Yep, that’s exactly what they’re doing now. They’ve shared data regarding their recent progress fairly well. Based on the details, the timing of the July 2025 estimate is logical. No guestimates about it. The details of accomplishments & the imminent plans leave little doubt about delivery, at this point. “No turning back!”

Spartan, another Australian corp was mentioned by Baldy recently, as one you might want to keep a watch on.

Morning Easy. I forgot to bring up Spartan Resources when it was acquired in March. Hopefully you, and others, were able to pick up some shares after we discussed last June. I only mentioned the name to emphasize that I’m not a perma bear on all stocks. LOL

This was a stock where I was sitting on a considerable loss when the company issued a rights offering at 20 cents a share as part of an overall restructuring. I almost didn’t do it (throwing good money after bad?) but ended up doubling down on the position based on a pretty compelling resource. They had a lot more than 70 million shares outstanding because they spent the time and money to properly lay out the potential for a WCD. Without delineating that potential they would have folded several years ago from a lack of available financing. Gold trading at $5200/oz in Australia didn’t hurt.

Baldy,

I responded on the Other Mining Stocks 2024 thread where I originally answered you on your recommendation last year. Your singular focus on this thread when mentioning other stocks is most curious. You should look on the Other Mining Stocks 2024 thread if you are addressing stocks that are not AUMC related, or would like to see if I indeed acted on your recommendation. Thanks for sharing.

EZ

Easy. I have no interest in reading through a thread with a bunch of “graveyard” stocks. Based on the thread’s activity I’m clearly not alone. Artemis? Ramaco??

FWIW, anybody with a retail account at IBKR or Schwab (or almost any other broker) can trade Australian/Canadian securities.

Based on your “bitter tone” I’m very skeptical you actually followed my recommendation. “You can lead a horse to water but…”

A closed mind learns nothing new.

What a Bull Run on Gold! 3500 in site. No turning back now.

The stockpile itself is enough to pay MC and the loan off

I tend to agree here with Zotron. I’ve already been waiting since ‘06, so a little more time won’t kill me -I hope! Sure, I want it all now, but I will be patient to see how everything comes together.

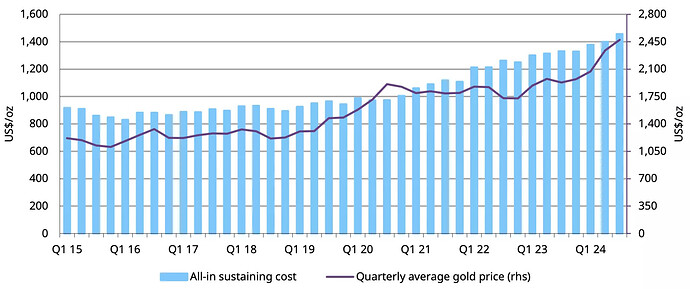

Some AISC perspective coming in on recent earnings reports:

NEM

Gold AISC per ounce increased 13 percent to $1,651 per ounce compared to the prior quarter primarily due to higher CAS per ounce as expected.

AEM

GOLD all-in sustaining costs (“AISC”) per ounce of $1,183

The best run, Tier 1 AISC average surpassed $1400oz last quarter and is averaging 4-10% higher on a Q/Q basis for Q1. FWIW

Nice exception, & Div $0.51US semi annually

Endeavour Mining Q1 $219M $0.90sh 341Goz AISC $1,129oz $737Mcash, net debt $378M down $350M

Endeavour is exceptionally well-run. To put it in perspective, the top-tier gold miners are averaging $1,400/oz in AISC. For smaller, less capitalized, and less mechanized operations, it’s much more expensive to produce. One advantage for AUMC, or even the project in Peru I’m invested in, is higher-grade material. Higher grades can significantly lower AISC. However, bootstrap-style operations like “blast and scoop” are much less efficient.

Here’s my point: an $800/oz AISC is unrealistic—no different from previous pipe dreams (60gpt+ average material, $5,000/t economic delta, dividends, etc.). We need to keep things grounded by referencing actual industry metrics.

Take the Peruvian project, for example. With an average of 9gpt material, they’re working to bring their AISC from $1,500–$1,700/oz down to $1,000 by building a 350tpd CIL plant on-site. This is a big swing, largely due to reduced transportation costs. Similar to AUMC, the Peruvian project is at a higher elevation, accessible via a long, winding road. The target is 25,000 oz of annual production at lower costs. Fingers crossed. The company’s current market cap is around $20M, which seems cheap but aligns with the realities of small-cap mining companies.

Modeling AUMC’s production profile is tough with limited info, but here’s my best-case assumption:

- 260 days of mining

- 75tpd processing

- 10gpt average grade

This gives an estimated 6,300 ounces in their first 12 months. The 260-day mining period may be generous, and assuming 75% of nameplate capacity is also optimistic. If they stay on the vein, mine efficiently, and reinvest cash flow into mechanizing operations, it’s possible for them to average 10gpt and produce at an AISC of $1,200/oz.

At $3,000/oz gold prices and 6,300 oz at a $1,200/oz AISC, they could generate $10M in free cash flow (if everything goes right). After operating expenses, debt service, Maurizio debt amortization, and so on, net income could be around $3–4M. Assigning a PE multiple (which I’d never do, but…) of 25x, the target share price would be around $1. This would be my bull case price target—$1 per share by the end of 2026. I’m assuming they can have the plant built by August/September with commissioning, in earnest around November/December. This should give them a full year (2026) of ramping production.

Per earlier posts, the correct way to, attempt to, value AUMC would be a discount to NPV using forward cash flow projections but, similar to everything else, this is just too difficult to calculate absent a mine plan/feasability study, etc.

For comparison, AUMC’s generous price target (with a $70M market cap and 6,300 oz at $1,200 AISC) should be viewed alongside the Peruvian project’s current market cap of $20M, with 25,000 oz at $1,000 AISC.

Ultimately, everyone has the right to pick their “horse”, but it’s useful to compare these metrics.

Also, the recent sharp decline in crude prices (which account for up to 1/3 of total production costs) will likely drive a big boost in cash flows for precious metals producers. It’ll take a couple of quarters to fully show in earnings, but IMO, this will be the catalyst that pushes the major players (NEM, GOLD, AEM) to new all-time highs, after gold consolidates through the summer months. This could also be THE catalyst to finally get some of the junior producers, many with share prices near historical lows, off the mat.

All IMHO.

Thanks Baldy, this is a very helpful comparison and analysis. Doc has been carefully estimating AISC at $800oz, but I’m not how anyone can come close to a target with this $20M service agreement hanging out there. That has to be baked into the AISC.

JimmyP.

I would agree that the $20M services fee and the $6M owed to Maurizio need to be factored into the investment/valuation equation but they wouldn’t affect the AISC. They wouldn’t even effect the CF/EBITDA but they will certainly impact earnings. I would guess that Maurizio would sweep all of the profits until he’s paid back. Maybe redirect a small portion to operations. That would be the fair things to do as he’s self funded operations at no intererest. The service fee is a different animal as no details have been provided. IMO, these guys are lazer focused on getting their project into production. If and when they are successful in doing so, they can start to focus on proper reporting, disclosures, uplisting, etc. (all of which will be required before attracting “normal” investor flows). Until then, AUMC’s share price is in a holding pattern.

It’s hard to understand why they don’t just deal with the MDMN share distribution, NOW, given how many steps and much time is still needed before AUMC is in a position to acheive a sustainably higher share price (that trades more than 1000 shares a day).

I don’t see how it would not. This is not equity (preferred shares) so it represents an operating cost. Its essentailly a fee to manage the operations of the project. Yes its subcontracted, not direct Labor, but it should quialfy for AISC. I consider it subcontracted management labor.

If you plug in the amortization of $ owed to Maurizio and/or the $20M service fee you might as well peg the ASIC to the spot price of gold until those liabilities are met. No idea. And the market has no idea which is why this isn’t an investable stock until there is more visibility. Put the shares in the sock drawer and, if they execute, things could get interesting in a few years.

Hello. Just checking in here.

Perhaps maurizio’s plan is to wait till gold hits 5k?

Anything going on?

How many more years do these shares need to be stuck in a sock drawer? We’re all gonna be dead at some point.

$5k coming sooner than you think

That’s what they’re banking on