They should have approached this whichever way made the most sense to attract a major financer/jv partner. If the way they chose was better than a drill program like BB claims, now would be about that time to prove it.

Should have, could have, would have.

I think you boys are in the wrong stock. Time for you all to move on?

And hence my upset at telling us they were shipping ore, but then stopped without explanation or justification for the last 32 months. And then rehashing the same “forward looking” statements from 32 months ago.

They shipped 50 tons of ore to Enami and Enami processed it and paid AURN for the processed ore. 50 tons is not just a “test run”. It’s most likely two loads in the truck (can’t find the truck specs). Enami didn’t guess on how to process it. They knew how to process it, did so, and paid out on it. If they knew how to process it, they knew the type of ore.

For those here on the board that love throwing numbers around, let’s speculate. 32 months, let’s call that 128 weeks. Let’s say on the conservative side it takes one full day to load and travel to Enami, and then one full day to return. So two days for each truck load of ore processes. We will call each truck load 25 tons. ~$16k net on each truck load. Call it two truck loads per week. 256 total loads. 256 x $16k = $4.096M. At three truck loads per week it would be approximately 384 x $16k = 6.144M.

Does anyone think AURN could not have needed or used an extra $4-6M of the last two years? Anyone? Does anyone think and extra $4-6M would have hurt AURN’s potential prospect to secure financing?

The fact AURN could have generated this revenue, but chose not to do so, IMO is inexcusable. And going back to the reference about ‘just now getting authorized to ship ore’. As Baldy pointed out, what have you been doing for the last 32 months? What’s the date on your application to secure authorization to ship ore? I’m guessing it’s not 32 months ago. Why did you not make this request and secure this authorization 32 months ago when you told us you were going to ship ore to Enami while exploring the best method to process the ore?

Peter and Baldy have it right and I also agree. AURN still has the potential to put the mine into production and become a viable and profitable mining company. MC has tried to act in honest and open fashion with shareholders. However, for as much as they have promised over the last 32 months, the time still has been wasted as AURN could have put itself in a better financial position but chose not to without any reasonable justification. Leaving all shareholders looking down two options, 1) further delays to bootstrap operations, ship ore and generate revenue to self fund, or 2) dilution of current shareholder interests from continued borrowing from MC (and friends) or a third party.

I do want to say, that I do not believe MC has it out for the shareholders and plans to screw us over anymore than we already have been screwed; however, I don’t believe any current path leads to any short term (2-5 years) appreciation of MDMN or AURN. MC started in a hole (no pun intended) and not being in a good position, has done an admirable job determining the depth of the hole and what’s needed to get out of the hole; but, IMO he failed to take steps to make the hole less deep. We are in the same position we were in 32 months ago, and probably worse due to the current economic client around the world. I still believe MC can get AURN profitable and mining, it’s just, still, IMO, going to take a long, long time from now.

I also want to say that I do not dislike any posters on the board or have hard feelings towards anyone here. I believe all of you bring different views, knowledge, and experiences which help all of us understand mining in general and AURN in particular. Just because I have a different view than some of you doesn’t mean I don’t respect your opinions.

I don’t know if I can add anything more than what I have until such time as AURN post some news which will actually have some beneficial effect to actually mining. I will check back into the board periodically. Until then, good luck to everyone’s investments which actually make money, stay safe, and healthy!

Does anyone know how much MC is worth? Could he just decide to go all in.

We aren’t AUMC shareholders until we get the share distribution. I should say if we get the shares. Not a word from Mdmn about it. As I’ve said before these guys put a lot out there followed by fizzle out.

The dream is getting old and sounding more and more like repeat with different cast

Well, Medinah’s website no longer exists :

Their last financials/disclosure :

2,882,282,073 shares (that’s 2.9 Billion shares)

Masglas Ltd. (controlled by Maurizio Cordova) owns 218,783,318 sh, 7.6%

Total Liabilities (Accounts Payable + Stockholder Loans) :

$395,090

At the current price $0.00095, that equates to 415,884,211 sh

So if AURNY does a cash call, This is what happens :

Dec 28, 2022 Jun 30, 2023

MDMN $0.00130 $0.00095

Debt $383,330 $395,090

=MDMN Shares 294,869,231 415,884,211

=AURYN Sh 1,647,525 2,323,674

AURYN Sh prev. 16,104,200 16,104,200

AURYN Sh (post debt pmt) 14,456,675 13,780,526

MDMN % of AURYN 20.65% 19.69%

MDMN % of AURYN prev. 23.01% 23.01%

Change -2.354% -3.32%

Let me know if I’ve made a mistake in my calculations.

Rod

Hi jak,

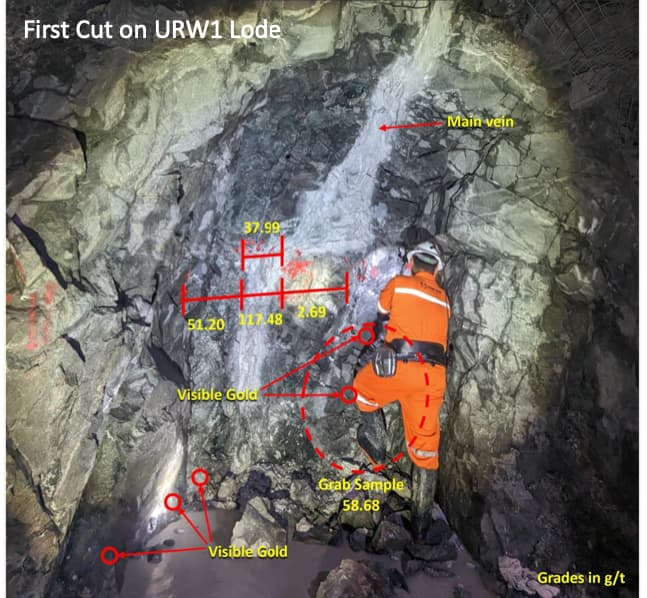

I read your post about being disappointed that Auryn didn’t ship ore over the last 32 months after stating that they INTENDED to soon be starting to make regular shipments to Enami. In the Jan. 3, 2021 quarterly update Auryn cited that they had mined 54 tonnes of ore FROM THE OLD WORKS (they hadn’t even started the Antonino Adit yet) that ran at over “two ounces” (62 gpt).

In the “OBJECTIVES” part of this PR, management cited that they wanted to start shipping ore to Enami and that the permit was “pending” at the time. They commenced the drifting of the Antonino Adit in Feb. of 2021. All the men and equipment headed to this site. In the “ACCOMPLISHMENTS” portion of the update dated 4/5/21, they said that they shipped 9 tonnes of ore under the temporary permit. They then said that they stockpiled the rest and that this ore was to be processed ONCE REGULAR SHIPMENTS TO ENAMI HAD COMMENCED.

Management THOUGHT that they were going to intersect the DL2 Vein quickly after commencing the drifting of the adit. Then they would be in a position to commence REGULAR SHIPMENTS TO ENAMI after the inspection by SERNAGEOMIN. The vein changed course from its original “dip” of 45-degrees to the NE at surface and it started going straight down. The intersection of the vein didn’t occur until Dec. 23, 2022 and SERNAGEOMIN didn’t sign off on the new ventilation system and safety egress chimney until just recently after the new “gallery” and “ventilation/safety egress chimney” was completed. This is 30 months after the commencement of the drifting of the Antonino Adit. ONLY UNTIL NOW CAN “REGULAR SHIPMENTS” BE MADE TO ENAMI. You can’t be producing and shipping from the “old works” when the men and the equipment are busy in the Antonino Adit.

From the 7/6/23 quarterly update:

“As announced AURYN sent 9 tons of ore to Enami for processing with a result of 45 grams of gold per ton. The remaining ore has been stock-piled and will be processed once AURYN begins regular shipments of ore to Enami.”

Auryn put the portal/entrance to the Antonino Adit right where it had to be. It had to be near the entrance to the North Road, at the 1,840 meters above sea level elevation and in a location such that the adit would bisect the vein so that 2 working faces could be simultaneously mined. The adit had to intersect the DL2 Vein underneath “Shaft C” of the old works. This way the 40-meter long “ventilation/safety egress chimney” would be sure to end up within the old works and not miss it to the NE or SW.

You probably remember the delays as they were being encountered. Three times management noted that they thought they intersected the DL2 Vein pending corroboration of a “DNA” match by the lab. Three times they hit nicely mineralized structures THAT WERE NOT THE DL2 VEIN. Management wasn’t interested in the other structures for two reasons. They KNEW how high-grade the DL2 vein was and they needed to intersect the old works which were also mining the DL2 Vein. They knew that intersecting the 7 vertical shafts and 5 chimneys already in place at the DL2 would bolster the ventilation system and provide a safety egress pathway that SERNAGEOMIN would sign off on. Once you have set the location of the “portal/entrance” to the Antonino Adit, you just keep drifting the adit UNTIL YOU HIT THE VEIN. If Mother Nature pulled a fast one, so be it. I don’t for a minute think that management tried to intentionally mislead investors. They wanted to commence production quickly as bad as we did.

Congrats to the buyer/s!!

Why aren’t you buying? We could be congratulating you as well…

Presumptuous to think I’m not.

I would think you would just say so instead of congratulating the new buyers. If it were me I would be embarrassed to admit I did buy more shares even at these prices. If it is such a great buy why aren’t there more buyers?

Some brokerages still won’t allow buys.

That explains it…lol

Yup I just bought some shares after a 7 year hiatus

George,

Did you happen to buy 329,500 shares ?

That was my partial fill. 600,000 prior was me too

In the last Auryn update dated Aug. 10,2023, under the “ACCOMPLISHMENTS-Antonino Tunnel” section management said the following:

“ACCOMPLISHMENTS

Antonino Tunnel

AURYN Mining Corporation has successfully extended a 40-meter ventilation chimney, connecting our Level 3 tunnel to the historic Level 2 tunnel structures. This SIGNIFICANT ENHANCEMENT (my emphasis, to be explained in further detail in a moment) accelerates ventilation after drilling and blasting events within the Antonino Tunnel, STREAMLINING OPERATIONS (my emphasis). Notably, this development has substantially improved our safety standards. Following a RIGOROUS EVALUATION (my emphasis), the mining authorities have FORMALLY ACCEPTED (my emphasis) our updated ventilation measures.”

I was especially curious about this “RIGOROUS EVALUATION” by the SERNAGEOMIN inspectors and what it involved. If you’ve ever waded through the hundreds of pages of Chilean Mining Regulations (this is the price one pays for being an OCD detail freak), you’ll know that they are very detailed. A lot of this has to do with the legislation passed after the 33 Chilean miners were trapped 700-meters below surface at the San Jose Mine back in August of 2010. The problem there had to do with the LACK of what Auryn just installed i.e. a “ventilation/safety egress chimney”.

Prior to completing this “ventilation/safety egress chimney” (also called a “ventilation raise”), in the past, if there were to have been a cave-in, let’s say, along the course of the Antonino Adit, any miners in between the cave-in site and the outside portal to the adit (the entrance) could escape but those deeper in the mountain than the cave-in site would have been trapped. Now, all miners will have a pathway to escape if such an event were to occur. In this Aug. 10,2023, update management cited “This development (the linking of level 2 and 3) has substantially improved our safety standards”. I would say that this was an understatement.

MINE VENTILATION RULES

The new rules mandate that any place that miners operate needs to have at least a 19% oxygen level and no more than a 0.5% carbon dioxide level. The percentage of “flammable gas” cannot exceed 0.75% in the “general body of the RETURN AIR” of any “ventilating district” and 1.25% in any place in the mine. Large fans are put in place to both draw in clean air from the plateau and exhaust out “dirty” air from the blast sites.

The mining engineers of SERNAGEOMIN have determined the “VOLUME”, expressed in cubic feet per minute, of air required to ventilate Auryn’s new mine. The rule is that you are not allowed to have less than 6 cubic meters per minute of air per person in the mine on the largest shift, or not less than 2.5 cubic meters per minute of air PER DAILY TONNE OF OUTPUT, whichever is larger.

ENHANCED ECONOMICS

You can see that PERMITTED DAILY TONNAGE is tied to the supply of fresh air. That’s what a mining firm wants when it has previous mining excavations including 7 shafts and 5 chimneys directly above where it is about to commence production. This accomplishment is not just about safety it is also all about ECONOMICS. Less time will now be required to clear out the post-blast noxious gases. This leaves more time to PRODUCE and higher PRODUCTION LEVELS. I’m not sure if Auryn management has received the requisite paperwork citing the newly calculated PERMITTED DAILY TONNAGE figures or not. The PERMITTED DAILY TONNAGE will represent a target for Auryn to go after in order to maximize profits. With the extremely high-grade ore being mined, one would hope that the PROFITS might allow Auryn to procure whatever equipment is needed to rapidly reach that PERMITTED DAILY TONNAGE. What comes to mind immediately is the deploying of a “jumbo” drill rig which will make the currently-used “jack-leg” drills a thing of the past. Being in extremely high-grade production also facilitates any outside financing that might be desirable to expedite production ramp ups. Financiers like to have visibility of how they’re going to be paid back.

The quarterly update cited that “the mining authorities have FORMALLY ACCEPTED our updated ventilation measures. This forum has been recently inundated with claims that “management never accomplishes anything”. Might this qualify as a “significant accomplishment” by management? Until I did a little extra digging and started to appreciate the ECONOMIC implications, I have to admit, I didn’t appreciate the significance other than the safety issues.

The result of the recent SERNAGEOMIN sign off was Auryn being allowed full access (for the first time) to the CHILEAN MINING REGISTRY which now, due to the ventilation and safety enhancements, authorizes the full-scale delivery and sale of minerals from Auryn’s mine to BOTH the Enami/Codelco flotation and direct smelting facilities. In the Antonino Adit, Auryn had already had in place a “forced air” ventilation system consisting of a blower and ducts made of fabric. This allowed Auryn to deliver a small amount of ore to Enami as per the regulations and the calculations of mandated air flow in order to allow a certain level of production. Again, allowed production tonnage is tied directly to air flow.

The quarterly update cited that this accomplishment will “STREAMLINE OPERATIONS”. What does this mean? You may have noted in a past update that Auryn had some issues in regards to clearing the air post-blasting and this slowing down the process of drifting the Antonino Adit.

The previous system was naturally less and less efficient as the Antonino Adit got longer and deeper into the mountain. After blasting, the miners are not allowed back to the blast site until the blast residue had been cleared to allowable levels of air contaminants. In the past, Auryn miners were blasting at the end of their shift and the air would clear overnight. There was only one working face back then at the terminus of the Antonino Adit, so another shift of miners couldn’t go elsewhere in the mine to work another shift like they can now.

Now there are 2 separate working faces within level 3 of the mine. One is oriented to the NNW and one to the SSE. This plus the new enhanced ventilation system allows 24-hour workdays (as indicated by management to be the plan), which should greatly enhance the PRODUCTION RATE and therefore the ECONOMICS. There is now even enough airflow to allow Auryn to extend the Antonino Adit straight ahead (to the SSW) in an effort to intercept, what management refers to as the 2 “monster veins”, that measured over 2-meters in width at surface.

On a watch dial, the DL2 Vein “strikes” from the NNW to the SSE i.e. from the 11 o’clock position to the 5 o’clock position through the center of the watch dial. The Antonino Adit came in from the NNE, i.e. from the 2 o’clock position to the center of the watch dial where it intersected the DL2 Vein at a right angle. Management will be not only mining the 2 working faces of level 3, they will also be extending the Antonino Adit towards 8 o’clock on the watch dial. The new “ventilation/safety egress chimney” (“ventilation raise”) is located at the center of the watch dial and it allows all of this mining to occur simultaneously in a safe manner. A tiny percentage of mines have “old workings” with 7 shafts and 5 chimneys above it to provide the ventilation and safety egress system to permit multi-level mining activities.

All PRODUCTION operations are now within the extremely high-grade DL2 Vein material itself. While drifting the Antonino Adit, Auryn was mining their way through the less well-mineralized and sometimes extremely hard barren granodiorite host rock. They were fortunate enough to have intersected 24 new “veins/structures” which are no doubt less well-mineralized than the DL2 Vein but for now these may only represent EXTENDED MINE LIFE possibilities. These veins DO NOT have the “old works” above them providing ventilation allowing the lower sub levels to be simultaneously-mined.

After Auryn mines the first 20-meters of the NNW branch of level 3, they will construct a “decline spiral” in order to access the various sub levels below. This will provide SCALABILITY to the mining operations and an enhanced PRODUCTION RATE. The RATE OF GROWTH in the PRODUCTION PROFILE is what many observers will key in on. There will be an INITIAL PRODUCTION RATE. Share prices are typically determined by the EARNINGS PER SHARE figure multiplied by an industry standard “MULTIPLE”. The “MULTIPLE” for any given issuer, will be upwardly adjusted for issuers able to accomplish impressive PRODUCTION AND PROFIT GROWTH PROFILES. The majors cannot replicate the DYNAMIC GROWTH PROFILES that a junior producer can achieve when it can regularly add new working faces via accessing sub levels that have good ventilation.

Mesothermal Vein systems like these, are famous for increasing in BOTH width and grade with depth. Management will have the OPTION to concentrate their mining efforts on the widest and richest levels within the DL2 Vein. This is referred to as OPTIONALITY. Inevitably, perhaps a decade or two down the road, the growth profile will plateau out and lesser and lesser grade ore will be mined as this OPTIONALITY diminishes.

The single event that might markedly increase PRODUCTION RATES would be the deploying of a “jumbo” drill rig. These not only prepare the drill blast holes very rapidly (especially when compared to handheld “jack-leg drills) but they also insert the explosives into the drill blast holes. This, in addition to the enhanced ventilation system, will permit more “blast cycles” per unit of time. The INITIAL PRODUCTION RATES are not likely to be around for very long as the cash flow generated by mining EXTREMELY HIGH-GRADE ORE permits the deploying of these “production enhancers”.

WHAT SHOULD OUR DUE DILIGENCE GOALS BE FROM HERE ON OUT?

- We want to get a feel for how many truckloads of ore/concentrate will be headed out to the ENAMI FLOTATION FACILITY as well as to the ENAMI/CODELCO DIRECT SMELTING facility, per unit of time, with just one truck at first. This will represent the INITIAL PRODUCTION RATE until more trucks are added. The cost per 20-tonne truck is about $100,000.

- We also want to get a feel for the PROFITABILITY of each truckload heading to those 2 destinations. This would involve some insight into ALL IN SUSTAINING COSTS (AISCs) including things like TRANSPORTATION CHARGES, diesel, electricity, labor, processing, etc.

- We want to get a feel for how PRODUCTION RATES will likely ramp up as the inevitable bottlenecks get worked out and as new sub levels are opened up and new equipment is deployed.

- We want to get a feel for the cost of an on-site FLOTATION FACILITY and what cost savings this might represent over using Enami’s facilities for this purpose, after amortizing out the cost over the projected life of the equipment. Management noted the use of any on-site flotation facility for other “lucrative” areas of the mining district.

- Since Auryn is going to be advancing the Antonino Adit straight forward towards the SSW, we want to monitor for progress there and whether or not they can intersect the 2 “monster veins” that showed widths of over 2-meters at surface. Is the ore in these veins amenable to “gravity plant” beneficiation? If yes, what are the approximate costs to install a “gravity plant”.

- We want to monitor for GRADES and WIDTHS as the lower sub levels are opened up.

- We want to monitor for progress in Auryn’s plan to become “fully reporting” to the SEC and moving on to a higher trading venue. A fully-reporting issuer will have a much easier time in regards to the distribution of Medinah’s “AUMC” shares.

- We want to monitor for any potential JVs on some of Auryn’s other assets. This might include the Pegaso Nero, the LDM, and other Main Veins within this overall VEIN SET. There will likely be new discoveries made as production ramps up.

- Keep in mind that it took 20 days from shipping to get the results from the DIRECT SMELTING shipments.

- Did the accomplishments regarding the admission to the MINING REGISTRY and the enhanced ECONOMICS associated with the new ventilation system attract the attention of any observers who had been seeking further DERISKING? Did the formal signing off on the new ventilation system and prescribing of PRODUCTION ALLOWANCES represent enough DERISKING to catch anybody’s attention?

- What have the 2 new BOD appointees been doing?

- Did the recent stellar results from the DIRECT SMELTING testing (73 gpt “gold equivalent”) catch anybody’s attention?

- Is management still able to extract the ore “DIRECTLY” from the DL2 Vein proper without blasting? If so, what ECONOMIC impact might this have and how might this effect the PRODUCTION GROWTH PROFILE?

Keep an eye on money flow that is about to start. I’m sure management will have a keen eye for where to put the new cash flowing in order to maximize profits in the most efficient way possible. There are two different shipping destinations possible, one for hi-grade and another for lower grade refractory ore. The direct smelt ship is not refractory to the extent that it needs flotation. Just look at the assays to see this.

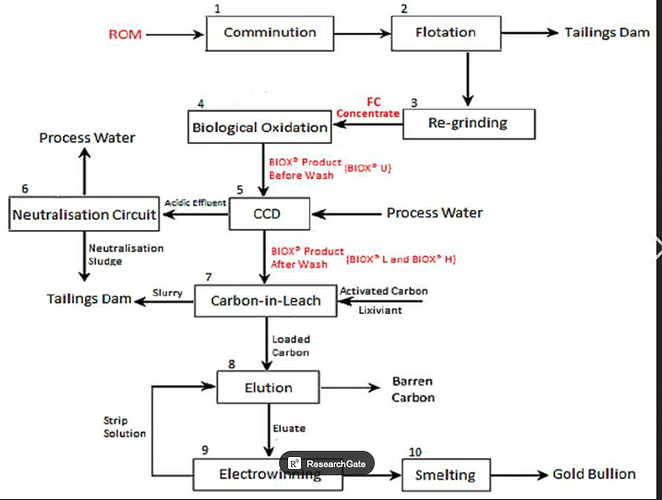

You’ll recall the flow sheet link provided by BB for refractory ore. Here is a diagram of a flow sheet from the link:

From the assays returned showing refractory ore with a hi percentage of CU, it is certain that a flotation circuit would greatly reduce the volume of ore to a concentrate, thus greatly reducing transportation costs. This will be weighed against the cost of financing a flotation circuit (recently estimated at $10 M) against shipping hi-grade gold ore directly to Coldeco’s newly updated smelters at only 10-cent per ton. The decision made was to direct ship high-grade minerals from the Don Luis vein for smelting. Several previous assays did not show the hi CU content of the refractory samples sent to Peru. Building a flotation plant will have to wait until financing has become feasible either from ramp-up of profits or 3rd party JV buy-in. Beneficiation will eventually be from gravitational concentration, but shipping refractory to the flotation facility for yields with concentrations under 20 g/t is still an objective and apparently part of the plan. I’d like to know what method is being used to separate and determine which facility will receive the ore. I find this image below may explain how visual determination is not straight forward. It is for illustrative purposes only and not from the ADL.

Auryn/Medinah - 2022 - 1st Half General Discussion - #104 by brecciaboy

16 samples were taken from the intersection of Shaft A and Level 2 of the Fortuna Mine/DL1 Vein. This is, unfortunately for SMFL, the spot where they ceased operations heading in a NNW direction. 11 came in at over 20 gpt gold, three at over 100 gpt gold and one at 1,220 gpt gold. If you take the arithmetic average of all 16 samples it comes in at an average of 116 gpt gold. If you toss out the 1,220 as a fluke sample, then the average becomes 40.6 gpt gold. Thus, the realistic “average” at this particular site, would be somewhere in between 40 and 116 gpt gold. But again, if all other >factors are equal, then this might present as a likely production site.

The question arises where is the greatest concentration of hi-grade non-refractory ore located that can be direct shipped to the smelter facility? Would gravitational beneficiation be of greatest benefit to reducing hauling costs for this ore? Will a Jumbo allow greater precision in determing hi-grade ore rather than blasting larger sections?

Gravity Recovery

Recovery of gold by gravity was the main method of gold recovery prior to the implementation of the cyanidation process around 1900.

…The recent development and industrial commercialization of highly efficient centrifugal gravity concentrators by two Canadian suppliers (Falcon and Knelson) has led to greatly improved gold recoveries by gravity separation, particularly finer gold particles, and this has revolutionized the industry over the last 30 years. The persistent efforts of the late professor André Laplante of McGill University, who worked in close collaboration with the supplier of one of the centrifugal concentrators over a period of two decades, convinced the gold mining industry of the value of incorporating gravity gold recovery in most milling circuits. Professor Laplante established a solid foundation for understanding gravity gold recovery in a Knelson concentrator (Figure 4) and for optimizing industrial gravity circuits.

Figure 4. View of a Knelson concentrator

The recovery of coarse gold by gravity separation enhances gold recovery by removing slow leaching gold grains prior to leaching, and it can also reduce capital costs by allowing for shorter leach residence time. In addition, gold that is recovered by gravity can be processed inexpensively to final bullion (often by direct smelting), so the diversion of gravity gold away from the CIP or CIL processes, where operating costs are higher, leads to an overall reduction in operating costs.

(https://www.com.metsoc.org/wp-content/uploads/2021/07/1-Highlights-of-the-Past-Five-Decades-of-Gold-Ore-Processing-in-Canada.pdf)

Note the right-hand side of this simplified Gravitational Circuit diagram compared to a Flotation Circuit. Eventually, both gravitational and flotation circuits may be incorporated to maximize efficiency and profitability.

The grade of the ore being shipped to the processing facility will be the key metric for profitability.

Reduced hauling costs of ore destined to the direct smelter has already been determined as announced in the latest announcement. “Adjusting to these circumstances, we’ll be extracting the mineral directly from the vein and transporting it to ENAMI for processing through Direct Smelting.”