JMO, with the disclosure of equity in AMC, the kimono should be opened immediately to see what is AMC.

Hi Whatever,

The 5% AMC stakes for Nuoco and Cerro and the 15% stake for Medinah are obviously very nice from a future cash flow point of view. But these stakes are also going to be in demand by others including AMC. These various stakes are a “package” of assets that took almost 20 years to assimilate and convert into a “turnkey” type of asset about to go into production.

Again you go back to the World Gold Council indicating that it currently takes almost 25 years from the commencement of exploration for a junior explorer fortunate enough to have made a significant discovery to get it into production. The “supply” of these completed “packages” of assets run by people like those at AMC is not very large.

My question is when do we get to see what value AMC holds?

Are you following their releases?

Their website is aurynmining.com.

Yeap I know their website .I don’t know what other assets (besides medinah and cerro), cash, etc. that they have if any. Can you put a value on Auryn at the moment?

On the CDCH site, to be able to email you apparently need : Captcha

When I try to send an email i.e. CONTACT US, I get this error

To use CAPTCHA, you need Really Simple CAPTCHA plugin installed.

Your entered code is incorrect.

There is no CAPTCHA plugin for Firefox that I could find.

Any solutions out there ?

Thanks,

Rod

I’ve searched high and low for the answer to this :

So the BIG question is …

What portion of the outstanding shares of CDC (Sociedad Contractual Minera Cerro Dorado Chile) does the 2,490 shares of CDC returned by JJ represent ???

These were NOT shares of CDCH.

How many shares are outstanding of CDC are outstanding ?

Rod

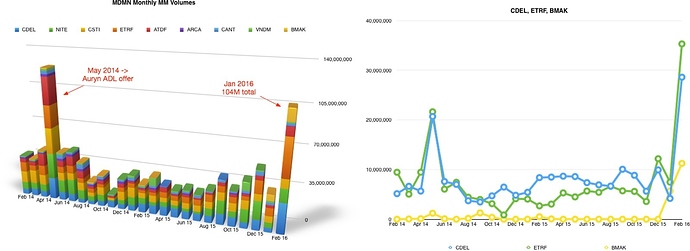

Feb 2016 FINRA data: SUMMARY - The huge volume from the big buyer shows up clearly in the overall volume (104M compared to something more like 35M) and primarily in the huge jumps in volume for three MMs, two of which have appeared to be part of the shenanigans in previous months. No MM comes close to 60M total however.

However, I’m sure you recall that we did see the bid moving back and forth between two MM’s a number of times when one would withdraw a large bid and another would suddenly show up with the exact same number at the same bid price.

Also, I’ll take this opportunity to thank you for all of the time you have put forth in providing some great DD for me and others who visit this board. ![]()

Some of the abusive NSS-ing cases has revealed a system of “netting” amongst the crooked clearing firms. A corrupt CF can slide under the radar if its NET difference between “failures to receive” of a given stock and its “failures to deliver” roughly equate. This results in the need to “rotate the ax” with the “ax” being the dominant MM.

If 2 corrupt MMs clearing through 2 equally corrupt CFs “pair off” and “A” owes “B” the delivery of 100 million shares of Medinah and “B” owes “A” the delivery of a separate 100 million shares of Medinah then they technically “net out” to no “net” deliveries owed to anybody. This is even though somebody sold 200 million NONEXISTENT shares that will never be delivered but all 200 million of these fake shares can be sold at will by the purchasers because they paid for them. Up goes the “supply” variable of that which needs to be treated as being readily sellable (real plus fake shares) and down goes the share price.

The NSCC subdivision of the DTCC has a similar “Ponzi” apparatus they refer to as their “Continuous Net Settlement” or “CNS” system. The same corrupt “netting” takes place. The NSCC states that their system is clearly “imperfect” but with quadrillions of dollars of trades to CLEAR AND SETTLE it’s the best they can do without slowing down the system. From a legal point of view these trades do “clear” which technically can involve “netting” but they certainly don’t “settle”. “Settlement” involves the “good form delivery” of that which the buyer thought he was buying i.e. legitimate shares of which there are a finite amount issued and outstanding.

“Netting” is also involved in “derivatives” which provides “systemic risk” possibilities none of us want to think about. CF “A” owes “B” and “B” owes “C” and “C” owes “D”. As long as none of these intermediaries go bankrupt then the chicanery is covered up and “netted” out. If one of the intermediaries is in danger of going b/k then the other parties need to “prop up” the zombie bank that is in trouble or else the entire house of cards collapses and the taxpayers need to get involved.

Right-O. And the tax payers bail them out after they’ve robbed the tax payer’s blind. Welcome to post-Friedman capitalism…I looked on in absolute disbelieve as crocodile tears rolled down Alan Greenspans cheeks in his Senate hearings that revealed Friedman economics to be nothing but a pile of fancy math (read: dung) dreamt up by the wizards at the Univ. of Chicago school of economics.

What fun. Ad don’t think it can’t happen again.

I loaded the plugin and it still did not work !

Doc, would suggest you stick to geology and skip the ridiculous NSS conspiracy theories. I know for a fact, they don’t exist. Does a covert debt holder sell before shares are deliverd, yes. Do MM’s short to create liquidity, yes. But unless, MDMN is showing up on the bi-monthly Reg SHO report, there is no naked short.

MDMN is not eligible to cleared in any other way but CNS, no matter whether trades are made by off shore brokers or not.

If anything illegal is happening it would be on exchange traded stocks, not some penny stock.

I believe there are 5,000 shares in CDC, but I am not sure.

LOL, I suggest you stick to overlaid mine claim maps. Illegal Naked Shorting exists and will exist as long as we have a stock market where Criminals can make money by Illegal Naked Shorting.

BB, you have no idea what you are talking about, Please explain how a naked short is created and does not show up on the bi-monthly report. I can wait

Does it really matter if it is naked or not? Just think about it, you can legally short the entire float that is in street name…

Karl, let’s be real, the economics of shorting a penny stock are terrible. The margin requirements are huge and the upside is quite limited. It is not happening in MDMN

BTW, the stock borrow program was done away a year or so ago, as no one was using it.

For the record, I agree we don’t need any further discussion on NSS on this forum. By the way, have you ever looked to see who actually owns the DTCC?

But since you kinda brought up a subject, please explain why it was necessary to create Reg SHO in the 1st place, and why thousands of naked shorted companies were “excluded” from settlement by the Regulation by adding the “grandfather clause”. This is in light of the fact the SEC maintained that NSS didn’t exist up until the time it was evident it did. DOC’s explanation is about as clear as one can make it, and explains the action of “the AX” for the trading patterns of many OTC companies that have their share price driven into the dirt.![]() With MDMN “the dirt” will turn to gold!

With MDMN “the dirt” will turn to gold!

That’s only because it cost money to borrow a stock more than 13 days (or was it 30?) MMs found it much easier and cheaper to use the loopholes in net settlement, IMO.

The only thing shareholders need be concerned about at this point is when will the $100M option be exercised, and how much is the TO for the 15% of AMC worth.![]()