That’s my point Baldy! OK, you are still the smartest guy on the block and that’s why you aren’t a shareholder, but so concerned for those of us that are. I traded and accumulated CDCD, MDMN and AUMC in USD over many years. But back in 2015 you had posted, “Precious metals co’s are down 90% over the past 4 years (the good, the bad, exploration stage and producers). Timing and the general market backdrop matter.” I can recall you were rather distressed at selling your MDMN (and hung onto your CDCH?) and now bragging you found a way to arbitrage your tax loss selling (to be clear, we are talking about trades on the OTC). So it appears you are now bragging you held and owned CDCH, and waited until after conversion to AUMC when it was trading at USD$1.50 before you sold? Yes, that was good timing for your particular circumstance, especially after having to take that oversized tax loss when you did. Excuse my curiosity, but just how many shares of MDMN did you sell and take a haircut on? AUMC related stocks of course didn’t trade on the TSXV. But you wanted to deride my chart on Soma which does traded in two markets?

So, regarding SOMA you want to compare apples and oranges; i.e. how stocks trade differently on the OTC from the TSX.V. As you well know, stocks trading on different exchanges, using different currencies, provide additional complexity to the Circular Ownership Model. Volumes and trading practices and sentiment vary greatly. I’ll stick to USD for now in speaking of SOMA. The effect on trades as a result of COVID in 2020 had a greatly exaggerated effect on the US trades that not only had a lower average trading volume but actually did drop to USD$0.005. Columbia is perceived by many to have an unfavorable risk component attached to it’s mining stocks. My weekly graph of SOMA accurately reflects the trading on the OTC in the US market.

I’m sure there are multiple differences and reasons why stocks trade the way they do. Do you recall this post from last year?

Continuing the discussion from Auryn/Medinah - 2023 2nd Half General Discussion:

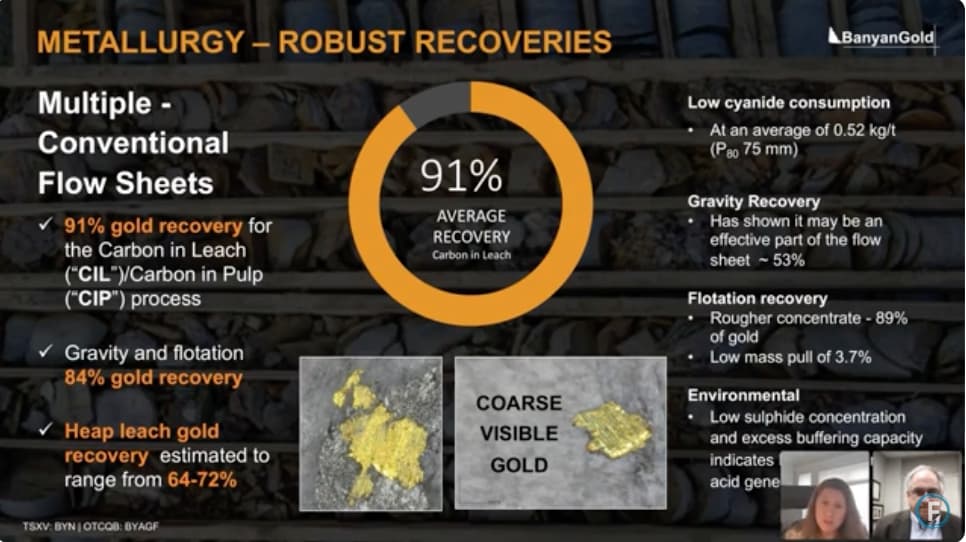

Perhaps Zotron provides a verifiable reason as to why SOMA has only a 5.3X recovery in Canada, despite its doubling of annual production to 40koz from COVID lows. Can you comment on the questions I posed in my last post? Perhaps someone with greater understanding of why so much modeling and testing goes into the flow sheets to optimize gold recovery in different stages of an FF circuit will respond. Here’s the Banyan image again to refresh your memory of what I was hoping someone more knowledgeable than me would answer:

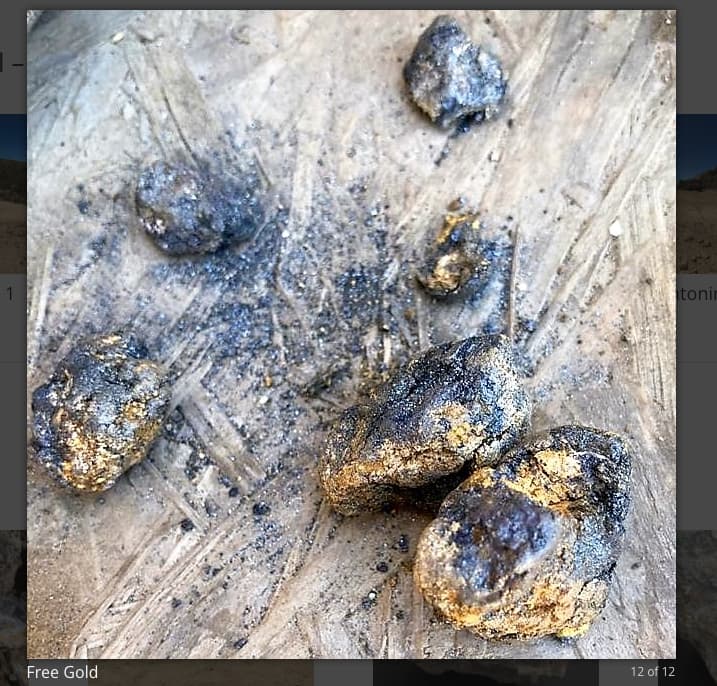

Also, how does one recover the gold from the type of gold that has been encountered and posted in the images below? Is just a standard FF circuit used, or will there be multiple stages of grinding and chemistry employed in the FF circuit?

Yes, I’m overweight and fully invested in AUMC as I’ve asserted many times. But I"m content to keep it safe in a sock drawer for now. I’m waiting to hear the answers to these questions I have posed from those professionals who have been hired and are on the ground at work. Also note, I urge you not to count me in as one of your “most investors” crowd. Every investor has unique circumstances and goals, short or long term. In the meantime I have other investments that keep me occupied, but thanks for your concern.

EZ