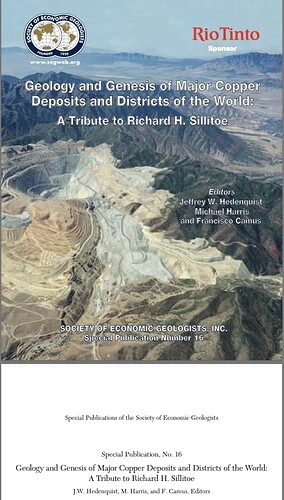

Another nuisance post does not negate the persistent forward progress management is making. My sock drawer investment is still intact while you’ve just failed to move on Baldy. ![]() Keep up the good work, I’m sure management is paying it a great deal of attention to you, Baldy, while weighing it to what Dr. Sillitoe had to say toward a mine plan.

Keep up the good work, I’m sure management is paying it a great deal of attention to you, Baldy, while weighing it to what Dr. Sillitoe had to say toward a mine plan. ![]()

I’m sure your words and wealth of knowledge overwhelm anything Dr. Sillitoe had to say in moving the company forward! ![]()