The flowsheet cited just goes to show how complex a process using flotation to get to the smelter is. Isn’t it much better to send hi-grade ore direct to the smelter if it can be mined efficiently in sufficient quantities? I note that there is a just 1 High Sulfide mine in Chile in the 5M oz category listed (El Indio/Tambo, Chile - Primarily high grade veins and breccias). Pascua//Lama/Veladero in Chile/Argentina, however, is a 40 M oz. combined district resource.

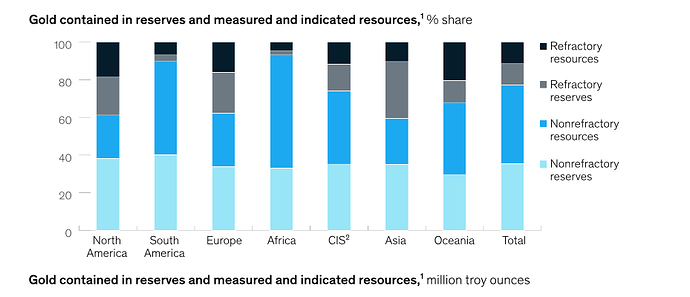

The link I provided in my earlier post (“Refractory gold ores: Challenges and opportunities for a key source of growth”) fully supports that 90% of all gold mined in SA is from non-refractory ores! It is for this reason that I support the idea that free milling ore may provide the most economical and profitable path to early cash flow. Of course, it is up to MC’s team to figure out how to bring in the quickest early cash return for the least cost. Maximizing profitable cash-flow will lead to realizing the longer term vision of becoming a mid-tier producer.

Earlier you supported this idea. It’s interesting that the hi-grade “bonanza grades” at the Merlin 1 and DL1, are at similar levels from an elevation point of view.

Continuing the discussion from Auryn/Medinah - 2022 - 1st Half General Discussion:

Also, about that same time you had noted an intriguing finding at the intersection of Shaft A and Level 2 of the Fortuna Mine/DL1 Vein.

Continuing the discussion from Auryn/Medinah - 2022 - 1st Half General Discussion:

Management is refining both the short-term and long-range business plans as the development of the entire project continues. This includes the possibility of bringing on and finding suitable additional partners for the various porphyry targets. CU is still the big prize if it can be nailed down. There is a significant amount of work remaining evaluating all the targets. It is encouraging to see MC’s team is fostering a close relationship with government officials as mining and permits progress forward.

EZ