Please put this small 2-armed air-powered drilling jumbo on Maurizio’s shopping list!

Easy, Why just one? They also make a four drill rig. The guys that run them in Austrial get as much as $1,800 a day to run one. Can you get them off of Amazon? We could all chip in and have one sent to the mine.

US,

I’m certainly not an expert when it comes to jumbo drill rigs, so I’d leave that question to someone more knowledgeable to answer in detail. What immediately comes to mind though, is size in a limited space (size limitations) and expense (budget constraints). Do you mean purchasing several jumbo drills instead of limiting it to just one? If using multiple units, timing between blasts, ventilation, and support personal would expand at a great pace, not to mention all the extra mechanical support equipment.

EZ

I think I recall our guys saying they hit the DL vein on or about March 29.

If the lab turn-around is about SIX weeks, then maybe we get some news coming up soon?

Those pictures Easy posted above look real prolific to my eyes (admittedly untrained).

My question is how do they know they hit the DL without getting the assays back?

Bingo. Yes!!!

Playing around underground = many more limitations then above ground open pit mining. And by now, you all know the TONS of planning that goes into a pit mine.

You can get “by with little” when punching in exploring tunnels, but once you go big, you have tons of planning and work to do, or your will live in a rock grave.

Just go to google or youtube “underground mining” and see for yourself.

We are just a baby learning how to crawl at this point. Walking takes time.

Much less the running, that all want to happen. C.s.

Hi Done Deal,

I think management is being super-conservative right now because in the past they thought that they had intersected the DL1 Vein then further testing suggested that they hadn’t. When the 30-meter-long “ventilation raise/chimney” connecting the Antonino Adit intersection with the DL1 with Level 2 of the “old DL1 workings” is completed then that would represent the definitive diagnosis because both structures are centered on the DL1 Vein.

We know what the DL1 Vein looks like 10-meters higher in the structure where Level 2 intersects Shaft A. This is where those huge grades came from in that 16-sample program Auryn completed. The vein has a certain “dip”/inclination to it; it’s not vertical. It started out dipping to the NE at about 45-degrees (from the horizontal) at the surface then it straightened out a bit and now dips at perhaps 70-degrees or so (from the horizontal which is 20-degrees from the vertical) to the NE.

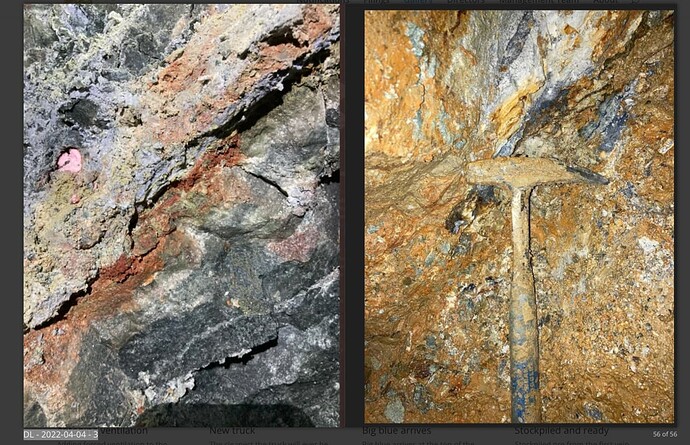

In the Auryn photo gallery, you’ll see a couple of hundred photos but only one that is paired up side-by-side with another photo. This is #56 of 56 photos in the “2022 Q-1” part of the gallery. The caption cites: ”Comparison of DL in Antonino Tunnel to high grade old adit.” I think that this is management’s safest way to say that we hit it. I think that what management is trying to show us with those 2 photos juxtaposed is how the inclination of the veins is nearly identical.

The photo on the right is from the intersection of Level 2 and Shaft A. You can see how wet this area recently was prior to being pumped out. The brownish-yellowish stuff is “limonite”. It is technically a “hydrated iron-oxide-hydroxide”. It is found where iron containing minerals (like pyrite) have been exposed to both water and oxygen, like in a mine shaft. It’s basically “rust” or “scale”. It’s also referred to as “bog iron” because it occurs in marshes and bogs. It likes to hang out with gold.

Its presence basically tells us that we’re near the current water table. In that photo, the limonite “scale” blocks out a lot of the anatomy of the DL1 Vein but you can see how the inclinations and rock types are similar between the veins in the two photos. You can make out that bluish-bornite in both photos. This is also an indicator of close proximity to the historical water table.

In these areas, the zone of mineralization can become pretty-wide and take on the character of a “breccia”. A “breccia” is a bunch of angular rock fragments glued together by a fine matrix of cooled hydrothermal fluids. What happens is that the ultra-hot magma comes up through a fault structure (future vein) and hits the water table and the resultant explosivity opens up the would-be vein into more of a much wider “war zone” of smaller fractures called a phreatic or sometimes a phreatomagmatic breccia. This is a good thing. Up above these “fault damage zones”, the vein goes back to its normal width.

In that photo with the limonite-soaked hammer being shown, I’m not sure if management is trying to highlight what is immediately above the center of that hammer or not. You can see that the yellowish coloration of this “anomaly” is different than the brownish-yellowish coloration of the limonite. Recall that one of the samples in this area came in at 1,220 gpt gold. You’d almost have to have some type of “nugget effect” involved in order to get a sample grade like that. That sample was an 11-pound sample, however, and the entire 11-pound sample averaged that insanely-high number. Slightly above that area were 3 other areas that each came in at over 100 gpt gold. I’m wondering if this “hammer” picture was taken of this spot, suspecting the yellow stuff as being gold, prior to the channel sampling in order to record this situation.

There’s kind of a weird phenomenon in geology in deposits that contain both gold and copper. Most gold/copper deposits are dominated by the form of copper known as chalcopyrite which is 34% pure copper. Rarely, they are dominated by that blue stuff we keep seeing all over the place i.e. bornite, which is 63% copper. The gold-copper deposits dominated by the form of copper known as bornite, have a tendency to also have gold grades 10-times higher than the gold grades in gold-copper deposits dominated by chalcopyrite.

Abnormally high-grade gold also is typically found in areas where the predominant form of quartz is chalcedonic quartz or milk quartz. This is that type of quartz we keep seeing in these photos. When the silicates (quartz) within hydrothermal fluids cools rapidly, there isn’t enough time to develop these beautiful quartz crystals you often see. Rapid cooling that leads to ultra-hot fluids cooling down enough to “boil” (sounds weird I know) leads to very high-grade gold amidst very bland-looking milk quartz.

So, you want a lot of SHINY YELLOW STUFF hanging out with BLUE STUFF amidst a bunch of boring looking WHITE STUFF. At surface, you want to see a bunch of YELLOWISH-WHITE STUFF known as argillic alteration (kaolinite, illite and smectite clays). The surface aspect of the DL1 as well as the other main veins (except for the Merlin 1) are immersed in this WHITISH YELLOWISH STUFF. In order to convert the host granodiorite (basically granite) into argillic clay, you have to have a well-developed “plumbing system” of faults and fissures to get those fluids up to the surface so that they can do their “altering”. Later, the plumbing system becomes a series of veins and breccias.

I used to teach biochemistry at the doctorate level, what’s fun for a dork like me is when the GEOCHEMISTRY MAKES SENSE. I like it when I see the SHINY YELLOW STUFF hanging out with the BLUISH STUFF in the midst of a lot of BORING WHITE STUFF. Chemistry is very honest.

There are a lot of variables at play when those scalding hot hydrothermal fluids and gases come roaring out of a magma chamber and start their ascent through the rock structure. It shouldn’t be surprising that certain mineral assemblages have their own environments where they prefer to hang out. It might have to do with their melting points and the temperature of these fluids, it could have to do with the ambient pressure levels, the PH of the fluids (acid versus base), the salinity of the fluids, the oxygen tension, etc. Simply put, high-grade gold, milk quartz and bornite just so happen to like to hang out in the same “neighborhood”. What else does gold like to hang out with? How about pyrite and limonite.

Thank you BB for the explanation!

Brecciaboys quote ; “I used to teach biochemistry at the doctorate level”,…

Ah ha ! Now I know where a dentist gets all his geeky stone /rock stuff from.

The plot thickens …

Glad to have you on board by the way.

*We used to nod out in our beers at the prospectors watering hole, when the rock geeks got to talking their trade.

But they were handy to have around the next day, finding some antacid limestone dust to chase the beer and hot wings heart burn away.

I still glaze over sometimes reading chapters in your book.

But thats mostly do to age now… Keep it coming, the book is getting interesting. Thank breech.

Distribute the Aumc shares and see if they still trade at .00228 for a few $s

Anyone thinking trading is on up is naive

I’m sick and tired of watching these games!

Distribute the shares and maybe the game will turn in our favor

Mdmn has in possession can update us any time re distribution and I don’t want to hear when the time is right

That’s Les Price type bull@“it

Im starting to feel like the dog in this picture.

"Hay guys, are we ever going to get some money out of this claim, so we can go buy some grub and put some meat back on our bones?

It's been some long, lean years.

C.s.

Joe Cazz, the penny stock speculator with probably the most Twitter followers, has just suggested looking at MDMN by tweeting.

“$MDMN Not going to get too much in detail on this one as i don’t own any shares (LOL) BUT, put it on your radar. Bidding low 20’s. 3 things to check. Filings, market cap and PPS. Let’s see who’s paying attention to my posts ! This should be 005-006 at least.”

[

Im not going to attempt to re-summarize this post in great detail. Instead I want to establish what your main point is and then discuss the implications.

That post in particular grabbed my attention because in a nutshell you are saying the historical data is better than a drill program in terms of reliable information. So if that is the case, there must be knowledgable mining interests making similar assertions that you are.

Baldy is hellbent on making the point that without MR/MR via a drill program, forget drawing the attention of major mining groups or the broader investment community for that matter. That point at face value is difficult to challenge given that does accurately depict how this industry traditionally works. Yes this discovery is unique in that there is historical data to analyze but would a major mining company see it Baldys way or your way? I know you mention that Maurizio may not be interested in giving any of the high grade gold away in a major deal but IF the data is sound and majors are comfortable with making assertions/projections in the same way or perhaps with even more confidence than simply having an old fashioned drill program, then a mutually beneficial deal should still be an option for the gold production. Maybe that is what Wiz was alluding to when he commented that if/when confirmed that AUMC is in fact sitting on what they thought, quantifying the number of round trip truck rides is going to be an irrelevant conversation. Maybe he just means that the internal investment for mechanization will be made.

It doesn’t make sense that going it alone at a slow and methodical pace would work out better than doing a deal with a major to accelerate production exponentially. This is based on the given presumption that a major is convinced that project is de-risked enough WITHOUT an extensive drill program. Since that is the point you are trying to make by saying that past production trumps a drill program, please comment on whether a mutually beneficial deal can or should be struck on the DL vein. My point is that if a major sees it they way you see it, Auryn won’t/shouldn’t need to sacrafice an inequitable amount of dilution in exchange for accelerated production. One would think that these circumstances present a perfect scenario for a mutually benefical deal to be reached.

Thanks

Not sure if you need apple news to open this link.

But essentially:

SANTIAGO (Reuters) - A constitutional assembly in the world’s top-copper producing nation on Saturday rejected a major overhaul to mining rights, including expanding Chilean state ownership.

Controversial Article 27, which would have given the state exclusive mining rights over lithium, rare metals and hydrocarbons and a majority stake in copper mines, faced fierce opposition from the mining sector and was voted down last week.

**SANTIAGO (Reuters) **…

; constitutional assembly in the world’s top-copper producing nation on Saturday rejected a major overhaul to mining rights, including expanding Chilean state ownership.

NEWS like this is BIG. We need to wait a few days/weeks for this to shake out, (stamped - sealed - and put on the books so to say)

Then the flood gates could open for all. Miners- explorations - deal makers etc, etc.

It just might have been our hang up.

This could get exciting! "here hold my beer, and hang ON !

C.s.Hi Jimmyp,

In regard to attracting the attention of new investors, whether they be mining investors or just Joe Public, I would posit that cranking out robust earnings while mining a deposit that clearly has a mine life of several decades would trump the results of any drill program. There are so many hoops and hurdles to negotiate in between obtaining promising results from a drill program and getting that project into economic production, that it’s night and day.

Successfully making it all of the way into production is the ultimate DERISKING MECHANISM. A successful drill program is a good start, but you still might be 8 to 10 years from production IF AND ONLY IF that deposit ever gets into production. The overall goal in mining is to convert the ore in a mountain into cash with as little dilutional damage to the share structure as possible. Management’s report card will be graded in terms of EARNINGS PER SHARE, not just EARNINGS.

Since junior miners need to service their monthly burn rate by selling shares, mining is also a race to get into production and convert the ore into cash within as tight of a share structure as possible. But it’s a marathon not a sprint. So, all decisions made by the management team of a junior explorer need to keep one eye on the share structure and the other eye on getting into production ASAP.

In a sense, Auryn is the exception and not the rule in regard to most junior explorers. Most prospective discoveries don’t come with 30-years of production history involving stellar grades. In a vein structure measuring 1.7 Km in strike length by 700-meters in known depth somebody already mined out a 250-meter lineal swath to a depth of 70-meters. They sold the gold to Enami and averaged 64 gpt gold even though the average grade of gold being mined worldwide is only 7 gpt gold. Those production figures are not only amazing but they are irrefutable.

What Auryn did was executed an exhaustive surface trenching program involving 1,600 samples. They exposed 5,000 meters of veins that made it all of the way to surface. They know what the grades are at surface for this entire nexus of veins. They also have a pretty good idea of what to expect in the first 70-meters of depth along that 1.7 Km strike length. They’re building a 3-dimensional model of this structure that measures 1.7 Km by 700-meters by perhaps 1-meter or so of width.

Most geoscientists would be pretty happy with what they know about the top 70-meters of this vein structure, and it looks pretty darn exciting. If they wanted to secure more information about what is going on below the 70-meter-level, then some deep and extremely expensive holes could have been drilled but what would have happened to the share structure? Would the additional information obtained justify the added dilution or the delays in getting into production? The monthly burn rate goes up with a drill program, not down. The timing until production commences goes up, not down with a drill program. Management decided the correct approach for the DL1 Vein was to go straight to production. They made a positive production decision based on what they know about the deposit which is vastly superior to what the average shareholder knows about the deposit. They found the project to be ECONOMICALLY FEASIBLE. They even agreed to advance the cash needed to go all of the way into production without charging any interest and without any need to repay these advances unless and until the profits from the mine could service that debt. They didn’t need to attract a major miner to pay for a drill program only to surrender a piece of the action to them. In Kevin’s words, management “bootstrapped” their way into production.

There are two types of DILUTION. One is of the percentage of the project owned and the other is of the share structure. Management successfully bypassed BOTH forms of dilution. Management made a production decision. They found the project to be ECONOMICALLY FEASIBLE and they’re advancing the project into production.

But how about below the 70-meter depth level in a mesothermal vein system famous for improving grades and widths with depth? Management got a peek at this area when they sent one of their geoscientists down Shaft A where it intersected with Level 2. They took 16 channel samples, and the results were stellar. That was their first peek below the level of the prior mine workings.

The production plan then became to drift the Antonino Adit at about 80-meters below surface. They came in near where the North Road intersected the plateau to minimize the commute to the processing facilities for the ore being produced. This adit would serve as both the “haulage adit” for production as well as an “exploration adit” to see what’s going on below the 70-meter level. The other way to explore this area would have been to drill a bunch of expensive holes from surface but why not kill two birds with one stone and have this “exploration adit” double as the “haulage adit.”

What did they learn during the drifting of this 350-meter-long Antonino Adit? In the first couple of hundred meters of this adit, they intersected 20 new mineralized structures. Nobody saw that coming. For the most part, these structures did not make it all of the way to surface and were not detected by the surface trenching program. We don’t know the relative importance of this yet because the grades about to be realized at the primary target, the DL1 Vein, may blow away the grades found at these new intersections. The least they may represent are future production options. We’ll know more when all of the assays are in.

Of more importance, might be the ubiquitous presence of what appears to be bluish-colored bornite and/or covellite. These two forms of extremely high-grade “secondary copper” are indicators for what is termed “supergene enrichment” or SGE. Some gold-copper deposits have these “SGE zones” while others don’t. These zones range in vertical width from 50-meters to 800-meters with an average width of 300-meters. Gold is also subject to “supergene enrichment”.

Keep in mind that the previous miners at the DL1 Vein had very little contribution to the “gold equivalent” grade from copper. Up higher in the vein structure they only averaged 0.2% copper. It appears (but is yet to be confirmed) that if this is indeed an SGE zone, then this is the very top of it. If a team could get in and test the DL1 Vein outcropping that is present at 700-meters below the plateau and find the presence of bornite, covellite and/or chalcocite then this would be beyond noteworthy.

I think the presence of these SGE mineral indicators, although they would be wonderful in increasing the “gold equivalent” grade of what Auryn produces, would be interpreted by the as speaking more to what to expect deeper in the belly of the mountain perhaps in the Pegaso Nero area. In that area, you might recall that they already found an “intrusive breccia”, an “intrusion breccia” and a “tourmaline breccia” with a variety of copper oxides as well as molybdenite found right at surface on the southern downslope off of the plateau. I would assume that the picture of what is going on in the belly of the mountain is starting to clarify a bit for the geoscientists.

Jimmyp, you asked about the role of a major miner at the ADL. In my opinion, it’s time to do some “Win-Win” deal designing with a major or a mid-tier. Auryn has too many assets that they’re not going to be able to monetize in the foreseeable future. Why not jettison a vein or two (not the DL1 Vein) in exchange for being able to ramp up production at the DL1 Vein in a dramatic fashion? Let a major miner donate a “jumbo drill”, some trucks and a few wheel-loaders. Let them put in the on-site mill and processing facilities that we would share with them. None of this would induce any DILUTION to the share structure but only dilute the ownership percentage of assets that Auryn can’t monetize in the near term anyways. I don’t think shareholders would have any problem with converting long term assets into short term production ramp ups.

It will be interesting to see how the recent overturning of the proposed Article 27 by the Chilean Assembly will affect mining projects in Chile. The threat of copper mines being nationalized by the Chilean government has been hanging like a sword of Damocles over copper and gold-copper projects but apparently has now been removed. It’s anybody’s guess if this legislation has affected the ADL Mining District’s progress or not but I think common sense would dictate that moving forward on a project whose future might involve being predestined to be stolen out from underneath the miner and nationalized would be risky at best. I doubt any serious deals were consummated during this period of uncertainty.

Thanks for the response. What you mention above would be fantastic to look forward to. I hope that is a plausible option sooner rather than later. I anticipated that 2022 would result in shareprice appreciation one way or another. So steady progress on all fronts, including the attention of mining companies, is both welcomed and expected.

That would be fantastic. Except they already have a deal with a “major.” Given BB’s unflinching optimism for all of these assets, would H’s lack of interest dampen his enthusiasm? Shucks no! Too many more chapters to write in the “Alto Almanac.” Isn’t it odd that a major who has a first look on all of these assets isn’t making a play?

Where are the assays with 60gpt+ material? Why isn’t the blue truck hauling the stockpiled ore to fund operations?

The reason why 99.9% of successful miners spend the money to actually drill a deposit is because they need to have a mine plan. Yes, the market cares but so do the miners. Otherwise you are dealing with a mine by braille operation chasing a vein. I’m guessing there a some mom and pop artisanal projects doing very well without a block model in place but…

BB is a very detailed guy with a lot of passion and conviction but I’ll never understand how anyone can be so buried in an investment while only focusing on the “lottery ticket.” There may be a winning number and hope is a positive stimulant but at least weigh the risks. Can anyone answer the preceding questions in this post or is it just to taboo to question why this has taken so long to advance?

Assumptions: tones of high grade ore stockpiled + new blue truck= free money and a ton of valuable assays on the grade.

Why is there no $$ nor data over the past several quarters?

Last question: can anybody find a gold mining operation/asset that was acquired for more than $69M based solely on historical data? (Including those in production). AUMC is currently valued at $70M

You are right until you are wrong. Those are legitimate questions.