Just to expand on this and to support my thesis that

This mine operation will not look anything like the most optimistic descriptions posted here, at least not for a long time. Nevertheless, is a potential solid money maker. But increasing production will be difficult and completely depends on having lots of faces in operation.

The basis of this assertion is fairly simple, mechanical, and as follows:

- Consider the dimensions of the ‘scoop’ being used (basically a bobcat):

- Next consider the dimensions of the Antonino tunnel through which this scoop must transport rock too and fro.

-

It is approximately 400m from the entrance to where they have intersected the DL and where they will be constructing the 50 sq. m “gallery” for maneuvering the ‘scoop’ moving up and down the tunnels.

-

The tunnel is about 2.5m wide and about 2.5m high as seen in various pictures

-

The scoop in the tunnel can be seen here: scoop in the Antonino tunnel

-

Consider the working face: 2.5m x 2.5m. So for every 2m of blast depth you will get 2.5x2.5.2 m^3 12.5 m^3 of rock which is about 3 m^3 of ore (4.5 tonnes or so) and the rest is 9.5 m^3 of empty rock.

-

So for every such blast the poor scoop with a meagre 0.37 m^3 scoop must scoop up rock, ore or waste, back down the working tunnel, which becomes longer and longer with each blast, get to the gallery and spin, and head down the Antonino tunnel for 400m, dump rock, and go back and do it again. It must do this approximately 35 times to clear the rock from one blast from one face.

Their tunnel can not be smaller than the scoop.: If you make it smaller you just make the bucket smaller. You don’t want to make the tunnel bigger so you can get a bigger scoop, because you just get much more waste rock you need to clear.

Now, if you are dealing with wide 3m or 5m veins, obviously you make the tunnel as wide as the vein and you get as big of a scoop as you can fit and you work that way and much of your transported rock is ore. The issue is the narrow veins.

You can’t fit more than one scoop in a tunnel at a time

So if you consider this, and consider you have to plan the blast, drill, place the explosives, blast, let the air clear, and transport → well there is one shift approximately, 8hrs. So 3 shifts per day, 3 blasts, = maybe 12 to 14 tonnes of ore per face per day. 6 faces = maybe 80 tonnes per day and 2000 to 2500 tonnes per month.

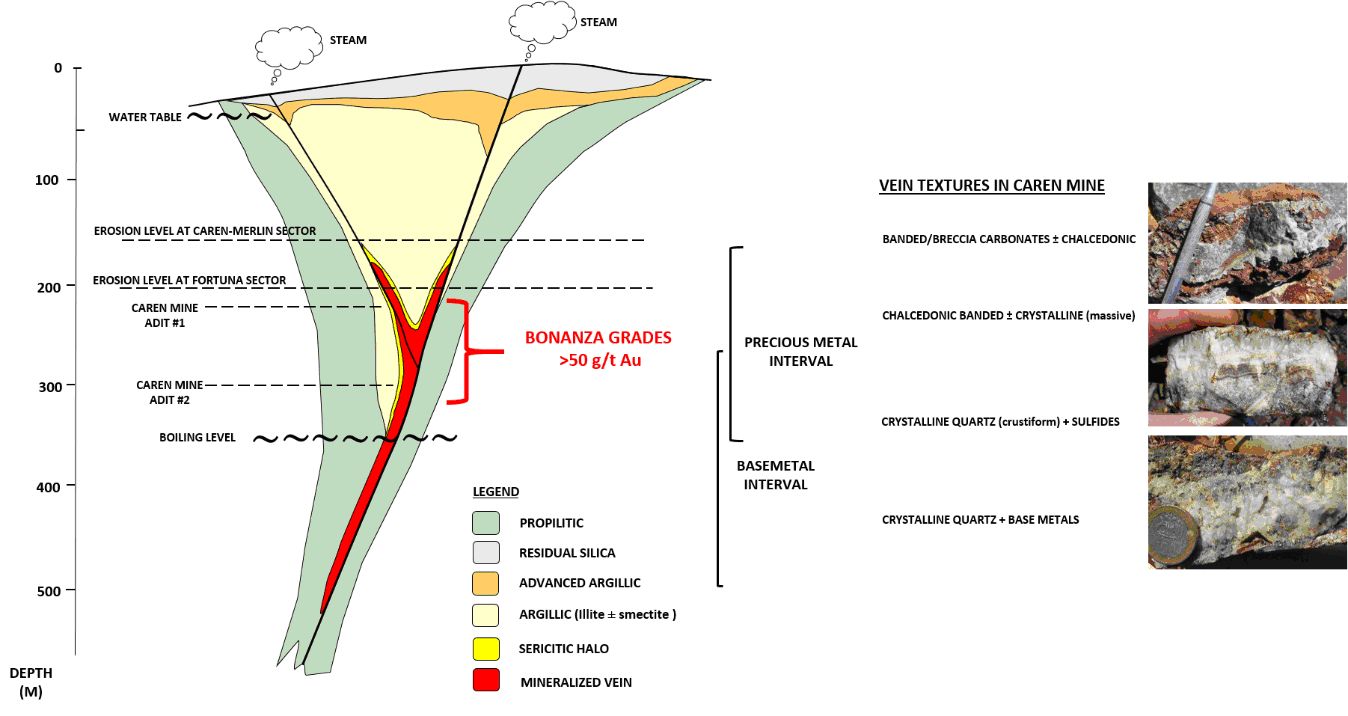

Very high grades and a high POG will enable you to do this and still make a nice profit per face if you are good at what you do. But is very difficult to scale. Making larger tunnels is self-defeating. All you can do is add more faces. And you can only have one scoop going up and down the 400m of Antonino at a time, even if you can have maybe two going in and out of the various active face tunnels.

This is why narrow veins are so difficult. And why Hecla has a 40+ gpt proven resource mine, on the ‘highest grade mines in the world’ list, on care and maintenance because it could not be mined at a profit.

In addition to scaling, another issue is that per blast so much rock is waste that it is hard to avoid dilution, that is mixing waste rock and ore. This study suggests even with optimization you may have 66% dilution with a 0.5m vein width and a very narrow working width, which can drop to below 10% with a 5m vein width.

Again, Auryn will have to be good at what they do. They can still make very good money if the grades hold up even to an average 60 gpt and even if they suffer 66% dilution. But scaling size will be very hard. All of this gets somewhat better if the grades hold up and the veins merge at depth and the width increases. if … if … if. Do note that the distance between DL1 and DL2 decreased from 4m to 3m by going about 35m to 40m down to level 3.