As Brecciaboy has emphasized time and time again, that’s the beauty of management’s equity interest being aligned with ours. And that’s a good explanation of why they will NOT do the conversion NOW - because they would have to liquidate some of THEIR OWN shares to pay company debt. Does one think they’d like to liquidate THEIR OWN shares at fire sale prices? Hurt themselves? Don’t think so. It’ll all happen when it’s ready to happen. Would very high lab results on the DL II vein be the catalyst? Or, will we need to wait until actual production commences? Hard to tell.

Looking forward to be able to do some meaningful revenue projections. Should be fun with the price of Gold on the rise. Hoping we can break and hold $1,900oz and then go past $2,000 this year.

AUMC has found several veins on the way to the Don Luis ranging from 5g to 15g AU. Widths have been so/so at 15cm to 60cm. At 15g, they are economical if the vein is on the wider side, but AUMC doesn’t know the extent of those veins. That’s why they are going to the DL, expected grades that are good and wide and deep.

Can’t wait to see what is inside the box!

Two question poll regarding assays?

How much gold do you think the assays will show?

- 5-10g

- 10-15g

- 15-20g

- 20-25g

- 25-30g

- 30-35g

- 35-40g

- 40g+

0 voters

What is the lowest grade you would consider satisfactory?

- 5-10g

- 10-15g

- 15-20g

- 20-25g

- 25-30g

- 30-35g

- 35-40g

- 40g+

0 voters

I edited the second question on the poll to more accurately reflect what I was trying to ask. Feel free to alter your vote.

I voted 15-20g as the lowest I consider acceptable. Anything over that acceptable too, but I was asking for the lowest acceptable here.  I’m hoping they are higher, of course.

I’m hoping they are higher, of course.

My recollection is the ACA Howe report indicated 15-20g on 1m width and we are in business (during the time it was written wrt metal prices and mining costs.) I assume that still holds true.

Thank you Kevin! When you get excited I get very excited  hope this is a grand slam!

hope this is a grand slam!

Do I remember the average grams per ton mined historically by the artisanal miners was 75 g/ton?

You remember well. It seems a little shy of 75. But that was a different era and hand selected material. I am not sure anyone is attaining those kinds of grades at scale today. If we get those on significant tonnage . . . oh my, goodness . . . hello naked beach running. ![]()

Seems like if we were better-equipped to find the DL II, the mesothermal vein which i am assuuming they did NOT, then maybe we ought to maybe out-perform them? Don’t know, but if they get anywhere close to 75 g/ton, we will all do well.

Happy 2023 Medinahmites.

Here’s what I’m putting together from Brecciaboy last month:

Permeability - known argillic alteration at surface is indicative of very good permeability, which is needed for the hydrothermal fluids to flow (BTW, same thing in the oil and gas arena)

We think Level 2 is the Oxide Zone, because we see in the mid-December sample pictures the cuprite (reddish color) and limonite.

We already have 18 samples from just ABOVE Level 2 - 6 of 18 were 100 gpt or better, and there was plenty of milk quartz (where gold tends to hang out)

The samples which we await were taken from just BELOW Level 2, maybe where the water table meets the SGE zone.

SGE zones have a high level of concentration of bornite (the bluish stuff) - and also covellite and chalcolite.

SGE zones tend to have INSANE concentrations up to 10-times the original grade they have above and are usually hundreds of meters thick.

The pictures from the first week of January features a lot of the bluish color - we THINK bornite.

QUESTION: Knowing the above - and the fact that there are PATTERNS in these deposits - Was Maurizio TAUNTING us with that picture from last week showing all the bluish-colored bornite?

Or, was he simply trying to justify the time spent on what turned out to be a failed experiment?

Delays? Is he having the samples double-checked because they might be real good and wants to be careful not to publish incorrect information?

All possibilities - we should soon find out. Maybe.

Hi Kevin,

Another way to have asked that question would be: “What do you think the average “gold equivalent” (including copper and silver) grade will be for the LIFE OF MINE at the DL1? The Antonino Adit is the new level 3. At Level 0 the average grade that the artisanal miners got was about 54 gpt gold. At Level 1, it was about 64 gpt gold. At Level 2, the average was about 74 gpt gold. It’s important to see the trend involving increasing grades with increasing depth. This is the hallmark of MESOTHERMAL VEINS.

Auryn already got a peek at the Level 3 area when they took a dozen samples at just below where Level 2 intersects shaft A (the northwesternmost of the 6 shafts named A-F). “Shaft A” is about 100 meters NNW of the intersection of the Antonino Adit and Level 2 which was near “Shaft C”. The first 11 of 12 samples at the intersection of shaft A and level 2 averaged 57 gpt gold. The 12th came in at 1,220 gpt gold (not a misprint). The first reaction would be, ah that’s just the “nugget effect”. Partially maybe, but the sample was a channel sample that weighed 11 pounds and all 11 pounds averaged 1,220 gpt gold. This was not a 2.2-inch in diameter HQ drill core intercept that nicked a gold nugget. The silver also came in off the charts (2,670 gpt) which, to me, is a head-scratcher but it helps corroborate the anomalous gold grades. I would assume that management is going to make a beeline to this area hoping to find an ultra-rich “ore shoot” and trace it out.

If you count that 1,220 gpt sample at full strength, the average of the 12 samples would be 154 gpt gold. JUST LIKE IN LEVELS 0,1 AND 2, WITHIN THESE 12 SAMPLES, THE GRADES GOT RICHER WITH DEPTH AND YES, THE LOWEST SAMPLE WAS INDEED THE 1,220 GPT SAMPLE. I wouldn’t suggest counting that highest grade sample with an equal weighting with the other 11 samples but I’d feel OK with saying that the “trend” to date, is definitely better grades with increasing depth.

Why are mesothermal veins famous for BOTH improving grades and widths with depth? Try to visualize an empty vertical fault or a crack in the rocks. The roof of an underlying magma chamber (its “carapace”) ruptures when the internal pressures exceed a certain “lithostatic threshold” level. Up comes a flow of extremely hot magma and hydrothermal fluids containing gold. The most characteristic property of gold is its specific gravity/density. It is one of the densest materials on the planet with a specific gravity of 19.3 (water has an SG of 1). A cubic meter of gold weighs an insane 19.3 metric tonnes. This is almost twice the density of even lead which has an SG of 11.34.

When the pressure pulse diminishes, the gold is going to drop like a lead sinker within that fault/crack. Some of the lower concentrations of gold will remain up high. As these pulses continue through millions of years, the gold keeps piling up relatively low in the structure in higher concentrations. It’s nature’s way of CONCENTRATING the gold. Placer gold is gold from outcroppings that has become dislodged and flowed downhill in the watershed of a mountain slope. When a river containing placer gold hits a bend, the waterflow will slow down and, again, the ultra-dense gold drops like a lead sinker on the spot. It burrows its way down into the layers of silt.

A similar phenomenon occurs in regards to the width of these about to become “Mesothermal veins”. Mesothermal veins form way down low where both the temperatures and pressures are huge. The pressures way down low in this fault/crack are so high that they will tend to widen the crack/about to become a vein, at its base. So, you end up with higher grades and wider widths in these meso’s down low. You can see this trend in the historical production figures at the DL1 Vein. Whatever grade numbers the Auryn geologists get at this Antonino Adit and DL1 intersection, they might (no promises) be the lowest of all of the future grades as they mine lower and lower in the structure.

What about all of these 25 or so other veins encountered in the Antonino Adit, should we expect the same kind of grades that we’re seeing in the much larger DL1 Vein? No. There is a phenomenon known as “phreatomagmatism”. This involves red hot hydrothermal fluids migrating up faults and cracks in the rocks and then encountering the water table. The resultant explosivity is like a firework show. Much smaller cracks are created in the rocks which take in these hydrothermal fluids and provide a place to cool and deposit the metals they contain. You don’t get the gold dropping like a lead sinker phenomenon in this case as the gold can travel in a gaseous form under these conditions. These “splays” will be numerous and feature lower grades than wider structures like the DL1 Vein. If the vein/veinlet pattern is dense enough, the possibility of exploiting the ore versus open pitting might come onto the table.

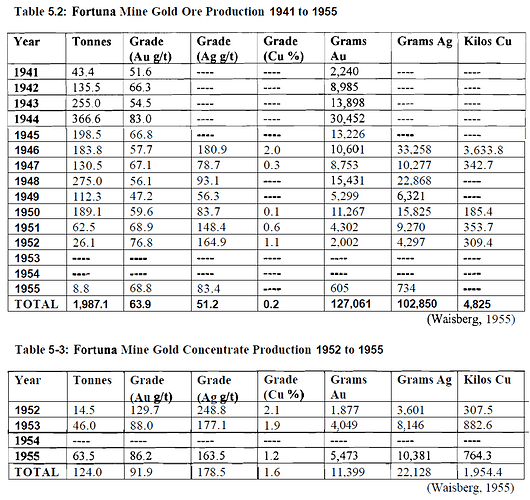

You can see in Kevin’s chart taken from the ACA Howe Summary Report, how the average of 64 gpt gold jumped to 92 gpt gold from 1952 on after they deployed a crude “flotation circuit” in order to capture more of the sulphides. The METALLURGY at the DL1 is favorable to being concentrated. What we really want to know once things get into high gear, is what grade of ore is going to be shipped to the processing facility AFTER any on-site “beneficiation” (concentrating) is done. We already know that this ore is amenable to being concentrated efficiently using inexpensive gravity circuits. These are basically centrifuges which rapidly spin around and the centrifugal forces push the more-dense materials like gold to the outside of the device. With favorable METALLURGY like this, a small expenditure on-site can result in a significant increase in SHIPPED GRADE and profits.

The other thing to keep an eye on are the copper grades. That historical average of 64 gpt gold didn’t have any copper byproduct credits built into it. At today’s prices of gold and copper, you need to add an additional 1.41 gpt “gold equivalent” for every percentage point of copper.

The numbers we’re bantying about are huge when you realize that the average grade of gold being mined today in open pits and in underground operations is 1.29 gpt gold. For underground only operations, the worldwide average is 4.15 gpt gold BUT THIS FIGURE HAS BEEN DROPPING BY 6% PER YEAR FOR SEVERAL YEARS. This is due to the 34-year drought in new “virgin” discoveries. The DL1 is an impressive structure with its 1,000-meter strike length and depth of at least 700-meters.

Kevin made a good point that the artisanal miners we’re probably doing some sorting and discarding of WHAT APPEARED TO THEM to be low grade ore. Interestingly, some of the tailings piles of these “discards” graded an average of 5.3 gpt gold which is higher than the worldwide gold grade average for underground operations mining fresh ore. Of course, the price of gold back then was about $35 per ounce, so the artisanal miners had to maximize their grade by on-site sorting. They couldn’t afford to bulk ship the lower grade ore. At A POG of about $1,875 per ounce, Auryn will be happy to ship pretty much everything they mine perhaps until they do some on-site “beneficiation/concentrating” of the ore.

So, we have two conflicting variables when handicapping if Auryn can match the extremely high grades of the artisanal miners. If Auryn doesn’t do any sorting or beneficiating at first, then the grades to expect might be slightly lower than that of the artisanal miners. Offsetting that would be the expectation that the grades down deeper are likely to be higher than those at level 2 and above. Another offset would be the contribution by copper ESPECIALLY IF WE’VE ENTERED INTO A SUPERGENE ENRICHMENT ZONE AS SUGGESTED BY THE PREVALENCE OF WHAT APPEARS TO BE COPIOUS AMOUNTS OF HIGH-GRADE BORNITE.

My advice would be to keep a close eye on the copper. Management hasn’t been using the “P” word so I’m a little hesitant to breach this topic. There is a geological entity known as a “gold rich copper porphyry”. One of Auryn’s geoscientists, Dick Sillitoe, is the premier authority on these deposits worldwide. We won’t know if we’re dealing with one of these until we get there either by mining or drilling, but these atypically high grades being found within these mesothermal veins may be suggestive of an underlying porphyry deposit perhaps also with atypically high grades. For now, the economic benchmark to keep in mind is that 4.15 gpt gold average worldwide by underground miners that are currently making decent money.

What I’m doing with the upcoming grades from the intersection between the Antonino Adit and level 2 is taking them and adding them to the 12 samples already taken at approximately this same depth about 100 meters to the NNW. The geoscientist on staff acting as the “QP” or “Qualified Professional” is able to assume that the 100 meters in between these 2 batches of grades will be close to the arithmetic average of all of the samples. As we progress to the NNW during the mining operations, the statistical validity of this assumption will be enhanced.

tl;dr according to ChatGPT:

The text is discussing a mining project by Auryn Resources to extract gold, silver and copper from a vein at the DL1 mine. The mine is composed of different levels, and it’s noted that as the level increases, the grade (concentration) of gold in the vein improves. It’s discussed that this is typical of mesothermal veins, which are known to improve in both grade and width as the depth increases. The text also notes that some samples taken from Level 3 at the mine have shown very high grades of gold, with one sample coming in at 1,220 gpt (grams per ton). It’s said that management is likely going to focus on this area in the hopes of finding a very rich ore shoot. It’s suggested that the grades they find at Level 3 may be the lowest they find as they mine lower into the vein.

You should see what I am doing with OpenAI and ChatGPT for work. Mind blowing stuff right now.

Wiz, we could appreciate the “mind blowing stuff” a lot more if you could remind us who OpenAl and ChatGPT are. TIA

Gold hits 1900

It’s machine learning/artificial intelligence. ChatGPT is a conversational bot built on a very large language model that has been trained on a mind-boggling amount of information. It’s able to use context from your conversation to further refine the results it generates. Still has some rough edges but it’s amazing what it’s able to do now. The underlying language model has been undergoing gradual improvements and each subsequent version has been a massive leap forward in the results. OpenAI is just the company behind ChatGPT - they’re also known for DALL-E, an image generating machine learning model. OpenAI’s name is misleading though. Their work is not open-source - just open for business.

That summary I had it generate was made by simply asking it to provide a tl;dr on the following text and pasting brecciaboy’s post in the chat.

Link with some examples if you’re interested: ChatGPT: Optimizing Language Models for Dialogue

Nice to see Gold rebound from this morning high. Let’s see if we break resistance at around 1910

Let’s see those results ![]()

I pulled the following information from an old 2015 article. Thought it might be of interest to those who took the survey. There is no doubt that Mesothermal Vein Structures are rare, very large in size and continue at depth, and are usually poly metallic. They are a major source of the world’s gold production. The info below was about the Fire Creek Mine in Nevada that was acquired by Hecla in July 2018:

Gold grade

Reliable up-to-date figures for grades of gold produced by various mines are difficult to find. …

Open Pit:

|Low grade| |0 - 0.5 gold grams per tonne|

|Average grade|0.5 - 1.5 gold grams per tonne|

|High grade|1.5 + gold grams per tonne|Underground Mine:

Low grade 0 - 5 gold grams per tonne Average grade 5 - 8 gold grams per tonne High grade 8 + gold grams per tonne ‘Bonanza’ grade Troy Ounces (31.1 grams) per tonne ( * [How Is Gold Graded In Mining?

Brecci …You must have tapped and sampled a whole bottle of wine for that post.

I fink iz had at leasst A 6pack of my chiep beeer readdingg all of dat. thumbs up ol mate…hope werrr rich when I wake back up.

Gold now over 1910! Looking good