Happy New Year Everyone!!

Hope this is the year for everyone to get filthy rich on Medinah. Fingers crossed ! All the best to everyone.

My filthy rich is when AUMC hits 20. Then I would be 1M after taxes. I think that will be a good year although I will most likely still hold at that point and be greedy. After all, its been 18 years, but who’s counting.

Coincidence Coindence Wizard. You’re welcome everybody for me calling out the equity grab which now forced them to rearrange this into a consulting agreement. The $20M is still getting funneled out. IMO, there is definitely a kickback to MC somewhere in that, you can be sure of it.

Very shady stuff. I’m bullish on the asset and the long-term outcome. I’m very dissapointed in the games and slight of hand going on. Wizard you are a huge asset for MC. He’s smart having you run PR interference. I urge you stay objective and continuously urge him not to be sneaky. If he feels he deserves a kickback for getting this dam thing off the ground, he’s probably right to to some degree. However be up front about it, thats what we all deserve. He’s invested and sacrificed alot, but he also took over the entire property for a song.

THis just blows!

That’s really disrespectful, and uncalled for. Your insinuations and lack of memory (or understanding of our situation) is incorrect.

-

You have no evidence of a kickback and no reason to even assert it. It’s like me saying, “I just know you are beating your wife.” Do you really think AmecoSA/Stracon is doing something because of your post on a board followed by 25 of us? That’s laughable.

-

Not only are you accusing Maurizio. You’re accusing AmecoSA/Stracon too.

-

As far as getting the property for a song . . . this shows a complete lack of understanding of where we were and what we really had. The property was a big chunk of undeveloped land with nothing on it to warrant the price MDMN or CDCH was trading at. If it was such a great deal, majors would have been buying it when it was shopped around all those years. Just because Price and company sold us on it being worth billions (and we bought in and invested millions [that incidentally supported LP’s lifestyle for 20 years!]) doesn’t mean it was worth anything.

You praise Baldy for him having the only grip on reality, yet you continue the to assert the property is worth $$$$ and MC is ripping us all off. It can’t be both ways.

This is reality. The property has great potential. MC put over $6 million into it (plus the cost of acquisition) to get it to where it is. That was good enough for us to get someone like AmecoSA/Stracon to loan $4 million along with up to $20 million for a services agreement.

Frankly, you’re saying there is a kickback, stinks and is insulting. It’s 100% fabricated nonsense and it comes from a place of pain. I get it (the pain) but you can do better than this.

January 2025 – Shareholder Update

Jan 7, 2025

AURYN Mining Corporation Shareholder Update

AURYN Mining Corporation (OTC: AUMC) is committed to keeping our shareholders informed with the most current updates on our progress and strategic initiatives. As we step into the first quarter of 2025, we wish to share significant developments and our forward-looking approach to our mining and exploration activities.

ACCOMPLISHMENTS

Fortuna Operations

During this quarter, operations at our Fortuna site have continued and concluded as follows:

-

Completion of New Mining Camp: Our new mining camp at Fortuna is complete. As previously announced, the camp has sufficient capacity for our entire operational workforce, provides accommodation for our management team, and can host academic missions. It is equipped with solar panels, ensuring clean and sustainable electricity. This setup has enabled us to connect our mining site to the internet via Starlink, ensuring connectivity, communication, surveillance, and monitoring of our operations and personnel.

-

Antonino Tunnel Operations: The mining plan has been designed to optimize production by extracting ore from the Don Luis Vein, which is the primary target, and accumulating ore for future processing.

Mining Plan Developments

In December, the Chilean Mining Authority (SERNAGEOMIN), under the Chilean statute for Small Mining Producers, extended a new operating permit for our “La Fortuna de Lampa” project, currently in operation. This permit allows an exploitation rate of up to 1,000 tons per month, sufficient for operations in Antonino.

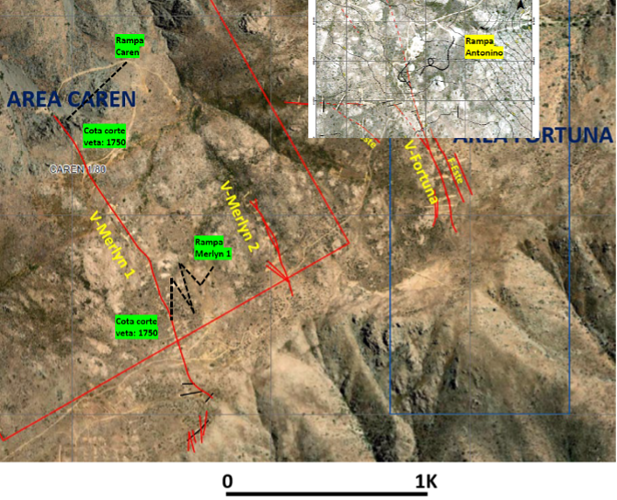

Our exploration team has identified two additional areas for new ore extraction points, aiming to incorporate monthly quantities similar to Antonino. This strategy will generate the critical mass and ore stock necessary to ensure continuous operation of our flotation plant. The additional exploitation points will be linked to the Merlin 1 vein, as indicated in the accompanying tentative location plan.

The exploitation projects for these two new points, each with an extraction capacity of 1,000 tons per month, will be submitted to SERNAGEOMIN for approval during January 2025.

Additionally, as we plan to expand and intensify our operations in the Lipangue Mining District, we have initiated a project for the repair, improvement, and permanent maintenance of the district’s access road. This effort aims to maintain high safety and quality standards, minimizing operational downtime due to adverse weather conditions.

On-Site Flotation Plant

The engineering and construction project for the plant is in full swing. While the basic components of the flotation plant are being manufactured, we are commissioning the fabrication of other individual units and completing the project’s technical dossier for submission to SERNAGEOMIN in January 2025.

Civil works for the preparation and construction of the plant will also commence in January 2025.

Based on current progress, we estimate that the plant will be operational and have the necessary permits by the third quarter of 2025.

For further details and to stay up-to-date with AURYN Mining Corporation’s activities, please visit our website and subscribe to email notifications.

We appreciate your continued support and confidence in AURYN Mining Corporation.

Submitted on behalf of the Board of Directors.

Forward-Looking Statements

This news release contains certain forward-looking statements within the meaning of the United States Securities Exchange Act of 1934, as amended. This forward-looking information includes, or may be based upon estimates, forecasts and statements of management’s expectations with respect to, among other things, the completion of transactions, the issuance of permits, the size and quality of mineral resources, future trends for the company, progress in development of mineral properties, future production and sales volumes, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining or milling charges, the outcome of legal proceedings, the timing of exploration, development and mining activities, acquisition of shares in other companies and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially and substantially from those anticipated in such statements. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Contact Information

Auryn Mining Corporation

One might be forgiven if they momentarily imagined a small bit of operational momentum building on the mountain. [Me Verifying my Desk Drawer of Optimism with its rusty old lock is still shut tight]

Hard to disagree. One would hope so given that AUMC is currently trading at a $50M valuation. There needs to be some solid execution over the next 12 to 24 months to grow into that valuation.

Its good to see a bit more details on progress on construction. Not sure having Starlink is worthy of a PR but baby steps. The only point of confusion: until Sernageomin issues the engineriing permit, AUMC can’t really do much to advance the construction. Even ordering custom parts/equipment for manufacturing can be a risky endevour prior to a permit. By way of example, the company I’m involved with in Peru experienced 9 months of delays b/c it took them 6 months to get their engineering permit (maybe Chile is more responsive?) and therefore could not begin construction nor order key equipment until after receipt. The permit required several modifications to the proposed flow sheet. If they had already strarted to build the plant it would have been an issue.

Similar to AUMC, the Peruvian company issued debt to finance the plant. A CP (condition precedent) of the first tranche was receipt of both the environmental and enginerring permit. This is pretty standard. Because we have no details of the debt facility one can only speculate but I’d be surprised if they have access to $ (beyond the $500k already received), until the second permit is issued, to start allocating $ to construction.

I would be impressed if the company is able to be in production prior to 2026. The caveat being, if they get the permit in the next 60 days, its possible they could get there in 2025.

Let’s talk in July. ![]()

Nice to see a bit of clarification !

Still worried about the $20 Million.

Services Agreement:

Under this same agreement, Ameco Chile SpA will provide a range of engineering and management services for the Fortuna de Lampa project, including:

Reviewing and optimizing mine plans and water management

Developing construction and operating budgets

Conducting training programs to maximize local labor involvement

Recommending and implementing social programs for community engagement

Supervising construction and mining activities to ensure environmental compliance

Leasing mining equipment required for project operations

I like all of their services, but unless they are paying for the leases for the mining equipment and/or preparing a PFS or FS (Pre Feasibility Study or Feasibility Study, which is a major undertaking), The $20M is a high price to pay if the two above mentioned, (paying the leases and conducting a PFS or FS) are not part of the agreement.

Now this is a company that keeps their investors informed !

They continually update their investors with everything.

West Red Lake Gold Mines Ltd. Vancouver WRLG, OTCQB: WRLGF

Latest update :

Strategic Investment went from a $20M dividend to now being affiliated with Ameco who now carries a $20M service agreement.

Why the change? Coincidence that several others, not just me, were highly concerned about a $20M dividend with no details being the cost of a $4M loan?

You are correct there is no proof, only evidence for all to consider.

Secondly, I have never been a Baldy cheerleader. Perhaps you are mistaken me for someone else. I am bullish on the investment, still skeptical of insider dealings. This is a pink sheet stock still. It makes matters worse when the company is vague and suspicious with their dealings.

Sorry nothing should be considered insulting since we are dealing with JJ’s son in law who was on the inside when fraudulent shares were being fleeced. He ended with the property and now here we sit. Everyone should remain highly skeptical until fruit is delivered. They have promised to convert shares, uplist the stock, cashflow projections, return value by way of dividends etc etc. Alot at stake for us to just blindly trust that this $20M arrangement is on the up and up. Nobody has ever heard of Strategic investments! Some people aren’t just blindly skeptical. I agree that unwarrented skepticism does this investment no service. Healthy skepticism is necessary or else we are risk of repeating history.

Instead of being defensive by my accusations, you should encourage MC to clear up ambiguities. Makes him look guilty of something nefarious. I start off being a healthy skeptic, questioning the $20M dividend that smelled funny. You were completely MIA for months. So I dialed the rhetoric, and low and behold, there is rearranged financing deal. Coincidence? Who knows. Plenty of skeptics here still concerned what the hell to make of that maneuver and clarity is lacking. As recent as todays posts. Im not the bad guy. I hope that you gleen some perspective from contarian viewpoints.

If this $20M arrangement wasn’t a secret, there would be no sourness. I want to get excited about this investment, believe me. I have plenty of skin in the game.

MY THOUGHTS

A friend of mine bought a bunch of MDMN many years ago, on my recommendation. Got disillusioned. Sold it all two years ago. Asked me to keep her updated. Last night I sent the below email to her. Thought it might be worth sharing here. I’m sure I’m not the only one laying in the weeds and thinking this way:

This is NOT a Buy recommendation, just an FYI…

The parent company of MDMN (AURYN Mining Corp – ticker is AUMC) has put out two upbeat announcements in the last ten days — they’ve completed a bunch of stuff (notably: completed a mining camp for workers; obtained $20 million in financing from a renowned mining industry source; permit applications advanced; plus other things) and say they’re expecting to have things fully operational in third quarter of this year…

They did all of this without issuing any new shares (without diluting the stock, as they have all along sworn that they would not do — maybe a better way to put it: They’ve done exactly what they said they were going to do). The stock price is triple what it was a year ago, volume (still quite weak) has picked up significantly from a few months back…

I know your old MDMN stock is gone, but here’s the deal with those of us who are still holding any:

The only asset that Medinah Minerals owns any more is approx 23% of the larger company (AUMC). There is apparently no way, right now, to buy or sell MDMN stock. The only way to invest in this endeavor is through AUMC stock. We are told that sometime in the future (we think and hope and expect in the near future — maybe this year, 2025?) our old MDMN stock (the 15.5 million shares still sitting in my brokerage account) will go through a process that will automatically convert it to AUMC stock.

I find numbers interesting. The roughly $155,000 I’ve invested here (those 15.5 million shares of MDMN) is currently worth $1,555 — almost exactly 1% of what I’ve invested. That’s a whole lot of 155 numbers. Stars aligned?

AUMC stock has tripled from a year ago — it’s still under $1. It’s a gamble.

I continue to trust this management. They have so much more invested here than I do, by far!!! They’re playing to win. They believe they’re going to.

![]()

All of this, simply FYI… You could easily lose 99% (or more) of anything you invest here. But you’ve asked a couple of times, and there’s tonight’s update…

– madmen

Yes, they’ve done exactly what they said they would do. Very appreciative of that.

Q1 2022 – OBJECTIVES

- Continue the extension of the Antonino tunnel and intersect the Don Luis vein. Once intercepted, an announcement will be made, and production will start immediately.

Q3 2021 – OBJECTIVES

- Begin an exploitation plan on the Don Luis vein on multiple fronts with regular shipments of ore to Enami along with the existing ore that has been stockpiled.

Q1 2021 – OBJECTIVES

- Start selling ore (mineral) to ENAMI for processing or smelting, permit pending and expected to be obtained within this period.

DEC 2018

We continue to provide logistical support to Hochschild’s work on the LDM project. Hochschild recently completed Phase 2 of their work on the project and plans to start Phase 3 in early January.

MAY 2016

We expect to start mine preparation during the second week of June. Mine preparation will take approximately two months.

We have conducted metallurgical test runs at recognized laboratories in Chile and Peru. These have resulted in an average gold recovery of over 90% from concentrated ore obtained by a gravimetric Falcon system. Based on this, AURYN expects to produce a total of 5,000 troy ounces of gold in 2016 and over 25,000 troy ounces in 2017.

The cash flow generated from production at the Caren Mine will fund an aggressive exploration program of the Pegaso Nero and further drilling of the Merlin-Fortuna targets. The Pegaso Nero target has great potential to begin proving up a mineralized porphyry.

As we progress toward full scale production AURYN will provide updates regarding costs, mine life, and reserves. In addition, we will be updating our shareholders regarding possible cash distributions after the first quarter of full production.

You obviously believe that when one states objectives that this means they are saying it is set in stone that it will happen.

Did you ever consider that maybe the word “objectives” might be interpreted as … goals?

Edit***

Some here are entrenched in the mining companies that work off the financial model of spending tens of millions of dollars (dilution dilution) with the hope that one day their efforts will result in a viable mining operation. They become frustrated at a company like AUMC which has taken a different approach. AUMC chose not to dilute dilute but rather to capitalize on the readily available resources to start a production operation as quickly as possible. AUMC is within months of production whereas many of these other mining companies continue to invest millions hoping!

Bubba. I’m simply responding to your post: they’ve done “EXACTLY” what they said they would do. Their objectives and goals and forecasts are what you are referring to. For several years they said they would be processing ore at Enami. They completely reversed course and decided to build a FF plant. One could argue that the information that catalyzed that change of course was readily available to them many moons ago (refractory ore!?). From day one they said they were fully funded. Also totally incorrect. Mining the Fortuna. Didn’t happen. They said they would never raise equity but spent the better part of 18 months trying to raise equity (went with debt as that was all that was available). Raising debt is also the antithesis of “doing it on his own.” The reason why almost zero junior miners have debt is b/c its extremely risky (to the equity holders).

I believe Maurizio and team have made a commendable effort to make something work and applaud his willingness to be flexible and put up his own $$. However stating that they have done exactly what they said they were going to (over the past decade) is grossly inaccurate. Maurizio would and has (in conversations) be/been the first to admit this.

`edit***