Why does anyone who has invested in MDMN (or CDCH), believe the MDMN share price is going to trade outside of its fairly narrow trading range, before a TO, or, option exercise? For this stock price to move in a BIG way is going to require institutional buyers, mega volume, sustained over a long period. For anyone to think differently after all these years of MDMN failures, is irrational. It just isn’t going to happen until one of these 2 events occurs.

While I agree that either of these 2 events would be wonderful to see neither of them would guarantee phantom selling would not continue to occur. The more likely positive toward moving the share price and slowing down the endless selling at these levels will be cash dividends.

I have believed for some time there is a massive short position on the company most likely at least double the outstanding shares but that is a guess

If such a short position exists, these mms that have been shorting and sold hundreds of millions of shares they never owned have the most incentive to hold the price down to keep their liability in check.

If mdmn announces a cash dividend even prior to exercising the option, we should know quickly how big the short position is.

If NITE. Or CDEL. For example have each sold 500M more shares than they had in possession to keep the price down, they would each have to come up with $5M per penny dividend based on 500M short “or” cover.

This is what drives a short squeeze and I would not feel one bit sorry for the pricks

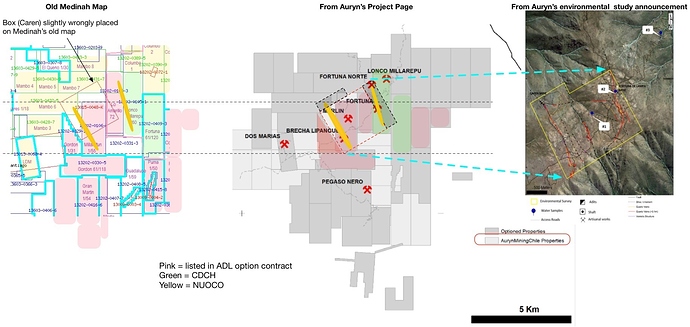

Here is my graphical synthesis of those sources of information.

Comments:

-

This is the old MDMN map, the AMC Projects page map, and the AMC Environmental Study Update map. Note the AMC maps include the northern extension of the Fortuna vein, which crosses over into a MDMN claim (this is noted in the Howe report also, although this northern extension was a hypothetical at that time, AMC is acting as if they know it is real)

-

I have placed everything so it seems to make sense as much as the precision of the input data allows

-

The AMC yellow box (on the right) is the environmental study area. It appears to me they took the Caren claim, added an extension onto the NW to catch the north / adit end of the Merlin 1 vein, and they added a box on the east side to include all the Fortuna stuff. The Caren claim square is placed a little differently between the old MDMN map and the AMC maps. We can safely assume AMC is correct.

-

The bad news, IMO, means that almost all of the AMC exploration of the Merlin / Fortuna stuff falls within the Caren claim or the old CDCH claims. My conclusion re. the southern extension of the Merlin 1 vein was INCORRECT, because the Caren box was placed wrong on the MDMN map and I had it slightly off in regard to angle.

So that takes us right back to the questions:

-

What is the relationship of that CAREN claim to the MDMN claims that it lays on top of?

-

As per Wiz’s earlier post there is a difference in production sharing between the “Caren” and the “ADL” claims. The Merlin is both. So which rate applies? Does it vary as to whether you are mining within the Millalelfun claim or not, which is within the Caren claim?

-

The 5000 tpm permitting is clearly attached to the CAREN claim. Will future permitting applicable to the Merlin 1 be tied to MDMN’s claims or to the Caren claim (which are the exact same pieces of dirt in places)

UPDATED: See update in later post

No.

The Caren claim is only the small portion that doesn’t overlap the other claims.

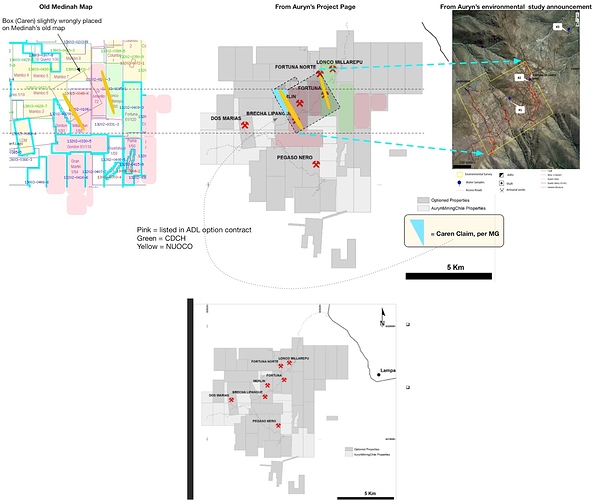

From Auryn’s Project Page…it is the small triangle area that is marked as already being optioned or just to the SW of left gold vein you marked. Note that the other areas within the overall greater Caren Boundary are marked as not being optioned.

Note:

-

AMC spent the fall of 2014 drilling those holes in the Gordon and nearby. These were clearly on the MDMN Gordon claim. AMC was obligated to spend $1M on ADL claims according to the contract.

-

In April 2015, NUOCO made an announcement re. a new high-grade gold vein. Reference is made to the grades found in the adits. This was clearly the Merlin 1 vein.

-

By Oct 2015, we had Google Earth images that showed all the work that had been done by AMC trenching the Merlin 1. This was especially visible all the way to the southern extension (the lower corner of the box - see the Environmental Study).

AMC clearly new exactly where they were headed. They traced that vein to the very corner of the Caren claim and nothing occurred outside of the claim. But trenching occurred all over the Caren claim and the Fortuna claims.

IMO the conclusion is, that MDMN BOD, NUOCO, and AMC knew the focus would be on those claims at that time, a year ago. There have been a few hiccups along they way like JJ’s shares, but otherwise things have been proceeding upon their fixed trajectory. I think it is fairly clear this was all the plan when the ADL Option agreement was formulated.

I believe the NUOCO acquisition was as well and the price undoubtedly. Those Jan 2015 announcements by MDMN re. the MMC NUOCO Option left plenty of questions about how it related to the ADL Option and the Option AMC had to buy the 85% of NUOCO from MMC once they had it from NUOCO. We just saw it play out, although it was not the way we thought it would be.

Fortuna, IMO, was probably the same thing. It’s just that Les and JJ etc. never bothered to let the Days know the entire trajectory was already planned.

You missed one MG. Here, I’ll do it for you: NO

Your sentence does not match the legend. See the original at the bottom of this version.

DARK GREY = OPTIONED.

LIGHT GREY = AURYN MINING CHILE PROPERTIES

Everything is optioned except for that little grey triangle, which I now marked blue and which you apparently are saying is the Caren Claim, and the various other light grey boxes.

So I believe this is the visual representation of MG’s interpretation.

UPDATED: See updated version in later post

No…you misunderstood me.

The light grey area is property Auryn already controls…ie optioned or otherwise now owns.

The other properties in the diagram are properties that have an Option on them. Of course the diagram is now out of date since Nunco/Fortuna etc.

The important point being…within the greater boundary of the Caren Claim block…there were 3 owners…Auryn/Medinah/Cerro. Now just Auryn/Medinah. The major of the veins on the Medinah side of the fence IMO. This is confusing since the Caren Claim overlaps the other claims.

I’ll admit defeat. If you want to clarify and have a map that represents your interpretation, you know how to contact me.

My first map could be wrong. I have no objective information on the definition of what the “Caren Claim” is other than that old MDMN map.

Auryn has been using the phrase “Caren Mine” in their PRs as far as I’ve seen so far.

NUOCO, in April 2015, used the phrase “Caren claims” for where the new gold vein is. This may have been referencing the adits. Or it could have just been typical Medinah poor wording.

I don’t know. Maybe someday when it’s all over we’ll actually know who owns what. In the meantime, Medinah, keep telling us how great the mountain is! {sarcasm} It’s helping! {/sarcasm}

Good! I’m glad you admitted defeat. I’m sure you are use to it due to your local basketball team!

Meantime,

Auryn is racing forward now; so much so that Medinah is having difficulty keeping up.

Auryn has lots of positive news to share.

Positive for us or for them? I’m not entirely sure our interests are aligned pre-option.

True but I don’t think they can contain their excitement about their discoveries/goings on the mountain much longer.

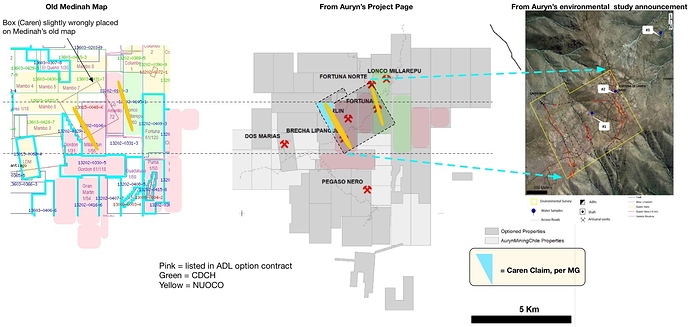

A couple of things jump out at me with your great map work. Perez’s hyperspectral imaging satellite survey revealed a 7 Km swath of “about a dozen” intrusives on the SOUTHERN DOWNSLOPE off of the plateau.

A lot of the new exciting findings, LDM’s Lo Aguirre type deposit, Caren adits, etc. are on the NORTHERN DOWNSLOPE off of the plateau. This suggests that the Pegaso Nero has some serious length to it in a SW to NE direction. Although the major faulting appears to be in the SW to NE direction it’s interesting how the PN ridge crest with the high moly grades plus the Gordon Bx plus the Merlin 1 Vein are all collinear in a NW to SE direction about 90-degrees to the main faulting. It makes you wonder which structure is the main faulting and which is the secondary “feeder” structure. The “plumbing infrastructure” of this mountain appears to be insanely generous.

This goes back to what ACA Howe told us about Chile having 2 distinct zones referred to as “primary tectonic segment boundaries”. One is at our site at 33-degrees south lat and the other is further north at the Candelaria Mine which is a gigantic IOCG deposit. One of the biggest Cu/Mo porphyry systems on the planet is also in our zone but right across the Central Valley from us.

You might note that AMC added 4,000 hectares to our property complex including some concessions in the SW corner. This is where Gana et. al.'s 1996 Regional Survey showed a massive area of intense hydrothermal alteration.

What’s also intriguing is where the porphyritic material has been defined the best. Nuoco’s crew found an Andesitic porphyry with “ocoite” texture (Veta Negro) featuring boring old chalcopyrite but also BORNITE, MALACHITE AND CHALCOCITE which is found almost exclusively in supergene enrichment zones. The “early cretaceous porphyry belt” in the Chilean Coastal Range has several porphyries with some pretty wide SGE zones.

AMC’s porphyritic findings are at the Pegaso Nero all of the way down to sea level. This is a granodiorite hosted Cu/Mo porphyry. If you do the trig the distance between these two porphyritic findings is 4.7 Km. Most porphyries have a zone of mineralization of around 1.5 Km. We don’t know yet if this is a multi-lobed porphyry with more than one porphyry stock or 2 separate porphyries smushed into the same stratovolcano. THE SIZE ARGUMENT IS VERY COMPELLING AS ARE THE EARLY PRODUCTION OPPORTUNITIES THAT CLOSE TO SURFACE WITH THOSE KINDS OF GRADES.

Two more and I am done:

Upon review of Auryn’s PR’s - see the primary usage of the word “Caren” in their updates given below.

-

They use the phrase “Caren Mine” and “Mina Caren” many times. Diagrams are given. This is the actual mine with the 3 adits on the north side of the plateau.

-

They use the phrase: “Caren Mine Sector” multiple times. They sort of define it one time in the Jan 6th PR:

The Mina Caren sector comprises the northern extension of Merlin I vein and there are three old adits exploited in the past by artisanal miners.

This clearly implies that the southern extension of the Merlin 1 vein is outside of the “Mina Caren sector” - this supports MG’s interpretation

-

They use the collective term “Caren-Merlin-Fortuna area” in the Jan 13th PR, to include the entire environmental study area. They did this clearly because “Caren” does not include Fortuna or the southern extension of Merlin 1.

-

They state

The Caren mine, through the acquisition of Minera Mantos Azules Chile, which in turn holds exploitation and environmental permitting to start early production of up to 5,000 t/month

So:

-

This supports MG’s interpretation

-

The permitting was tied to the company Minera Mantos Azules Chile. This is probably but not with certainty, limited to the small blue triangle area if that permitting is tied to the Caren mine.

-

If 1 and 2 are accurate, my earlier post about the contradictions of the overlay is probably inaccurate

-

In a fortuitous turn of events and a I-was-right-for-the-wrong-reasons situation, this means that large portions of the Merlin 1 vein lie on MDMN’s claims. This southern portion will probably not be mined initially because the permitting does not apply.

Best guess,

CHG

DATA:

Jan 6, 2016

Discovery of Bonanza Gold Grades at Caren Mine

The company owns the exploitation permissions up to 5,000 Tn/month in Caren Property.

AURYN Mining Chile SpA is pleased to announce the discovery of bonanza gold grades (>50 g/t) at Merlin I vein in the Caren Mine sector

Today the company is pleased to complement information with the bonanza-type gold mineralization results in Caren property.

to evaluate the early production in the Caren Mine,

The Mina Caren sector comprises the northern extension of Merlin I vein and there are three old adits exploited in the past by artisanal miners.

The mineralization in Mina Caren presents a mineralogical zonation in the vertical extension

These variations suggest the preservation of an entire epithermal system in the Caren sector

Jan 13th:

Positive Results in the Environmental Survey at Caren-Merlin-Fortuna Area in the Altos de Lipangue Project

The environmental survey in Caren-Merlin-Fortuna area was executed by the renowned private consultancy IAL Ambiental INERCO based in Santiago, Chile.

Jan 27th:

Update on bonanza gold grades in Caren mine,

Merlin I vein in the Caren Mine sector

vertical zonation in Caren mine.

The Caren mine, through the acquisition of Minera Mantos Azules Chile, which in turn holds exploitation and environmental permitting to start early production of up to 5,000 t/month on the identified high grade veins that yield grades as high as 124 g/t

The 300k @ .015 is mine. Didn’t do it because I know something. Just like seeing my cost basis drop down to almost a dime now.

What I find strange is the seller/sellers had a chance to sell when the bids were very high @.020-.021 a few days ago instead he/they are selling @.0147?? that is totally absurd! unless these shares are shorted.

On another note since Auryn will be at the PDAC why not announce it? They must have some good stuff if they will be attending the PDAC. The news well had dried up over a month since the last release from Auryn.

I posted a couple of weeks ago that AURYN will not be at PDAC as a presenter. Some members of AURYN are there as buyers or investors in projects. They won’t have a booth – maybe next year.