That stockpile may as well be at the end of a rainbow!

John,

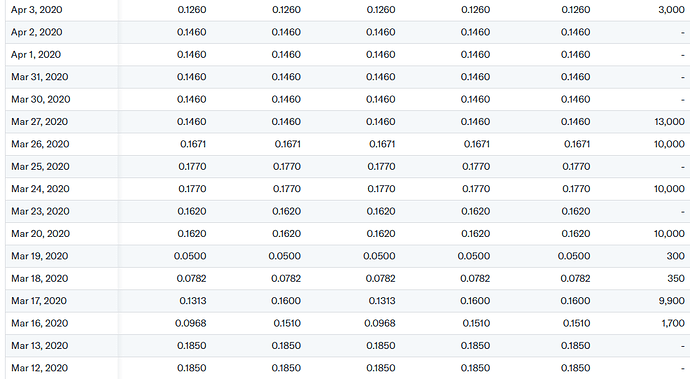

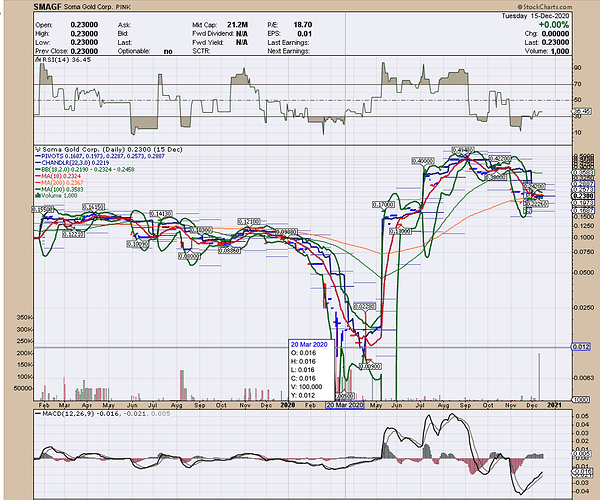

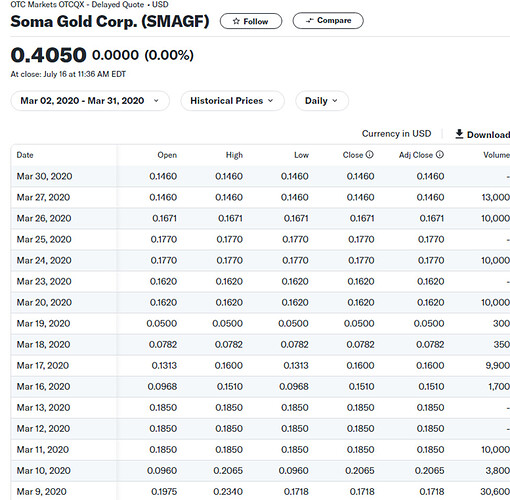

Let me try to explain as best I can so perhaps you can better understand my perspective and what I would like answered. Maybe it’s just your arrogance that prevents you from seeing another investors point of view despite certain facts that differ from your opinions. Your earlier denigrating comments regarding the need for me updating my charting skills is a case in point. It’s clear your line chart does not show the low price of the day for a very good reason; a line chart is useful in visualizing a trend, not price. Despite an OHLC bar chart clearly showing a low of $0.005 your insistence that the OTC SOMA low price was not $0.005. When saying “I can’t believe I’m bothering to respond but, again, the low price on the OTC is 15 cents.” …is demonstrably incorrect. It is a false statement! Although trading volume may be light on the OTC side of dual listed commodities, there is a distinct advantage of buying incrementally at the lowest prices when the stock rebounds, even if it is countertrend for brief intervals. There is often advantage of using trades in one currency over another in such situations. With SOMA, the potential for someone buying at the very lowest price of the week could have gained a 60X using $USD at $0.005. I concede that it is rare to buy at the very lowest price of any stock during a sharp downtrend in a short interval, but it is possible for a few lucky souls. Buy low and sell high!

As I’ve repeatedly emphasized there is no doubt an FF circuit cannot proceed without 1st having approved permits and plans. John, I definitely agree with you that management/BOD needs to spend the money for proper grind/crush units appropriately conforming to the flowsheet testing. The immediate question to be answered is how to maximize cash flow in the quickest manner possible to take advantage of the current POG which is likely to continue increasing for a number of years. That was actually part of the question I’d like the experts making decisions to provide an answer to. Is there a possibility of using a Gravity Concentrator with a coarse screened crush of 3mm and appropriate grind size prior to entering a FF circuit? Using a coarse grind of 3mm instead before performing a Gravity Concentration of rougher size before a typically finer grind introduced later in the FF circuit would avoid creating flat flakes which could reduce recovery. Flattening larger free gold into flakes by using too fine a grind can damage equipment further along in the recirculating loads fed through the FF plant. Can the larger coarse visible free gold particles be removed by some means before entering the FF circuit to prevent flattening the gold into flakes that do not process efficiently in an FF circuit?

I was asking how the $500K in hand might possibly be used to best accelerate the process of procuring essential equipment that includes procuring needed crushers and specified grinds to fit all stages of the pretested recovery flow sheet as was outlined in the Banyan example. Coarse chunky free milling gold poses special difficulties for predominately refractory gold ore.

It is well known “Gravity gold recovery is environmentally friendly as no reagents are required. … In the case of gravity recovered gold, faster cash flow, higher overall recovery and lower cost per ounce are all significant advantages. Gravity gold recovery is environmentally friendly as no reagents are required.”

ADVANTAGES OF GRAVITY

In the case of gravity recovered gold, faster cash flow, higher overall recovery and lower cost per ounce are all significant advantages. Gravity gold recovery is environmentally friendly as no reagents are required. Other benefits include reducing the CIP feed grade, recovering coarse gold that would otherwise be slow to leach, improving CIP leach kinetics, reducing carbon loadings, reducing gold in circuit lock up and reducing cyanide consumption. The trend over the last twenty years has been to maximize gravity gold recovery for the above reasons.Proper sample selection and planned laboratory test work form the basis of process selection based on gravity recoverable gold (GRG). Interpretation of test results and translating to an operable flowsheet is critical.

CONCLUSION

Gold mineralogy particularly particle size determines amenability to gravity gold recovery. There are large financial drivers to maximize gravity gold recovery. Sample selection and representivity are risks that need to be managed in assessing gravity gold recovery.

The geologists, engineers and metallurgists involved in a project must truly want to work together with a shared goal and jointly recognize the value they can each contribute to the project. This approach requires geologists, engineers and metallurgists to develop significant understanding of the mining and ore treatment flowcharts. Technical professionals must become ‘multi-lingual’, (capable of speaking and understanding geological, metallurgical and business language and concepts).

Gravity Gold-Selection Sizing & The Optimum Circuit.

(Gravity Gold-Selection Sizing & The Optimum Circuit.)

I fully recognize the deposit at the Fortuna mine is overall considered refractory, largely due to the presence of supergene CU enrichment zones of probable economic value. This ore to be processed maximizing profit demands multiple steps and multiple reagent concentrations to fully capture all economically recoverable minerals. My question is whether a portion of the ore can be screened and ground to a size amicable to be considered suitable to treatment as Sulfide-Associated Gold as described below. After rough free milling gold has been removed, further grinding results in reducing the size typically amenable to flotation processes designed specifically for refractory ore in the particle size range of 75-300 µm. The complete process is planned first in laboratory tests to maximize recovery through several steps in the FF circuit.

Sulfide-Associated Gold

Gold is often associated with many sulfide minerals including arsenopyrite, pyrite, chalcopyrite and galena. Often a portion of the sulfide-associated gold can be considered free milling while the remainder is occluded or very finely disseminated within the sulfide matrix.While the free-milling portion can be recovered by traditional gravity or cyanidation processes discussed above, the sulfide-associated gold can cause issues with these processes. Some sulfide minerals consume large amounts of cyanide or dissolved oxygen (critical to the cyanidation process) and make whole ore leaching impractical or uneconomic. The ultra-fine gold particles associated with sulfide minerals are often too small to recover by gravity and very expensive to liberate by grinding.

Typically, sulfide-associated gold is recovered by froth flotation. …

CONCLUSION

When it comes to the gold recovery process, there is no “one size fits all”, but there are plenty of options and solutions.

GOLD RECOVERY 101

(Gold Recovery 101 From Sepro's Gold Recovery Experts)

I respect you are not a metallurgist, and I have no claim of expertise in this area either. I do have an inquisitive mind however, and would like to hear back from those in management that are responsible for overseeing and optimizing this recovery process. I’m always open to learning something new, regardless of who provides the accurate information. I expect Management is diligently progressing to inform shareholders when they have definitive answers. Those wishing to rush this process forward are better served by allowing management to continue to work out the details.

EZ

You’re really going to make me do this? Here’s the daily high/low/volume for the period. The stock traded 300 shares at 5 cents on March 9th (obviously a $150 “blip” as it traded at 17 cents the day after) over the EXACT period you are referencing. This was the low, if you can call it that. The .005 never happened. Nobody, and I do mean nobody, follows the US tracking vehicles for Canadian listed stocks for technical nor fundamental analysis for this reason.

My intent is not denigration and I’m certainly not trying to be arrogant. However, if calling me names somehow makes you feel less embarrassed about this ridiculous “debate” have at it!

Attemting to make an argument based on a fictitious 60x return that never happened is not much different from worring about “maximizing” cash flows and optimizing recoveries in an investment that hasn’t even confirmed if they have the money for a FF plant that will take a minimum of 12 months to build.

Like I said, two different realities and we clearly aren’t in the same area code. Have a nice morning.

This is the quote of the year. I couldn’t agree more.

Yes John, here it is!

I used to do a lot of bottom fishing off the east coast of Florida in my younger days. It taught me a lot of patience as there were days I would get Skunked and catch nothing. But on my lucky days I would bring home a nice catch of Red Snapper or Black Grouper.

Now days I will put in stink bids on the off chance there may be some outside trading days, expecially on TSXV stocks that trade on the OTC. Occasionally I get lucky and snag something that is even below the low quote for the day!!! I don’t bother trying to explain it.

Sometimes a picture is worth a thousand words. ![]()

EZ

Another spot on post. I fully agree. Your passionate defense of this specific picture speaks to many more than a 1000 words.

I’m admittedly jealous. I too want to live in a world where dividends grow on trees , one can buy the highest grade gold mine in the history of mankind at a price of $0.00, and bottom fishing for penny stocks (using erroneous charts) leads to 6000% returns.

Thankfully, I don’t use StockCharts.com otherwise I might rely on misleading charts and remiss about not buying shares at prices that never existed. I’ve been long Soma since well before 2020 and probably would have noticed if my position dropped by 99%. Comically, your illustrious charting service failed to incorporate the 1:10 stock split on May 8th for what looks like the better part of a month.

That is why the chart you continue to reference is simply a mirage (read: error) created by a website most, I assume have never heard of.

Again and hopefully for the last time, I will provide you the opening, high, and low price and volume for SMAGF that don’t “jive” with your chart, over the period in question. If this continues to keep you up in night, you might consider calling StockCharts.com, if anyone actually works there, and advise that they should fix their chart to properly refect the stock split. I know I would be feel better in knowing that I didn’t miss out on the chance to add to my position at $0.005.

Either way, we can both agree that there was clearly a missed opportunity in not pulling the trigger on the 350 shares at $0.05. That $17 investment could have been a real life changer.

![]() [quote=“Baldy, post:36, topic:3393”]

[quote=“Baldy, post:36, topic:3393”]

I can’t believe I’m bothering to respond but, again, the low price on the OTC is 15 cents. This is not complicated stuff.

[/quote]

I’m so glad you finally decided to correct this other erroneous post of yours. SOMA is not a stock I’m invested in, even though you have chosen to highlight it as one of your shining examples. Yet you bother this forum again to let us know you are always right. ![]() Face it BE, you not only have an inflated ego where your arrogance comes out as being belligerent all too often. If you were my neighbor, I would gladly welcome the opportunity to have another learning experience and perhaps learn something new that I hadn’t realized before. Have you made up your loss that you made in this stock yet?

Face it BE, you not only have an inflated ego where your arrogance comes out as being belligerent all too often. If you were my neighbor, I would gladly welcome the opportunity to have another learning experience and perhaps learn something new that I hadn’t realized before. Have you made up your loss that you made in this stock yet? ![]()

To be clear, nobody is always right but some folks are indeed almost always wrong. You brought up Soma in a misguided attempt to suggest that stocks with tight floats, like SOMA (and clearly AUMC) have the ability to go up 6000%. Unfortunately, this attempt hit a bit of a wall because you use a charting system that doesn’t bother adjusting prices, post stock splits, on a real-time basis. On Soma, I’m only up 40% because I bought as high as $1 and as low as 25 cents. but the latest doubling of the stock helped me into the green. Its not one of my favorite holdings. My best performer over the past year has been Spartan Resources. Even a blind squirrel finds a nut every once in awhile.

I appreciate that the Soma discussion is a very lame topic for the two of us to ping ponging post but facts and details are important. I’m not sure why you feel the need to attack me for simply pointing out that you are wrong but, it comes as no suprise. The same thing happened when I dismissed the viability of an offtake financing, or claimed that the company wasn’t actullly sending ore to Enami, or that the mine was on care & maintenance. These were just the latest false facts/assumptions carrying a lot more relevancy for those who are long or looking to get long but I was accused of creating false rumors to create a better buying opportunity. I was wrong in my forecasts for an imminent dilutive financing but this was based on the knowledge that an equity financing was being pursued at a discounted price. Unfortunately for my predictive track record and even more unfortunately for holders of the stock, a totally different deal has materialized (as far as we still know).

At this point, nobody can even purchase shares of MDMN (b/c of some super secrete corporate game plan for a downlisting to Expert Market). At least nobody can still accuse me of ulterior motives but arrogance, narcissm, belligerence, etc will do just fine for now.

This is not good news for exploration companies:

US mine development timeline second-longest in world, S&P Global says

BY ERNEST SCHEYDER, REUTERS - 7:04 AM ET 7/18/2024

INVESTMENT NEWS

(Reuters) - It takes an average of nearly 29 years to build a new mine in the U.S., the second-longest in the world behind only Zambia, hampering Washington’s efforts to boost output of lithium, nickel and other metals for the energy transition, a report said on Thursday.

The report by consultancy S&P Global comes amid rising pressure on U.S. officials to streamline what is seen by mining companies and some policymakers as a confusing and lengthy process to obtain a mining permit that harms efforts to offset China’s near-total control of the critical minerals sector.

S&P studied 268 mining projects across the globe from when a metal deposit was first discovered until production began. The report found the development timeline in copper- and cobalt-rich Zambia to be the longest in the world at roughly 34 years, five years longer than the U.S.

Canada, Argentina and Mongolia - where Rio Tinto developed the Oyu Tolgoi copper project - rounded out the top five longest development periods.

Ghana, the Democratic Republic of Congo and Laos had some of the shortest development times in the world, at roughly 10 to 15 years, while Australia at 20 years was the best among countries most comparable to the U.S.

The report, which did not offer policy recommendations, was paid for in part by the National Mining Association, a U.S. industry trade group. S&P Global said the NMA did “not provide data or substantive input.”

The NMA is helping lead a campaign to convince Washington to revive the long-dormant U.S. Bureau of Mines, Reuters reported this month. The S&P report noted that Canada and Australia have federal-level mining offices.

Data on Rio and BHP’s Resolution Copper project in Arizona and Northern Dynasty’s Pebble copper and gold project in Alaska - neither of which are permitted - were included in the report, which assumed they would open by 2030. Both projects have faced Indigenous and environmental opposition that the report did not offer suggestions to overcome.

The report did not discuss how increased use of copper leaching by Freeport-McMoRan ( FCX ) and others - processes that do not require new permits - could affect U.S. output of that key metal.

A high rate of litigation against U.S. mining projects, the report found, has dampened exploration budgets, with companies with projects in Canada and Australia spending 81% and 57% more, respectively, to find new deposits than those in the U.S. in the past 15 years.

That was despite the U.S. having more than twice the copper and lithium reserves and resources of those countries, S&P data show.

The 28-page report also found that, globally, gold mines are developed the fastest, at an average of 15.2 years, with nickel mines developing the slowest, at an average of 17.5 years.

Best to stay with existing Tier 1 and producing profitable miners for most secure gains.

EZ

Our current globalist administration is against anything that utilizes our natural resources to benefit the US. Just like oil and natural gas, mining for rare minerals can be changed in 4 months.

Hi EZ,

Thanks for the article. Right now, it’s the extended time period between discovery and day 1 of production, that gives the producers, which implies they have their permits in place, their value. This is especially true when the price of gold is at all-time-highs. Starting exploration from scratch makes no sense anymore.

These facts bolster the value of those that have the permitting process under control. It’s a process more than an event. Maurizio was wise in hiring EIA many years ago to do the “baseline environmental studies”. When you submit your permitting paperwork for a froth flotation plant, the first thing SERNAGEOMIN is going to ask is if you have your “baseline environmental studies” on file. Maurizio was able to say yes.

Recall that Auryn’s Caren Mine/Larrissa Vein project had already been permitted for up to 5,000 tonnes per month. I would guess that the DL2 Mine will get (or already has) the same rating or higher because of the superior ventilation system at the DL2 Mine. Froth flotation systems are pretty benign environmentally, so I wouldn’t anticipate many hassles on that approval. Working on a flat plateau that is 4 Km by 1.5 Km makes constructing the tailings storage facility (“TSF”) pretty straight forward. The SERNAGEOMIN website provides a good read on the rules for a TSF.

SERNAGEOMIN has already sent reps to the DL2 Mine. When they got interviewed, they were singing the praises of the DL2 Mine for how technologically advanced the project was and how it was a good example to others as to how to handle the various ESG mandates and protocols. They even had Auryn’s staff give workshops to other members of the mining community on how to follow the ESG mandates and on new advanced blasting techniques.

Maurizio, and even his wife Amparo, are all over the new ESG scene which is important because permitting can go slow for those not in very good compliance. All the miners are getting ESG ratings nowadays and there are a lot of mining funds will only invest in miners with super low carbon footprints. The University of San Sebatian helps Maurizio with carbon footprint calculations and the like. The key concept right now is “SUSTAINABILITY”. Before Covid hit, Auryn was setting up some programs with the local communities in this regard.

The SERNAGEOMIN engineers did a thorough going over of the new ventilation and safety egress system and it passed with flying colors. That was a huge box to check off because of what happened at the San Jose mine (near Copiapo) a decade ago when the 33 miners got trapped for a month or so because the owners were to cheap to put in a good safety egress system.

I haven’t heard any dollar figures, but a permitted production facility, with these extended timeframes for putting a project into production, are worth a fortune because time is money. With the POG where it is today, I’m going to guess that Maurizio has received a few phone calls by now. Somebody asked Kevin a while back if Maurizio would take $100 million for the ADL “as is”. Kevin about tore them a new one. I don’t think Maurizio would ever sell, especially the vein deposits, but it would sure be nice to get a big fat tender offer from somebody that we could at least discuss.

If you get a minute, make a list of exactly what’s going to change if and when the funding deal closes, which means that the permitting all got checked off on. It’s going to be a lot of fun.

Is this “statement” consistent with what the company has publicly disclosed? In other words, if someone was willing to pay $100M for the assets (pre permit, pre-pre production, etc.) is this consistent with Maurizio’s inability to raise equity, at considerably lower prices, and the ultimate financing package that AUMC was forced to accept, after over 10 months of trying to raise money?

Let’s just assume that this financing is moving foward (a dangerous assumption given that its been nearly 8 weeks from the time of the non-binding LOI announcement).

Putting aside the $20M dividend (a potential 500% return for a debt facility which makes this extremely expensive financing), its important to keep in mind that this debt facility has senior security over the project and has senior security over Maurizio’s $6M loan to the company.

I am NOT critical of Maurizio’s decision to take the plunge/risk as this was his only option to advance the project. However, I sincerly don’t understand how anyone can reference $100M tender offers given the deal on the table that was agreed to. How does one explain this massive disconnect (honestly)?

These types of statements ($100M tender offer getting laughed out of the room) are no different from assertions that AUMC could be making 60gpt and “oodles” of money if they decide to pursue the option of sending material to Enami. A literal sliver of the supposed high grade stockpile could pay for the entire FF plan and, yet, inexplicably the board “chooses” to skip this supposed “option” waste another year landing the financing (and then another year building the plant), and then agrees to eggregiosly expensive debt financing to pay for it. Does this really seem like a realistic analysis/assertion?

Its worth noting, people can still be constructive on this investment and confident in Maurizio without subscribing to some of these crazy theories.

How long does it takes to secure/purchase a plant? Hopefully it gets done soon. Would be nice to actually hear an update regarding the progress if there truly is any!

Jake,

My guess is that they will have the plant built by the first quarter of next year and be in production by the second quarter of next year (the company guided to Q1). This would assume that they don’t run into any issues on the permitting, long lead time items, and the recently announced financing. I would guess that the next update will provide details on what they have purchased/accomplished from a preliminary mine plan perspective from drawing down the $1M debt facility. They already announced $500k so you have to assume that this deal will ultimately get done. Hopefully they will provide the “fine print” of the financing once it becomes a binding agreement. This would be a typical disclosure.

That question about $100M was a long time ago. As I recall, it wasn’t a real offer from anyone, but a tongue-in-cheek ‘what-if’ presented to Kevin. And as you stated, Kevin ‘tore them’ a new something. ![]() He was only stressing Maurizio’s determination to become a junior miner and see this well into production, just as you’re doing now.

He was only stressing Maurizio’s determination to become a junior miner and see this well into production, just as you’re doing now.

(Massive disconnect? Context please) Anyway, just in case anyone tries to put this under a black-light, I just want to point out how Kevin made Maurizio’s intentions very clear. And that this was never claimed to be a statement from Maurizio.

Thank you for all your insight too, Jim.

This one is worth putting on your screen

From time to time I look at google maps satellite view of the “Alto”. Sure looks like they have been busy compared to the last image. ![]()

Hi Hoopity,

Welcome back. With a little luck, the next time you go to Google maps you might see a big square tailings pond or maybe even a 4-pack of them. Then you might think, holy cow, these guys really built a mine.

Hoppity are you able to post those images on MP

Sorry, I’m sort of computer inept in that way. It can be viewed on Google maps by entering “Alto de Lipangue” . Click on the satellite image. Then zoom into the site. ![]()