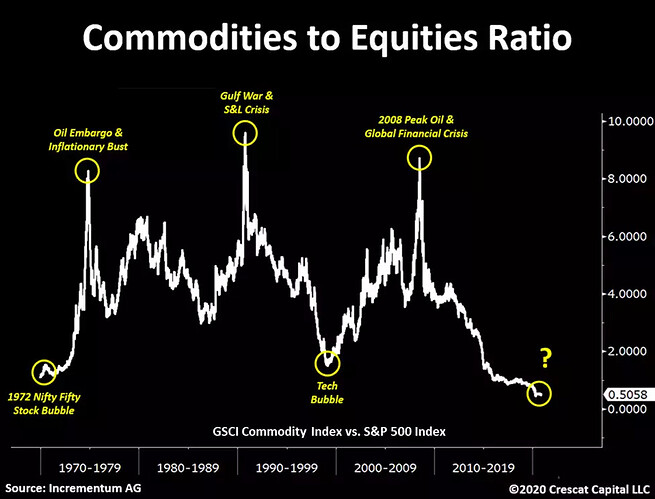

A lot of mining costs are of a “fixed” nature. This means that increases in the price of gold/”POG” tend to drop down to the bottom line. The cost of diesel, which is increasing, will lessen this effect a bit. The price of gold is tightly correlated with both geopolitical issues like the war in Ukraine as well as inflation. The FED can’t increase rates too aggressively without risking the economy going into collapse mode. This is an election year and inflation has already hurt all consumers.

Auryn management will be highly-incentivized to pull out all of the stops and crank up production aggressively. Decisions like buying a “jumbo drill rig” are going to be a lot easier to make because the payback period will be greatly diminished. Mining majors are going to be on the prowl especially for juniors with near term high-grade gold production opportunities. I don’t think that Maurizio is going to be buying his own lunch for quite a while. THESE MOVES IN THE POG WON’T LAST FOREVER AND IT WILL BE THE PRODUCERS THAT INITIALLY STAND OUT LIKE A SORE THUMB.

Conservative mining investors, like institutions, are going to be going after the majors with plenty of near-term production projects in the pipeline. The problem is that we’re in the midst of a 33-year drought in new discoveries and the amount of ounces of MR/MR on the balance sheets of the majors is at a 30-year low. M and A within this sector could become frenetic. The juniors with polymetallic deposits with near-term production opportunities including BOTH gold and copper (and to a lesser extent silver) are going to be in high demand IF THERE WERE ANY.

What might we expect in the near term? I would guess the hiring of more miners and the purchase or rental of more mining equipment might be in the cards. I would think the expansion of the camp facilities would also be in order. I think that the PACE of new developments is what we’re going to witness in the near term.