EZ copied me on the linked-to article below on what’s new in VEIN MINING. This is from the ENGINEERING AND MINING JOURNAL (E and MJ). Here’s the link:

Narrow Vein Mining Fit for the Future | E & MJ (e-mj.com)

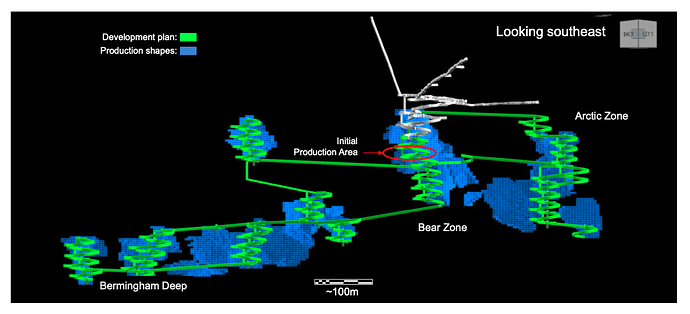

I’ve found myself in a bit of a defensive posture since I recently opined that Auryn might be able to MATCH (not exceed) the SHIPPING GRADES that the artisanal miners at the DL2 Vein achieved when they produced 2,000 tonnes at an average SHIPPING GRADE of 64 gpt gold. The SHIPPING GRADE is composed of the DL2 VEIN GRADE less the DILUTION caused by the necessary mining and shipping of some of the less well-mineralized wall rock. These accomplishments of the artisanal miners occurred in between 1940 and 1970 utilizing the mining technology available at the time. Apparently, the only “beneficiation” methodologies used, except for those outlined below, was visual sorting.

The ore from the DL2 Vein has at least somewhat of a track record for being amenable to “beneficiation/concentrating” methodologies. The artisanal miners experimented with a 4-cell “flotation” circuit and this got their average SHIPPING GRADE up to 92 gpt gold. Later they deployed an unidentified beneficiation methodology (probably gravimetric concentration) that got their SHIPPING GRADE up to 102.7 gpt gold. Many years later, Auryn experimented with the Sepro/Falconer gravity concentration system and had excellent results with the system recovering over 90% of “even the fines”. I believe we’re close enough to receiving the results of the gravimetric methodologies being deployed at the 2 labs in Peru that the prudent move might be to patiently await those results.

The problem the artisanal miners at the DL2 Vein had was in recovering the very small particles of gold called the “fines”. Approximately 50% of the ore they were processing had “fines”. Their recovery rates were so bad that their tailings/discards still ran at 14 gpt gold over and above the 64 gpt gold ore that was shipped. As far as a benchmark, the average grade of gold being mined today is 4.15 gpt gold and it is dropping at a rate of 6% per year. As one might expect, miners have a tendency to go after the highest-grade gold ore first, a process referred to as “high-grading”, and leave the lesser grade ore for later. This is WHY the “head grade” of gold ore being mined worldwide is dropping by 6% per year. Next year, the average gold grade expecting to be mined worldwide is expected to have a “3gpt-handle”.

Today’s “GRAVIMETRIC PLANTS” can recover even “ultra-fine” gold measuring 50 microns, which is the average width of a human hair. A “micron” is one-millionth of a meter.

The last shipment of gold mined by the artisanal miners at the DL2 Vein was shipped 53 years ago when the price of gold was $35 per ounce. Producing only 2,000 tonnes over the course of 30 years (about 5.5 tonnes per month) tells us that this was a “mom and pop” type of operation probably with minimal mechanization. This has NOTHING to do with the production rate to be expected from Auryn.

The recovery rates of the gold by the artisanal miners was pathetic, yet they still averaged a SHIPPING GRADE of 64 gpt gold. This does have something to do with the SHIPPING GRADES to be expected by Auryn which is recommencing production from the very same site that the artisanal miners ceased operations at 53 years ago.

If the grades of this vein were so high, then why did the artisanal miners cease operations in the first place? The grades were indeed exceptional but the price of gold was only $35 at the time, so the ECONOMICS were good but not stellar partly because of the low production rates.

When Pinochet came to power in Chile shortly after 1970, he started “nationalizing”/stealing the mines from the smaller producers and gifting them to the people that brought him into power as the new dictator. The owners of the DL2 Vein, then called the Fortuna Centro Vein, dynamited all of the adit entrances in order to conceal the mine. His reign lasted 17 years.

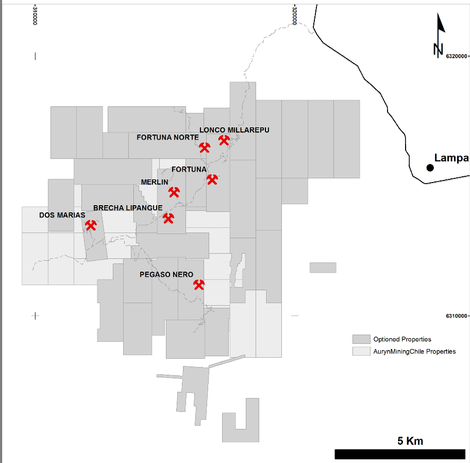

After Pinochet’s reign, the mine changed hands a couple of times but nobody was able to consolidate the nearby mining concessions into one ownership and advance the development of the ADL Mining District. Maurizio came onto the scene and successfully merged the concessions he had already purchased with those of Medinah Minerals and Cerro Dorado. Today the ADL Mining District is composed of about 10,500 hectares with a hectare equating to about 2.5 acres.

In the interim timeframe between 1970 and today, the price of gold has gone up 57-fold but the stellar gold grades obviously didn’t change. Theoretically, in the absence of the Pinochet coup, all of the 6 main veins at the ADL Mining District should have been mined out by now but in reality only about 4% of the DL2 Vein has been mined.

This linked-to article should provide us with a sense of humility because today’s narrow vein underground mining techniques are complex and they have advanced markedly over the years.

A line that caught my attention cited: ”The low waste, small footprint ethos of narrow vein mining aligns perfectly with the environmental, social and governance (ESG) conscious direction in which the mining sector is heading.”

I think we need to face the facts that the ESG movement in mining, especially in Chile with Marcela Hernando at the helm as the MINISTER OF MINING, is the way of the future. Narrow vein miners have a distinct advantage over the much larger open pit miners when it comes to following the ESG protocols.

The equipment available to the narrow vein miners is now much more compact. This reduces the DILUTION RATES associated with the need to mine some of the wall rock located on either side of the vein proper. There is constantly a trade-off in vein mining between minimizing DILUTION and having an adit wide enough to allow the passage of more powerful equipment.

Another sentence that caught my attention cites: “There has also been a quantum leap in mine design software in a relatively short space of time which, from the engineer’s perspective, has made designing narrow vein operations and orebody modelling infinitely easier and faster.”

I can’t provide you with any hard and fast predictions as to what SHIPPING GRADES Auryn is about to average after on-site beneficiation probably via a GRAVIMETRIC PLANT if Auryn ends up doing business with the “INTERNATIONAL MINERALS TRADER”.

What I do know is that the artisanal miners being able to average a SHIPPING GRADE (VEIN GRADE plus the negative effects of DILUTION) of 64 gpt is pretty extraordinary especially when mining up higher in the vein structure where grades are typically low in these MESOTHERMAL VEINS.

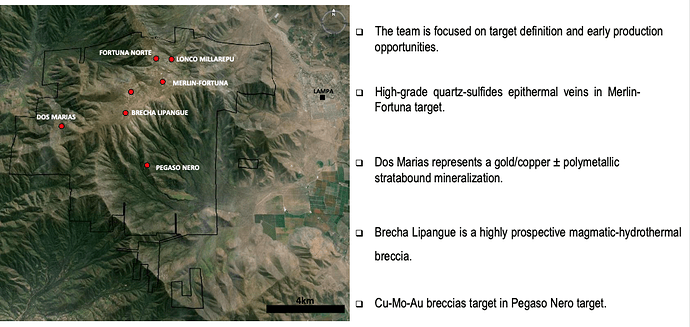

Most narrow grade vein deposits are situated in EPITHERMAL VEINS. MESOTHERMAL VEINS, like those at the ADL Mining District, form lower in the earth’s crust where PRESSURES and TEMPERATURES are much higher. They have a tendency to be of a much higher average grade than those encountered in the much more common EPITHERMAL VEINS. The “Meso’s” are famous for CONTINUITY to great depths and for “telescoping” out of porphyry deposits. The DL2 Vein can be traced downwards on the downslope off of the ADL plateau to an outcropping 700-meters below the plateau. They are also known for BOTH INCREASING GRADES and INCREASING WIDTHS with depth.

Below is a link to an article on VEIN DEPOSITS that describes the differences between EPITHERMAL VEINS and MESOTHERMAL VEINS.

In the “MESOTHERMAL TYPE CHARACTERISTICS” section of the article, you can see the blue-colored “ADVANCED ARGILLIC ALTERATION” which we see at surface in the area of the DL2 Vein. It is colored yellow in the Auryn Power Point presentation.

The MESOTHERMAL VEINS are depicted in the olive color. Towards the bottom of the picture you see the “FLUID-SATURATED CARAPACE”. The “carapace” is the roof of the magma chamber from which the metal-bearing hydrothermal fluids and gases escaped and migrated upwards to fill the cracks and the faults within the overlying rock structure. When these fluids cooled and crystallized these cracks then became “ORE-BEARING VEINS”.

When you read about the drifting of the Antonino Adit, you’ll recall how the miners encountered several hundreds of meters of solid ALTERATION as well as the appearance of copper which was not encountered in the higher levels mined by the artisanal miners.

Note on the left-hand side of the drawing just above the “FLUID-SATURATED CARAPACE” how it says “K-SILICATE ALTERATION CU-BEARING”. This lines up nicely with the level of the Antonino Adit where the copper in the form of blue-colored BORNITE started appearing. You might remember how Maurizio hustled up to the mountain and did a taped-interview inside the Antonino Adit where all of a sudden the adit walls turned blue.

In these types of deposits, after everything had cooled the “carapace/roof” of the magma chamber and the area immediately above it, can become what is called a “porphyry deposit”. You might remember when Auryn did their “ridge crest sampling program” on the southern downslope off of the plateau, they discovered 2 anomalies within a 3,600 meter expanse. They called the upper one the “MOLY ANOMALY” and the lower one the “COPPER ANOMALY”.

In porphyry deposits, MOLY (molybdenum) occurs near the “carapace/roof” of the relict magma chamber accompanied by K-silicate. I think you can see how nicely the “Sillitoe porphyry model” fits here with the MESOTHERMAL VEINS “telescoping” out of the porphyry structure. London-based Richard Sillitoe spent 4 and a half days at the ADL as a guest of Maurizio.

If you scroll down in the article to the drawing under the EPITHERMAL (VEIN)TYPE CHARACTERISTICS, you’ll see how the much more common “EPITHERMAL VEINS”, pictured in red, are much thinner and more fragmented. The ADL Mining District probably had several of these but over the 91-million-year life span of this district, EROSION has removed the once conical-shaped upper third or so of this mountain leaving behind the current “PLATEAU”.

The “GRANODIORITE” that occurs at the current surface of the plateau is an IGNEOUS INTRUSIVE type of rock that does not belong at surface unless there is a tremendous amount of EROSION that has occurred. IGNEOUS INTRUSIVE rocks like granodiorite “intrude” into the belly of a stratovolcano like this one and stays there. IGNEOUS EXTRUSIVE rocks like the ANDESITE we see at the north and northwest areas of the plateau, “extrudes” through the volcano’s apex as “lava” and flows downwards in a 360-degree fashion. There is a world of difference between the grades and mine lives of MESOTHERMAL VEIN SYSTEMS like this one and EPITHERMAL VEIN SYSTEMS.