Great read Doc and Easy! Thank you! Now let’s see that 1st check ![]()

My understanding of the long series of updates is that:

-

They expected the new tunnel to be much shorter than it turned out to be so the expectation was that they would be to the DL quite soon.

-

As they progressed, they cross cut a number of “structures”. These veins were generally lower grade than the DL so the value of any of the ore was probably too low for ENAMI shipping for a profit.

-

These structures were also rather narrow. So if you make a tunnel through a 1m thick vein (like drilling through a sheet of plywood), you do not get much ore. They were not tunneling parallel to or within a vein all this time. So any stockpile was quite small and of limited grade.

IMO there has never been a ‘huge stockpile’ of ore to ship. Yes, a pile of some yards of some decent grade if you were locally processing. But a pile of ore similar to the original sample sent to ENAMI several years ago of something like 16 gpt was not going to lead to any material profit.

This chimney construction which was within the DL vein itself is the first shippable ore that has been available.

imo,

CHG

Wow Z. Great cherry picking. It must be a crappy stock. I guess I’ll take my double and invest it in AUMC which is bid at 40 cents (28M milliion market cap, which is still too expensive). It’s always a good ideas to pick up shares in a company that just publicly stated they are looking to raise equity financing. The blinders on this crew is simply amazing. The company is literally telling you in a PR that they cannot economically transport any materials less the 20gpt and it only takes a few days for the dumb dumbs to talk about using Enami’s floatation circuit for the low grade material. As a stated to Easy, its impossible to have a substanittive debate with anyone who won’t even accept bad news when the company delivers it. Its also very difficult to feel sorry for the same invididuals for being down 99% on their investment.

Sitting on ore for two years makes zero sense. Not knowing that this ore was refractory in nature is inexplicable. They are either incompetent or lying (not an opinion) or as CHG points out there simply isn’t a lot of this high grade stuff that the likes of BB salivates on incessantly. I’ll leave it to the blind optimists on this board to come up with the excuses until we get the next update. Rinse and repeat for the next 3 years. Nothing will change

What makes more sense: AUMC is sitting on the higest grade deposit in history by a factor of two, without being able to find any suitor beyond an MOU with a third tier “offtake financier” or AUMC is struggling to find a mine plan that can actually make a dollar based on the actual, decent grades in the face of extreme transport costs and refractory ore? Mining is tough. It’s especialy challenging if you take short cuts and cannot refer to an actual resource. This, IMO, is the reality of the day.

As of March 31, 2023, the related party has incurred approximately

$3,990,000 in expenses

As of June 30, 2023, the related party has incurred approximately

$4,640,000 in expenses.

While we wait, the tab is running.

Seems to me since Auryn started mining “in earnest” as of August 10, 2023 - we should therefore get reports of revenue proceeds starting about August 30, 2023 (20-day turn-around). Then we should get reports at least weekly? Don’t know.

I would like to offer my thanks and appreciation to Mauricio Cordoba for expending $5,000,000 of his own money to get our mining operation to the point where we can now begin production. He did this without diluting our equity or charging us any interest.

Thank you!

What happens when the money runs out? Dilution…

Its very appropriate to thank Maurizio for an interest free loan. Very rare. To be fair, in closing the acquistion he awarded himself 30% of the company (27M shares) for very little upfront capital while vending in some valueless (today) assets.

The bigger question: what has been accomplished with $5M of debt/capital expenditures in the 7 years since taking over AUMC/MDMN. Clearly the timeline to “production” is at least two years past due and that would be giving them a 5 year “freebie” where they essentially sat on the asset. Meters driled, ventilaion chimney, a new truck, new board members. All progress. Was the time and cost commensurate with this progress? If you are an investor, this is a determination you can make in assessing whether you want to add, sell or hold.

How’s it 7 years past due? They found the vein this past December. Like you said in your previous posts mining is slow and takes time. Now they completed gallery, completed ventilation, were granted permits and production is commencing. Looking forward to seeing the balance sheets moving forward. I say progress

Hi Done Deal,

You might remember that the original plan was to commence production at the “Caren Mine” and the Merlin 1 Vein. The PRODUCTION ADIT over there is pretty much done. It’s called the “Larrissa Adit”. Maurizio had some pretty ambitious plans there involving simultaneously mining 6 levels above and 7 levels below the “Larrissa Adit”. SERNAGEOMIN said that if you’re going to do that, you need to put in 3 separate “ventilation/safety egress” chimneys each about 140-meters in height.

The last we heard on these “chimneys” was that they were nearing completion. Meanwhile, Auryn had a couple of their geoscientists snooping around over at the DL2 Vein within the “old workings” (levels 0,1,and 2 ). They did what they called a “SYSTEMATIC SAMPLING PROGRAM” to test the ore right where the artisanal miners left off at those 3 levels. The channel sampling of the DL2 Vein in these areas came in at an average grade of 85 gpt gold. In the Larrissa Adit, they uncovered a 42-meter long stretch of vein with nice grades but not that nice. They also found pockets of “bonanza” grade gold exceeding 100 gpt gold. Interestingly, these were found at the 1,840 meters above sea level elevation which is the same elevation that the off the chart grades were found at the DL2 Vein.

All of a sudden, Maurizio said that were moving onto “Plan B” which was to commence production at the DL2 Vein first and then the Merlin 1 Vein via the new “Larrissa production adit”. After finding what they’ve been finding at the DL2 Vein, all of a sudden, we don’t hear much about the Merlin 1 Vein. The Merlin 1 Vein had surface trenching results that I’ve never seen before. They did 1,500-meters of trenching (a lot) and took over 200 samples. The average grade they found was 26 gpt gold AT THE VERY SURFACE.

Management mentioned in their most recent release that they were going to advance the Antonino Adit, straight ahead to the SSW in order to go after the 2 “monster veins” (their phraseology). One of these, the Don Enrique is very close to where they are now. The second is further to the SSW. It’s called the Leopoldo Antonino Vein. To the west of it is the Merlin 1 Vein.

Right, so we expended all that time and money on the target we won’t even be producing first. This is the essence of the the expression “time is money”. It also shows why spending 3x what Maurizio spent if it meant going into production 5 years sooner would have been well worth it. He bootsrapped along and in doing so, miscalculated that the DL should have been targeted first and then when it finally was, it took forever and a day to find it. Eventually he brought in and paid professionals to help AFTER they were a year behind in finding it. Then there was the nauseating revelations such as “the scoop broke” and xyz yada yada. It spells amateur operation. If you have a wold class deposit, there’s no reason to be making amateur moves.

AURYN Sells Mining Claims to Cerro Dorado, Inc.

Dec 15, 2017

I stand corrected, 6 years. Two years hunting the elusive 2 year vein. Mining is very tough and slow but it shouldn’t take 6 years to make very small, incremental progress unless you are starting from scratch. The argument made here is that the project doesn’t need to be drilled out, no need for a resource (yes, that takes a long time)…no need for a feasibility (also taking time and money)…but you are sitting here with a tunnel and ventilation chimney.,…oh, and a truck…and refractory ore (which should have been recognzied on the first, second, etc. shipments to Enami.

Mining in “earnest” as of August 10th. What does that mean? I guess we’ll find out but I would be shocked if you get any actual numbers this year. We never saw any metrics nor revenues from the last truck load. How does that happen? If the first truckloads of ore to Enami all go towards paying down the debt and are never recognzied as revenue you could be waiting years for any reports of revenue proceeds.

However, as stated every investor has the right (and personal obligatoin) to make their assessment on progress. You are clearly in the buy or hold camp. Down 75% on AUMC and 90% on MDMN since Maurizio took control may indicate that the market is not in alignment with your assessment.

Beyond performance, one point of major concern for any holders of MDMN shares is the level of the share price. I appreciate that MDMN is current in its filings but its only a sneeze away from trading a levels that risk delisting. Triple digit (.009) ain’t no joke. Yes, its going to be a lot more costly for Auryn to net out the outstanding expenses at 22 cents but better late than never. The company really has no excuse for further delays given the issues they have demonstrated on their end. AUMC does not have any issues nor risks of delisting.

Apologies. I should have stated quadruple digits (.0009)…they don’t trade to quintuple. But, yes, many thanks and appreciation to Maurizio for not diluting the stock even though its literally worthless at this point.

Hi jak167. I’m curious about how difficult it really is to determine refractory from non-refractory ore. How could AURYN not be aware of the refractory nature of their ore, as you stated? Also, to what degree has it been found refractory?

If it were easy, then it doesn’t make sense that GoldLogic would have signed an MOU and insist the ore be tested at a special facility in Peru. Apparently GoldLogic anticipated non-refractory ore as well. So I don’t think that makes MC an ameteur for not knowing ahead of time.

**From the April 2023 Update:

** " * To ensure that AURYN can meet the terms of the agreement with the minerals trader, a 120 kg sample of the ore has been sent to two different specialist labs in Peru for comprehensive testing. The sample is expected to clear customs in Chile this week and will then be sent to the labs in Peru. These tests, including gravimetric and chemical assays, will provide crucial information for maximizing profitability under the agreement. The analysis will be carried out in special laboratories in Peru since they offer the most complete set of gold tests we have been able to find. The labs that we use in Chile are unable to perform all the metallurgical tests required to satisfy the requirements of the terms sheet."

(I italicized and highlighted some of the direct quote.)

Clearly, there was no easy way for MC to fully determine the ore to be of refractory nature prior to the testing in Peru.

From the August Update:

“After comprehensive metallurgical testing at a specialized laboratory in Peru, we’ve identified that our ore possesses a refractory nature. This characteristic means it is unsuitable for gravimetric processing, a fact which directly impacts our initial plans with Goldlogic.”

Since it was determined to be refractory by GoldLogic’s standards, Auryn had to adjust their plans to find the best extraction methods. This doesn’t mean that gravimetrics cannot be used on some of the other claims.

When you take those facts, along with MC completing the necessary work required to meet standards for SERNAGEOMIN and ENAMI, then it’s difficult for me to see him as being an ameteur. Did it take longer than it should have? Yes it did; he had to overcome several pitfalls. But how can anyone blame him for time spent since he first took the reigns. He had so much BS to clear up before he could get started in the first place. Now, as far as I can see, we are finally there.

Feel free to correct me if I don’t have all the facts straight. I am a mining ameteur, lol! …but I’m not just a blind investor. I try to put all the pieces together to understand it better without the hopium.

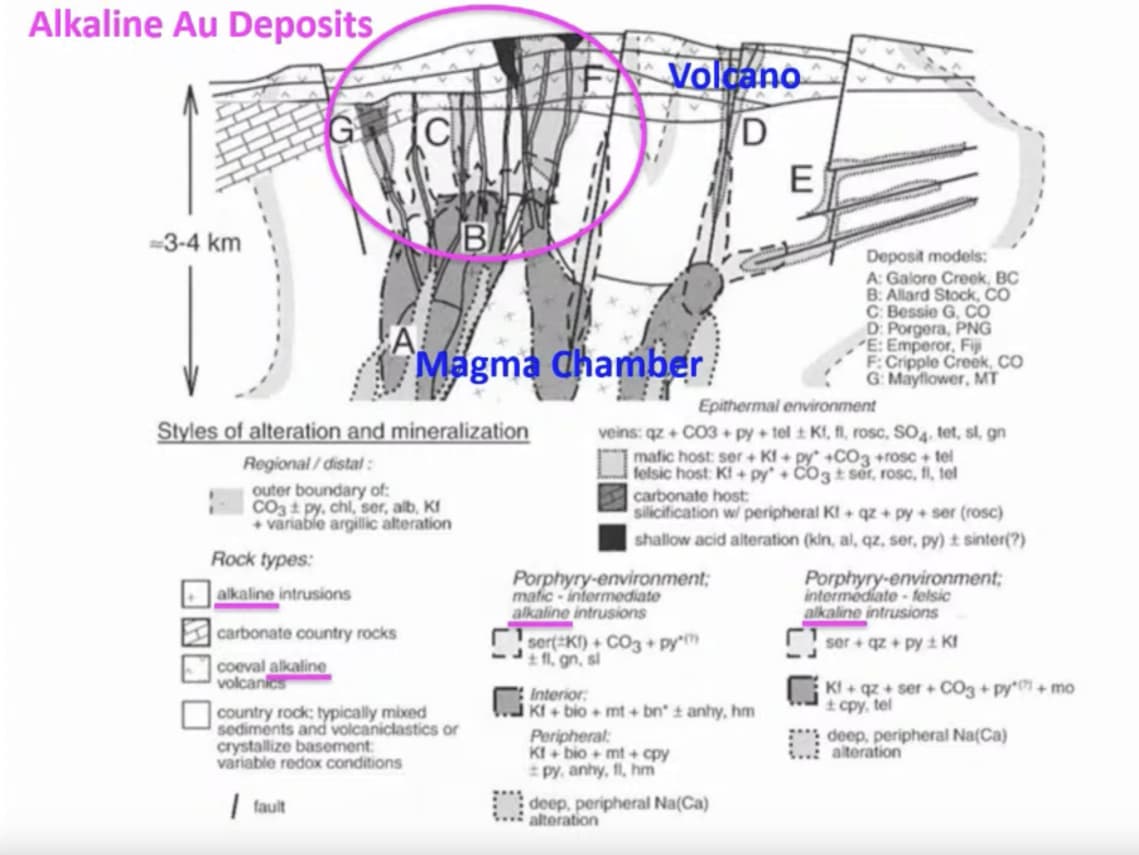

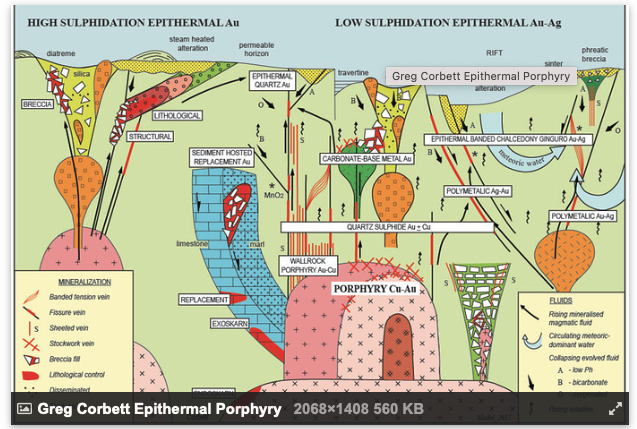

At this point it’s all about gold and gold grade. Many of your posts BB accurately point to the low sulfidation gold present that is largely free milling. A gravitational processing unit would enhance these deposits to a very profit concentrate to haul to ENAMI’s smelting facility. Until the gravitational concentration processing plant can be obtained, the very high gold content ore can be mined and hauled with a very profitable margin. With two porphyries present on the Alto it is difficult to show both a typical Moly-AU model in the same model as a mesothermal vein deposit which I think this model shown below depicts well. I remember this diagram that represents a model of the complexity of the type of deposits located across the ADL.

![]() It is a simplification of a small section of Greg Corbett’s overview of structures in a classic copper porphyry model containing both high and low sulfidation zones with offshoot veins. Assays have clearly shown the presence of these ore types.

It is a simplification of a small section of Greg Corbett’s overview of structures in a classic copper porphyry model containing both high and low sulfidation zones with offshoot veins. Assays have clearly shown the presence of these ore types.

Now that we are REGISTERED MEMBERS and on the CHILEAN MINING REGISTRY things can proceed. The free milling ore now being mined and shipped will become the immediate cash cow for further production. There are many intersections mapped with over 100 gpt gold and one of 1,220 gpt gold and off the chart silver. These deposits originated from the PN which is a copper rich CU-(MO)-(AU) porphyry and likely progenitor of deposits on the ADL. It is not so much a disappointment that the detailed assays did not meet the spec sheets for a contract with the Goldlogic group. I see it as advertising that we are shopping for some larger deal with a major for the PN to provide the financing for building out an onsite flotation circuit to make shipping all ore economical as a concentrate. Why would a major be interested in making a deal?

Bornite is typically 60% or greater copper.

Porphyry deposits are hosts to one of the most important economic mineral associations (Cooke et al., 2005, Halter et al., 2005, Heinrich et al., 2004, Mutschler et al., 2010, Sillitoe, 2010), accounting for ~ 80% Cu and ~ 95% Mo of the world’s total reserves.

(https://www.sciencedirect.com/science/article/abs/pii/S0169136814002054)

EZ

That’s interesting, then what was the purpose of the ore sent for testing set forth in the January 2021 update? And, from the same update, the Q1 2021 goal of shipping ore to Enami?

They had results from testing back in 2021 and they had the geo students working on the mountain. From the January 2022 update “Students took samples from each of the structures and several of the Don Luis branches encountered during the development of the tunnel. The university expects to provide us with a full report on their analysis of these samples during Q1 2022.” And the April 2022 update “Research and analysis of samples taken on the structures found in the Antonino Tunnel are still in progress. A new group of students is continuing this project and will be coming to Fortuna for further sampling and analysis.” I find it hard to believe Enami and the geo students could not identify the type of ore, when it’s critical to mining to know whether you have refactory or non-refactory ore. It’s not like it’s some obscure thing no one knows. Refactory/non-refactory ore is vital to knowing how you work your mine. I find it hard to believe only one lab in Peru could make this determination. And AURN only used the lab in Peru because the alleged offtaker wanted it. If you google ore testing, at least a hundred companies pop up saying they will test ore. Not a single one of those could determine refactory/non-refactory ore?

Oh, and how about this wonderful nugget (pun intended) from the April 2021 update: “AURYN is analyzing which type of concentration and processing plant is best for ore from La Fortuna de Lampa. Meanwhile, we will continue to sell ore to Enami. AURYN acquired production equipment, including two new compressors, two jackleg drills, and a Bobcat in order to reduce the time required for drilling, blasting, and removal of material. In addition, AURYN acquired a crusher and conveyor belt to reduce the size of the ore and match Enami’s processing requirements.” Let’s compare this update to the one just released. “Adjusting to these circumstances, we’ll be extracting the mineral directly from the vein and transporting it to ENAMI for processing through Direct Smelting. However, to ensure efficiency, scalability, and improved margins, the establishment of a flotation plant is in our purview, given that this method is the most effective for our ore’s composition.” Hmmm. Seems extremely similar. So, back in April 2021 you were exploring the type of plant to use and would ship ore to Enami. In August 2023, you are going to explore what type of plant to use and would ship ore to Enami.

I will only go off what AURN tells us. They told us they were testing ore, exploring what best plant to use, and would ship ore to Enami in 2021. They shipped a total of 50 tons of ore over a 32 month period, earning a grand total of ~$36k. I gave them the benefit of the doubt as they were making progress on other matters and had an alleged offtake agreement. I wanted to see their plan and the justification as to why they stopped shipping ore. Unfortunately, the agreement was not really much of anything and they provided no justification as to why they stopped shipping ore. They just stopped. If they told us why they stopped shipping ore, I could understand. But they didn’t. They just stopped shipping even though they told us they would ship during the investigation process. Now their August 2023 update mirrors the April 2021 update.

I want to believe in AURN and MC. ANd the only reason I haven’t sold like Baldy was I had no use for the tax loss, so might as well hold on. Unfortunately, IMO they have not stood true to what they have told us. If they they been sending ore non-stop for the last 32 months, AURN would be in a much better position than it is now. IMO, that’s why the last 32 months have been wasted. AURN said we would ship ore while we investigated. They didn’t.

I hadn’t sold any of my worthless MDMN/AURN shares as I have only been growing my portfolio over the years and not needing to sell. My oldest daughter will be starting college in Fall 2024 (she was in diapers when I first got into MDMN). At least with it staying in the dumpster I can start using the tax loss to my advantage. If I have any left, I might as well hold on to it to use for tax loss once I retire, as if this is how AURN is run, this mine will not see any decent production for another 20 years.

Below is a link to a “typical flowsheet for processing refractory gold ore”:

A typical flowsheet for processing refractory gold ore (Sulphidic Gold… | Download Scientific Diagram (researchgate.net)

A lot of this talk about “refractory” ores and “flotation” and “DIRECT SMELTING” can be confusing but it’s really not that complicated. Most gold ores are destined for the smelter (ultra-hot reverberatory furnace) eventually. “Refractory ores” are gold ores that are typically encapsulated in “sulfide” or “arsenic” minerals like arsenopyrite or “apy”. Sometimes it is the gold’s association with “carbon” in “carbonaceous minerals” that makes it more difficult to recover. Other times, it’s the size of the gold particles, “fines” and “ultra-fines”, that make it tougher to recover and less amenable to processes like “gravity separation”. As noted, eventually the final destination is likely to be a “smelter”. The main difference is the pathway to the smelter. It can be “DIRECT” as in what Enami calls “DIRECT SHIPPING ORE” or INDIRECT involving preliminary steps prior to smelting.

Is ”refractory ore” a bad thing? If you recall the typical layers to a hydrothermal vein deposit like that of Auryn’s, at surface you have the “gossan”. This is a colorful area often composed of “altered” clays that make up “argillic alteration”. These are illite, smectite and kaolinite. This is the “X marks the spot” for prospectors because rich deposits often show this at surface right above the deposit. The DL2 Vein has a corridor of “argillic alteration” with a width of up to 200-meters. The next layer down from surface is the “leached zone”. Not much valuable material is found here because, as the name implies, it has been “leached” by surrounding acids, and the sought after metals have been dissolved and they drift lower in the structure. Next comes the “oxide” layer. Now things start getting interesting. “Oxides” are relatively easy to process and the recovery rates are high in mining operations. The thing that does the “oxidizing” is the oxygen contained in “meteoric water” which is rain water. If you look at that “typical flow sheet for processing refractory ore” you’ll notice that several of those steps for dealing with “refactory” ore involved “forced oxidation” of sulfide material. These include “pressure oxidation” or “POX” and “biological oxidation” or “BIOX”. Even “smelting” involves “forced oxidation”.

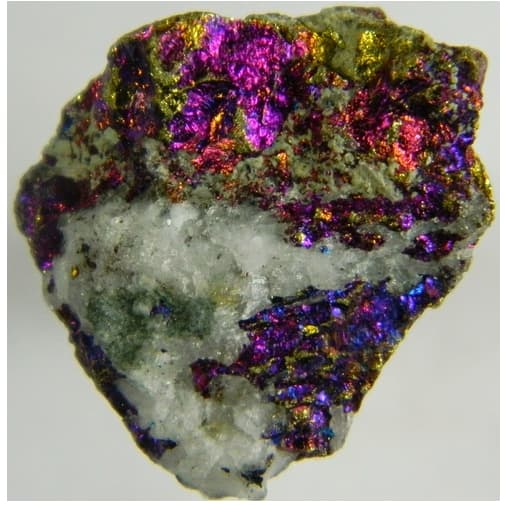

The next layer lower is the “SUPERGENE ENRICHMENT ZONE” if a deposit is lucky enough to have one. This is where the material that has been “leached” by acids piles up in large very high-grade mineral assemblages down by the historical water table. Auryn got lucky in this respect with all of that high-grade copper known as “BORNITE” (the blue stuff) you saw in the “photo gallery” of Auryn’s website.

The layer underneath the SGE zone is called the “sulfide” layer. This is where Auryn is currently mining. As the name implies, this layer is inhabited by gold, copper and silver “sulfides” which are often “refractory” because the gold can hide within the crystalline lattice of these sulfide minerals, especially arsenopyrite or “apy”. Most mines are mining “sulfide” ore.

In “mesothermal” vein systems like these, as you go deeper into the “sulfide” layer, BOTH the grades and the widths of the veins tend to improve. Both Dick Sillitoe and Rob Cinits of ACA Howe have noted this happening at the DL2 Vein. Auryn is currently mining level 3. When they start mining, let’s say, level 5 or 6, the grades are likely (but not assuredly) to be higher and the vein widths more favorable.

The question becomes, IS “REFRACTORY” ORE A BAD THING. The answer is easy, it depends upon the GRADE of the “refractory” ore. “Refractory” ore will cost more to process because more steps are involved. The GRADE of the ore is still, by far and away, the primary determinant of the ECONOMICS. Would you rather average grade oxide ore or would you rather have off the chart grade sulfide ore? It’s not even close. The Auryn story is all about EXTRAORDINARILY HIGH-GRADE SULFIDE ORE. Sure, it would have been great if we were mining EXTRAORDINARILY HIGH-GRADE OXIDE ORE.

On the flowsheet that is linked to, if you draw a straight line between “comminution” (crushing and grinding) to “smelting”, this represents the path for Auryn’s “DIRECT SMELTING” ore, i.e. DIRECTLY to the smelter. For those Enami (a branch of the Chilean government) clients that have qualified to be “registered” with the Chilean Mining Registry, like Auryn did on July 4, 2023, they have the right to send their DIRECT SMELTING ore to the nearest CODELCO (another branch of the Chilean government) smelter. Codelco runs 4 of the 7 smelters in Chile. This policy, which was approved by the Chilean legislature’s Lower House Mining and Energy Committee, is very important for a producer like Auryn. The Las Ventanas Smelter, in Valparaiso, is being shut down, for reasons associated with environmental concerns. There are 2 Codelco smelters located within about 100 miles of the ADL.

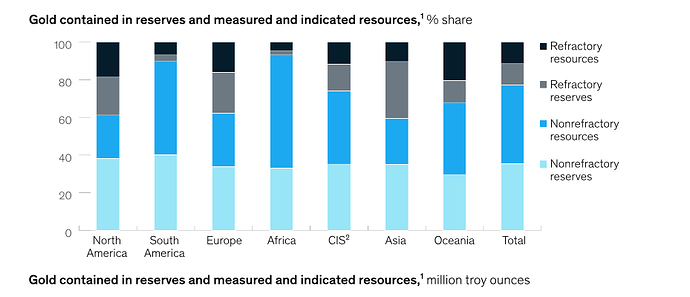

About one-fourth of all gold ores are considered “refractory”. The great equalizer in gold ore processing is that “refractory” ores tend to have grades approximately 1.86-times the grades of non-refractory ores. This has nothing to do with the stellar grades being found at the DL2 Vein. Those “RUN OF MINE” grades are simply off the chart whether, from a processing point of view, the ore be “refractory” or non-refractory. As noted, by far and away, the most important characteristic from an ECONOMIC point of view is GRADE. At the end of the day, pretty much all of the gold will be recovered. It’s mainly a matter of how many intermediate steps between comminution and smelting need to be taken.

“Smelting” is what’s called an “extractive metallurgical process” that produces a metal from its ore. Smelting uses heat, usually from a reverberatory furnace, in order to decompose the ore and drive off unwanted waste material and gases, leaving the desired metals behind. Those “sulfides” that give ore its refractory nature will be volatilized and the “sulfur dioxide” gases will carry away those impurities. In the case of the unwanted “carbon” material, they will be volatilized away as carbon monoxide and carbon dioxide gases. Toxic gases released by smelting will be “scrubbed” later in order to detoxify them. The operating costs for Codelco’s newly updated smelters is only 10-cent per tonne for Codelco. I personally find this hard to fathom but it is what it is.

At the DL2 Vein project, Auryn will be shipping their RELATIVELY LOW-GRADE ORE (below 20 gpt gold but still actually very “high-grade” ore) to Enami’s FLOTATION FACILITY. NOTE THAT 18 TO 20 GPT GOLD ORE IS NOT “LOW GRADE” BY ANY MEANS. At the DL2 Vein, this material is “RELATIVELY” low-grade. The average grade of gold being mined worldwide today in underground vein operations is 4.18 gpt gold. When you factor in above ground “open pit” operations, the average grade of gold being mined worldwide today is a little bit over 1 gpt gold. The ore that Auryn will be shipping to the Enami FLOTATION FACILITY will be somewhat “high-grade” ore derived from the less well-mineralized wall rock just lateral to the DL2 VEIN PROPER. This ore will be very ECONOMIC but just not to the degree that the super high-grade ore from the VEIN PROPER will be. The good news is that, after all of this time, we’re about to find out the ECONOMICS involved.

At the DL2 Vein project, the highest grade-ore is that located within the vein itself. You already know what types of grades that this ore is running in the area where Auryn is currently mining. The “channel sampling” or “channel chip sampling”, which measures only the grade of the VEIN ORE itself, ran from 150 gpt to 164 gpt gold. But do not expect the SHIPPING GRADE of a truckload of Auryn’s DL2 Vein ore to approach these kinds of numbers. This kind of grade will become DILUTED because what is shipped will include some of the “RELATIVELY” low-grade wall rock.

On any given working face, the ore located lateral to the vein and within the surrounding “wall rock” is less well-mineralized and of a LOWER grade. This does not translate into this ore being of “LOW-GRADE”, i.e. perhaps 1 to 2 gpt gold. When you mine a 3-meter-wide adit working face, the miners have to remove all 3-meters of rock so that men and equipment can access the next upcoming “working face”. Visibly non-mineralized rock near the lateral borders of the adit can be visually sorted and discarded prior to crushing.

The only grade that matters is the grade that Enami will pay you for. In the recent shipment of an unknown quantity of ore to Enami/Codelco’s DIRECT SMELTING facility, the “settled upon” grade or “agreed to liquidation grade” was 73 gpt “gold equivalent” when you add to the gold grade, which was 57 gpt gold, the contributions from silver and copper. Do not expect the grades of the ore being shipped to Enami’s FLOTATION FACILITY to be that high.

SOME POINTS BEING CURRENTLY DISCUSSED ON THE MININGPLAY FORUM

- CRITIQUE: Management should have known that the ore had a refractory nature to it.

What management KNEW or DIDN’T KNOW about any potential refractory nature of the ore isn’t the issue. The potential offtake partner, Goldlogic, had to learn about the refractory nature or lack of a refractory nature to the ore LOCATED AT WHERE AURYN WAS ABOUT TO COMMENCE MINING. Auryn has never been at this 1,840 meters above sea level depth before so, of course, COMPREHENSIVE METALLURGICAL STUDIES needed to be done.

Auryn tested a well-known “gravity plant” model known as the Sepro-Falconer. This was done at an unknown depth over at the Merlin 1 Vein to the west of the DL2 Vein. The results were great and they saw an over 90% recovery of “even the fines”. Whatever technology that Goldlogic insisted on utilizing for the ore located at the 1,840 meters above sea level at the DL2 Vein did not show the results that Goldlogic was looking for. Was Goldlogic looking for ore that made THEIR PARTICULAR TECHNOLOGY look like the new ultimate “better mousetrap” of the future, I don’t know. Would Auryn have had to purchase this new better mousetrap technology through Goldlogic? I don’t know. What was wrong with the standard “mousetraps” (gravity plants) available right there in Chile i.e. Sepro, Knelson, etc? I don’t know.

Here’s what we know to be the facts. The Sepro-Falconer worked just fine at the Merlin 1 Vein which is located to the west of the DL2 Vein. It is part of the same VEIN SET as the DL2 Vein. The DL2 Vein ore located at the 1,840 meters above sea level did not meet the goals set forth by Goldlogic, whatever they were. Did they want a PERFECT MATCH for their technology that would make their technology look awesome for promotional purposes? I don’t know. The need to ship the ore to 2 “specialty labs” in Peru seemed a little bit weird but who the heck knows? WOULD I RULE OUT THE FUTURE USE OF GRAVITY PLANTS AT THE ADL MINING DISTRICT? NOT ON YOUR LIFE. When Auryn (hopefully) intersects the Don Enrique Vein very close to where the terminus of the Antonino Adit currently is, might this ore (from a different vein than the DL2 that is located closer to the Merlin 1 Vein) have results equal to those achieved by the Merlin 1 Vein with the Sepro-Falconer? Of course it might, but I certainly don’t feel qualified to handicap the odds.

CRITIQUE #2: Auryn took way too long to locate the DL2 Vein.

The plan was to locate and intercept the DL2 Vein at approximately the 1,840 meters above sea level elevation underneath where “Shaft C” of the “old workings” intersected level 2. You need to think in 3-dimensions here. They are looking for a certain “spot” in the belly of the mountain. You want adits to be fairly level with maybe a slight incline or decline. You don’t want low spots that will attract water. Next, you need to pick the location at which you want the transported ore to arrive at the plateau surface. The obvious choice would be at the junction of the North Road and the plateau. You then go to this area with a topographical map and locate where the 1,840 meters above sea level elevation is. This gives you a line that the adit to the portal is going to be on. You need to keep thinking in 3-dimensions. The elevation needed to be right and the proximity to the North Road had to be right. You also wanted to intersect the DL2 Vein at somewhat of a right angle so that you could establish 2 working faces, one oriented to the NNW and one to the SSE. Now you know where on this topographical “line” to construct the “portal”/entrance to the adit. This is where Auryn put it.

You start drifting the adit, in the direction of the “strike” of the DL2 Vein. You can’t miss it because you’re going to “broadside” it. Near surface, the DL2 Vein “dipped” from the surface to the NE at a 45-degree angle. Since management was coming from the NNE and heading to the SSW, from 2 o’clock to 8 o’clock on a watch dial with 12 o’clock being due north, if the DL2 Vein continued on that “dip” of 45-degrees to the NE, they should have hit it fairly early during the process IF THE VEIN DIDN’T CHANGE ITS EARLIER COURSE. As Mother Nature often does, She threw a bit of a curve ball and the Vein up-righted itself and started plunging straight down. The intersection point was much further to the SSW than originally anticipated. Veins are DISCORDANT. They can zig-zag all over the place just like the cracks through rock structures do before they became “veins”.

Three separate times, management declared that they thought that they intersected it and we are awaiting lab confirmation that this was indeed the DL2 Vein. Three straight times, the lab reported that the “DNA” (so to speak) of the vein you just intersected DID NOT MATCH. Keep in mind, you’re underground. There is no GPS. You’re looking for a specific “spot” in the belly of the mountain. Finally on Dec. 23, 2022 they intersected the DL1 Vein, the skinnier of the DL1 and DL2 Veins that the artisanal miners were mining. On January 4, 2023, they confirmed intersecting the main target, the DL2 Vein, and the “DNA match” was confirmed. They ran 2 “channel chip” sampling surveys about 10 days apart. Both came back with literally off the chart results. The original set of 4 “channel chip” samples came back with an average of 164 gpt gold and 4.5% copper. The second sample came back “as expected” (management’s terms) at approximately an average of 150 gpt gold. THE SIGNIFICANCE OF THIS WAS THAT THE STELLAR HISTORICAL SHIPPING GRADES AVERAGING 64 GPT GOLD, AS REPORTED BY ENAMI AND SERNAGEOMIN, HAD FINALLY BEEN CORROBORATED. This is a very, very high-grade mesothermal vein system.

CRITIQUE #3: Why didn’t management ship ore for the last 2 years if the grades were so wonderful? You can’t make regular shipments/”consignments” to Enami, over and above test shipments, until you qualify your project with the CHILEAN MINING REGISTRY and become a “REGISTERED” Enami participant. Auryn qualified and became a “REGISTERED” participant on July 4, 2023.

I think this is an important post. Obviously I agree with the points being made but, more to the point, there is a MAJOR issue with what AUMC is communicating to investors. I won’t say they are outright lying but, as Jak points out, these press releases are literally on a rinse and repeat pattern. I’m not going to spend the time going over all of their communication but they have announced shipping to Enami and commencement of prodcution countless amount of times. I’m not sure why this time is any different.

Are they lying or just coming up with vague excuses because they know they have the blind support of many of their investors?

For those looking to find excuses for management’s not processing any ore for all of these years, this one takes the cake:

In order to make regular shipments of ore to Enami, Auryn needed to be approved and put on the CHILEAN MINING REGISTRY. This occurred on July 4, 2023

I would agree it takes time to register a mine with the Chilean Mining Registry (Registro Minero de Chile) . Once the application is filed, the registry will review it to make sure that it meets all of the legal requirements. If the application is approved, the registry will issue a mining concession. This concession gives the applicant the exclusive right to explore and exploit the minerals within the boundaries of the claim. There is NO way that AUMC wasn’t already on the registry as they would need approval for exploration in digging the tunnel. An exploitation license on top of an exploration license is a very easy step as you are already registered. I don’t know if they waited until July 4th to receive this concession but, if true, there is NO explanation as to why they waited years to apply for the same. The bigger quesiton: if they needed to wait to be registered how could they have claimed in the past that they were commencing production??

Are they lying or just coming up with vague excuses because they know they have the blind support of many of their investors?

Many eager beavers on this board like to refer to results and grades from decades of historical mining to make an argument that there is a large untapped resource. Are you telling me that artisinal miners sent ore to Enami for decades and there was no mention of refractory ore??? Enami has a completely different payment/cost mechanism to treat the more complex refractory vs. non-refractory ore. They had to go to a “specialized lab in Peru” to gain this clarity on their dirt (one of the most important variables in mining)? Additionally, you’re telling me that Goldlogic wouldn’t enter an offtake b/c of refractory ore? If the ore is grading anything near 20gpt they could easily divert the refractory material to a smelter/refiner that could process at a huge profit. Offtakers take refractory ore all day long if its grading North of 5gpt.

Are they lying or just coming up with vague excuses because they know they have the blind support of many of their investors?

This mining stuff is very difficult. I won’t fault the guys for finding the DL Vein 3 times but, if they spent $1M on a drill program they would actually have a resource and, more to the point, they would have actually known where the vein was. I will not be suprised if some here will still argue that spending $5M to find the vein was the right call. Maybe there is a reason why 99% of successful mining projects actually start with a mine plan (drilling, block model, metallurgical work which would tell you if the ore was refractory, etc, etc).

The flowsheet cited just goes to show how complex a process using flotation to get to the smelter is. Isn’t it much better to send hi-grade ore direct to the smelter if it can be mined efficiently in sufficient quantities? I note that there is a just 1 High Sulfide mine in Chile in the 5M oz category listed (El Indio/Tambo, Chile - Primarily high grade veins and breccias). Pascua//Lama/Veladero in Chile/Argentina, however, is a 40 M oz. combined district resource.

The link I provided in my earlier post (“Refractory gold ores: Challenges and opportunities for a key source of growth”) fully supports that 90% of all gold mined in SA is from non-refractory ores! It is for this reason that I support the idea that free milling ore may provide the most economical and profitable path to early cash flow. Of course, it is up to MC’s team to figure out how to bring in the quickest early cash return for the least cost. Maximizing profitable cash-flow will lead to realizing the longer term vision of becoming a mid-tier producer.

Earlier you supported this idea. It’s interesting that the hi-grade “bonanza grades” at the Merlin 1 and DL1, are at similar levels from an elevation point of view.

Continuing the discussion from Auryn/Medinah - 2022 - 1st Half General Discussion:

Also, about that same time you had noted an intriguing finding at the intersection of Shaft A and Level 2 of the Fortuna Mine/DL1 Vein.

Continuing the discussion from Auryn/Medinah - 2022 - 1st Half General Discussion:

Management is refining both the short-term and long-range business plans as the development of the entire project continues. This includes the possibility of bringing on and finding suitable additional partners for the various porphyry targets. CU is still the big prize if it can be nailed down. There is a significant amount of work remaining evaluating all the targets. It is encouraging to see MC’s team is fostering a close relationship with government officials as mining and permits progress forward.

EZ

I have a good friend who has a very successful project in South America **Ero Copper Corp. (TSX: ERO, NYSE: ERO)

I asked his group to give me their “opinion”, especially given their success thus far. Basic summary; this is going nowhere unless there is significant financing. I’m a foolish long time shareholder who fell into the quicksand years ago. IMO tread the conversations haven’t changed much. Only difference is “honest management”. the first group were thieves at best. Now I “think” we have honest mgmt but still going nowhere until there is significant financing…in the xxx,xxx,xxx Sorry for the input, but I’m not interested in redundant text book chatter about something that can’t possibly happen without serious financing