Seems pretty useless with no new info. What am I missing? Why all the delay?

Yes, so the good:

They put a $56M asset value on the ADL claims, which is slightly more than the current market cap of CDCH. Coming up with this value in a defensible way was the primary source of delay.

Also they made clear, as previously deduced, that Auryn Holdings made the loan for the cash call, and controls the 500K preferred shares. They also disclosed that Marizio controls Auryn Holdings. So Masglas, Auryn Holdings, and Auryn Mining Chile (which owns 95% of CDCH shares) are all controlled by Maurizio.

Also this little tidbit in Item 6 (page 6) of the Disclosure:

On December 15, 2017, following the Closing set forth above, the Company closed its acquisition of all of the mining concessions of Auryn, pursuant to an Asset Purchase Agreement of the same date, and is continuing with the exploration of such mining claims.

However according the financials the company continues to have only $21 in cash and had only $9,279 in operating expenses, so no one is getting paid by Cerro to be sure. Nor were any significant taxes on claims paid by Cerro. So … mysteries remain

And the bad:

The Disclosure is titled “Annual Report” when it is a Q1 quarterly report …

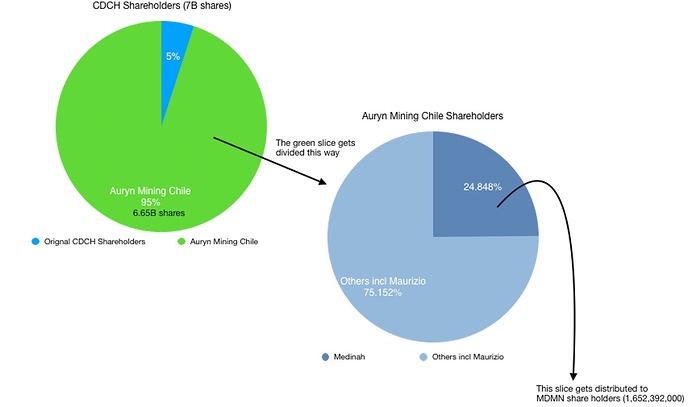

So Maurizio owns 6.65b shares of cdch and everyone else owns part of the remaining 350m shares? Or do we own some of his 95 percent of 7B shares?

Maurizio controls Auryn Mining Chile. He does not own 100% of it.

Medinah owns 24.848% of Auryn Mining Chile, and so 24.848% of the 6.65B shares. That amounts to

1,652,392,000 shares of CDCH plus another 29,150,000 CDCH shares which Medinah holds independently of Auryn for a total of 1,681,542,000 or 24% of the 7B outstanding.

Auryn will eventually exchange those CDCH shares for the Auryn shares Medinah holds. And then Medinah will distribute those shares to MDMN shareholders via some undisclosed method/mechanism and then afterwards or concurrently cease to exist. At least that was the general plan which was laid out.

If 1.6b is part of 7b outstanding, how does he own 95 percent of 7b including our 1.6b?

Auryn Mining Chile (AMC) owns the 6.65B shares, not Maurizio. AMC got those shares by selling the ADL claims to Cerro in exchange. Maurizio did not personally own the claims. He did not personally receive those shares in exchange. It was a purchase agreement between the companies, Cerro and AMC.

Medinah owns 24.848% of AMC by holding 24.848% of the outstanding AMC shares

Maurizio owns some amount of AMC that is greater than 50% and thus he controls it. He obviously holds less than 100% - 24.848% or less than 75.152%. So he holds something between 50% and 75.152%

AMC will buy back Medinah’s AMC shares by giving Medinah 24.848% of its Cerro Shares (1,652,392,000 of the 6,650,000,000). And Medinah will in exchange give AMC back the 24.848% of the outstanding AMC shares, which it currently holds.

Caveat: There could still be modifications to this plan. So use this only as a “current plan” model. For example, more claims were recently discovered in the ADL area under Auryn’s name. Thus there are claims in Auryn that have not been sold to Cerro. So how will this be accounted for? It’s possible / probable that Auryn continues to pay for some expenses like keeping the original claims up to date (aka paying taxes / fees) even though the original claims are now in Cerro’s name. How will this be accounted for?

“and is continuing with the exploration of such mining claims.”

At least they are moving forward.

Thanks CHG

And where are we on that? Whatever happened to photos they put out for us to see?

A nice thorough update would be nice

Are these guys still a grade school and not know the difference between an annual report vs a quarterly report? Who signs off on these to be released?

Thank you, CHG, for taking the time and effort refreshing us all in a clear way on the status as it appears for now!

BTW I suspect a lot of clerical errors occur as a result of the common practice of cutting and pasting updated info into a previously created document without proofreading and updating other parts of it. See it all the time in lots of other contexts these days. Just sloppiness but is inexcusable.

Any idea how they came up with that number? Overall, the financials are consistent with what we have learned to expect…provide us with the bare minimum and continue to keep all of us in the dark on what is actually going on.

Best guess is that we continue to wait on the conclusion of a JV(s). They probably got a handful of bad JV offers and they have been working to turn a bad offer into a reasonable offer. Alternately, they simply aren’t going to promote in anyway until their stock becomes unrestricted.

As of

March 31, 2018 and 2017

the

mining concessions

are reported at $56,000,000

and

$

0

, respectively

.

Management determined fair market v

alue of the

concessions

based upon comparable values of a

public mining holding

company in the area,

and

the value of the consideration paid for the mining concessions.

Note 4 of the financial statements state:

As of March 31, 2018 and 2017 the mining concessions are reported at $56,000,000 … Management determined fair market value of the concessions based upon comparable values of a public mining holding company in the area, and the value of the consideration paid for the mining concessions. [1]

At least in part, I think earlier MDMN financial statements from before the property consolidation were given consideration. For example, consider the MDMN 2015 annual report issued in early 2016. [2] At that time MDMN still had all their claims. They had purchased the 49% previously owned by JJ. But of course they did not have the claims owned by NUOCO, Cerro (the Fortuna), or LDMC (the LDM), and importantly, not the Caren. Those financials show an asset value of just over $45M for the MDMN claims.

More important than the absolute number, which can vary on the balance sheet according to various factors as you can observe in mining companies all the time,

is the fact that Cerro management (aka Auryn Management) wanted to show a significant value instead of the $570K shown on the balance sheet included in the recent CDCH 2017 annual report. One might safely guess that this is an important part of the longer term plan.

I did noticed there is no official StaynerBates notification sheet attached like there was on the annual report, although their name appears at the end under CPA. I don’t know if that means anything or not.

CHG

===========================

A thought came to mind could it be Auryn doesn’t want to release news until their stock is unrestricted. Why promote now?

well first off what did they spend on MDMN to get these claims? WERE we not told they will prove up the property to earn in? Who did they get the property for free from us and why is our portion not protected from dilution? FML for ever getting involved and believing

This has been gone over many times. Medinah owned a portion of what is now all of the ADL mining district. Medinah had no money, and little to no exploration done on their claims. The opportunities for JV agreements that we were told about over the years were pie-in-the-sky. Nobody was ever giving Medinah money up front for anything. The one decent opportunity Medinah had from Volcan was turned down (or reneged on depending on your pov) by JJ. CDCH was in the same situation.

The Amarant deal was basically a P&D scam, in my opinion. Medinah via Les Price was already selling shares over the authorized and (illegally and fraudulently depending on your pov) filing intentionally inaccurate financials. The option agreement that they signed with AURYN was not in good faith. Medinah is fortunate that AURYN went through with the idea of consolidating all the claims.

Medinah provided no money to the consolidation, but did provide rights to their claims. Cerro did the same. AURYN invested several million in the development of the project and provided the one set of claims which AURYN is fairly confident will prove economical. Medinah got 25%, Cerro 5% and AURYN 65%. That portion has suffered some (but little dilution.) The big haircut was unauthorized issuance of twice the known float and all the preferred shares.

George, wake up to reality. Who gave you the idea that anyone should be protected from dilution? The guy who sold 1.5 billion shares out from under us. If you recall, back a couple of years ago when I met Maurizio in Toronto and started asking about the deal, he told me straight up that what was on this board was wrong. There was know cash offer and even the option agreement was not a Free Carried Interest.

Think as a business person. You own a restaurant. You have a great product. I own a nice piece of real estate. I don’t know if it’s worth much but I’m told if you put a restaurant here the location is ideal and people will flock to it and you’ll make a FORTUNE. Way more than you’d make at some other location. Your restaurant, your knowledge of building businesses, your food, your staff, your skill. I just have a potentially decent location that people may come to if you use all the know how. I’m going to sell you my land and I want $5 million cash for it AND I want 15% of the PROFIT from your restaurant for the rest of its existence. When you build the restaurant, staff it, etc. That’s on you. All the CapEx is yours.

Are you doing a deal or not?

That we have ANYTHING left to speak of and a chance here is a miracle given the past years of association with LP, JJ, and their activities and associations. That is a fact. Most companies that have what happened to us are halted and belly up.

Only thing I can say wrt to CDCH and MDMN is read the last news release and wait patiently for a bit longer. The story is FAR from over.

I assume you are talking about these items?

"Creating a management team and Board of Directors suitable for an exploration company intent on becoming a junior and major mining company.

Launching a massive exploration program on the Altos de Lipangue mining district including entering JV agreements with companies that have the specific expertise necessary for exploring and mining the variety of targets we believe we have in the district.

Focusing our resources on becoming an active gold producer by reopening the Fortuna gold mine and actively exploring and mining the gold veins found in the Larissa tunnel.

Subject to regulatory approval, consolidating the capital structure, changing the name of the company, and moving to a higher exchange or tier on the OTC."

Does anyone not remember what occurred early in 2016 when the Okanadian law suit was first filed in Nevada? One should note back in 2016 before the share count “discrepancy” was unmasked MDMN’s share count was reported as 1,361,703,709.

AURYN was still a subsidiary of MASGLAS and after much wrangling they had acquired 218,763,318 shares of MDMN common stock representing 16.1% of the OS. In the latest 2018 Q1 the OS is reported as 2,882,282,073. Those same 218,763,318 shares of MDMN common stock are still held, but now only represent 7.6% of the OS. The share structure is going to take time and a plan to get all MDMN shareholders accounted for and have a pro rata distribution of CDCH shares placed in their individual brokerage accounts. There is more than just the recent expanded claims and exploration going on that AURYN, CDCH, MDMN and MASGLAS are working on. The story is still unfolding.

Attorney letter for CDCH reports back to the June 30, 2017 reports:

https://backend.otcmarkets.com/otcapi/company/financial-report/196679/content

Looks like the Yield sign should be coming down.

Q2 reports are due Aug 15 though there isn’t really anything major to expect out of them at this point unless perhaps MDMN manages to settle their long-standing Godwin legal dispute which is still outstanding according to the Q1 MDMN report.

Otherwise, we wait for announced new developments. A new mining season approaches, just a couple of months away now.