If the gold rally continues, there will be no shortage of opportunity for mining stock speculators. "

shush…I want a pullback so I can buy back in to my favorite PM stock

This week it has been a blood bath. What do you want more?

This isn’t my favorite stock…FWIW

It will be soon I have a feeling.

Care to divulge what your favorite PM stock is? Trying to figure out a stock to park some money in or if I should go the ETF route.

Does anyone think the upcoming 15c211 will have any significance? I think it will be worth some scrutiny.

If it’s worth any scrutiny it’s only because MDMN failed to do its job in communicating to its shareholders in a timely fashion. Any events in the 15c211 are already old news.

Would someone care to elaborate on the 15c211? first time I hear about this.

I ran across a very interesting (to me) comparison to the Merlin veins and their production this week. I think it provides insight into costs, timelines, recent financial analysis, even pit design for a relatively similar structure deposit, at least for one vein, Merlin 1.

DISCLAIMER: this is not investment advice or a suggestion to invest in this example company

SUMMARY: there is too much decent stuff here to put into one post. I am going to hit some highlights and provide references. Others who are prone to digging into some of these details can do so. Perhaps some follow on discussion will ensue. I think you will find many similarities if you think of this company as Auryn and how they are proceeding on the Merlin 1. This most closely compares to that single vein opportunity.

DESCRIPTION:

Company: Northern Vertex, {1}

This is a small non-producing company which has completed a 70% earn-in on their Arizona property via an Option Agreement which resulted in a feasibility study last summer. The property and deposit are modest but very easily accessed making for an inexpensive deposit to put into production and a 5 year mine life. They did a pilot production (aka - bulk sampling) stage to test metallurgy as part of the JV. They produced the feasibility study.{2} They are now in a permitting stage. They have financing mostly in place except for the equity portion (i.e. some dilution is coming). So post-permitting they will begin a 12 month construction phase including a heap-leach facility and then production begins with a 5 year mine with 5000 tpd production.

HIGHLIGHTS AND SUMMARY:

DEPOSIT:

This is an epithermal gold/silver vein which is expressed at surface for 1400m. See picture below {3}. It doesn’t get much easier than that. M&I is 15MT{4} at 0.76 g/t Au, 9.3 g/t Ag. The reason the grade is decent but hardly eye-popping is that the mineable ore includes the vein itself plus associated stock works. So to compare, instead of a 1.5m highly concentrated vein, they have anywhere from 2m to 15m or so width to mine and this dilutes the grade a bit but gives them more tonnage compared to Merlin 1. The vein is known to be 1400m long and at least 340m deep.

EXPLORATION:

They have done on the order of 40KM of drilling to get to this stage of M&I. This is a fairly modest amount. Some of this was before them. But they did most of it over the course of two seasons.

PILOT PLANT:

As part of their exploration they constructed a “pilot plant” and actually mined and leached 100,000 tonnes of ore primarily to prove the metallurgy and other parts of the recovery process as well as the competency / consistency of the vein beyond the drilling. That is, they derisked the actual final mine.{6} This is what Auryn is doing with early production except it looks like Auryn is going to just ship their ore to remote facilities for processing. But they will get the same information out it. And Auryn is going to make money at it due to higher grades. This produced about $5.2M from 3851 ounces of gold so it was a little revenue as well but this basically paid for the pilot plant for NV.

FEASIBILITY STUDY RESULTS:

Mine Design: This will be mined via open pit. Of interest is the discussion in the feasibility study of the pit design. Obviously if they could they would go to full depth (at least 340m). But since a modest open pit is easiest, cheapest, and most importantly fastest, they are doing that. But this will limit them to the top 70m to 140m of the vein.{5}

Production:

They end up with a 5 year mine life, 5000 tpd, average gold grade of 0.82 gpt, 42,000 Oz of gold equivalent per year, with a total production of 173 KOz of gold and 1.5 MOz of silver.

Financial Parameters:

Mine Cap Ex: $33M

All-in-Sustaining Cost: $624 / tonne

After tax IRR: 44%

Payback Period: 2.4 years

Timeline:

This company knows how to execute. But things still take time:

2011: Option agreement

2012: Drilling

2013: Drilling. Preliminary Economic Assessment (PEA). Permitting for pilot plant. Pilot plant opens in August

2014: Continue drilling. Resource Report for Feasibility Study. Near final leaching results in Apr. 2014.

2015: Feasibility Study completed - July

2016: Final permitting and contract with their JV partner. Construction starts?

2017: 12 months of construction (pit and mill/leaching facilities)

2018: production?

SUMMARY and COMMENTS:

Timeline Comparison:

I think this is a very good parallel to the process Auryn is undergoing. I would view Auryn as in the 2013 pilot plant phase. And that 2018 production timeline would be on the order of 4 or 5 years from now and would be equivalent to a high grade gold (maybe copper) production at something like 5000 tpd, instead of the pilot 5000 tpm which the Caren permitting enables right now. 5000 tpd will not be trucked from the ADL. So that includes a lot of work and time for permitting, construction of local processing, etc. For Northern Vertex this is a 5 year stage. For Auryn it could definitely be longer because they have more ore.

And note, none of this is the huge porphyry mega mine timeline. That is much farther in the future than this timeline.

Financial Comparison:

Auryn should, probably will, do much better financially per tonne than NV did, because their grades will be much better. But 100,000 tonnes at 5,000 tonnes per month is 20 months. So, that’s a trade off.

Undoubtedly Auryn will get the 5,000 tpm raised and perhaps add some additional spots to the pilot over time. I’m sure they would like to “bulk sample” the LDM and eventually some of the P. Nero. And if they are making money they will not have a stop-goal like NV did (100K tonnes). They will just keep going as they view this as a primary source of funding as per their own words.

But as long as there is no local processing, there will be some fairly severe limits on how high they will take the mining rate. They have to be able to get all those trucks up/down the mountain for one thing. As I mentioned earlier Hecla just re-opened production on a high grade silver mine in Mexico where they have to ship ore for remote processing. This is about 400 tonnes per day (tpd). This is also in the range of what LDMC was proposing, so I would guess there will be a 250 tpd to 400tpd limit in what the remote facilities will take from you. So in the end, I would use that as an optimistic first pass remote-processing production limit. That’s twenty 20-tonne trucks up and down the mountain each day. I would not believe more until Auryn said they were going to put in the money to build roads to do more. And we will need additional permitting before we can even go above 5000 tpm (about 160 tpd). So my definition of “pilot plant” for Auryn is “remote processing of ore at a rather limited production rate”.

Construction of local facilities and a much higher mining rate will mark the true exploitation of the “early production opportunity”, by my definition, several years from now. Then comes the long haul efforts to explore and develop the mountain as a whole.

Enjoy the weekend,

CHG

-

The feasibility study is here.

-

As a comparison of size , recall the LDM skarn is currently estimated to be 10MT to 15MT but yet to be proven.

-

See Table 16-1 Pit Domains on page 106 of the Feasibility Study. You can also search for “maximum depth” and similar terms as this limit of depth of the pit is discussed or referenced in multiple places.

-

See slide 25 of their presentation

Ah grasshopper, good post. But to fill in the blanks, the Moss Mine is a JV between Northern Vertex and Patriot Gold. Northern Vertex is the operator and it took alot of overburden removal to get a level surface for operations and heap leach pad.

Two things happened; 1) They needed to install additional equipment (Merril-Crowe) as this is polymetalic deposit (gold & silver) and 2) There was an arbitration hearing that just ended over who got the proceeds from the bulk run gold. Northern Vertex won.

Northern also just announced a non-brokered private placement for $2.5MM to go into production. But in terms of processing, and I think i previously posted the Moss Mine video, they need to run the material through two circuits to grind to almost sand like mesh and do aglomeration. That won’t be the case with the high grade veins at the ADL.

In any event, I do agree it is a very well run mining company.

What I find interesting from exploration to the Preliminary economic assessment took only 7 months. Where is ours?? Auryn is not disclosing quite a bit of info and that doesn’t help our SP but i just get this feeling that our SP will skyrocket once all the info is released.

Yes, I barely avoided drawing attention to parallels in behavior between our JJ and Patriot in regard to attempting to decline the Feasibility Study (and blow up the Option) and claim part of the $5.1M from the pilot plant. … but since you mentioned it…and since Patriot lost …

But my main points were:

-

the similarity in approach - exploration, small mining of higher grade material, bigger exploration, hopefully leading to bigger mining

-

the amount of money to get to “small mining” - $33M is right where “Volcan” said several years ago: $30M to $50M

-

the timelines involved. some people here still need to wrap their heads around what is involved in getting even a modest mine constructed and operating esp. in regard to time - “early opportunity” still takes significant time

And this, in turn, is important when one asks the question: how and when will I make money on this investment? and in evaluating potential outcomes in terms of returns and time involved

The only drilling to date we know of was in the Fall 2014 to March 2015 on the Gordon.

A PEA needs formal resources. Until at least the Merlin 1 or the Fortuna veins have some drilling done and a formal resource report, there will be no PEA

Perhaps a better question: is why has a whole season almost past with no announcement of drilling starting (other than the announcement of intention to drill last Sept) and no announcement of any results? Just lots of trenching results. As useful as those are there has to be drilling to depth.

CHG, I agree on the drilling as they need to define the resource to be able to formulate pit designs and a mining plan. But given the high grade, they, like GORO, may just skip the pre-feas and feas study and start mining.

They might. I agree.

Not trying to contradict myself here (like MG  )

)

Whatever labels you want to put on them, these things are clearly distinct:

-

Phase 1: remote processing (5000 tpm to start, increasing with time) - I am equating this with NV’s Pilot Phase - why? very low start up cost, severe tonnage limitations. The difference compared to N.Vertex is Auryn will not stop at 100,000 tonnes. Auryn is trying to achieve what N.Vertex achieved in terms of knowledge from their ‘Pilot Plant’ plist Auryn is trying to actually make money in Phase 1. N.Vertex was not trying to make money in Phase 1. They were solely planning for Phase 2.

-

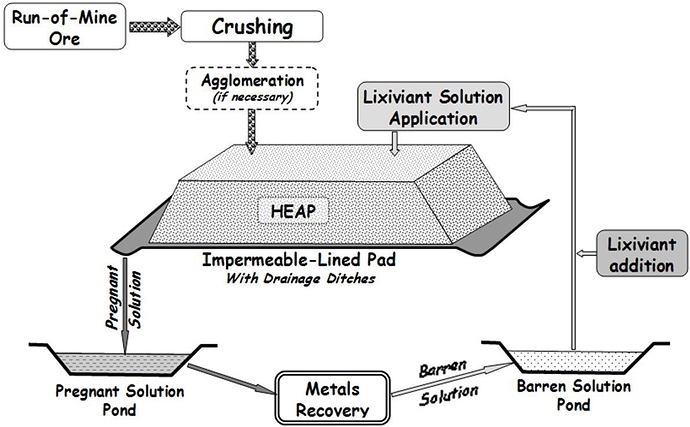

Phase 2: local heap leach processing: will require permitting which will require significant environmental work etc. This is what I am calling “early production” (which is what NV calls their next step). This will require $30M to $50M (or so) and several years to get to. They will not do this until they have the permits and they understand the metallurgy/recovery, which will be learned from Phase 1. Phase 2 will happen as long as there are no ugly surprises in Phase 1. BUT AURYN WILL NOT GET TO PHASE 2 BY AUG. 2017. THERE IS NOT ENOUGH TIME FOR CONSTRUCTION OF LOCAL FACILITIES.

Auryn may or may not require a PEA or FS to go to this step as MDMNH stated. The question is how much will be required for permitting. And what is required by contract? MDMN stated early on a “full feasibility study” was required for the option. Clearly that isn’t going to happen. So how is all that reconciled? It may have been reconciled via recent trips to Chile and the notario for all we know. -

Phase 3: giant CODELCO style copper mine (or whatever the ‘next big thing is’). This is so far out there it is all just ‘potential’ at this point. Phase 2 will provide the funding and time to do the exploration and formal steps to get to Phase 3 and beyond.

It would be useful if we could agree on definitions for terms for 1. and 2. because they seem very clearly to be separate steps Auryn will go through but TMP is largely confusing in its conversation because it mixes up definitions, terms, ideas, words, etc. and at present we have no useful pattern for these words and definitions from Auryn or Medinah. So when we talk here, many times it is right past one another.

Just a clarification, the 100,000 NV is doing is just the size of the leach pad. It takes 90 days to leach, then another 100,000 tons goes on. Once permitted, they could expand to two or three leach pads.

Maybe you can explain leaching more at some point. That is definitely down past my level of detailed understanding.

However, if you look at the start of NV’s leaching, the start of the pilot plant in Aug 2013, they reported recovery progress and they were still reporting in April 2014 after 192 days or something like that. Not sure how that relates to your 90 days.

Click on the first video, it shows and pay attention to Joe Bardswich explaining the heap leaching.