Wait John’s wrong? Cant be

Mischaracterizing what i said. If your truckload assumption is wrong, then clearly yes your caluclation for annual profit thereby will also be incorrect. Not rocket science John.

Wiz I assume you would know (and based on the Jan 2021 shareholder update below, you do). I guess I assumed that people complaining about Maurizio not distributing the shares was related to him having control of the same. So, if that is the case, IMHO, based on some of the other points I raised, it really is a bit baffling for the company not to distribute them and equally confusing that those restricted shares aren’t disclosed in the balance sheet. While I understand the notion of waiting for a higher AUMC price (both the risk and reward) one could argue that the longer MDMN waits the higher the accrued liabilities.

"Medinah Minerals, Inc. owns 16,104,200 common shares of AUMC received from AURYN Mining Chile, SpA. These shares are currently restricted. The Company intends on removing the restriction, selling a small portion of its shares to satisfy corporate liabilities and legal expenses, and allocating the remainder of its AUMC shares to its shareholders, pro rata, in the form of a dividend payment. This is subject to a final recommendation by our securities attorney and approval by regulatory authorities. "

The timeframe for these actions is to be determined and is based on the Company’s desire to maximize the number of AUMC shares it is able to retain and allocate to its shareholders.

John did you slam a red bull and regain alertness now? This has been well understood for awhile now, which is why it was baffling you had it all wrong. You took a credibility hit there. Welcome back though.

If I took a credibility hit in your eyes I can still sleep perfectly well at night. Even with all of the RedBull consumed. Candidly, my point for the benefits of an immediate distribution of AUMC shares is even more relevant than before but I don’t anticipate you understanding as you foam at the mouth for my miss on the mechanics of where the shares are held (even though they aren’t on the BS).

I’ll go back to the rabbit hole and wait for further “information” from the company in May when we can discuss grades, ore shipped, and all of the fun stuff. I do enjoy that all of these posts are archived so, as in the past, the cards falls where they may.

Congratulations folks!! We made it an entire week without speculative posting or finger pointing or negativity!!

I’m just breathlessly waiting for futher information from the company this month when BE climbs out of his rabbit hole to save us further from what we already know! ![]()

![]()

in April’s Notification

We anticipate our mining teams to spend most of Q2 preparing the mine for exploitation at the current level and sub-levels. Minor production will occur during this process. Results will be reported accordingly. Once fully prepared, exploitation begins.

… forward-looking information includes, or may be based upon estimates, forecasts and statements of management’s expectations with respect to, among other things, the completion of transactions, the issuance of permits, the size and quality of mineral resources, future trends for the company, progress in development of mineral properties, future production and sales volumes, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining or milling charges, the outcome of legal proceedings, the timing of exploration, development and mining activities, acquisition of shares in other companies and the financial results of the company.

Over last weekend, one of the shareholders asked about where my group is at in regard to our preliminary modeling for the DL1 Vein. It’s a work in progress but what I tried to get across to him is that we really do know quite a bit about this particular vein. We know much more about the DL1 than the other 5 main veins at the ADL except perhaps for the Merlin 1 Vein/Caren Mine. But there is obviously an enormous amount of information that might soon be revealed. The history of this vein is what it is and the stage of development for exploiting the DL1 Vein is what it is. What have we got so far?

I think that we might tend to get a little hoodwinked by looking at the history of the DL1 Vein and saying to ourselves that the past production results were so long ago that they are no longer valid and maybe we should start from scratch and wait for some fresh results. That’s not how Mother Nature works. This is a 91-million-year-old deposit. The ore that was present on the last day of production over 50 years ago hasn’t gone anywhere. We don’t have to start from scratch on our due diligence efforts. IN FACT, THERE IS NO MORE RELIABLE INFORMATION AVAILABLE THAN PAST PRODUCTION STATISTICS,ESPECIALLY IN RELATION TO ORE GRADES, FROM CONTIGUOUS AREAS BEING CURRENTLY EXPLOITED IN THE EXACT SAME VEIN STRUCTURE.

The source of all of the historical production figures is Enami itself, which is a state-owned enterprise of Chile. My first goal would be to debunk the myth that the past production data is too old and unreliable. ACA Howe’s 1999 exhaustive report on the Fortuna Mine (DL1 Vein) is a reliable resource that covers almost all of this data. It is available on-line. THE PROBLEM IS THAT SEVERAL OF THE MOST CRITICAL “FIGURES” (especially Figs. 5.3 and 6.2) ARE NOT AVAILABLE ON-LINE BECAUSE THEY WERE MULTI-PAGE “FOLD OUTS” IN THE ORIGINAL HARD COPY. I bought a hard copy of this report when it first came out in 1999. For the better part of the last two decades, I just couldn’t figure out why nobody was referring to the critical information featured in these figures. Now I know.

There is a lot of very good mining modeling software available out there and a lot of it is actually free. For the DL1 Vein deposit, a simple 3-dimensional “wireframe” model is adequate for developing a much better understanding of this vein and this deposit. What I would recommend is reproducing Fig. 5.3 of the Howe report yourself by drawing a cross-section of the mountain going from NNW to SSE along the strike length of the DL1 Vein itself. You’d be facing ENE. On a watch dial, the DL1 Vein “strikes” from about 11:00 to 5:00 with 12:00 representing due north. The cross-section will reveal a rectangle that is 1,700-meters long (the “strike length” of the vein) on the top of the rectangle by 700-meters in depth (“geological continuity” to a depth of 700-meters). For now, mentally get rid of all of the granodiorite wall rock surrounding the actual vein material and isolate on vein material only.

What we basically have is a gigantic sheet of plywood/vein material. This is a “planar” structure. I’d label the top of this “sheet of plywood” as being 1,700-meters in length and the depth 700-meters. To the left of the top of that rectangle put an arrow aiming left with an NNW directional designation. Likewise, to the right of that top line put an arrow aiming to the right labeled SSE.

On the top of the sheet of plywood, locate the approximate midpoint. Then put a mark about one-seventh of the way from the midpoint to each side along the top of the rectangle. The distance between these two new marks will be about 250-meters i.e. about one-seventh of the 1,700 Km strike length. This is the length of the DL1 Vein that the artisanal miners at “SMFI” already mined out.

If you drop a perpendicular line from each of those two points one-tenth of the way to the bottom of the rectangle, this will represent the 70 vertical meters that the predecessor miners at “SMFL” already mined out. Now you can envision the 250-meter by 70-meter “already-mined” rectangle within the overall 1,700-meter by 700-meter rectangle. Label that smaller rectangle “64 gpt gold”. That is the average grade shipped and processed for that entire “already-mined” rectangle over the course of 30-years. Is this a good grade? A reference point would be that the average grade of gold being mined worldwide is 7 gpt. What can we say with 100% certainty? We can say that the top 70-meters of this structure in the area already mined consisted of very high-grade gold.

GRADE MODELING AS OF TODAY

As far as predicting the grades that might soon be mined by Auryn, historical production reports from contiguous areas of the same exact vein structure are the GOLD STANDARD in mining. Junior explorers with a legitimate discovery seldom have access to this critical information, so we typically go to the next best source which is geomapping, surface trenching and Phase 1 drill results. The problem with drill results is SAMPLE SIZE. An HQ drill bit will give you a 2.2-inch (.055-meters) in diameter core of vein material of a vein that might be 1-meter or so thick. A typical drill hole spacing might be 50-meters or so.

So, every half of a football field we get a tiny peek at the vein material. If our predecessors would have drilled 5 holes spaced 50-meters apart into the DL1 Vein (which they didn’t), they would end up with 5 approximately 1-meter-long drill core intersections into the vein. Assuming the width of the vein is about 1-meter and a drill core of 2.2-inch diameter, each drill core intersection would have a volume of .0024 cubic meters. The 5 drill cores combined would have a volume of .012 cubic meters of vein material. That’s NOT a very statistically accurate sample size to estimate anything from.

The volume of vein material that the predecessor miners shipped to Enami was approximately 250-meters of strike length times 70-meters of depth, times the average width of the vein they mined. If it was 1-meter, it would equal 17,500 cubic meters (as opposed to .0024 cubic meters of drill sampling). From a geostatistical point of view, the differential represents a ratio of 7.3 million-to-1. A BULK SAMPLING of vein ore measuring 250-meters by 70-meters is deemed “highly representative” because of the sampling size. IF YOU’RE FORTUNATE ENOUGH TO HAVE ACCESS TO HISTORICAL PRODUCTION STATISTICS FROM A CONTIGUOUS PORTION OF THE VERY SAME VEIN YOU ARE ABOUT TO EXPLOIT THEN YOU’VE GOT TO USE IT. It’s there, it’s free and it’s reliable.

Although the artisanal miners only mined a little bit over 1.4% of the known extent of the DL1 Vein (the bigger rectangle), it provided us with a MUCH MORE ACCURATE grade predictor because of the size of the bulk sample. You can’t get much more accurate than taking all of the vein ore out of a CONTIGUOUS area and shipping it to Enami and getting a grade back of 64 gpt gold. The standard drilling out of a deposit definitely has its place partly because if you only need 1 drill hole per lineal 50-meters, you can cover great distances and great surface areas with a relatively small amount of (admittedly expensive) drill holes. The results, however, will include a large range of grades and huge margins of error.

Not many deposits have 30-years of PRODUCTION RESULTS wherein 100% of the ore in a given area had been mined, shipped and graded by an impartial party like Enami. That being said, we still want to wait and see the exact grades of that which Auryn ships from the new “Level 3” which is the level of the Antonino Adit. We’ll be able to take that information and add it incrementally to the prior results and determine a new average grade with an even higher level of geostatistical certainty. In that area of your sketch of that rectangle within a rectangle in which you wrote “64 gpt gold”, underneath that write “EXTREMELY ACCURATE” because it really is.

You might want to go one step further with that smaller rectangle. At the very top you could put a horizontal dotted line marked “plateau surface”. Right below that, you might add “Level 0”, and below that “Level 1” and the bottom line of that smaller rectangle would be labeled “Level 2”. The “old workings” were done on 3 different horizontal “levels” with an adit portal (opening to the outside) servicing each “Level”. That 64 gpt gold grade could be further broken down into approximately 58 gpt gold at “Level 0”, 64 gpt at “Level 1” and 70 gpt gold at “Level 2”. Notice the trend associated with improving grades with depth. To those 3 numbers, if you wanted to, you could add 5.2 gpt gold to account for the grade of gold left in the discarded tailings and dumps. “SMFL’s” operation wasn’t extremely efficient. The key metric for us will be what is the grade of the ore that will be shipped to the processing facility by Auryn until they have their own on-site mill and processing facility. As Kevin recently hinted to you, the shipping of the ore to an off-site processing facility is a temporary reality, a means to an end to develop some cash flow. Maurizio wants to pour his own dore bars on site and cut out the middleman.

Just to the left of the lower left corner of that smaller rectangle put an asterisk labeled “recent 16 sample program”. This is right at the border between the two rectangles. This sampling program was recently completed by Auryn at the intersection of Level 2 and Shaft A right at the edge of the old workings and the new exploitation efforts. The average result was even higher than the 64 gpt gold encountered in the smaller rectangle. Recall how management made a press release citing that “the grades and widths were BOTH improving with depth” and that they were “very bullish” about the mining opportunities at hand. We’ve seen the grades improve from the plateau surface trench sampling to Levels 0,1 and 2 and the intersection of level 2 and shaft A.

What’s the statistical significance of that 16-sample program with the stellar results? Management doesn’t communicate a whole lot and they didn’t spell it out, but IT CORROBORATED THE BONA FIDES OF THE 64 GPT ENAMI RESULTS OVER THAT 30-YEAR STRETCH. It served as a sort of “check assay”. It taught us that we can trust those Enami figures, even though they were pretty much through the roof and 50 years old.

In our grade modeling efforts for the entire DL1 Vein i.e. the larger rectangle, the goal is to take 100% of the information available to us today (thousands of pages) and estimate what might be expected lower in the vein structure. Critical to an analysis like this is a knowledge of how the grades within other mesothermal vein structures behave with depth. An extrapolation like this is always going to have a statistical reliability factor appended to it. Thus, conservatism is critical.

Thankfully, we already have the results of an exhaustive surface trench sampling done by Auryn. We also have the grades found over a 250-meter width at Levels 0, 1 and 2. We also have the results from the 16 samples taken at the intersection of level 2 and Shaft A. We know that the grades have been improving with depth. Management told us this. We know that in mesothermal veins, the grades typically improve with depth. We know that the ADL is located in an “Early Cretaceous Mesothermal Vein Belt” that extends from our next-door neighbor to the south, the Curacavi Mining District to our next-door neighbor to the north, the Colliguay Mining District. Everything is making pretty good geological sense.

High on my wish list would be to find out the representative grades and widths of the DL1 Vein where it outcrops 700-meters below the plateau surface. Then we could extrapolate what the grades and widths might be in between that level and the current level at 80-meters below the plateau surface. There would obviously be an impossible to define level of statistical certainty attached.

We need to recognize that it’s going to take many decades to mine out this entire vein. For now, we need to concentrate on Level 3 and what kinds of grades and widths are encountered there. At Level 3 (the level of the Antonino Adit), we’re going to be soon evaluating widths and grades at 3 sites. The first will be the “ventilation raise/chimney” that is going to link the Antonino Adit to Level 2 of the old workings 10-meters above it vertically. This will represent working face #1. This is going to be a 30-meter-long structure that inclines upwards at a 20-degree slope. This will supply the fresh air that will enhance the air quality for the exploitation efforts which are going to involve a lot of blasting and blast dust as well as exhaust from the wheel loaders. This “ventilation raise” will be within the vein material of the DL1 so a limited amount of production might ensue which management referred to in a recent update.

Once the access to the fresh air is intact, then management will have 2 working faces available (working faces #2 and #3) to officially commence EXPLOITATION. The Antonino Adit made a “T” with the DL1 Vein. One branch of the “T” will be heading in a NNW direction and the other in an SSE direction. Once the NNW leg has advanced 20-meters, a downward spiral will be put in to advance to Level 4 which will also add 2 additional working faces (working face #4 and #5) so that 4 working faces can be simultaneously developed. Working face #1 would be gone by now as the “ventilation raise” will have been completed.

I’m going to guess that once 4 (or maybe 6) working faces are being simultaneously mined, management is going to consider moving from hand-held “jack leg” drills to prepare the 2-meter deep bore holes for blasting to a fully-mechanized “jumbo drill”. From an economics point of view, it will be important to have enough working faces in operation to keep it busy due to their expense. Keep in mind that the metrics involving economics by then will be based on how many days of profits will be needed to fund the purchase or rental of a “jumbo”.

I’m going to continue to refuse to provide any TIMING projections as I feel this would be reckless because in this sector, things seem to take forever. Instead, I think the laying out of the pathway of this journey and some of the mileposts would be the proper approach. From what I understand, once you hit the “jumbo” stage, production can be expected to ramp up in a very dramatic fashion. If you get a minute, go on-line and watch some videos of “jack legs” and “jumbos” in action and get a feel for the amount of the upgrade.

MODELING OF THE POTENTIAL NUMBER OF OUNCES OF GOLD EQUIVALENT IN THE GROUND (in situ ounces)

The “volume” of this sheet of plywood measuring 1,700 meters by 700-meters by 1-meter width (an estimate only for now) is 1.19 million cubic meters. Based on a specific gravity of 3.1 metric tonnes per cubic meter, you get a “tonnage” of 3.69 million tonnes of vein material within the DL1 Vein. At an ESTIMATED average grade of 31 gpt gold equivalent (1 ounce per tonne), or a little less than one half of what the predecessor miners averaged, that would represent about 3.69 million ounces of gold equivalent AGAIN IF THE ASSUMPTIONS HOLD TRUE. Don’t focus as much on the absolute number of ounces as much as the formula to compute that number. Wait for the numbers to come in and then plug them in as they arrive. This is just the DL1 Vein and does not factor in the other 5 main veins including the Merlin 1 Vein/Caren Mine which has a longer strike length and features a large suite of “bonanza grades” at similar elevation levels to where the DL1 Vein features “bonanza grades”.

The issue with the Merlin 1 Vein/Caren Mine was that it didn’t have the system of shafts and ventilation raises/chimneys that the Fortuna Mine/DL1 Vein already had in place. When SERNAGEOMIN insisted on Auryn putting in 3 new 140-meter-tall ventilation raises/chimneys, the Merlin 1/Caren Mine took the back burner for later development and the Fortuna Mine/DL1 Vein the front burner. AGAIN, WAIT FOR THE ACTUAL NUMBERS TO BE REPORTED, BUT JUST DON’T BE A DOUBTING THOMAS IF THE GRADE FIGURES, THE IN-SITU OUNCE FIGURES AND THE PRODUCTION FIGURES ARE RATHER ROBUST. As a reference point, the average grade of gold being mined today worldwide is about 7 gpt. My message is that HISTORICAL PRODUCTION FIGURES from the very same Mesothermal Vein are very nice to have in hand and very helpful for modeling purposes and enhancing geostatistical certainty.

MODELING OF POTENTIAL MINE LIFE

“Mine life” (in terms of years) is defined as TONNAGE divided by annual production rate. Management projected that after intersecting the DL1 Vein via the Antonino Adit, they could realize an “INTRODUCTORY” production rate of 40 tonnes per day (tpd) which would scale up over time. Assuming 250 working days per year, this represents 10,000 tonnes per year. This represents a theoretical mine life of 369 years for the DL1 Vein AT THAT RATE OF PRODUCTION. If management can ramp up that 40 tpd production rate to, let’s say, 200 tpd OVER WHO KNOWS WHAT KIND OF A TIMEFRAME, then the resultant mine life would be approximately 73 years. In other words, there is plenty of mine life just within this one DL1 Vein.

THE 64 GPT GOLD FIGURE ACHIEVED BY SMFI HAD NO CONTRIBUTION FROM COPPER. WHAT CONTRIBUTION MIGHT COPPER MAKE TO THE “GOLD EQUIVALENT” GRADE THAT AURYN CAN ACHIEVE?

In the photos taken during the drifting of the Antonino Adit, we saw the ubiquitous presence of what appears to be a bluish-colored “bornite” material. Bornite is a “secondary” form of copper found in what are termed “SUPERGENE ENRICHMENT ZONES” or SGE zones. SGE zones typically contain large amounts of extremely high-grade copper in the form of bornite (33% Cu), covellite (36% Cu) and chalcocite (80% Cu). The average copper grade being mined worldwide today is about 0.6%. SGE zones often feature average grades of 8 to 10-times those of copper deposits without SGE zones. These zones range in vertical width of from 50-meters to 800-meters with the average at about 300-meters.

For copper deposits, SGE zones can be economic game-changers. In a gold-copper deposit like the DL1 Vein represents, it will be interesting to see what contribution the copper grades will make to the overall average grade in terms of “gold equivalent” grade. If the copper grades are strong, then this could open up the universe of potential investors and/or acquirers in a project like this because of the “decarbonization” movement and the potential for electric vehicles and the need for a system of charging stations. “EVs” contain 10-times the amount of copper as a vehicle with an internal combustion vehicle. The problem with SGE zones is that there aren’t many left on the planet. The miners tend to go after these ultra-rich areas aggressively (“high-grading”) and mine them out only to result in their average grade being mined to fall off of a cliff at some point in the future.

MODELING OF PRODUCTION RATES

As far as daily production rates go, we know that management originally projected a 40 tpd production rate just from the old workings before the Antonino Adit drifting had commenced. Later they retracted that projection and stated that they couldn’t meet that projection until after the DL1 Vein was successfully intersected.

From the location of the two processing facilities, we do know that a round trip commute from the top of the hill is going to take right around 5 hours. If you add in loading time and unloading time, I’m going to guess the actual round trip will take around 6 hours. This assumes tip-toeing down the hill at about 11 MPH. Since we’ve been told that they will be working three 8-hour shifts (24 hours per day), it appears that they could get 4 round trips in if everything went smoothly. I’m penciling in 3 round trips carrying 20-tonnes of ore each or 60 tpd in production. The key will be to keep the mountain of crushed ore underneath the end of the inclined belt coming from the crusher intact so that the empty trucks can get refilled without waiting. I’m going to assume that management is going to want to have a huge stockpile of crushed ore in inventory prior to their shipping of ore. The volume of rock removed while drifting the 350-meter Antonino Adit could theoretically fill about 800 twenty tonne trucks. One might assume that management has been sorting and stockpiling well-mineralized ore away from what appears to be sterile ore from the Antonino Adit.

Nice descriptive narrative, Jim. Two questions - 1. what chapter(s) of your book is all this from? As they say, a picture is worth a thousand words! 2. Not too likely we’ll be seeing a wireframe model of the DL1 vein any time soon, is there? Okay, 3rd question, are you working on a screen play version of the last 20 years ( or 50 years)? It would be incredible, for sure. ![]()

Seriously, you provide so much information to support why management states they are very bullish. It appears to be a much greater rough estimate than the ADL Breccia (Gordon pipe) estimate you wrote up years ago, which was based on 18 diamond drill holes. You had written a well researched scholarly “gross metal content” estimate of $1.35B at a time when Gold was $620/oz, Silver $12/oz and Copper $3.10/lb. Taking into account inflation over the years, how much has that estimate changed? This was from just the porphyry rock encompassing the area of the Gordon pipe. Do you think a PEA leading to a Feasibility Study will ever be performed on this Lipangue Breccia area?

This is one of most optimistic and fantastic findings of recent discoveries revealed to date! Thank you BB!

Breathtaking analysis, Breccia! Absolutely breath-taking… Thank you!

I love how you’ve contrasted the thirty years of insane grades detailed in official production records vs. the need for two-inch drill holes spaced fifty meters apart.

And your deep dives into the data continue to remind me of “The Big Short.”

The dozen or so lone wolf analysts who had pored over the actual pages of the toxic mortgages that had been bundled into “investment-grade bonds” and sold to bankers worldwide? Those guys actually knew what was coming.

Didn’t matter that the mortgage industry had its own traditional and unquestionable way of doing things.

Didn’t matter that panels of financial experts and government officials scoffed at the crazy notion that a mortgage meltdown might tank the global economy.

Didn’t matter that tens of thousands of Smart Money investment pros rolled their eyes at the lone wolves’ stupidity, guffawed, rolled on the floor in howling fits of laughter.

The lone wolves had seen the numbers, done the math, placed their bets. They were smart enough to not predict a time frame, but in their bones they felt it: Any quarter now… No, any day!

They knew. They did.

And then finally the entire rest of the world knew, too.

Well before impact, the lone wolves stood beside the lifeboats and fingered the life vests, drummed their fingers on the life boats, watched over the railing as the torpedo that was about to broadside the whole unsinkable ship churned through the placid waters, a distant hint of a ripple just below the surface, unwavering. Silent approach… Direct hit… Ka-boom!

Coming soon, in reverse, to a theater near me…?

– madmen

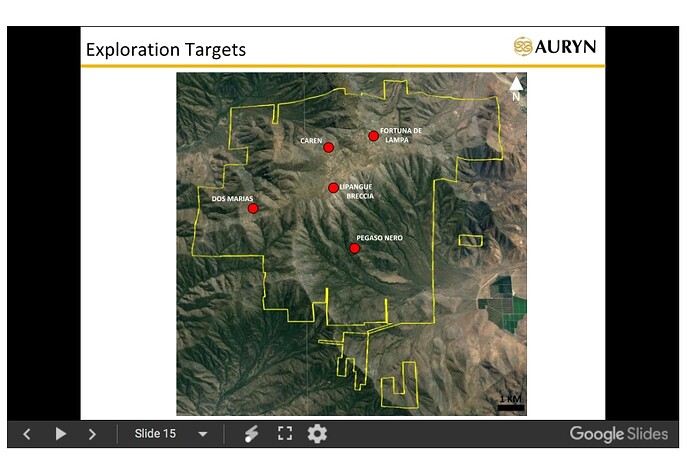

PS – I look at that map in Easymillion’s post. The Alto de Lipangue Mining District (controlled entirely by AURYN), is four-fifths the size of the city of San Francisco. (The Alto is 40 sq mi, San Francisco is 49 sq mi.) The Don Luis vein amounts to barely a toothpick sliver. And again I find myself wondering about Maurizio. He’s placed his bets. He’s standing by the railing. Everything is coming together the way he envisioned it coming together a decade ago, maybe longer. How does the man stay inside his own skin?

I think the key to studying the Auryn/Medinah deal is to realize early on that management is NOT going to be overly promotional until the deal has been sufficiently DERISKED and it’s time to be promotional without risking screwing anybody over. Maurizio blew me away at the Las Vegas informational meeting when he asked the attendees for a favor. He asked that if any of the attendees chose to share their notes from the meeting with others that were not in attendance, that we provide those people with the standard safe harbor boiler plate information. This is that statement at the bottom of the press releases that basically says that this investment is risky and not for widows and orphans.

I’ve been involved in many, many dozens of mining deals and I’ve never seen this before. The CEO of a junior explorer actually has a functioning moral compass. No way! We investors in this niche are not used to this. We’re used to management telling us that the 12-inch trout he just caught had to be at least 2-feet long. This took a little bit of getting used to especially for those that watch the share price quote all day long.

Management teams that pay the monthly burn rate by constantly selling Treasury shares almost have a duty to be at least a little bit promotional in order to support the share price and minimize dilution. When management is advancing the cash to go into production in an interest-free manner, the need to keep the share price inflated in order to minimize dilution goes out the window. A CEO with a functioning moral compass can then keep his nose to the grindstone and concentrate on DERISKING the deal for all concerned.

This approach is going to result in those with a lesser amount of patience probably hitting a moment in time when it’s just time to say enough already and make an exit. This is especially true for those who couldn’t sense progress being made towards a goal. Maurizio was ultra-clear at that informational meeting in Las Vegas. He wanted to become a “mid-sized gold producer” as rapidly as possible. He told us that he had the resources to advance the vein projects into production but that the CAPEX for the Pegaso Nero was way too big and would need a major or consortium of majors to develop.

When the original plan was to drift the Larrissa Adit and put it into production, Maurizio made a comment in a press release that he figured that they could simultaneously mine 6 levels above the Larrissa Adit and 7 levels below the Larrissa Adit. That comment and the stated goal of rapidly becoming a “mid-sized gold producer” suggests to me that the DL1 Vein may be about to go into play in a large way. What I’m looking for is a press release stating that management procured a “jumbo” drill rig. That’s my signal that the game is on.

Rich Strike today, AURYN tomorrow!

Yeah, the Derby was WIDE open - should have picked 5 longest shots and put down $100 each to win.

From TheAthletic.com article on the 80-1 long shot winner “Rich Strike” in yesterday’s Kentucky Derby:

The beauty of horse racing, what draws bettors to the windows time and again and makes them rise in full throat when the horses ride down the stretch, is the possibility. “Small trainer. Small rider. Small stable. We should have been 80-to-1,” trainer Eric Reed said. “But I knew what I had. I knew what we had and what it was capable of…"

Hi Madmen,

Great find! What I personally needed in my 42-year investment life involving the junior explorers was a good butt-kicking. I got this on the “Aurelian Mining” deal with their discovery of the Fruta del Norte deposit. I knew what they had but at the time I didn’t have the confidence in my own abilities to act on it. I got a good reaming out by a geologist/mining analyst named Dirk Masuch who was all over this deal. He put out an analysis, after the fact, that told us that everything was right there in front of us on their website. He made us out to be a bunch of morons and we were. It was a classic geomapping of the watershed from an outcropping upstream. The gold grades kept getting better and better in the water sampling as they tracked down the outcropping upstream.

It ended up being a huge bowling alley-shaped linear deposit hosted by a fault zone. It was a total no-brainer but somehow, I talked myself into just continuing to watch and soon enough it took off like a rocket (like I knew it would) and I figure I’d missed the boat after the PPS doubled and tripled. Well, in one sense I didn’t really miss the boat as it went on to be something like an 80-bagger. It was then that I conceded that I really did miss the boat.

I’m kind of OCD and when I get into something, I tend to go all out. I’ve told myself that I’ll never get “Masuch’d” again and I haven’t. The ADL Mining District and the Auryn/Medinah situation is quite a bit different. Aurelian was working in the jungles of Ecuador where there was a thick jungle to deal with. At the ADL, the geology is much simpler. Aurelian never had artisanal miners that produced gold over 30 years with an average grade of 64 gpt WITH NO CONTRIBUTION FROM COPPER.

In “meso’s” the high-grade stuff is down deeper. It’s not up where “SMFL” got those excellent production grades. Those guys were mining extremely fine gold associated with arsenopyrite. ACA Howe’s report confirmed that there was no VISIBLE GOLD being mined by SMFL. Most of the high-grade gold gets dumped down deep where the hydrothermal fluids were allowed to boil. This severed the bond between the gold and the sulfur it likes to travel with. The teeny-tiny particles that SMFL was mining were so small that they were allowed to float up higher and not get dumped with the larger-grained gold. It takes a lot of teeny-tiny particles to result in 64 gpt gold way up high in the vein structure. These little specks are the “escapees” from the boiling zone.

In these meso vein deposits, the copper will hang out lower near where the historic water tables were. The Antonino Adit intercepted what is probably the top of one of these supergene enrichment zones. That’s what all of that blue stuff is i.e. bornite.

The photos in the Auryn “gallery” reveal a lot just like the Aurelian website did in that case. But keep in mind that all of those awesome looking ore samples (except for the most recent ones where the DL1 was intersected) are the sideshow. They may be rich, but they may never get mined for decades. The big show is the DL1 Vein. That is the “known” in this equation. The crummy stuff up high in the structure weighed in at 64 gpt gold WITH NO VISIBLE GOLD. There’s no “nugget effect” to worry about skewing the assay results. The photos that constantly showed that ubiquitous blue bornite, to me, speak more to what to expect down deeper and also in the Pegaso Nero. I’m pretty sure that the copper grades will give a nice bump to the overall “gold equivalent” grades.

Another big difference in between the Aurelian story and that of the ADL is the predictability of the future ECONOMICS. (Below is a snip-it from a project I’m working on. I hope it helps.)

IN REGARD TO PRODUCTION MODELING AT THE DL1 VEIN

Just as the grades from the past production results from the artisanal minders working that “already-mined” smaller rectangle of the DL1 Vein, we also have valuable historical data regarding future production modeling. Auryn’s crew just drifted a 350-meter-long Antonino “haulage/potential production” adit. During this process, they essentially “mined” and removed about 15,190 metric Tonnes of rock. The adit drifting process done here is the same as the “mining” process about to commence at the DL1 Vein. You drill 2-meter-deep holes into the working face of an approximately 4-meter by 3.5-meter adit, you blast it, you muck/scoop up the ore and you deliver it to the area outside of the adit entrance/portal.

It took them about 242 nine-hour-long working days to do this over the course of about 1 year. They had to take 5 weeks off starting in mid-November when their wheel-loader broke down. They averaged removing about 62.7 Tonnes of rock per 9-hour workday. This equates to about 7 metric Tonnes per hour worked.

We now know that the old crew and the new crew about to join them will be working three 8-hour shifts or 24 hours per day. At the rate of removing 7 Tonnes per hour that suggests the ability to “mine” about 168 Tonnes per 24-hour workday. This is based on them using the same old-style “jack leg” drills. If only one 20-tonne truck is in use, and it makes 3 round trips per day to the processing facilities then it will deplete only 60 metric Tonnes of crushed ore per 24-hour workday. This means that the mountain of crushed ore should be growing on a daily basis even after servicing the needs of a truck making 3 round trips.

Let’s take a quick timeout. What just happened here? We took readily available and 100% trustworthy data from the Antonino Adit drifting, sprinkled in a little bit of knowledge that adit drifting is basically “mining”, and we came up with a rough model for predicting THE MINIMAL LEVELS OF future production. WE KNOW MORE THAN WE THINK WE KNOW.

What we don’t know is what percentage of the 15,190 metric Tonnes of ore removed during the drifting of the Antonino Adit will be shipped. If you’ve studied the photos, you can see that a significant percentage of that ore appears to be very well-mineralized. However, we need to wait on the assays and management’s guidance. If half of that ore is destined to be shipped, then that represents almost 400 twenty-tonne truckloads of ore to “jump start” the production process. Clearly, they’re going to need more trucks sooner than later. You don’t want that mountain of crushed ore to grow too large and occupy a significant portion of the loading area.

If the economics of the operation suggest that it is time to rent or purchase a “jumbo drill rig”, then this increased mechanization is going to necessitate a significant increase in the number of trucks being simultaneously deployed. Based on an “All-In-Sustaining-Cost” of somewhere around $900 to $950 and the recent prices of gold over the last couple of months, it appears that the profit margin on each ounce shipped will be about $1,000. Therefore, each 20-tonne truckload carrying 1 ounce per tonne ore, should represent about $20,000 in profit. One truck making 3-round-trips per day, should represent about $60,000 in DAILY profits BASED ON THE VARIOUS ASSUMPTIONS OUTLINED PREVIOUSLY.

You can clearly recognize how motivated management will be to crank up production in order to be able to maximize the number of trucks being deployed that are each clearing $60,000 per day ($15 million per year) in profits. In terms of the number of days of profits needed to rent or pay for a “jumbo”, you can see that a “jumbo” is probably going to be in the cards sooner than later. Depending on the number of booms that the jumbo has (in between 1 and 4), a new jumbo with a warranty will cost somewhere around $600,000 and a used one somewhere around $250,000.

If you do the math based on one truck being able to generate $60,000 per day in profits and 70 million shares being issued and outstanding, you can see where one truck making 3 round trips per day would generate about $15 million in profits annually. This is based on 5-day work weeks. You can see how the focus will be on getting that mountain of crushed ore, between daily production and existing stockpiles, as tall as possible. This way more and more trucks, each making $15 million in profits, can be deployed in order to keep that mountain of ore from getting too large.

Before gaining access to the fresh air contained within the “old workings”, SERNAGEOMIN had Auryn’s preliminary allowable production rate set at 5,000 tonnes per month. This represents about 11.3 truckloads being shipped per day based on 22 workdays per month. I’m going to assume that the ventilation improvements and the housing improvements will result in that figuring being larger now.

We need to remind ourselves that we are living in an investment neighborhood characterized by speculators taking on ULTRA-HIGH RISK while searching for ULTRA-HIGH REWARDS. Remember the World Gold Council’s statistics that say that 1-in-1,000 junior explorers will ever make a significant discovery that they can get into production. Do you remember the corollary? Even for that lucky 1-in-1,000, it takes an average of 24 years to go from the commencement of exploration activities to finally going into economic production. Now that we are blessed with 20-20 hindsight, why in the world would anybody invest in a junior explorer UNTIL they had made a legitimate discovery and UNTIL they were at the brink of putting it into production? There better be some SCARY numbers in that ULTRA-HIGH REWARD calculation after knowingly or unknowingly assuming that much RISK.

Is it fair to say we/you also don’t know why the company only managed to send two truck loads of ore (of what you claim to be 15k tonnes of stockpiled ore) to Enami during this entire drifting process? They had a truck just sitting there with a mound of economic material. Based on everything you KNOW doesn’t this fact give you some pause in your analysis? (rhetorical question)