Who can keep up with who owns which claim and the possible % MDMN has in each claim? Anyone know? Do we have any % of Caren/Fortuna/ Merlin claims??

I think that people might be getting out a little bit over their skis from a geology/mining industry point of view when they extrapolate that since the Caren Mine (which is mining the Merlin 1 Vein which Medinah owns 90% of as it extends southwards from the Caren Mine) will host the initial exploitation efforts then Medinah’s properties are somehow less important.

The initial production efforts are going to be at the Caren Mine because the permitting is already in place for a 5,000 TPM facility. It appears that this is going to be an UNDERGROUND operation unless the intra-adit drilling they’ve been doing plus any IPs done found nearby subparallel veins. If you closely study AMC’s brand new 24 page “ALTOS DE LIPANGUE PROJECT” power point presentation as well as the AMC Jan 13, 2016 press release regarding the completion of certain environmental studies the emphasis for the early production opportunities is clearly the 400 hectare plot stretching from Merlin 3 to the Fortuna mine about 85% of which is on Medinah’s ground. This area is a yellow box on the 1/13/16 PR of AMC and an oval surrounded by a red hatched line on the power point presentation on slide 13. The statement there reads: “Intersection between Fortuna and Merlin 3 suggests a WIDE (emphasis added) mineralized area coincident with the FDL Mine site (crossed red line)”. ACA Howe warned us that the mineralization at the FDL Mine has barely been touched. The criss-crossing of all of these vein systems in this Medinah/Cerro area clearly appears to render it open pitable and subject to bulk mining methodologies and the economies of scale associated therewith. You can see the IP/CSAMT print out at line 5500 (UTM 6315500) showing the red area of ultra high conductivity/ultra low resistivity.

On the 1/13/16 AMC PR you can also see the 3 points where the baseline environmental water sampling was done as part of the permitting process. Note that Site #1 is described as being a “small stream in the CENTRAL SECTOR of the area involved” just as the yellow box implies. If you drop a vertical line downwards from a spot just left of the “Fortuna de Lampa Mine” this represents the border between Cerro’s property and Medinah’s Lo Amarillo property.

This early production opportunity is of a much grander scale (and probably of lower cost) than the underground mining opportunity at the Caren Mine which will still make somebody a fortune due to the grades and infrastructure. We need to keep in mind that these opportunities are just the tip of a very large iceberg of production opportunities. The high grade moly found at surface at the Pegaso Nero as well as the 1% Cu in the brecciated areas there might also be “early production opportunities”. This is all Medinah land.

It’s key to get the production started somewhere as soon as possible not just from a cash flow point of view but it also establishes a glide path wherein permitting levels will increase once you prove to the regulators that you can behave in an environmentally responsible fashion. The permitting for the Caren Mine happens to be currently in hand and the gold grades happen to be insane.

As the mining efforts proceed at the Caren Mine heading south in these existing adits, they will soon be under Medinah’s portion of the M 1 Vein. Think of these efforts as removing “overburden/lateral burden” in order to access Medinah’s ore at the M 1. Hopefully the gold grades show “continuity” with those at the Caren Mine.

As far as the order of the timing of the Nuoco, Cerro and Medinah deals, I don’t believe that the management teams of Nuoco or Cerro would want a 5% stake in any AMC corporation devoid of an opportunity to eventually open pit the entire mountain. That’s how almost all porphyries are mined. I would assume that Nuoco and Cerro would stand to make a big fat check if a deal were cut with a major to take on the Cu/Mo porphyry that appears to be centered near Medinah’s PN.

But on the other hand, you’ve got a guy with the porphyry development resume of Aquiles Alegria already on the AMC staff. His job is centered on the PN while Bocanegra (from Hochschild that specializes in vein mining) is concentrating on the veins. It would make sense for AMC to continue to fly solo in their development efforts as long as they can afford to while driving up the NPV of the deposit. That way later on they’ll have to give up a lesser percentage of the action to a major if they need to. During the development of a project of this scale with this much “blue sky” available the early phases can support a very robust growth in the NPV of the entire deposit. I would think that the recent geochemical sampling and geomapping AMC completed at the Pegaso Nero increased the NPV of the deposit 20 times more than it cost them to do.

AMC’s emphasis on the early production opportunities on the Medinah and Cerro properties probably explains why both Nuoco and Cerro got 5% of the AMC equity even though Nuoco contributed 2,450 ha and Cerro only 675 ha. The findings at the Nuoco properties have been extremely positive including the stratabound Cu/Ag deposit that AMC claims is the spitting image of the Lo Aguirre and El Soldado deposits. To me, the Nuoco and Cerro deals with AMC sends the subliminal message that Nuoco and Cerro were promised a 5% stake in THE ENTIRE MOUNTAIN and not just the non-Medinah aspects of the mountain on opposite sides of the Medinah property.

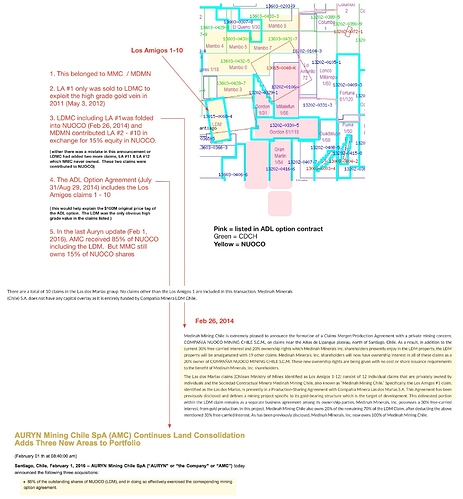

Nice catch! That’s probably the most important catch around here in a long time. I long maintained the $100M had to in some way be connected to the LDM. And there it was right in front of my eyes all the time. When I made my colored claims map I went through that list multiple times and I didn’t catch that one. wow. So congrats on that.

However, I still don’t understand your conclusion or the main point you are trying to make re. 15% “in the ADL properties”.

I have created the attached “info graphic” re. the LDM claims ownership. Quite a story it is. But then every mouse wants the big piece of cheese don’t they. And this was before the Caren / Merlin claims emerged to be as big a piece of cheese:

Now to summarize as I understand it :

No. 2 above: The Los Amigos claims (LA #2 - #10) were “contributed” by MMC to NUOCO in exchange for 15% of NUOCO in Feb 2014. LDMC was folded into NUOCO and thus the LA #1. MMC / MDMN still retains that 15% of NUOCO. NUOCO has the titles to the claims with some ambiguity as to the status of LA #1 and the original LDMC / MMC agreement. The Feb 2014 announcement says that agreement is still in place.

No 3 above: The ADL option agreement (July / Aug 2014) contains LA #1 through LA #10 in section 2.vii. This could only have happened via agreement between NUOCO and MMC/MDMN because NUOCO had title to the claims at that time as per the 2014 announcement. This agreement had to be in place previous to or as part of the ADL Option agreement.

No 4 above: NUOCO bought the 85% remaining shares of NUOCO from the private owners of NUOCO (JJ, Greg, Les etc.) in exchange for 5% of AMC (Feb 1, 2016). NUOCO still retains the title to the claims. AMC has 85% of NUOCO. MMC has 15%.

The ADL Option agreement, if still unaltered and exercised, would move title of the LDM claims (at least #1 through #10) to AMC / Auryn thus removing the LDM claims (#1 - #10) from the 15% of NUOCO that MMC owns in exchange for $100M and 15% of AMC

The LDM is the hot potato here because it was the original entity that drove this entire deal that had any hope back then finding some short term way of justifying the $100M price tag.

The Caren / Merlin have (and maybe P. Nero) have changed that balance of the deal - as per MG earlier and has dominated the exploration for the first 2 years of this thing

It’s probably not surprising in that light that some new terms are being discussed

The NUOCO part of this should be clear from today’s discussion on Z’s discovery! NUOCO would lose the LDM (at least LA 1 - LA 10) when AMC exercised the ADL option. This would leave NUOCO with a bunch of properties with no work done on them and the need for tons of capital. 85% of NUOCO for 5% of AMC was a deal for 85% of the LA #11 and LA #12 (assuming they exist), the Mambo and Columbo claims. The primary LDM claims (LA #1 - #10) go to AMC 100% if/when the ADL option is exercised. This puts NUOCO in as bad / worse shape than CDCH in terms of immature claims.

CDCH is its own topic - but they had no path forward and no money. 5% of AMC was a decent deal.

If all of the above holds up, if we look around the kitchen, what assets does MMC / MDMN have in the current negotiations:

-

100% of two+ claims right in the middle of the high grade Caren / Merlin gold play (the northern extension of the Fortuna runs onto MMC claims)

-

100% of several claims covering at least major parts of the P. Nero expression of the copper / moly porphyry

-

100% of claims associated with the Gordon breccia

-

Perhaps still retaining the 20% ownership / 30% production FCI on LA #1 gold production going back to the LDMC agreement. (No way to be certain if this is still valid or not - but it was apparently with the formation of NUOCO)

-

Multiple other claims in / around the ADL (see Auryn’s map)

-

15% of NUOCO shares

-

7.5M+ shares of CDCH or a little less than 3% of the 5% of AMC that CDCH owns (0.135%)

-

Maybe a few other misc. items. if we threw in Les would that help

And of course, a current Option Agreement with AMC calling for $100M / 15% of AMC that runs out in Aug 2017

I assume you are referring to this item:

"Las dos Marias History & Update April 2, 2013

Medinah-Minerals, > Shareholder Updates 2013 > Las dos Marias History & Update April 2, 2013

Dear Medinah Shareholders:

The LDM project is privately held and funded on a profit-sharing basis with a 37.5% net worth of profits accruing to the benefit of Medinah Minerals, Inc. It should be noted that Medinah Minerals, Inc., made no monetary or share distribution for their position."

While the update stated, “It should be noted that Medinah Minerals, Inc., made no monetary or share distribution for their position.” If I recall 80% ownership of the property was taken from Medinah in trade for the 30% FCI that we should have a continuing ownership of at this time.

Everyone knows that AMC is after the Alluvia shares

I did forget that asset! You could be right!

There were several descriptions of that whole thing. I was referring to the one given in the Feb 2014 Update shown in the graphic - see the lower part of the paragraph.

Here is what I think has been happening regarding the option agreement and what MDMN’s 15% interest is:

The original option agreement ( 7/31/14 ) called for MDMN to receive $100million and 15% of Auryn stock for all of the ADL claims and the LDM 1-10 claims.

Since the LDM claims were owned by NUOCO due to the 2/26/14 consolidation of the LDM and MAMBO claims, there had to be an agreement to get the LDM claims back to MDMN. The 9/17/15 agreement ( put forth by Auryn ) was for MDMN to purchase the remaining 85% of NUOCO it did not own already.

In the MDMN 2/6/16 update it is announced that AMC is going to purchase the 85% of NUOCO directly for 5% of AMC stock. This eliminated the need for MDMN to purchase the 85%.

This is where the terms of the original option agreement have to change. With AMC having purchased the 85% of NUOCO directly and giving up 5% of their stock they are not going to compensate MDMN for it. Hence the $100million plus 15% of AMC stock has to be revised. This is probably what the negotiations are about currently. Does the $100 million get reduced and we keep the 15% of AMC stock or does the $100million remain and we get a lesser % of AMC stock or…

We will still own 15% of NUOCO but we will only get compensated for the ADL property claims and not for the 85% of the LDM 1-10 claims.

JMO

As far as I am concerned, there have been so many what if’s suggested on this board that I as a non experienced investor "6 years now " in MDMN that I am completely confused. If I could afford to lose what I have invested so far I would throw in the towel and never invest again. Sorry for the negative outlook but I for one are getting fed up with all the BS we are being fed. It is too bad that our BOD isn’t looking after better instead of lining their own pockets and saying f#$% the share holders.

I agree Hunter. This is beyond pathetic. Nobody knows for sure what we own or don’t own. Almost seven lousy years for me, and I would take break even right this second. It is so painful, to have all these great posters trying to figure out how this will turn out. Unfortunately, we may not know where we stand for quite some time. I am sure I am not the only one having a difficult time keeping a good attitude, when the final outcome is still very much in doubt…HELP!!!

As suggested by several other posters, read the Auryn contract and use that as the lowest common denominator of what’s what. Do not fill in the blanks by rounding up or rounding down. Assume that there is nothing else but the contract governing the future of this investment. However, supplement that with Auryn’s updates. Do no supplement it with Les’ updates. Do not supplement it with message board opinions or rumors (positive or negative).

Casually follow the price of gold and macro-industry developments (i.e. check Kitco.com every morning). I would also read Wizard’s Auryn blog, but understand when he is stating something factual versus opinion. He’s usually pretty good about stating what is specifically his own opinion.

That’s it. That’s all you have to do. Investing in a mining company is not a day-to-day activity. It is a month-to-month or quarter-to-quarter activity. The share price will work itself out once production begins - once production begins according to Auryn’s guidance, not any poster’s or Les’ guidance.

Anything else that you are reading, with the exception of the helpful geological explanations by CHG, mdmnholder, MikeGold & BrecciaBoy, is just speculative nonsense that if you don’t treat as “for entertainment purposes only” you’ll drive yourself crazy wondering what your investment is all about. Trust me, ignore it. I assure you that you’ll feel a lot more comfortable about this investment when you don’t let the noise of this board alter the lowest common denominator.

And one final thing…do not let the share price affect your interpretation of the fundamental developments of ADL…unless you’re looking for an early exit. If that is the case, you’re going to be disappointed.

Exactly why the sp is where its at, and trending to the basement. I am getting tired of all the BS about the stock and BOD. AMC is great to be involved, but I think they are out smarting them, and share holders are getting screwed, or maybe. Who knows anymore?

At this point I hope I break even, which is around 0.08/share. But I am not thinking we have a 10 bagger, even at current so, and I think we are all screwed. At least until July 2017, then we get lucky maybe.

Getting more info here than from MDMN IS MY MAIN REASON FOR THIS.

TDK