By April they may be going to this one…

Does anybody know if MDMN is on the hook for the mine development cost to the tune of 15%. If we are then we could experience a serious liquidity crisis. This may already have been covered and I missed it. thanks leif

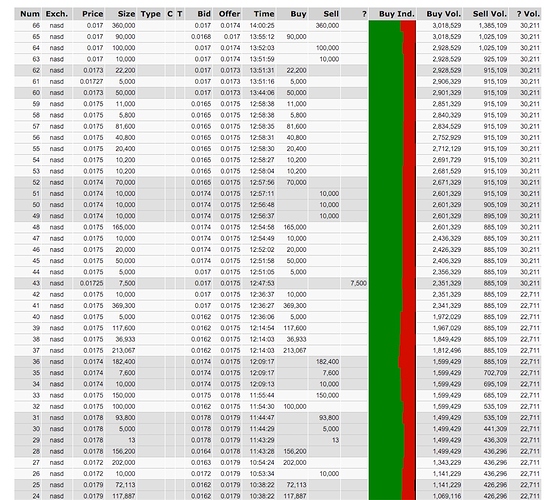

Good hits on the ASK and BMAK keeps showing 10K

No they aren’t.

Once the option is executed, AMC owns 100% of the properties. At that point MDMN owns a 15% equity interest in AMC.

MDMN’s interest is dilutable after the option is exercised the same way any shareholder’s interest in AMC is dilutable if cash needs to be raised through investment and the shareholder doesn’t cover their pro rata share of expenses.

Think of it just like MDMN now. When MDMN has raised funds over the years to cover expenses, they have issued shares. You and I were diluted whenever that happened. It won’t be any different with AMC. However, I expect AMC to be managed in a much more prudent fashion.

The Rod is number1 unsung hero in my book when it comes to recording and documenting all things MDMN. A monumental effort by this man.

Good volume today and overwhelming buys, hmmm, something is coming??

Post option we will be a 15% shareholder in Auryn and not 15% owner in the property.

Auryn (AMC) the company will have to come up with the money one way or another, not shareholders. It will be just like if you are a shareholder in Barrick and you do not have to contribute money in ratio to your ownership for Barrick to build a mine. While one way Auryn could get money is to ask for additional capital from shareholders, it is much more likely that Auryn will have the capital in hand already or will come up with it via borrowing or something else.

This is different from a typical JV, where the JV partner and the junior split ownership in the property, then each company typically has to find a way to contribute money in ratio to their ownership of the property.

Everyone knew going in that Medinah has no money. It is in no one’s interest to delay progress while Medinah tries to figure out how to come up with money they do not have. In addition, the early opportunity near-surface stuff they will target at first will have a modest construction budget within reach of Auryn (AMC), IMO.

This is exactly why MDMN should have negotiated early production NSR agreements for the high grade gold in the most recent meetings. AMC could then fund their progress without dilution. At some point, rather than continue allowing MDMN to retain a 15% equity that becomes ever more valuable, a TO will be offered.

Thanks Gold.

Makes the effort more worthwhile.

Level 2 anyone ?

Rod

Since we still don’t have a thread where we can post opportunities regarding possible 2, 5 10 bagger companies, I’ve been a shareholder (buying as well as private placement purchaser) in this company for a LONG time. And of course I’ve been dragged up and down (sound familiar ?) share price wise.

This company has massive land holdings in BC which as you can read contains at least 3 past producing mines.

The reason for posting is they have a large institutional holding including SPROTT (see below). Already have the infrastructure (complete operational mill) + it’s one of the stocks that once it starts to rise, ‘someone’ starts to sell a lot of shares into the higher bids (guess ? it may have been shorted, although being under $2, this apparently is not allowed). I suspect that SPROTT or ? is quietly picking up a greater percentage of the shares.

Be cautious, do your own investigation (due diligence) and if you’d like any info I can provide, just send me a message (PM).

My DD is in the next posting.

Rod

Someone asked before if people could mention a good exploration stock.

This one has had near spectacular drill assays over the last 3 months. Most of these holes are at shallow depth ! (see last assays for example of depth)

BGM-15-121:_____6.71 g/t (0.2ozt) Au over 5.50 m

** BGM-15-139:__7.87 g/t (0.23ozt) Au over 15.05 m

- BGM-15-141:__26.21 g/t (0.76ozt) Au over 2.80 m

- And__________13.62 g/t (0.4ozt) Au over 5.50 m

** BGM-15-142:_11.26 g/t (0.33ozt) Au over 8.90 m - BGM-15-143:___6.62 g/t (0.19ozt) Au over 10.50 m

___2.49 g/t (0.07 oz/t) Au over 21.30 m

___3.17 g/t (0.09 oz/t) Au over 11.80 m

- 10.52 g/t (0.31 oz/t) Au over 4.50 m

___7.06 g/t (0.21 oz/t) Au over 3.47 m

*__1.42 g/t (0.04 oz/t) Au over 50.46 metres

___5.15 g/t (0.15 oz/t) Au over 6.03 metres

___6.04 g/t (0.18 oz/t) Au over 3.50 m

** BGM-15-064: 27.93 gt (0.81 oz/t) Au over 3.90 m

- BGM-15-070:_ 21.72 gt (0.63 oz/t) Au over 3.75 m

BGM-15-050:___ 10.54 gt (0.31 oz/t) Au over 3.00 m

BGM-15-071:____ 8.72 gt (0.25 oz/t) Au over 3.60 m

BGM-15-087:____23.47 g/t (0.68ozt) gold over 3 m

BGM-15-089:____12.37 g/t (0.36ozt) Au over 3 m

** BGM-15-090:_13.21 g/t (0.39ozt) Au over 9 m

** BGM-15-092:_17.00 g/t (0.5ozt) Au over 4.45 m

- BGM-15-096:__10.17 g/t (0.3ozt) Au over 5 m

** BGM-15-097:__5.27 g/t (0.15ozt) Au over 18.00 m - BGM-15-102:__22.48 g/t (0.66ozt) Au over 2.50 m

- BGM-15-109:__11.23 g/t (0.33ozt) Au over 4.05 m

BGM-15-109:_____8.99 g/t (0.26ozt) Au over 2.80 m - BGM-15-110:__10.03 g/t (0.29ozt) Au over 5 m

**BGM-15-145 22.60m-27m___4.4m___18.95gt 0.55ozt

BGM-15-145 54m-59.3m______5.3m____8.78gt 0.26ozt

BGM-15-149 26m-31.3m______5.3m___11.70gt 0.34ozt

BGM-15-150 37.7m-41m______3.3m____8.07gt 0.24ozt

- BGM-15-160 25.3m-44.70m_19.4m__10.06gt 0.29ozt

BGM-15-162 22m-27m_________5.0m___6.79gt 0.20ozt

*BGM-15-162 37.00m-41m_____4.0m__21.49gt 0.63ozt

** BGM-15-163 23.05m-31m___7.95m_43.48gt 1.27ozt

It owns/controls 1,177-square-kilometres in Cariboo mining district with a rich gold-mining history that started in the 1860s with the Cariboo gold rush. It includes three main zones: Bonanza Ledge, Cow Mountain and Island Mountain. All these properties have several past producing mines.

Cow Mountain by itself contains :

2015 Cow Mountain Mineral Resource reported at a cut-off grade of 0.5 g/t Au

Indicated 35.8Mtonnes 2.4mAu 2.8Moz

Inferred 27.5Mtonnes 2.3mAu 2.0 Moz

Also owns the QR property, claims, mine & mill in which they have been producing gold from the Bonanza Ledge.

NO DEBT.

Current Outstanding Shares, 239M, of which these investment companies and insiders own 61.6% ! :

July 8, 2015 - Mr. Eric Sprott will hold, directly and indirectly, 41.8% of the Common Shares

Nov 11, 2015 - Osisko Gold Royalties Ltd has purchased 32,000,000 (flow-through)common shares @ $0.32/sh ($10,240,000)

Osisko owned 15,625,000 Barkerville Shares (the “Prior Holdings”), representing

approximately 6.9% of the 227,442,168 issued and outstanding Barkerville

Shares and 4,687,500 common share purchase warrants.

After giving effect to the Purchased Shares to be acquired by Osisko pursuant to the Private Placement, Osisko would own 47,625,000 Barkerville Shares and 4,687,500 common share purchase warrants, for total ownership of 19.9% on a partially diluted basis.

Pending : acquisition by Osisko of a 1.5% net smelter return royalty on the Cariboo Gold Project located in BC for cash consideration of $25,000,000

Thanks Mark…

Putting a value on MDMN

Method 1 = $0.06 per share short-term

-

$0.05 / share for the cash value and roughly $0.01 / share for the retained 15%.

-

$75,000,000 cash after taxes, commission, expenses.

-

1,500,000,000 shares fully diluted.

-

MDMN will have the choice to dividend out the cash after taxes, commissions, and expenses or they will retain the cash so they can cover any pro rata expenses and thus retain the 15% of AMC.

Method 2 = $?.?? per share

-

MDMN takes some lesser amount of cash and retains some larger percentage in AMC.

-

They still need to come up with some amount of cash to retain their percentage. How much remains to be seen.

-

If they don’t retain enough cash to cover cash calls, they could be back to 15% and no cash and no dividend. So this formula really needs to be considered.

Method 3 = $?.?? per share

-

Somehow they reverse AMC into MDMN where AMC takes control and MDMN begins with much, much larger percentage of AMC, but not any cash.

-

At this point, our interest and AMC’s interest are exactly the same because we are amalgamated into one company with AMC in control.

-

Small dividends from production may occur, but in this case I imagine most money will go back into the property.

-

In this case we may actually begin to trade at a more fair value as AMC takes over control of MDMN and transparency and professionalism become the rule of the day.

Preferences

I cannot speak for anyone else, but I’d prefer option 1 with a good bit of the dividend going out and us retaining 15% that will we use the revenue to pay AMC to keep from being diluted. This will allow shareholders to get $0.03 or $0.05 a share now and the potential for much more as the property proves out.

Hopefully as AMC continues to explore and put more meat on the bone, the best decision will become clearer. Either way, it’s not our decision so we’re along for the ride.

I won’t speak for Mike but I’m confident in answering “no” to both of those questions.

[quote=“Wizard, post:38, topic:880”]

Method 1 = $0.06 per share short-term

$0.05 / share for the cash value and roughly $0.01 / share for the retained 15%.

[/quote] Does the “nickel” include the value of Fortuna (was Fortuna rolled in?). How about early production if Fortuna and LDM/NUOCO were rolled in, not to mention the ADL early production? Wouldn’t these necessarily have separate early production agreements, if there is indeed any early production NSR? Where do shares of the Quijanos’ fit in? Shareholders need to see what news is remaining to be released before any appreciable rise in PPS occurs. Of course, increased volume is an early indication. Let’s see some real volume buying with some serious investors. The story does indeed need to unfold.

DUH …

Bill H. phoned me and asked for the name of the stock. It’s amazing how one can become so involved in the info, so as to forget to name the the stock.

The stock is BARKERVILLE GOLD MINES LTD , trades on the Vancouver exchange :

Ignore any past, concentrate on the present and future.

Sorry about that. ![]()

Rod