I’m on board with shipping ore to Enami with the price of gold being over 2400 and use the proceeds to fund our own plant. Could this be why we haven’t seen an update or signed binding contract?? Maybe Maurizio is second guessing going with Strategic investment group. I guess we will have to wait and see. Thanks Doc!

Thanks BB,

You provide a lot of information and thoughtful considerations for those of us much less knowledgeable. Your posts are greatly appreciated by this long-time shareholder!

Isac Burstein is a resourceful and creative exploration and mining business development professional with extensive experience and contacts in Peru, the US, Canada, Mexico, Chile, Ecuador, Brazil, and Guyana. He has a proven track record in identifying and negotiating the acquisition of prospective claims, developing earn-in JV structures, and evaluating mining investment opportunities. Isac has been involved in four discoveries that became operating mines, over 60 deals from asset sales, JVs, earn-ins, private placements, royalty sales, etc. His skills include negotiating and structuring deals, financial modeling and valuation, and technical due diligence. Isac holds a BSc in Geological Engineering from the Universidad Nacional de Ingenieria in Peru, an MSc from the University of Missouri, and an MBA from Purdue University.

![]() Has anybody been wondering what this newer BOD member has been looking at since the announcement March 1, 2023. And, let’s not forget the legal expertise and additional negotiating skills that the 2nd BOD member brings to the table:

Has anybody been wondering what this newer BOD member has been looking at since the announcement March 1, 2023. And, let’s not forget the legal expertise and additional negotiating skills that the 2nd BOD member brings to the table: ![]()

Mark Dingley is a board-level senior leader with a background in mining and on-shore/off-shore oil & gas industries. He has demonstrated increasing levels of technical, financial, and decision-making authority and has accumulated extensive experience working with government bodies up to and including heads of governments and heads of states. Mark is a published author and served as the President of Africa Oil (Ethiopia) and Vice President of Operations at Africa Oil Corp. He has also held several executive positions at Talisman Energy, where he was responsible for exploration activities in the Middle East and Latin America. Mark is a certified UK Offshore Installation Manager (OIM) and an associate member of the International Bar Association. He holds a Law degree (LLB) and an Economics Master’s degree from Canterbury, an MBA from Harvard Business School, and a PhD in Applied Economics from Wharton Business School.

I’m wondering where the $500,000 cash advance announced on May 29, 2024 has been put to work.

Loan Provision : Auryn Mining Chile SpA has received an immediate advance of $500,000, with the potential to increase the total loan amount to $1 million. This loan features a 10-month grace period and is repayable over five years in equal monthly installments.

Our previous Qtrly report carried information for the period ending March 31st 2024. Our next Qtrly report should be available mid August and will have information current to June 30, 2024. I’ll be interested to see what progress $500K can accomplish in one month. ![]()

EZ

DD. I would suggest a little common sense to explain the “mystery” of why AUMC has never pulled the trigger on sending ore to Enami. Even if gold was still at $1800oz it would literally be insane to borrow $4M (to owe $20M) or raise equity at any price if the option to send a small portion of hyper grade ore would raise the necessary $$ to build a plant. Not to mention, it took ten months to get to a non-binding LOI while the price of gold has been ripping. Unless you think Maurizio is insance, there would need to be another reasonable explanation. Even if you were to believe the $5,000 per ton direct financial impact (which has been grossly misinterpreted by some shareholders and thus never reiterated by the company) it would still be an obvious option to send ore to Enami vs. giving up $20M in dividends. Do the math.

This shouldn’t be some sort of big revelation and anyone who was genuinely communicating with Maurizio would be told the same, but the grades that were reported were simply on a small sample of ore taken DIRECTLY from the vein. When it comes to mining you have to include the high grade ore with all of the other worthless, barren rock, you generate in the process of mining. They are targeting a blended, average grade of 10gpt. A 200lb sample sent to Enami has ZERO correlation with what you can actually expect. This is why most companies spend the time and money to pursue extensive drill programs. Those programs generate grades over certain lengths/widths. As a next step you average the grades x the lengths over 100’s (or thousands) of drill results to come up with a 43-101 and a reasonable resource estimate. Because AUMC is simply working from historical grades (which were handpicked by the artisenal miners who weren’t interested in hauling ANY barren rock down the mountain) and surface samples (which can be very misleading) they have had challenges finding financing.

They didn’t send any ore to Enami b/c, at an average 10gpt, they would have lost money due mainly to the small scale of production and transportation costs. Maurizio’s pursuit of a FF plant was the right and only choice for the company. I appreciate that anyone clinging to the “glass half full” narrative can simply dismiss this analysis to an opinion and this would be accurate. I believe I’m offering an informed opinion but, more importantly, this opinion is consistent with the reality of the decisions the company is making. Does anyone actually believe that AUMC’s decision not to monetize a fraction of a supposed pile of gold for two years while agreeing to insanely expensive, senior secured debt as an alternative sounds plausible? If anything goes wrong Maurizio will lose the asset. If things go well he’ll be paying a 500% return ($20M) to the lender. If Enami was an option it would have been pursued a loooong time ago. Don’t forget that the cut off grade for the Caren was a monstrous 15gpt. The Caren was another example of an imminent production opportunity that “mysteriously” never materialized. I would imagine that DL has a similar cutoff and cost profile (transportation costs + Enami fees). A FF plant will bring those costs waaaay down.

The previously announced financing is crititcal and clearly needs to be updated as soon as there are any developments. Based on my last conversation with Maurizio, over a month ago, it sounded like a binding agreement was very likely but, admittedly, a lot of time has passed. If/once the financing is executed I would hope to see some guidance on a timeline to production along with details on how they are going to deal with tailings, water, power. Ideally, AUMC would/could provide high level details on production and grade estimates so that this 100gpt+, $5,000t differential, discussion can FINALLY be put to rest.

I’ve searched the cost of 100-ton flotation plant, it seems to be US $150,000-200,000 FOB, so shipping, set-up, etc. would be extra.

Hopefully the $1M would cover this, so I don’t understand what the extra $3M would be for.

And @ ~$0.50 sh that would be only 2M shares, a paultry < 3% increase in the share count. They could do an At The Market share sale to raise the $1M

Hi Rod,

I haven’t done a very good job of explaining this, but a 100 tonne per day FF plant is pretty tiny. In the press release, you may have noticed a bunch of “up to’s”. “Up to” $4 million in aggregate between the “loan provision” and the main financing. They already advanced $500,000 but that is expandable “up to” a total of $1 million.

It sounds a lot like a line of credit Auryn can access IF IT WANTS TO. It might be serving partly as a “backstop” until a better deal can be accessed. Who knows? I still wouldn’t rule out selling some stockpiled ore to knock down the amount of money needing to be borrowed. When you look at the quality of the assets Auryn has, and you juxtapose the comment about charging $20 million over 5 years for a $4 million loan, then you might suspect that there’s MORE TO THE STORY and that we should “stay tuned” for the details. You never know, the team that Maurizio assimilated might be smarter than we think.

The key to this deal, that should jump out at us, is that THERE IS NO DILUTION OF THE SHARE STRUCTURE involved. In a recent communication with Maurizio, he put that phrase in italics to provide some extra stress on it. Maurizio has hinted to us many times that the 70 million shares outstanding figure is not likely to go anywhere and he has kept his word.

In my opinion, this deal is clearly morphing into a cash dividend play. With only 70 million shares outstanding, all Auryn needs to achieve is MODERATE EARNINGS. The tiny amount of shares outstanding will convert that into robust levels of share dividends. If you can ramp up production levels over time, then Auryn should be able to declare and distribute PROGRESSIVELY LARGER CASH DIVIDENDS through time. If “the market” doesn’t reflect the proper valuation for that flow of cash dividends, then that’s just fine by me. I can take my dividend cash and buy more ultra-cheap shares, and thereby expose larger and larger levels of shareholdings to PROGRESSIVELY LARGER CASH DIVIDENDS. In my book, that represents a POSITIVE FEEDBACK CYCLE. Hopefully, the preferential tax treatment of “qualifying cash dividends” stays in place because the CAPITAL GAINS rates that are proposed look a little scary.

Once the cash starts flowing, the need to sell shares to raise funds for any purpose diminishes. If the share price gets way out of whack with reality, then management can simply buy back and cancel shares in order to get that 70 million share number even lower and those dividends even more generous.

The $8-$10M capex for a plant, which I had previously referred to, was what it would cost for a small, starter, plant: crushing, grinding, 350tpd capacity, capable of leaching oxides and floatation for the sulphides. I only know this because I’m on the board of a high grade gold producer in Peru who is in the process of building one (planned for the end of this year) which they have been working on for the past year.

AUMC is building a very modest, 100tpd, plant. When I spoke to Maurizio 8 months back, when they were actively pursuing an equity raise, he indicated they only needed $3M and subequently the company announced the 100tpd plant. I’m assuming $3-$4M covers something of that size but Google searching the cost of a flotation plant can be a bit misleading. Maybe one piece of the FF only costs $200,000 but it won’t get you very far without all of the supporting equipment in the circuit… You also want to include a miniumum 30% contigency for any unforeseen costs so you really do need $4M for a $3M Capex. Especially with today’s inflation.

If AUMC was actually able to draw down on the first $500k as has been claimed on multiple occassions, I don’t see why they would run into any problems in accessing the full $4M and, per my comments above, that’s what they need. The only caveat to this assumption is time and why it has taken so long to receive an update re: a binding deal.

To restate the obvious, if the stockpile could have been monetized there is no Earthly explanation as to why an insanely pricey financing and another 24 months of delays would have been preferrable over a few shipments to Enami. Its unfathomable to me that anyone would continue to argue this point. As an example, if one is claiming that shipping to Enami is an option AND that AUMC is about to become a “dividend machine” how does this jibe with the debt financing with $20M in dividends!! How does the dividend machine work when the first $6M of profits goes to Maurizio and another $20M is paid out to third party (who’s making 500%!!)? One might pause on the dividend predictions with the realization that the equity holders who avoided dilution, are the last in line for profits/dividends, assuming they are acheived.

IMHO, this debt deal was the only one on the table after an extensive/lengthy campaign to land offtake and then equity and then debt financing. I credit Maurizio 100% for aggeeing to subordinate his $6M to the new debt to get this project off the mat. Its a big risk but it shows that he has confidence in the ultimate viability of this project.

Keep your eye on the ball to understand what is actually happening vs. what others hope is happening to fit some sort of predetermined, narrative.

I absolutely agree with this conclusion BE, but for more practical reasons than you expound upon. Certainly, trucking raw ore is uneconomical and somewhat hazardous with the number of trips required. The delay is primarily in obtaining permits and submitting a plan of operation to the regulatory authorities. Things will move with more transparency and speed once those items are taken care of. I agree with what BB just pointed out. The wording in the last announcement is for a loan of up to $1M with a grace period of 10 months (time for permit approvals?) payable in monthly increments over a 5 year time span. That’s quite generous and easily handled once everything comes together. They already have the $500K to work with, the remaining amounts are an “up to” in case as needed. The $3M “equity financing” has a contingency attached that requires both parties agree. Will it be needed? It does not appear likely if production results in sufficient cash flow self-funding the progress being made. The FF plant will be in place to assure that an efficient and profitable mining plan is executed. Everyone realizes there is no cash flow until permits and plans are submitted and approved, and work on the commissioning of the FF plant are completed. Then, and only then, will value emerge in real terms for all to see.

EZ

Yes, an interest rate “holiday” is typical for loans to pre-rev companies (for obvious reasons). Otherwise the lender will force you to set aside 24 months of interest against the principle of the loan. I would not be at all suprised if the remainder of the $ commitment (beyond the $500k-$1M) is tied to certain milestones, like permitting. Permitting can definitely take up to 10 months and that clock only starts after the FF engineering designs are completed. I have no idea where that stands. However, it would still be nice if AUMC confirmed the deal was binding. The terms of a binding agreement would spell out the milestones, etc. As per my last post I believe they will need and have asked for the entire $4M as they have no other source of $$ to build the FF.

So, surely you are not doubting what was filed as "Entry into a Material Definitive Agreement"?

LoanProvision:Auryn Mining Chile SpA has received an immediate advance of $500,000, with the potential to increase the total loan amount to $1 million.

https://www.otcmarkets.com/otcapi/company/dns/news/document/74940/content

I hope you aren’t just bottom fishing here for yourself, or perhaps a friend or two, because your skepticism has grown over the years to really undermine any shareholder that has confidence that this company will eventually succeed. Only a sick mind would continue adding as skeptical a view for entertainment value. Are you still maintaining your presence because you find it entertaining? Do you hold the same skepticism for the Columbian company you sit on the board of? I’m sure it actually has value to the investors over there. I don’t think Mark Dingley and Isac Bustein have been sitting idly by the past year since joining the BOD.

EZ

You can’t even get the country right. If I didn’t have a healthy level of skepticsim for a high-grade underground mine in Peru, I would be an idiot BUT they are making incredible progress and I appreciate how difficult it is to acheive profitable production. Maurizio knows the project well.

Easy, you don’t seem to get it. I stay involved here to follow a “potential” investment opportunity. I have healthy skepticism for any investment, especially when it comes to mining. However, I believe Maurizio is a straight shooter and there may be a window to establish an investment (admittedly at lower prices) at some point in the future. There are two “stories” evolving here. One, is reality and another is a demented form of a fantastical “reality” with the supposed highest grade mine in history, 25 year old stories of massive dividends, consipiracy theories of ulterior motives, and a stock trading a 0.000 (for strategic reasons)… which, clearly and obviously, to any sane individual has no basis in fact.

My “sick mind” is solidly in the reality camp and, what may seem like constant skepticism, is simply an analysis of the ACTUAL risks, facts and potential returns of AUMC, in the real world. I admittedly can’t relate to the “fantastical” spin (nor can Maurizio) and that may be the source of your confusion and the reason why many here are constantly attacking my motives.

What amazes me, after this much time, and so much empirical evidence, and so much money lost, is that there are still a handful of folks stuck in the “other” reality… If you can’t learn from past mistakes you will NEVER evolve. However, as a positive, I’ll have a cold beer waiting for you when you finally decide to cross the abyss and I’ve heard that there is a sci fi novel, apparantly very long, being written of the “other” MDMN reality…I’m guessing that chapters are still being written.

OK BE, so you don’t sit on the BOD of the highly successful company you touted early in the year. My bad! But you are right in something you pointed out. That stock you pointed to went from .005 to .30 after doubling their production to 40koz this year in only a few short years…

Your oversized EGO in this stock you no longer own (MDMN and AUMC) is completely overriding your apparent diminished common sense in your constant derision of most every stockholder commenting on this stock. I continue to hold because of my ownership of stock in an IRA and ROTH and having nothing to gain by selling. You lost real $$$ funds for a different reason as you sold and arbitraged a tax loss in pursuit of profitable gains elsewhere. Why do you fail to realize investment reasons for holding a stock differ among shareholders in this stock? You may not agree with many posts here, but why do you think compelled to post as though you know better than Mark Dingley and Isac Burstein and the rest of the team on the ground working to salvage the harm done by earlier management over many years?

BB wrote: “Advancing into high-grade gold production with only 70 million shares outstanding is beyond a rarity."

Here’s what you wrote in response:

Disclaimer: These comments are offered from a troll with inconvenient facts.

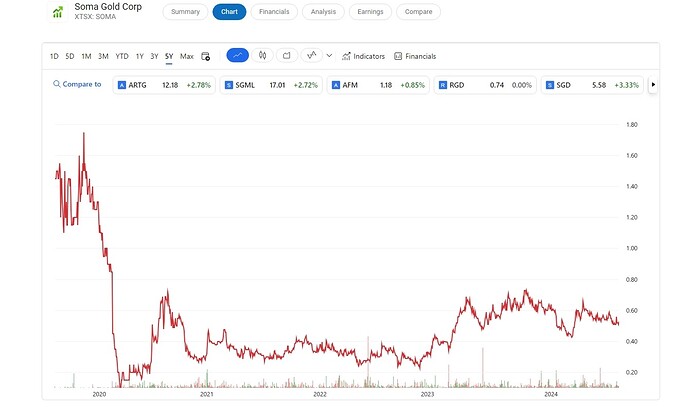

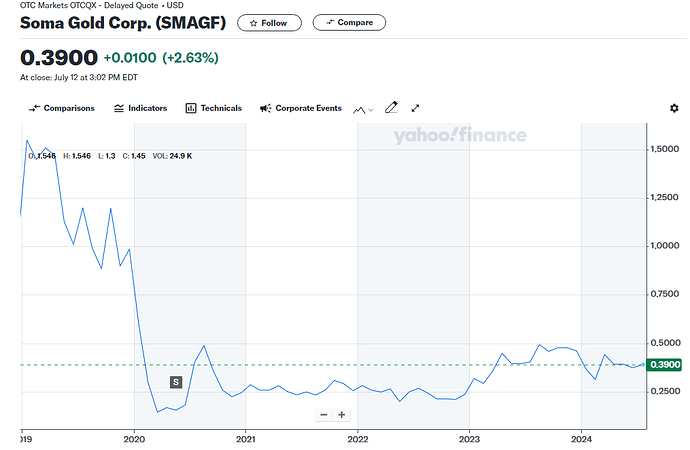

Soma Gold is a South American, high grade producer (an actual producer) with forecasted production of 40koz in 2022, high grade material, two producing mines (actually own the mills).

Earnings and cash flow surging. Trading at less than 2x 2022 cash flow.

Outstanding shares: 63M with two insiders owning 60%+ of the outstanding shares.

Market Cap: $20M vs. AUMC at $60M

The reason why Soma trades at such a discount is b/c no institutions can own the stock. No liquidity and complete control (60%) by the CEO and head Geo. Most agree this should be a private co b/c of the capital structure.

![]() I agree with your last statement regarding an unrelated stock that exhibited a huge gain of 60X with an OS of 63M shares, that I note, may also have been relatively tightly held as are shares in AUMC. You fail to realize that we have great confidence in Maurizio Cordova to navigate what is necessary to make this a successful mine and develop the other resources present on the ADL. This is thanks to the consulting input from Dr. Raymond Jannas, Dr. Richard Sillitoe, EGV Ingeniería , Collaboration with the University of San Sebastian, Prof. Dr. Helmut Mischo, Dr.-Ing. from the Institute of Mining and Special Civil Engineering at the Technical University Bergakademie Freiberg (TUBAF) and others. Additionally, visits by Mr. Carlos Hunt, SEREMI de Minería-Region Metropolitana, and Mr. Christian Orellana, Central Regional Director for SERNAGEOMIN, were highly complementary. I don’t think your comments have changed much here, but respect would be much greater if you were an actual shareholder here, rather than a former shareholder that lost a great deal of money and holds animosity towards current shareholders that have refused to let go of their shares and follow your example. I take responsibility for my investment decisions which are notably quite different from yours.

I agree with your last statement regarding an unrelated stock that exhibited a huge gain of 60X with an OS of 63M shares, that I note, may also have been relatively tightly held as are shares in AUMC. You fail to realize that we have great confidence in Maurizio Cordova to navigate what is necessary to make this a successful mine and develop the other resources present on the ADL. This is thanks to the consulting input from Dr. Raymond Jannas, Dr. Richard Sillitoe, EGV Ingeniería , Collaboration with the University of San Sebastian, Prof. Dr. Helmut Mischo, Dr.-Ing. from the Institute of Mining and Special Civil Engineering at the Technical University Bergakademie Freiberg (TUBAF) and others. Additionally, visits by Mr. Carlos Hunt, SEREMI de Minería-Region Metropolitana, and Mr. Christian Orellana, Central Regional Director for SERNAGEOMIN, were highly complementary. I don’t think your comments have changed much here, but respect would be much greater if you were an actual shareholder here, rather than a former shareholder that lost a great deal of money and holds animosity towards current shareholders that have refused to let go of their shares and follow your example. I take responsibility for my investment decisions which are notably quite different from yours.

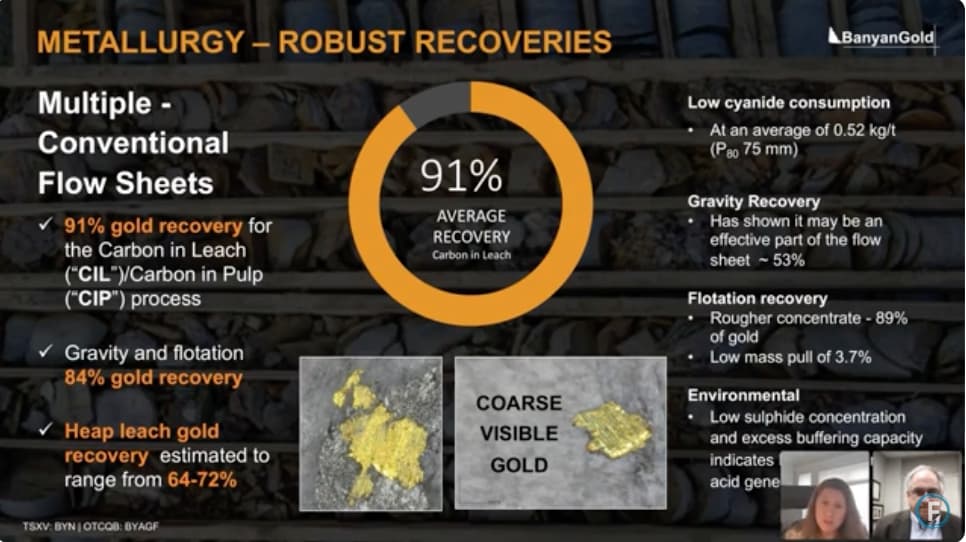

As a side note, has anyone looked at the recovery flow sheet from Banyan Gold posted earlier in the year where an item in their metallurgy recovery flow sheet still has me wondering what is possible with what is noted as Gravity Recover of 53%. First of all, I’ve no expertise in this area so I ask questions and look for answers. Is Banyan’s Metallurgy Recovery Form with the coarsest grind recovery of free visible gold present before it enters the FF circuit? While this wouldn’t efficiently recover the fine gold, I question if it would very likely result in a great debulking of the volume of ore and result in a very high content concentrate free gold that could be shipped immediately. Later in the flowsheet it shows a FF recovery of rougher concentrate of 83% and low mass pull of only 3.7%. Is this run the same ore of what remains from the Gravity Recovery that is run again and floated in the circuit to further recover the fines? What is the exact meaning of “low mass pull of 3.7%”? Perhaps someone more familiar with these terms would be so kind as to take a closer look and comment. I’m sure our experts in our BOD and management team will provide answers. I’d like to know if a coarse grind could be run through a gravity concentrator before entering the FF circuit to recover free gold in ore showing visible gold. Perhaps this will be answered when we have our permits and plans in place.

GLTA

EZ

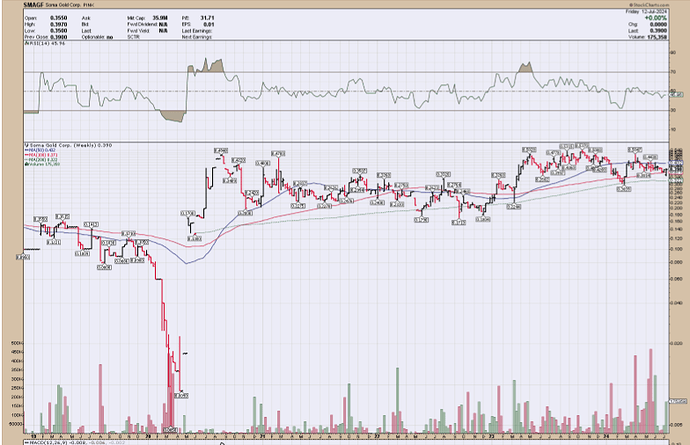

Easy. I wish I could take credit for stock that has risen 6000% but you need to update your charting skills. You can’t rely on the US trading/technicals for company listed in Canada. Here’s the actual chart of Soma. Its done OK but, similar to most of the junior producers, has not performed as one would hope given the move in gold. I’m hoping your inability to properly read a chart doesn’t deflate your expectations for AUMC’s ability to go up 60x ( a $2 billion market cap seems very reasonable).

A couple quick points to respond to: I’m not sure why you are fixated on this IRA issue. Regardless of any ability to realize losses, most investors still seek to avoid losing 90% of the value on any stock in their IRA. My decision to sell AUMC at $1.50 and MDMN at a couple pennies was aided by the fact that I could realize losses but was driven by my desire to avoid further losses. This shoud be a straight forward investing concept and I hope you don’t have other losing positions that you are holding onto purely for tax loss reasons. There is always something to gain by selling in an IRA if the stock isn’t performing.

As to your comments on “respect” I find it very telling that you would have more respect for me if I had made the mistake of holding onto shares and taken the additional losses. As much as I desire your respect, admittedly, I think avoiding the losses was a better option for me. You cleartly don’t allocate respect based on the accuracy of forecasts offered on this board so it appears I’m all out of options.

I don’t claim to know more than Maurizio or Mark Dingley or Isac Bursetein but I certainly wouldn’t allow them to STILL blame anything on “the harm done by earlier management.” They took on this project over SEVEN years ago and the share price has reflected the fundamentals. If Maurizio had delivered on his plan waaaay back when, invetors would be in a completely different position. Pretending to spin a story where AUMC has somehow delivered vs. what has actually occured places one heavily in the “other” reality I previously referenced. Maurizio would be the first to admit that there have been a series of unfortunate false starts but, as with most things in mining, you gotta keep charging forward (as he has). They now finally have a plan on which to execute.

I also have confidence in Maurizio’s ability to navigate what is needed for a successful mine, otherwise I wouldn’t still be here making so many friends. I do indeed blame a handful of shareholders who relentlessly attempt to spin the “other reality” as though this might somehow right the wrongs of the past two decades of inaccurte predictions. I believe Maurizio shares this view (he’s NOT in this "other " reality) and needs to take it upon himself to deliver an update detailing what is ACTUALLY being targeted. This will be highly beneficial in restoring crediblity while properly setting investor expectations and acheivable milestones. As BB has stated in the past, Maurizio is not very promotional, unfortunately there are some shareholders who have taken up that baton. Not a healthy dynamic, especially when this promotion has never been on target.

All of these issues will sort themselves out over time, with the right execution. As it stands today there is no market for MDMN and AUMC is not a tradeable security. AUMC will eventually start trading volume if production commences. Whether that volume occurs at 20, 30, or 40 cents is up for debate but, regardless, the company and its loyal base of shareholders NEED to be in the same reality when it does. IMHO

That’s my point Baldy! OK, you are still the smartest guy on the block and that’s why you aren’t a shareholder, but so concerned for those of us that are. I traded and accumulated CDCD, MDMN and AUMC in USD over many years. But back in 2015 you had posted, “Precious metals co’s are down 90% over the past 4 years (the good, the bad, exploration stage and producers). Timing and the general market backdrop matter.” I can recall you were rather distressed at selling your MDMN (and hung onto your CDCH?) and now bragging you found a way to arbitrage your tax loss selling (to be clear, we are talking about trades on the OTC). So it appears you are now bragging you held and owned CDCH, and waited until after conversion to AUMC when it was trading at USD$1.50 before you sold? Yes, that was good timing for your particular circumstance, especially after having to take that oversized tax loss when you did. Excuse my curiosity, but just how many shares of MDMN did you sell and take a haircut on? AUMC related stocks of course didn’t trade on the TSXV. But you wanted to deride my chart on Soma which does traded in two markets?

So, regarding SOMA you want to compare apples and oranges; i.e. how stocks trade differently on the OTC from the TSX.V. As you well know, stocks trading on different exchanges, using different currencies, provide additional complexity to the Circular Ownership Model. Volumes and trading practices and sentiment vary greatly. I’ll stick to USD for now in speaking of SOMA. The effect on trades as a result of COVID in 2020 had a greatly exaggerated effect on the US trades that not only had a lower average trading volume but actually did drop to USD$0.005. Columbia is perceived by many to have an unfavorable risk component attached to it’s mining stocks. My weekly graph of SOMA accurately reflects the trading on the OTC in the US market.

I’m sure there are multiple differences and reasons why stocks trade the way they do. Do you recall this post from last year?

Continuing the discussion from Auryn/Medinah - 2023 2nd Half General Discussion:

Perhaps Zotron provides a verifiable reason as to why SOMA has only a 5.3X recovery in Canada, despite its doubling of annual production to 40koz from COVID lows. Can you comment on the questions I posed in my last post? Perhaps someone with greater understanding of why so much modeling and testing goes into the flow sheets to optimize gold recovery in different stages of an FF circuit will respond. Here’s the Banyan image again to refresh your memory of what I was hoping someone more knowledgeable than me would answer:

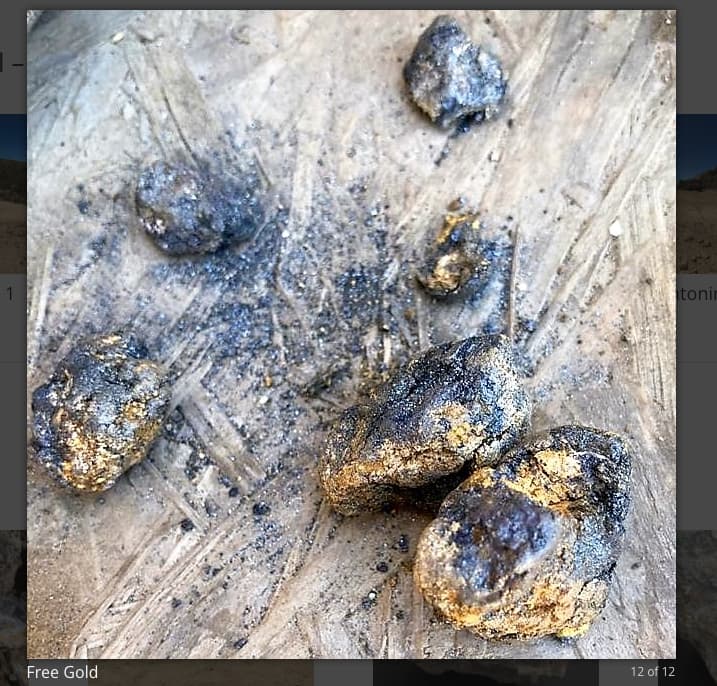

Also, how does one recover the gold from the type of gold that has been encountered and posted in the images below? Is just a standard FF circuit used, or will there be multiple stages of grinding and chemistry employed in the FF circuit?

Yes, I’m overweight and fully invested in AUMC as I’ve asserted many times. But I"m content to keep it safe in a sock drawer for now. I’m waiting to hear the answers to these questions I have posed from those professionals who have been hired and are on the ground at work. Also note, I urge you not to count me in as one of your “most investors” crowd. Every investor has unique circumstances and goals, short or long term. In the meantime I have other investments that keep me occupied, but thanks for your concern.

EZ

I can’t believe I’m bothering to respond but, again, the low price on the OTC is 15 cents. This is not complicated stuff.

I agree, this is not complicated stuff. I used a weekly chart because of the precipitous drop and abnormally high volume for the week. The decreasing momentum during that week of COVID was extreme with a high volume skewed for selling. I Trust sharpcharts to show the true price range and abnormally high volume during that week for SOMA on the OTC. The low in the US OTC was actually USD$0.005 as shown on the sharpchart. Similarly, there was decreasing momentum and high volume comparable to the selling during COVID this past week. Why? Shareholders got spooked on the news.

July 8, 2024 /CNW/ - Soma Gold Corp. (TSXV: SOMA) (WKN: A2P4DU) (OTC: SMAGF) (the “Company” or “Soma”) announces a temporary suspension of mining and processing activities at its el Bagre mine and mill in Antioquia, Colombia, due to a community blockade. This action by the local community has restricted access for employees and supplies, leading to a Care and Maintenance status for the site. The blockade began on Wednesday, July 3, driven by community frustration over delays in local road maintenance and paving. Despite ongoing efforts by Soma and municipal authorities to address these concerns through a cost-sharing plan for paving approximately 3.5 km of regional road, the community has expressed dissatisfaction with the pace of progress.

Company has been a relatively steady producer with PPS doubling within a range over the past 4 years. Soma has total debt of USD$ 59,945,873 and total equity of $74,099,483 reported for 2023. It continues to have high debt as Zotron pointed out. Are you going to address anything else in my post, or will you just keep to your usual, and obfuscate on other concerns I asked about?

Keep spinning it any way you like Baldy; Afterall, you are always right. ![]()

EZ

Easy. Candidly, I can’t understand the questions you are attempting to ask. I feel like I’m at a Biden/Trump debate. Something about Canadian vs. US listed stocks? The point I was trying to make, companies listed on the TSX or TSX.V often have US listed, OTC dual listings. However, the US counterparts rarely trade and NOBODY references them in technical or fundamental analyis. By way of example, this SMAGF version on Soma hasn’t traded in 3 days. To use the US placeholder ticker (a simple marker) for analysis is akin to relying on grades reported by artisenal miners, 70 years ago, to forecast future results.

If you want a response on your questions re: comps to Banyan, I don’t claim to be a mettalurgist but high 80’s to low 90’s gold recovery is a reasonable expectation for what AUMC could expect but they definitely need to spend the money for proper grind/crush. They will lose another 5%+ of the offtake for the concentrate. More immediate questions/concerns should be: do they have the money to build a FF plant and what are the details of the terms, how long will the design/permitting/build take, how do they plan to deal with the tailings/water/power at that elevation, what additional costs will need to be considered (road, logistics, labor)?

Easy, you many want to spend more time focusing on (worrying about) the next few inches vs. miles when it comes to this investment. This has always been a sound approach.

Per my earlier posts, there are two, stark realities in Medinahland. Lucky for you, we aren’t neighbors.

Why is there still no update? Is the contract still not binding? Did Strategic Investments pull away from the deal? What’s it going to take for these guys to start moving their asses?! Gold is now at 2430! Let’s f’ing go already!

Where are they at with anything they said?

Lots of talk but no follow through.

What have they actually done?

Now we are flat out stuck. They’ve taken away the dream of a short squeeze some of us were hoping for upon Aumc share distribution by moving markets.

Did they strike a deal with brokers who couldn’t cover? The only way is for mdmn to dissolve to save their asses?

MC said all mdmn shareholders would be treated equally. Yes we’re all screwed including MC and his shares of mdmn. He does have a ton of Aumc though.

24 yrs of this BS for me

Time soon for someone to go visit them?

Wow what a move by Gold today! All time highs and is ready to break over 2500! Unfortunately, we don’t see the proceeds yet.